Ramsay Sante Bundle

How Did Ramsay Santé Become a European Healthcare Giant?

Explore the remarkable journey of Ramsay Santé, a leading force in European healthcare. From its inception in 1987 as Générale de Santé, the company has evolved into a vast network of hospitals and clinics. Discover how strategic decisions and a commitment to patient care have shaped its impressive trajectory.

This deep dive into the Ramsay Sante SWOT Analysis will uncover the key milestones and strategic moves that have propelled Ramsay Santé to the forefront of private hospitals in France and beyond. Understanding the brief history of Ramsay Santé France, including its mergers and acquisitions, provides crucial insights into its current market position and future growth potential. Examining Ramsay Health Care's international expansion alongside its financial performance helps to paint a complete picture of this healthcare leader.

What is the Ramsay Sante Founding Story?

The Ramsay Santé story begins with two key entities: Générale de Santé and Ramsay Health Care. Générale de Santé, the direct predecessor to Ramsay Santé, was established in 1987, marking the initial foray into private healthcare in France. Simultaneously, the foundation for the broader group, Ramsay Health Care, was laid in Sydney, Australia, in 1964.

While the founders of Générale de Santé are not widely documented, the vision was clear: to establish a prominent presence in France's private healthcare landscape. The Australian counterpart, Ramsay Health Care, was founded by Paul Ramsay. His early venture involved transforming a guesthouse into a private psychiatric hospital, demonstrating an early focus on essential medical services.

The evolution of these entities reflects broader trends in healthcare. As the 20th century progressed, privatization and specialization in healthcare gained momentum. This context provided a fertile ground for the expansion of private hospital groups like Ramsay Health Care and, subsequently, Ramsay Santé. Understanding the brief history of Ramsay Santé provides context for its current position in the market.

Ramsay Health Care was founded in 1964 in Australia by Paul Ramsay, while Générale de Santé, the precursor to Ramsay Santé, was established in 1987 in France.

- Paul Ramsay's initial venture was a 16-bed private psychiatric hospital.

- Générale de Santé aimed to become a major player in the French private healthcare sector.

- Ramsay Health Care went public in 1997, signaling a shift towards broader investment.

- The growth of these entities was influenced by the increasing privatization and specialization in healthcare during the late 20th century.

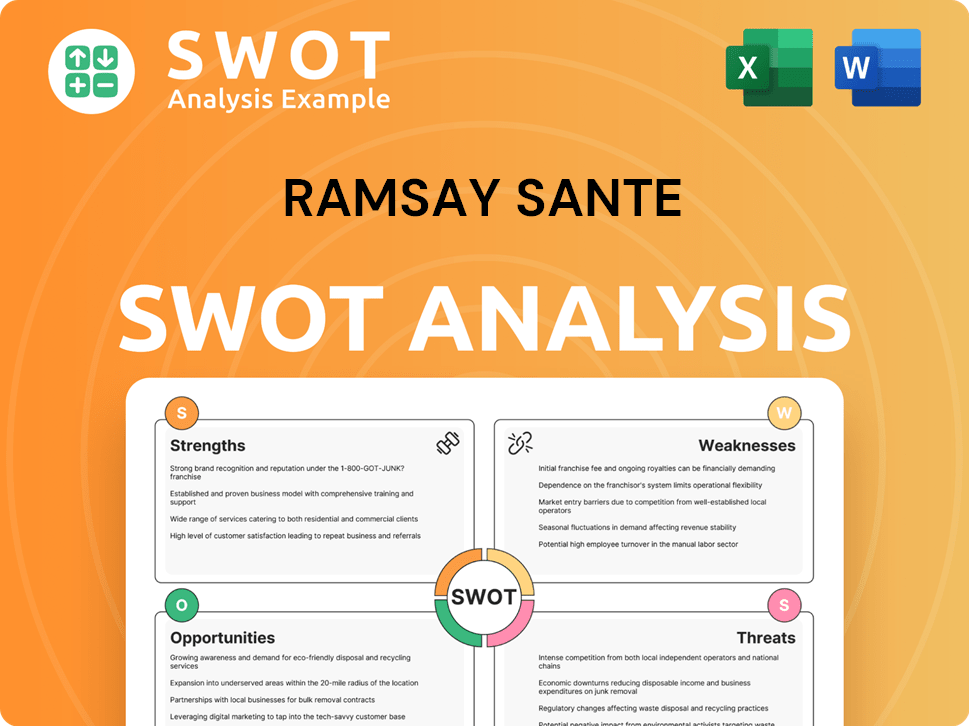

Ramsay Sante SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ramsay Sante?

