Raizen Bundle

Who Really Owns Raízen?

Understanding the ownership structure of a company is crucial for investors and strategists alike, as it dictates the company's direction and potential for growth. Raízen, a major player in the global energy market, presents a compelling case study in how ownership dynamics shape business strategy. This exploration dives into the Raizen SWOT Analysis and the key players behind this dynamic company.

From its beginnings as a joint venture between Shell and Cosan, Raízen's ownership has evolved, impacting its strategic decisions and financial performance. Knowing who owns Raizen is essential for anyone looking to understand its role in the energy sector, its relationship with Cosan, and its future prospects. This analysis will uncover the intricacies of Raizen's ownership, including Raizen shareholders and the influence of its major investors, providing insights into this significant company based in Raizen Brazil.

Who Founded Raizen?

The formation of the Raizen company didn't involve individual founders in the traditional sense. Instead, it was a strategic move, a joint venture between Royal Dutch Shell plc (now Shell plc) and Cosan S.A. This partnership, established in June 2011, marked the beginning of a significant player in the energy sector.

At its inception, the Raizen ownership structure was straightforward: a 50/50 split between Shell and Cosan. This meant each company held an equal share of the equity and voting rights. This arrangement was designed to leverage Shell's global energy expertise and Cosan's strong presence in the Brazilian sugar and ethanol industries.

The early agreements between Shell and Cosan likely included detailed provisions for governance, management, and profit sharing. The equal split ensured both parent companies had significant control over Raízen's strategic direction and operations. This structure was a reflection of the partners' desire for a balanced and collaborative approach in the Brazilian and broader South American energy markets.

The initial ownership structure of Raizen Brazil was a 50/50 joint venture between Shell and Cosan. This structure was designed to combine Shell's global energy expertise with Cosan's strong presence in the Brazilian sugar and ethanol industries. The equal partnership ensured that both companies had significant influence over Raizen's strategic direction. This collaborative approach allowed Raizen to leverage the strengths of both parent companies effectively.

- The joint venture was formally established in June 2011.

- The initial ownership was equally split between Shell and Cosan.

- The partnership aimed to integrate Shell's global energy expertise with Cosan's Brazilian market presence.

- The equal split ensured shared control and influence over Raizen's operations.

As of 2024, Cosan S.A. holds a significant stake in Raízen, reflecting its continued involvement in the company's operations. Shell has also maintained its interest. The specific ownership percentages may have evolved over time due to various financial transactions and market dynamics. For more detailed information about the company, you can read this article about Raizen.

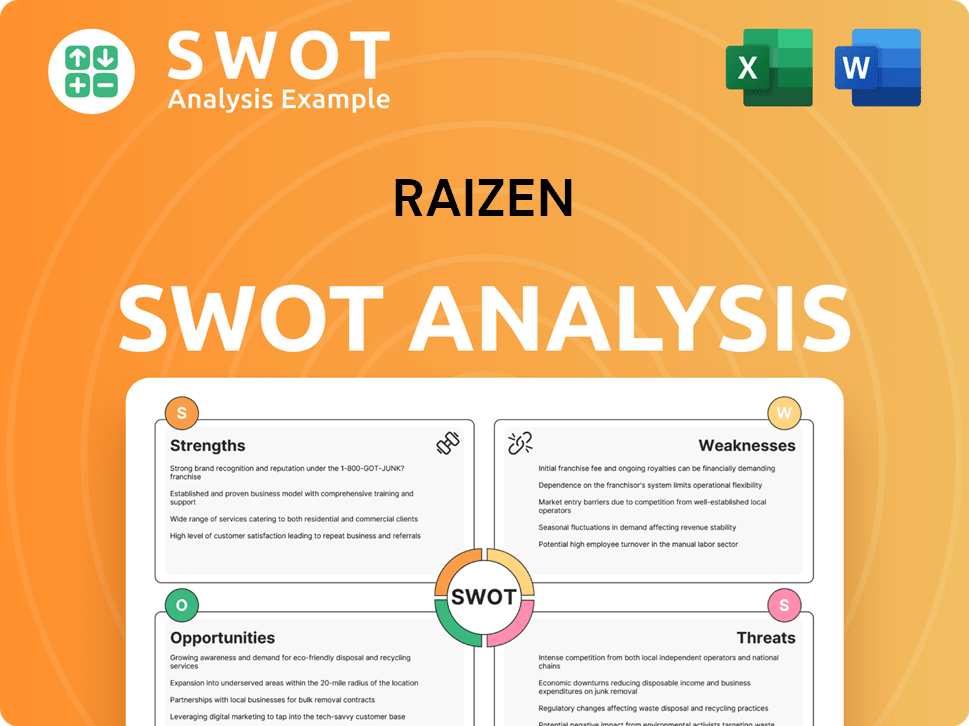

Raizen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Raizen’s Ownership Changed Over Time?

