Raizen Bundle

How is Raízen Shaping the Future of Energy?

Raízen, a powerhouse in the integrated energy sector, has strategically positioned itself for significant growth. Formed in 2010, the company quickly rose to become a leading player, leveraging Brazil's agricultural strength. Now, with a massive footprint across South America, Raízen is on a trajectory that demands a closer look.

With a revenue of approximately US$45.5 billion in the 2023/2024 harvest year, understanding the Raizen SWOT Analysis is crucial for investors and analysts. The company's expansion is driven by strategic initiatives in second-generation ethanol (E2G) and electric mobility, which are key components of its Raizen growth strategy. This analysis delves into the Raizen company's future prospects, market analysis, and sustainability efforts, offering insights into Raizen's business model and its impact on the energy landscape.

How Is Raizen Expanding Its Reach?

Raízen's expansion strategy focuses on strengthening its position in bioenergy and fuel distribution, while also venturing into new energy solutions. The company is significantly investing in second-generation ethanol (E2G) production to boost productivity and sustainability. This approach aims to leverage existing infrastructure and byproducts to drive growth.

The company's growth strategy is multifaceted, encompassing both organic expansion and strategic partnerships. Raízen is increasing its fuel distribution network and exploring electric mobility solutions. These initiatives are designed to capitalize on evolving market trends and consumer demands. For a deeper understanding of the company's origins, consider reading the Brief History of Raizen.

Raízen's strategic moves are geared towards sustainable growth and market leadership. The company is aiming to increase its biofuel production capacity and market share. These strategies are designed to enhance financial performance and long-term growth potential.

Raízen plans to operate 20 E2G production units by 2030. New facilities are expected to begin operations in Valparaíso and Barra Bonita (São Paulo) during the current harvest year. Additional plants are scheduled for the 2024-2025 and 2026-2027 harvest years. This expansion aims to increase productivity by up to 50% without requiring additional sugarcane planting area.

Raízen, as Brazil's second-largest fuel distributor, operates over 7,000 Shell-branded service stations in Brazil and Argentina. The company is expanding into electric mobility through partnerships. This strategic move is designed to strengthen its market position and cater to evolving consumer preferences.

Raízen Power, partnered with BYD to construct EV charging hubs under the Shell Recharge brand. The initiative will install 600 new DC charge points, adding 18 MW of installed power. This expansion will start in 2024 across eight Brazilian capitals over the next three years.

Raízen is exploring new business models, such as selling non-core assets. It is considering selling stakes in its E2G plants to raise capital and reduce debt. The company recently sold its Leme plant for R$425 million.

Raízen's expansion plans include significant investments in E2G production and electric mobility. The company is focusing on sustainable growth and market leadership. These initiatives are designed to enhance financial performance and long-term growth potential.

- Aggressive development of E2G production with multiple new plants.

- Expansion of the fuel distribution network with over 7,000 service stations.

- Strategic partnerships in electric mobility to build EV charging hubs.

- Exploration of new business models, including asset sales and joint ventures.

Raizen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Raizen Invest in Innovation?

The innovation and technology strategy of Raízen is a core driver of its growth, particularly in the sustainable energy sector. The company's focus on advanced biofuels and digital transformation is central to its long-term plans. This approach is designed to enhance operational efficiency, reduce environmental impact, and capitalize on emerging market opportunities.

Raízen's commitment to research and development is evident in its investments in proprietary technologies like second-generation ethanol (E2G) production. This technology converts sugarcane bagasse and other byproducts into biofuel, improving ethanol production efficiency. The company's strategic initiatives also include expanding its renewable energy portfolio and leveraging digital tools for operational improvements.

Raízen's approach to sustainability is comprehensive, integrating environmental, social, and governance (ESG) factors into its business model. The company actively seeks to align with stakeholder expectations and address industry challenges through innovation and strategic partnerships. This commitment supports Raízen's goal of long-term sustainable growth and market leadership.

Raízen's E2G technology is a key innovation, converting sugarcane byproducts into biofuel. This process increases ethanol production efficiency by up to 50% without requiring additional land. The company's E2G strategy supports its goals for sustainable energy production and reduced environmental impact.

Raízen operates E2G plants with significant production capacities. The plants in Piracicaba and Guariba, São Paulo, have capacities of 30 million and 82 million liters per year, respectively. The company plans to expand its E2G production with a goal of having 20 units by 2030.

Raízen is broadening its renewable energy portfolio beyond ethanol. The company is investing in biogas, biomethane, and bioelectricity, generated from 100% clean energy sources. This diversification supports Raízen's sustainability goals and expands its market opportunities.

Digital transformation is a key element of Raízen's strategy to enhance operational efficiency. The implementation of solutions like ION's TriplePoint integrates business operations. This integration helps in the timely identification and mitigation of operational risks.