The early growth and expansion of Ramsay Santé showcases strategic acquisitions and a commitment to broadening its healthcare services. Established in France in 2010 by Ramsay Health Care, the company quickly expanded its footprint. Key mergers and acquisitions have been instrumental in shaping Ramsay Santé's position as a leader in the European healthcare market.

In 2010, Ramsay Santé was founded in France by Ramsay Health Care, initially acquiring eight clinics with support from Crédit Agricole. This marked the beginning of its strategic expansion within the French healthcare market. The early acquisitions laid the groundwork for future growth and established a strong presence in the private hospital sector in France.

A significant milestone occurred in 2015 with the merger of Générale de Santé and Ramsay Santé. This merger created the Ramsay Générale de Santé group, positioning it as the largest private hospital group in France. The combined entity comprised 121 facilities, significantly increasing its capacity and market share in the private healthcare sector.

In 2018, Ramsay Générale de Santé acquired the Swedish Capio AB Group, which added 260 facilities and 16,000 employees. This acquisition expanded its reach across France, Sweden, Norway, Denmark, and Italy. The acquisition transformed the group into a major player in comprehensive care services across Europe.

In 2019, the combined entity officially adopted the name Ramsay Santé. In June 2024, Ramsay Santé acquired 12 Cosem primary care centers in France, enhancing its primary care offerings. This move aligns with its 'Yes We Care 2025' strategic plan, emphasizing integrated care and growth in outpatient activities. For more information about the company's structure, you can read more about the Owners & Shareholders of Ramsay Sante.

The company's financial performance reflects its strategic investments and market adaptations. For the half-year ended December 31, 2024, consolidated revenue reached €2.5 billion, a 5.8% increase on a reported basis, and a 3.7% like-for-like growth. For the nine months ending March 31, 2025, consolidated revenue increased by 5.1% to €3.9 billion, with a 3.2% like-for-like growth. These figures highlight the company's continued growth despite challenges.

Ramsay Santé faces challenges such as inflationary pressures and under-funded government tariffs in some regions. Despite these hurdles, the company continues to invest in strategic initiatives and adapt to market demands. The focus on integrated care and outpatient services demonstrates its commitment to evolving with the healthcare landscape.