The ownership of the Raizen company has seen a significant shift, most notably with its Initial Public Offering (IPO) on August 4, 2021, on the B3 stock exchange in Brazil. This IPO was a landmark event, raising approximately R$6.9 billion, which equated to about US$1.3 billion at the time. This move transformed Raizen into a publicly traded entity, though the core ownership remained firmly with Shell and Cosan.

As of early 2025, the ownership structure continues to be dominated by Shell and Cosan, who jointly control Raízen. Their stakes are substantial, though they may vary slightly. For instance, as of March 31, 2024, Cosan S.A. held roughly 49.9% of Raízen's total shares. Shell plc maintains a similar level of ownership. The remaining shares are publicly traded, held by a mix of institutional investors, mutual funds, and individual shareholders. This structure highlights a balance between corporate control and public market participation.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| IPO on B3 Stock Exchange | August 4, 2021 | Introduced public shareholders; Shell and Cosan remained dominant. |

| Shareholding as of March 31, 2024 | March 31, 2024 | Cosan S.A. held ~49.9% of total shares; Shell plc held a similar stake. |

| Ongoing | Early 2025 | Shell and Cosan jointly control Raízen; Publicly traded shares held by various investors. |

Major institutional investors have also acquired stakes in Raízen through the public market, influencing strategic decisions alongside Shell and Cosan. Raízen's recent focus on renewable energy and sustainable aviation fuel production aligns with both the parent companies' sustainability goals and investor demand for ESG-compliant investments. This evolution from a joint venture to a publicly traded company has diversified its funding sources and increased market visibility while maintaining strategic alignment through Shell and Cosan's significant ownership.

The ownership of the Raizen company is primarily controlled by Shell and Cosan, with public shares also available. This structure allows for a balance between corporate strategy and public market influence.

- Shell and Cosan are the major Raizen shareholders.

- The IPO in 2021 made Raizen Brazil a publicly traded company.

- Institutional investors also hold significant stakes.

- The company's strategic direction is influenced by its major shareholders.

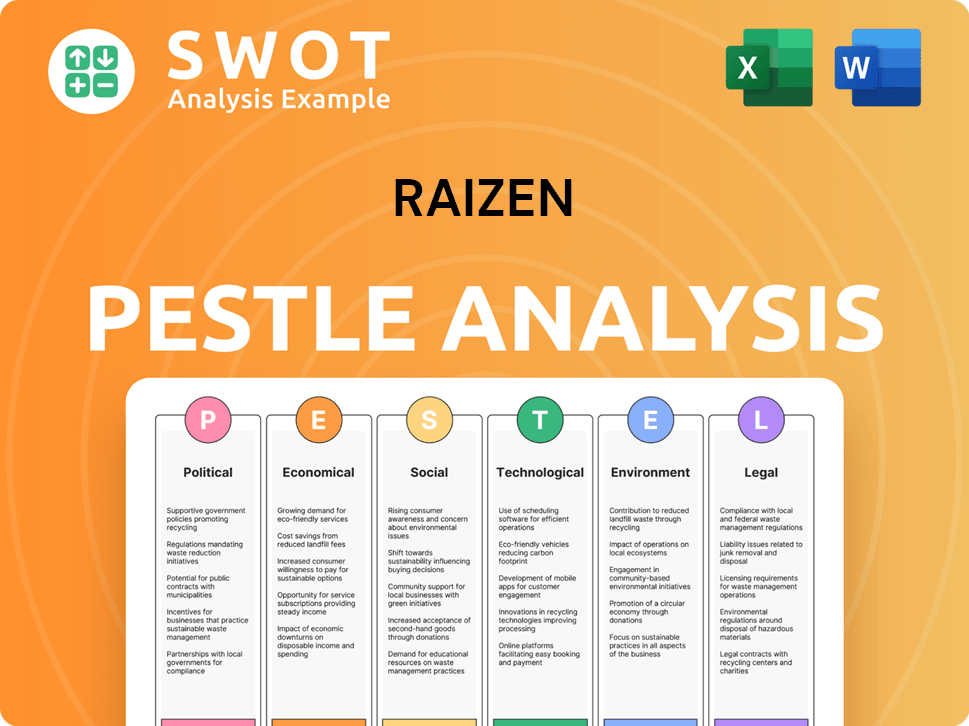

Raizen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Raizen’s Board?