Raízen uses a double materiality approach to regularly revisit its sustainability strategy. This approach ensures alignment with stakeholder expectations and addresses emerging industry challenges. The company's sustainability efforts are a core part of its long-term value creation.

Raízen has established the Pulse innovation hub to foster advancements through connections with startups. This hub supports the company's innovation efforts and helps to identify new technologies and business models. This approach promotes continuous improvement.

Raízen's innovation and technology strategy has yielded significant results and ambitious goals, driving its position in the market. The company's commitment to sustainable development is evident in its environmental impact and expansion plans. For more details on Raizen's business model, see Revenue Streams & Business Model of Raizen.

- Raízen produced over 32 million gallons of cellulosic ethanol in 2023.

- Brazil's total cellulosic ethanol production reached 51 million gallons in 2024.

- The company has avoided 30 million tons of CO2 emissions since its inception.

- Raízen aims to avoid over 10 million tons of CO2 emissions per year.

Raizen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Raizen’s Growth Forecast?

The financial landscape for Raízen reflects a period of strategic recalibration. The company is navigating challenges while focusing on core strengths. Understanding the financial outlook is crucial for assessing the Raízen growth strategy and its Raízen future prospects.

For the fiscal year ending March 31, 2025, Raízen reported a net loss, contrasting with the previous year's profit. This shift underscores the need for strategic adjustments. The company's performance is under scrutiny, making a detailed Raizen company financial analysis essential.

Raízen's sales reached BRL 255.27 billion in the fiscal year ending March 31, 2025, an increase from BRL 220.45 billion the prior year. However, the company reported a net loss of BRL 4.26 billion, a significant change from the BRL 520.72 million net income of the previous year. In the third quarter of the 2024/25 harvest season, a net loss of R$2.57 billion was recorded, compared to a profit of R$793 million in the prior year. Adjusted EBITDA for the third quarter decreased by 20.5% year-on-year to R$3.12 billion, falling short of expectations. These figures highlight the need for strategic financial planning.

S&P Global Ratings revised the outlook on Raízen's global issuer credit rating to negative from stable in January 2025. This revision reflects concerns about the company's debt levels and financial performance. The outlook indicates potential challenges ahead for the company.

Debt to EBITDA was 3.0x in the 12 months ended September 30, 2024, and is expected to remain between 3.0x-3.5x by the end of fiscal 2025. Net debt reached R$49.7 billion as of September 30, 2024, and increased to over R$34 billion by March 31, 2025. The high debt levels are a key area of focus for Raízen.

A free operating cash flow (FOCF) deficit is projected to exceed R$5 billion in fiscal 2025. This indicates that the company may face challenges in generating sufficient cash flow to cover its obligations. The FOCF deficit is a critical financial indicator.

Raízen's CEO, Nelson Gomes, is emphasizing a return to core businesses, including sugar and ethanol production and fuel distribution. The company is focused on cutting expenses, rationalizing investments, and lowering debt to improve its financial position. These actions are part of the overall strategy.

Raízen is implementing several strategies to improve its financial position and ensure Raizen's expansion plans in Brazil. Capital expenditure for the 2025/26 harvest year is estimated at BRL 1.6 billion. The company is also divesting non-core assets to reduce debt and aims to recover the value of its assets in the capital market in the second half of 2025. For a deeper dive into the company's target market, consider reading Target Market of Raizen.

Raízen is actively working to reduce its operational costs. This includes streamlining processes and improving efficiency across its various business segments. Cost reduction is a key element of the company's financial recovery plan.

The company is carefully evaluating its investment portfolio. This involves prioritizing projects with the highest potential returns and delaying or canceling those that are less promising. Rationalizing investments helps to conserve capital.

Raízen is committed to reducing its debt levels. This includes divesting non-core assets and managing its cash flow effectively. Debt reduction is crucial for improving the company's financial stability.

The company aims to recover the value of its assets in the capital market. This involves improving operational performance and strategic positioning. Asset value recovery is a long-term goal for Raízen.

Raízen is concentrating on its core businesses, particularly sugar and ethanol production and fuel distribution. This strategic focus aims to leverage the company's existing strengths. This is critical to the Raizen business model.

Capital expenditure for the 2025/26 harvest year is estimated at BRL 1.6 billion. This expenditure is essential for maintaining and improving operational efficiency. Careful management of capital expenditure is crucial.

Raizen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Raizen’s Growth?

The Raízen company faces several potential risks and obstacles that could affect its growth strategy and future prospects. These challenges include intense competition in the fuel distribution market, regulatory changes, and supply chain vulnerabilities, particularly in sugarcane production. Understanding these risks is crucial for investors and stakeholders assessing the company's long-term viability.

