RiseSun Real Estate Development Bundle

How did RiseSun Real Estate Rise to Prominence?

Delve into the captivating RiseSun Real Estate Development SWOT Analysis and uncover the story of RiseSun Company, a powerhouse in China's dynamic real estate sector. From its inception in 1996, RiseSun Development has navigated the complexities of a rapidly evolving market, transforming from a fledgling enterprise into a significant industry player. Explore the key milestones and strategic decisions that have shaped its remarkable journey.

This exploration into RiseSun Real Estate's history reveals a tale of strategic expansion and adaptation within the competitive Chinese real estate landscape. Understanding the company's background, including its early focus on property development, sales, and management, provides crucial context for analyzing its current market position and future prospects. The evolution of RiseSun Development offers valuable insights into the broader trends shaping the Chinese real estate market.

What is the RiseSun Real Estate Development Founding Story?

The story of RiseSun Real Estate Development Co. Ltd. began in 1996. This marked the start of a journey that would see the company become a significant player in the Chinese real estate market. While the exact details of its founding, including the founders' names and backgrounds, aren't widely available, the company's creation was undeniably linked to the opportunities presented by China's booming economy and the rising demand for property.

The core of RiseSun's initial strategy was property development. This encompassed everything from acquiring land and constructing buildings to selling the properties and managing them. The focus was on meeting the increasing needs for both residential and commercial spaces across China. The company aimed to cater to the growing middle class and businesses that were emerging during this period of economic expansion.

RiseSun's founding was driven by the need for modern properties in China's rapidly growing cities.

- The initial business model centered on property development, covering land acquisition, construction, sales, and management.

- Early offerings included residential units and commercial spaces, targeting the expanding middle class and businesses.

- Initial funding likely came from private investments and early bank loans.

The context of China's economic reforms and rapid urbanization played a crucial role in RiseSun's early success. The company found fertile ground for its real estate ventures, capitalizing on the changing landscape of the country. Details about the company name selection or initial funding sources are not widely publicized. However, given the mid-1990s context, initial funding would have likely involved a mix of private investment and early bank loans, as the sector began attracting significant capital. For more insights into how the company approached its market, consider reading about the Marketing Strategy of RiseSun Real Estate Development.

The early years of RiseSun Development were characterized by a focus on building a strong foundation in the property market. The company's ability to identify and capitalize on the opportunities presented by China's economic growth was key to its initial success. While specific financial data from the late 1990s isn't readily available, the company's early projects likely reflected the broader trends in the Chinese real estate sector, which saw significant growth during this period. The company's focus on residential and commercial properties positioned it to benefit from the increasing demand for housing and business spaces.

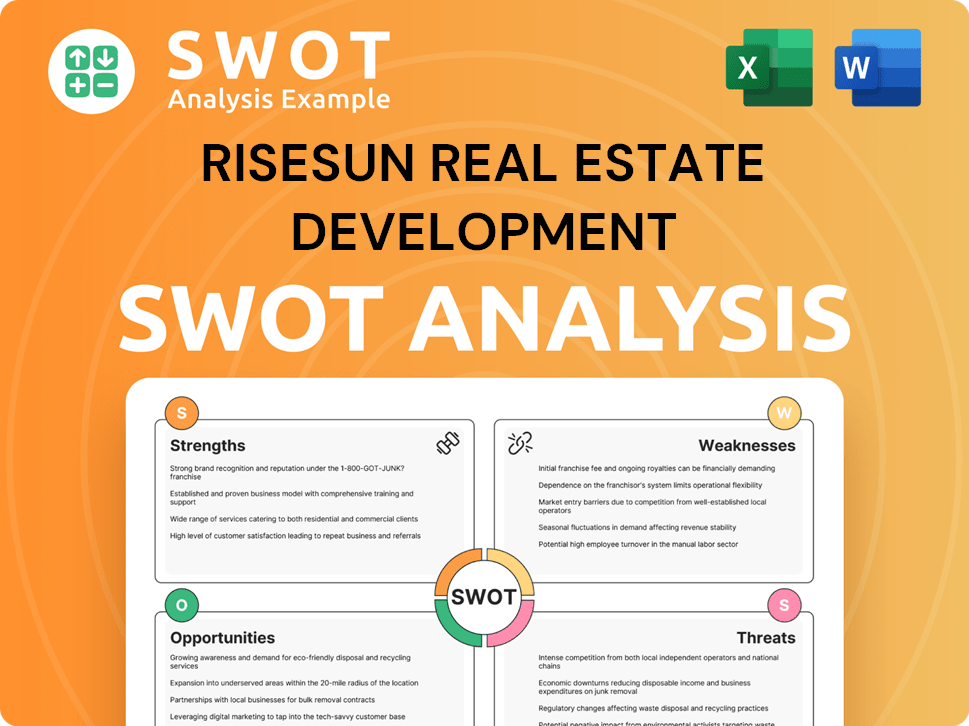

RiseSun Real Estate Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of RiseSun Real Estate Development?

