Ramsay Sante Bundle

Who Really Owns Ramsay Santé?

Understanding the ownership of a major healthcare company like Ramsay Santé is crucial for anyone making investment decisions or analyzing the industry. Did you know that the strategic direction of a company is significantly influenced by its ownership structure? This knowledge is vital for investors, analysts, and anyone interested in the healthcare sector. This analysis dives deep into the Ramsay Sante SWOT Analysis and its ownership dynamics.

The story of Ramsay Santé, a leading European hospital group, is a fascinating one, marked by strategic acquisitions and evolving ownership stakes. From its origins as Générale de Santé to its current status, understanding who owns Ramsay Santé reveals insights into its governance, financial performance, and future trajectory. This exploration of the Ramsay Santé ownership structure will provide a comprehensive view of its major shareholders, including Ramsay Health Care, and how they shape this prominent healthcare company.

Who Founded Ramsay Sante?

The story of Ramsay Santé, a prominent healthcare company, begins with two key entities. Générale de Santé was established in 1987 by Compagnie générale des eaux. Later, the Australian hospital group, Ramsay Health Care, played a crucial role in shaping the company's current form.

Ramsay Health Care, founded by Paul Ramsay in 1964, entered the French market in 2010 by acquiring clinics. This strategic move set the stage for the future of Ramsay Santé. The merger in 2015 between Générale de Santé and Ramsay Health Care marked a significant turning point, leading to the formation of Ramsay Générale de Santé, which later became Ramsay Santé in 2019.

The initial ownership structure of Générale de Santé involved major corporate investments, particularly from Compagnie générale des eaux. Ramsay Health Care's expansion in France was supported by Crédit Agricole, indicating a reliance on financial group investments rather than individual investors. This approach facilitated the growth and expansion of private healthcare services, a core strategy that has been consistently pursued.

Générale de Santé was founded in 1987 by Compagnie générale des eaux. This marked the initial entry into the healthcare market.

Ramsay Health Care, an Australian hospital group, entered the French market in 2010. This was a key step in the evolution of Ramsay Santé.

The merger in 2015 between Générale de Santé and Ramsay Health Care created Ramsay Générale de Santé. The name was later changed to Ramsay Santé in 2019.

Early ownership involved major corporate entities like Compagnie générale des eaux. Financial backing from Crédit Agricole supported Ramsay Health Care's expansion.

The early focus was on expanding private healthcare services. This strategy has been consistently pursued through mergers and acquisitions.

Key players include Compagnie générale des eaux, Ramsay Health Care, and Crédit Agricole. These entities shaped the ownership and direction of Ramsay Santé.

Understanding the ownership structure of Ramsay Santé is crucial for anyone interested in the Competitors Landscape of Ramsay Sante. The company's evolution from Générale de Santé to its current form involved significant corporate and financial backing. The early involvement of entities like Compagnie générale des eaux and Crédit Agricole highlights the strategic importance of financial partnerships in the healthcare sector. This structure has enabled Ramsay Santé to grow and expand its services in France.

- Ramsay Health Care, through acquisitions, has a significant stake in Ramsay Santé.

- Financial institutions like Crédit Agricole have played a role in supporting the company's expansion.

- The ownership structure reflects a focus on corporate and financial investments, rather than individual investors.

- The company's history shows a clear strategy of growth through mergers and acquisitions within the private healthcare market.