Market dynamics and weather-related events pose significant hurdles for Raízen's business model. The company must navigate the complexities of the renewable energy sector while managing internal financial constraints. Strategic adjustments and proactive risk management are essential for Raízen's continued success.

This analysis examines the specific challenges Raízen faces, providing insights into its strategic responses and the potential impact on its financial performance and market position. For more information on the company's ownership structure, you can review the Owners & Shareholders of Raizen article.

The fuel distribution sector in Brazil is highly competitive, with major players like Vibra and Ipiranga. This competition puts pressure on margins and market share. Raízen must continuously innovate and optimize its operations to stay ahead.

Regulatory changes, such as the RenovaBio Enhancement Law (Law no. 15.082/2024) and the Fuels of the Future Program (Law no. 14.993/2024), introduce new compliance requirements. These regulations mandate increased ethanol blends and the use of sustainable aviation fuel (SAF).

Sugarcane production, a critical component of Raízen's operations, is vulnerable to weather conditions. Drought and fires significantly impacted the 2024/25 harvest, leading to reduced sugarcane crushing and lower production volumes.

While Raízen is involved in bioenergy innovation, it faces risks if it cannot maintain leadership in developing and scaling new technologies. The performance of cellulosic biofuel plants and their ability to operate at full capacity is a key factor.

Raízen faces internal financial constraints, including high leverage and interest burdens. The debt to EBITDA ratio reached 3.0x as of September 30, 2024, and is projected to remain high. A free operating cash flow deficit exceeding R$5 billion is also a concern.

Fluctuations in commodity prices and currency exchange rates can impact Raízen's profitability. Economic conditions in Brazil and international markets affect demand and pricing for its products.

Raízen has implemented strategic adjustments to mitigate these risks. This includes selling non-core assets and considering selling stakes in its E2G plants to raise capital and reduce debt. Prioritizing core businesses is also a key strategy.

Management is reviewing its asset portfolio and adopting a more conservative financial model for the 2025/2026 fiscal year. This is designed to curb cash burn and reduce capital expenditures. The goal is to improve financial stability and performance.

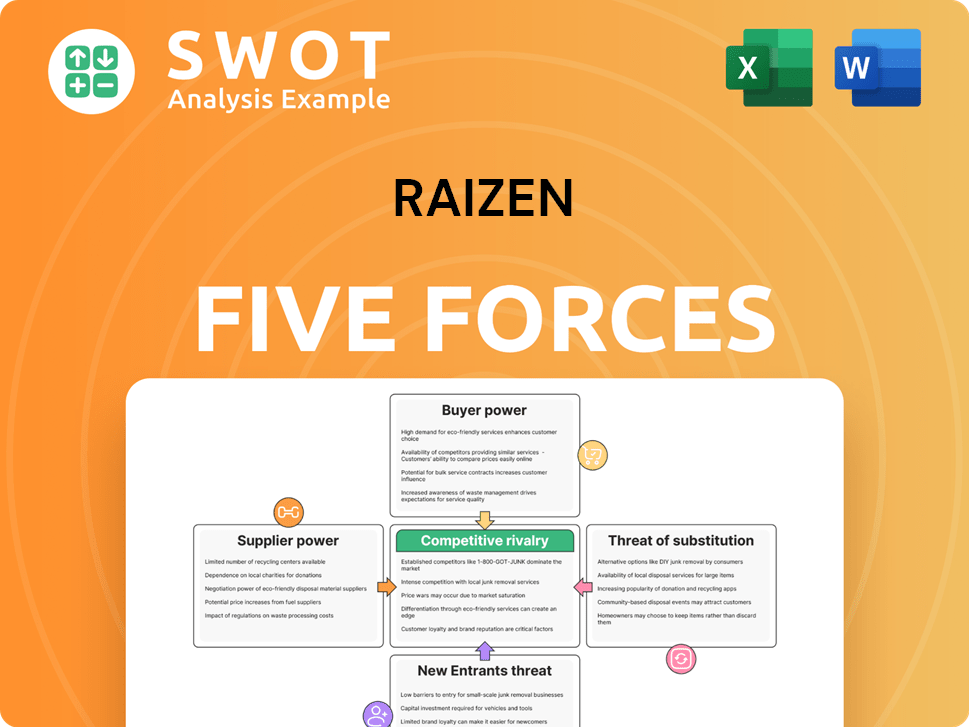

Raizen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Raizen Company?

- What is Competitive Landscape of Raizen Company?

- How Does Raizen Company Work?

- What is Sales and Marketing Strategy of Raizen Company?

- What is Brief History of Raizen Company?

- Who Owns Raizen Company?

- What is Customer Demographics and Target Market of Raizen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.