The Board of Directors of the Raizen company reflects its unique ownership structure, with representation from both major shareholders, Cosan and Shell, alongside independent members. As of early 2025, the board typically includes members nominated by Cosan, members nominated by Shell, and independent directors. This composition ensures that the strategic interests of the principal shareholders are well-represented in the company's governance. For example, the current board includes individuals with affiliations to both Cosan and Shell, ensuring alignment with their respective strategic objectives.

The voting structure for Raízen's common shares generally follows a one-share-one-vote principle. However, the joint control agreement between Cosan and Shell likely outlines specific matters requiring consensus, effectively granting them significant control over major strategic decisions despite the public listing. This arrangement is a key aspect of understanding Raizen ownership and its operational dynamics. The presence of independent directors is crucial for ensuring good corporate governance and representing minority shareholder interests, yet the influence of Cosan and Shell shapes major initiatives and leadership appointments.

| Board Member | Affiliation | Role |

|---|---|---|

| Example Board Member 1 | Cosan | Director |

| Example Board Member 2 | Shell | Director |

| Example Board Member 3 | Independent | Independent Director |

While no widely publicized proxy battles or activist campaigns have directly challenged Raízen's core governance, the balance of power between Cosan and Shell is a defining characteristic of its decision-making process. Key strategic initiatives, major investments, and leadership appointments often reflect a negotiated outcome between these two major shareholders. Understanding the dynamics between these Raizen shareholders is crucial for anyone interested in the company's operations and future prospects.

The Board of Directors at Raízen is structured to represent the interests of its major shareholders, Cosan and Shell, alongside independent directors. The voting structure generally follows a one-share-one-vote principle, but key decisions require consensus between Cosan and Shell.

- Board composition includes members from Cosan, Shell, and independent directors.

- Joint control agreement between Cosan and Shell influences strategic decisions.

- Independent directors ensure good corporate governance and represent minority shareholders.

- Major initiatives and leadership appointments often reflect a consensus between Cosan and Shell.

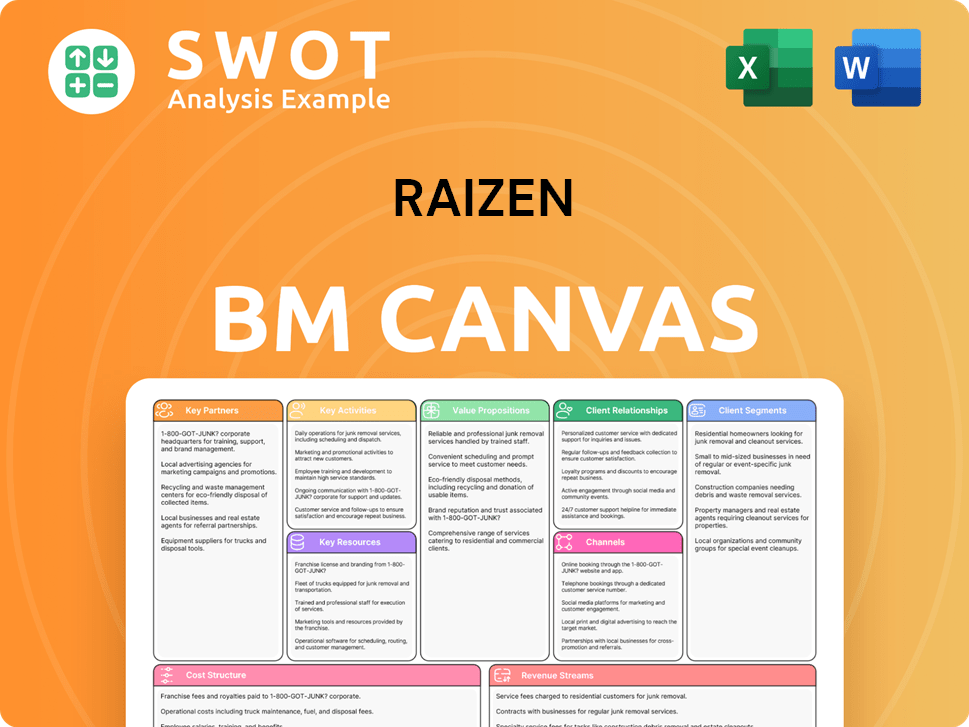

Raizen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Raizen’s Ownership Landscape?