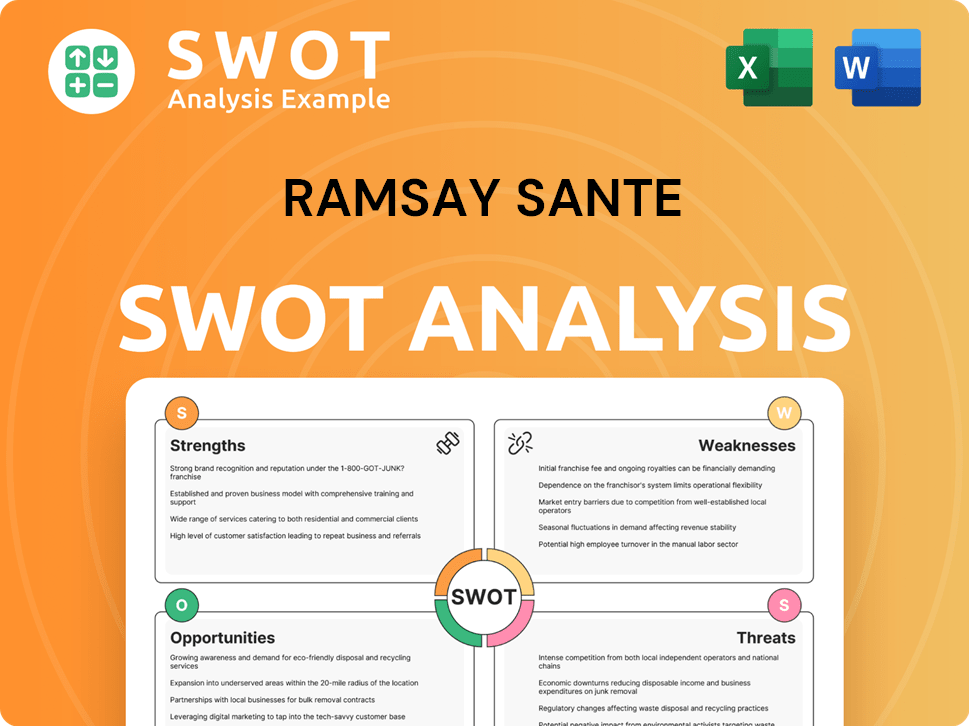

Ramsay Sante SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ramsay Sante’s Ownership Changed Over Time?

The ownership of Ramsay Santé has seen significant shifts, mainly due to strategic investments by Ramsay Health Care Limited. Currently, the majority stake is held by Ramsay Health Care (UK) Limited, with a 52.79% share. Predica, a personal insurance subsidiary of the Crédit Agricole Group, holds the second-largest share at 39.82%. These major shareholders are governed by an agreement established on September 30, 2014, and later amended on December 12, 2016. The remaining 7.39% is distributed among other shareholders.

A pivotal moment in the ownership structure was the 2018 acquisition of Capio AB. This acquisition was financed through a combination of €750 million in debt and an equity injection of approximately €550 million from its ultimate parents, Ramsay Health Care Ltd. and Predica. Ramsay Health Care contributed €314 million, with Predica providing the rest, ensuring Ramsay Health Care maintained majority ownership. By April 2019, Ramsay Générale de Santé controlled 100% of Capio's shares following a squeeze-out of minority shareholders. This expansion strategy highlights the healthcare company's commitment to growth and market consolidation.

| Shareholder | Stake | Notes |

|---|---|---|

| Ramsay Health Care (UK) Limited | 52.79% | Majority Stakeholder |

| Predica | 39.82% | Subsidiary of Crédit Agricole Group |

| Other Shareholders | 7.39% | Remaining Shares |

As of December 2024, Ramsay Santé reported a consolidated revenue of €2,507 million for the half-year period. For the financial year ending June 30, 2024, the company reported a net loss of €53.9 million, contrasting with a net profit of €49.4 million the previous year, influenced by lower operating income and increased debt costs. The group's revenue increased by 6.5% to €5 billion, with organic sales growth of 7.5%. The net financial debt as of December 31, 2024, amounted to €3,715.6 million. For more insights into the financial aspects, consider exploring the Revenue Streams & Business Model of Ramsay Sante.

Ramsay Santé's ownership is primarily controlled by Ramsay Health Care (UK) Limited and Predica.

- Ramsay Health Care (UK) Limited holds the majority stake.

- Predica, a Crédit Agricole Group subsidiary, is the second-largest shareholder.

- The company has been listed on Euronext Paris since June 19, 2001.