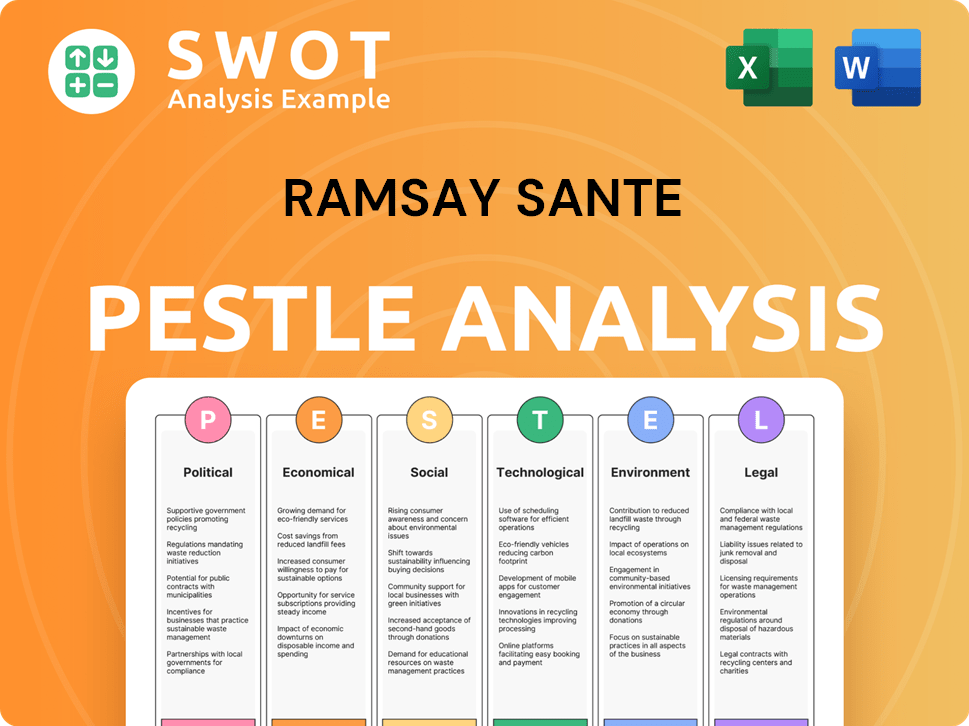

Ramsay Sante PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ramsay Sante history?

Throughout its history, Ramsay Santé, previously known as Ramsay Health Care, has achieved significant milestones in the healthcare sector. These achievements have contributed to its growth and position in the private hospitals sector in France and internationally.

| Year | Milestone |

|---|---|

| 2022 | Became a mission-driven company, committing to social and environmental objectives. |

| 2024 | Refinanced €1.65 billion senior debt facilities, extending maturities to 2029-2031. |

| 2025 | Repriced senior debt facilities at more favorable margins with a single maturity in 2031. |

Innovation is a key focus for Ramsay Santé, driving improvements in patient care and operational efficiency. The 'Yes We Care 2025' plan is a strategic innovation, focusing on integrated care services and expanding facilities.

The plan emphasizes integrated care services, including expanding imaging equipment and opening new primary care centers.

Ramsay Santé is focusing on digitalization efforts, including using AI in medical reporting and remote monitoring.

In January 2023, the company launched its first 'Living Labs' to foster innovation and accelerate the transition from ideas to real-life testing.

Despite these achievements, Ramsay Santé faces several challenges, particularly in the French healthcare market. These challenges include financial pressures and regulatory hurdles.

Increasing salaries and procurement inflation, often underfunded by governments, have put pressure on EBITDA. For the half-year ended December 2024, Group EBITDA was flat at €284.6 million.

The withholding of the 2024 prudential coefficient on French tariffs and lower subsidies have weighed on results.

In the financial year ended June 2024, Ramsay Santé reported a net loss of €53.9 million, compared to a net profit of €49.4 million in the prior year.