Over the past few years, the ownership structure of the Raizen company has seen key developments. A significant event was the Initial Public Offering (IPO) in August 2021. This IPO partially diluted the direct stakes of Shell and Cosan, but it also brought in substantial capital and expanded the shareholder base. Despite the IPO, Shell and Cosan have maintained their joint control over Raízen, demonstrating their long-term commitment. As of early 2025, the ownership split between Shell and Cosan is approximately 50/50, indicating a stable controlling interest.

Industry trends, such as increasing institutional ownership in the renewable energy sector, have likely influenced Raízen, attracting investors focused on sustainability and bioenergy. Raízen has actively pursued growth in its renewable energy segment, including advanced biofuels and biomaterials. This aligns with global energy transition trends and investor interest. There have been no public announcements indicating an immediate plan for a major change in the core ownership structure, such as a complete divestment by either Shell or Cosan, or a move towards full privatization. The current trend suggests a continued partnership between the two major shareholders, leveraging Raízen as a key vehicle for their strategies in the global energy market, with an increasing emphasis on sustainable solutions.

Raízen's IPO in August 2021 brought in significant capital and broadened the shareholder base. Shell and Cosan have maintained joint control, with an ownership split close to 50/50 as of early 2025. This indicates a stable controlling interest and continued commitment from the major shareholders.

Increased institutional ownership in renewable energy has impacted Raízen. Raízen's focus on renewable energy, including biofuels and biomaterials, aligns with global trends. The company is positioned to benefit from investor interest in sustainable solutions.

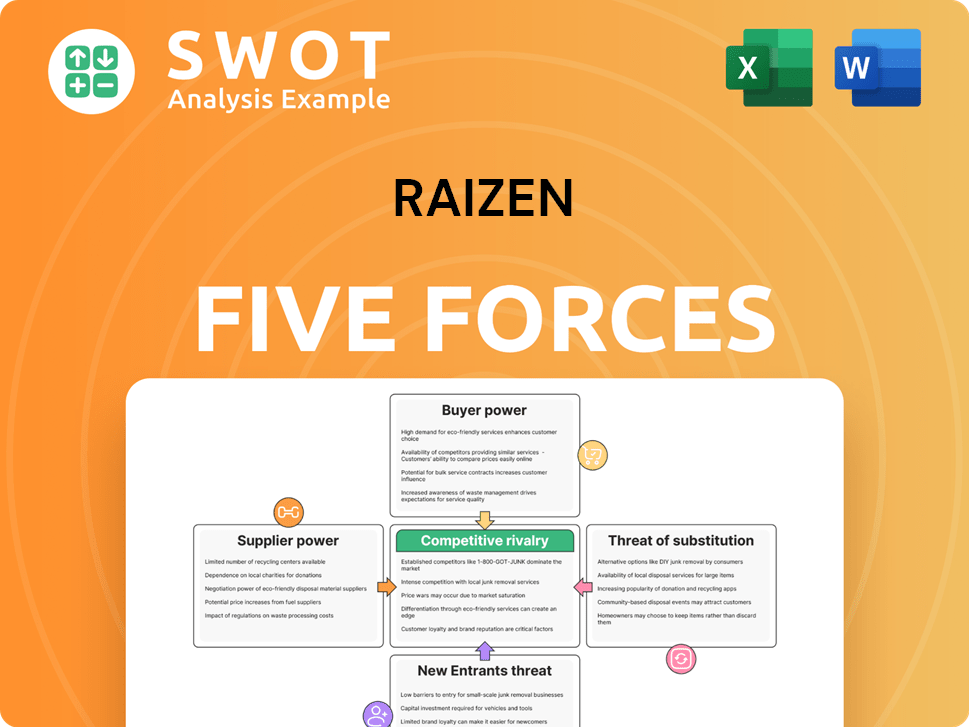

Raizen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Raizen Company?

- What is Competitive Landscape of Raizen Company?

- What is Growth Strategy and Future Prospects of Raizen Company?

- How Does Raizen Company Work?

- What is Sales and Marketing Strategy of Raizen Company?

- What is Brief History of Raizen Company?

- What is Customer Demographics and Target Market of Raizen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.