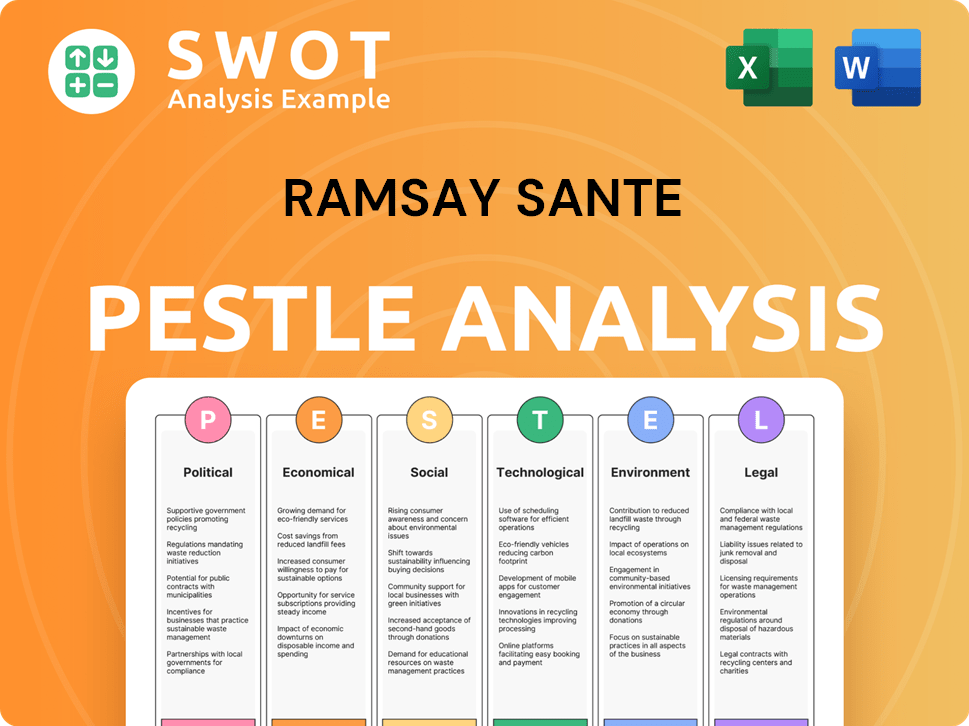

Ramsay Sante PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ramsay Sante’s Board?

The governance of Ramsay Santé is overseen by a Board of Directors, with the roles of Chairman and Chief Executive Officer separated. As of October 29, 2021, the board comprised ten members. Mr. Craig McNally served as Chairman of the Board. Mr. Matthieu Lance holds the position of Vice-Chairman. The board includes representatives from major shareholders and independent directors, ensuring a diverse range of perspectives in decision-making.

The Board of Directors includes representatives from major shareholders, such as Ramsay Health Care (UK) Limited, represented by Madame Colleen Harris, and Crédit Agricole Assurances (Predica), represented by Madame Magali Chessé. Independent directors like Madame Anne-Marie Couderc and employee representatives also contribute to the board's composition. Other directors include Madame Natalie Davis, Mr. Nick Costa, and Madame Karen Penrose. Natalie Davis was appointed Group CEO-elect of Ramsay Health Care Limited on October 1, 2024, and is set to become Managing Director and Group CEO later in 2025.

| Board Member | Role | Affiliation |

|---|---|---|

| Craig McNally | Chairman of the Board | Ramsay Health Care Limited |

| Matthieu Lance | Vice-Chairman | N/A |

| Colleen Harris | Director | Ramsay Health Care (UK) Limited |

| Magali Chessé | Director | Crédit Agricole Assurances (Predica) |

| Anne-Marie Couderc | Independent Director | N/A |

| Elvire Kodjo | Employee Representative | N/A |

| Olivier Poher | Employee Representative | N/A |

| Natalie Davis | Director | Ramsay Health Care Limited |

| Nick Costa | Director | N/A |

| Karen Penrose | Director | N/A |

Regarding company ownership, Ramsay Health Care (UK) Limited holds a significant stake of 52.53%, and Predica holds 39.62% of the share capital. This ownership structure gives these shareholders considerable voting power and influence over the strategic direction of the healthcare company. For more details on the target market, consider reading the article about the Target Market of Ramsay Sante.

The Board of Directors at Ramsay Santé includes representatives from major shareholders and independent directors, ensuring diverse perspectives.

- Ramsay Health Care (UK) Limited and Predica are the major shareholders, with significant voting power.

- The company follows the AFEP-MEDEF corporate governance code.

- There were no recent proxy battles or activist investor campaigns.

- The Board decided not to propose a dividend for the financial year ended June 30, 2024.