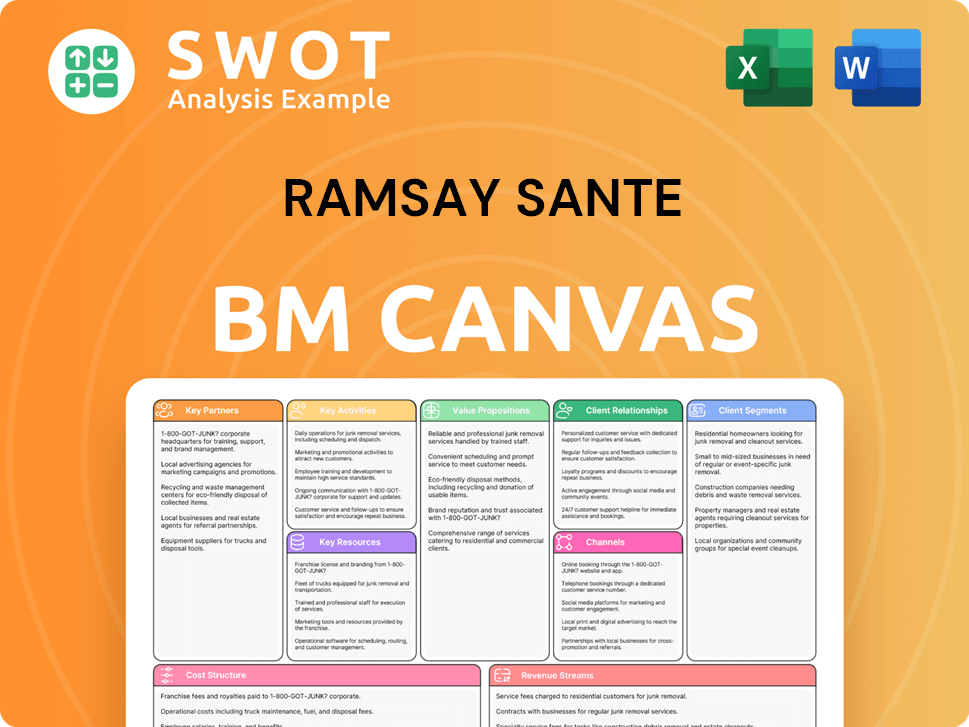

Ramsay Sante Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ramsay Sante?

The history of Ramsay Santé, a key player in healthcare in France, is marked by strategic acquisitions and a commitment to innovation. From its origins in 1987 as Générale de Santé to its current status, the company has evolved significantly, expanding its services and footprint across Europe. The journey includes mergers, acquisitions, and a shift towards mission-driven operations, highlighting its adaptability and growth in the private hospitals France sector.

| Year | Key Event |

|---|---|

| 1987 | Creation of Générale de Santé by the Compagnie générale des eaux. |

| 2010 | The Australian private hospital group Ramsay Health Care creates Ramsay Santé in France by buying 8 clinics with the support of Crédit Agricole. |

| 2015 | Merger of Générale de Santé with Ramsay Santé, creating the new Ramsay Générale de Santé group and making it the number one private hospitalization provider in France. |

| 2018 | Ramsay Générale de Santé acquires Swedish Capio AB Group, becoming one of the European leaders in comprehensive care services. |

| 2019 | The new group takes the name of Ramsay Santé. |

| 2022 | Ramsay Santé becomes a mission-driven company, committing to social and environmental objectives. |

| January 2023 | Launch of the first 'Living Labs' for innovation. |

| June 2024 | Acquisition of 12 Cosem primary care centers in France. |

| August 2024 | Successful refinancing of €1.65 billion senior debt facilities. |

| October 2024 | Capio (Ramsay Santé's subsidiary) is awarded the assignment to provide care at St. Göran's Hospital in Stockholm for at least 8 additional years, with a potential 4-year extension, for a contract value of approximately €4.8 billion (SEK 55 billion). |

| February 2025 | Repricing of senior debt facilities at more favorable margins with a single maturity in 2031, supporting the 'Yes We Care 2025' strategic plan. |

The strategic plan focuses on integrated care services, expanding out-of-hospital and outpatient activities. It also emphasizes the development of primary care. The plan includes continued growth in France through acquisitions and the opening of new mental health day facilities, reflecting the company's commitment to comprehensive healthcare.

Ramsay Santé aims to leverage digital capabilities, including AI in medical reporting and remote monitoring, to enhance patient care. This demonstrates the company's commitment to innovation and improving patient outcomes. This approach integrates technology to improve the quality and efficiency of healthcare services.

The company is focused on cost control measures and productivity improvements. Recent refinancing of €1.65 billion senior debt facilities supports its strategic initiatives. The parent company, Ramsay Health Care, is exploring strategic options for its majority shareholding, which could lead to changes in ownership or structure.

Ramsay Santé's focus on innovation, integrated care, and operational efficiency positions it for continued growth. The company's mission is to improve health through constant innovation. This includes building upon its founding vision to provide high-quality healthcare services across Europe, despite challenges such as underfunded government tariffs and inflationary pressures.

Ramsay Sante Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ramsay Sante Company?

- What is Growth Strategy and Future Prospects of Ramsay Sante Company?

- How Does Ramsay Sante Company Work?

- What is Sales and Marketing Strategy of Ramsay Sante Company?

- What is Brief History of Ramsay Sante Company?

- Who Owns Ramsay Sante Company?

- What is Customer Demographics and Target Market of Ramsay Sante Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.