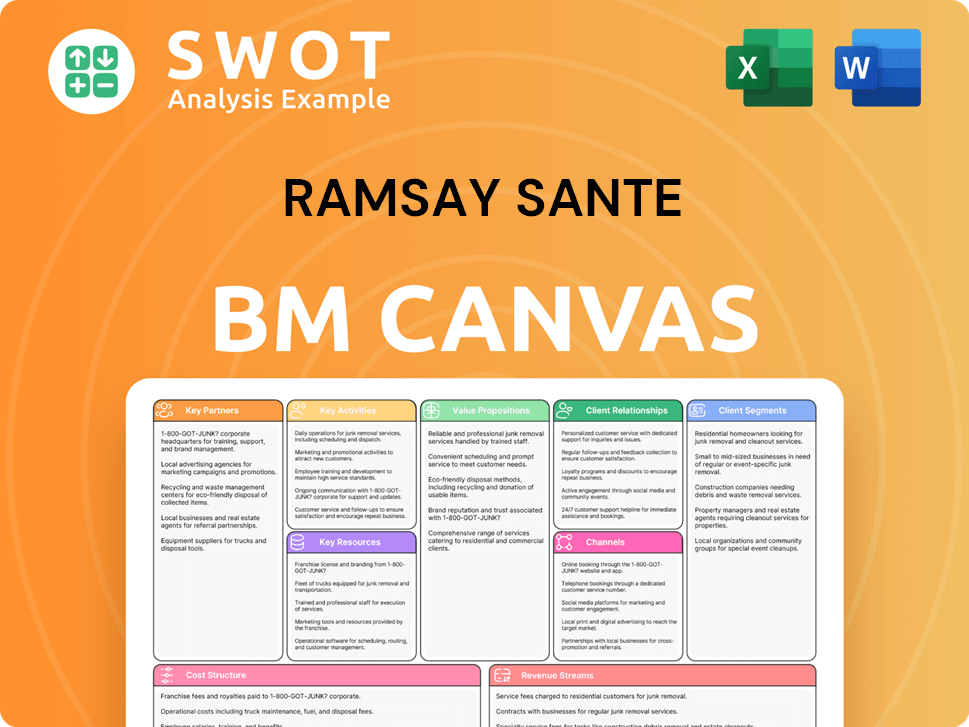

Ramsay Sante Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ramsay Sante’s Ownership Landscape?

Over the past few years, the ownership landscape of Ramsay Sante has seen significant developments. A key move in early 2025 was Ramsay Health Care Limited's decision, announced on February 27, 2025, to explore strategic options for its majority stake in Ramsay Sante. This strategic review, advised by Goldman Sachs, reflects Ramsay Health Care's focus on its hospital businesses in Australia and the UK. It also acknowledges that Ramsay Sante, along with its Elysium mental health services business in the UK, has generated lower returns on capital.

Financially, Ramsay Sante reported a net loss (group share) of €53.9 million for the 2023-24 financial year, ending June 30, 2024, a shift from a net profit of €49.4 million the previous year. Despite this, sales increased by 6.5% to €5 billion, with a solid 7.5% organic sales growth. The company also successfully refinanced its €1,650 million senior debt facilities in August 2024, extending maturities to 2029-2031, which provides a long-term financing framework. These financial adjustments and strategic reviews indicate potential changes in the Ramsay Sante ownership structure.

Industry trends also play a role in shaping the future of Ramsay Sante. Increased scrutiny of private healthcare providers, particularly in France, highlights concerns about the flow of public funds. A January 2025 report showed that private hospitals, including those operated by Ramsay Sante, might have paid approximately €2.5 billion in 2023 to private property investors. Leadership changes at the parent company, Ramsay Health Care, further signal potential shifts. Craig McNally's retirement as Managing Director & Group CEO of Ramsay Health Care and Chairman of Ramsay Sante at the end of June 2025, along with the appointment of Natalie Davis as Group CEO-elect on October 1, 2024, and Clément Lafaix as Group CFO of Ramsay Sante in July 2024, suggest a period of re-evaluation and potential changes for the company.

Ramsay Health Care currently holds a majority stake in Ramsay Sante. The strategic review announced in early 2025 may lead to changes in this ownership structure. This review is influenced by the parent company's focus on its core businesses.

Ramsay Sante reported a net loss of €53.9 million for the fiscal year ending June 30, 2024. The company's sales, however, increased by 6.5% to €5 billion. The company also refinanced its debt facilities in August 2024, extending maturities to 2029-2031.

Increased scrutiny on private healthcare providers, especially concerning property investment funds. Private hospitals in France, including those operated by Ramsay Sante, potentially paid around €2.5 billion in 2023 to private property investors. This has raised concerns about the flow of public money.

Craig McNally, the long-serving Managing Director & Group CEO of Ramsay Health Care and Chairman of Ramsay Sante, is retiring. Natalie Davis was appointed as Group CEO-elect on October 1, 2024, and will assume the full role later in 2025. Clément Lafaix was appointed Group CFO of Ramsay Sante in July 2024.

Ramsay Sante Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ramsay Sante Company?

- What is Competitive Landscape of Ramsay Sante Company?

- What is Growth Strategy and Future Prospects of Ramsay Sante Company?

- How Does Ramsay Sante Company Work?

- What is Sales and Marketing Strategy of Ramsay Sante Company?

- What is Brief History of Ramsay Sante Company?

- What is Customer Demographics and Target Market of Ramsay Sante Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.