The early growth and expansion of RiseSun Real Estate, or RiseSun Development, centered on capitalizing on the burgeoning Chinese property market. While specific details of early projects are not widely publicized, the company's trajectory suggests a rapid scaling of its development activities. As China's urbanization accelerated, RiseSun likely expanded its portfolio beyond initial residential projects to include commercial properties. The company's expansion strategy would have involved entering new geographical markets within China, gradually extending its reach beyond its initial operational bases.

RiseSun Company's expansion likely involved entering new geographical markets within China. This would have been supported by an increasing team size and the establishment of new office and facility locations. Competitors Landscape of RiseSun Real Estate Development provides insights into the competitive environment during this period.

Major capital raises would have been crucial for financing large-scale developments. Funding was likely sourced from a mix of domestic banks and potentially private equity, as the company matured. The real estate history shows that securing capital is vital for growth.

The market reception for RiseSun's properties would have been generally positive, given the high demand in China's real estate sector during this period. Strategic shifts in business model or vision would have likely focused on optimizing project pipelines, enhancing construction efficiency, and adapting to evolving government policies and market demands. By the mid-2000s, RiseSun would have established a solid foundation.

Key acquisitions or mergers during its early phase are not extensively documented, but such strategic moves are typical for property development companies. Leadership transitions, while not detailed publicly for its early years, would have played a role in guiding its strategic direction. The company's early years reflect the dynamic nature of Chinese real estate.

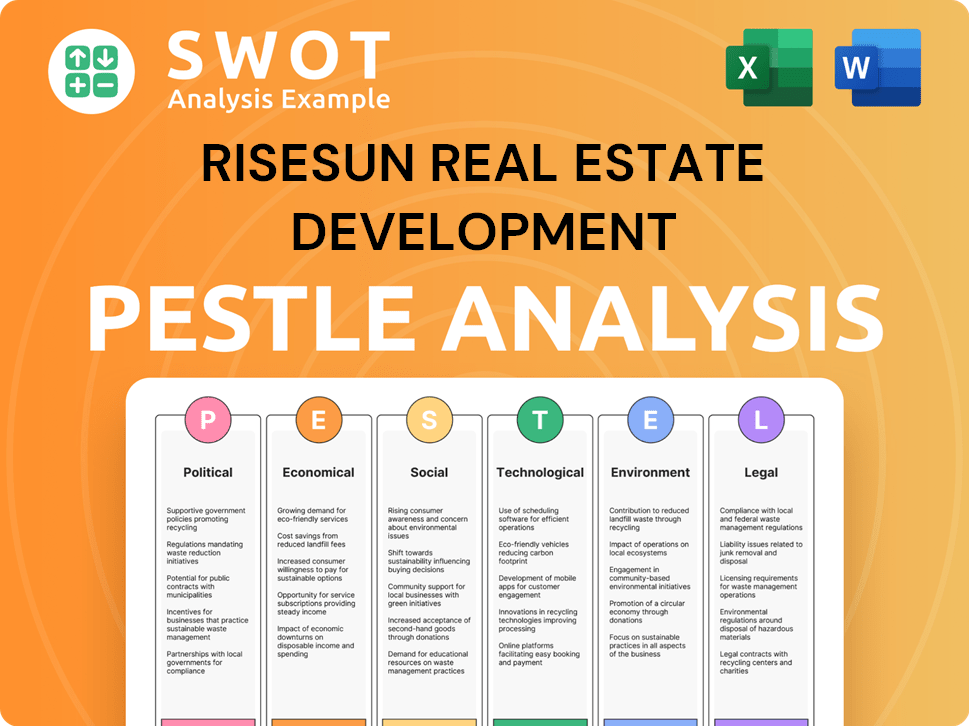

RiseSun Real Estate Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in RiseSun Real Estate Development history?

The journey of RiseSun Real Estate has been marked by significant milestones, reflecting its growth and adaptation within the dynamic Chinese real estate market. From its inception, RiseSun Development has aimed to establish a strong presence in the property development sector, navigating the complexities of market fluctuations and regulatory changes. The company's history showcases its resilience and strategic adjustments in response to various economic conditions, solidifying its position in the competitive landscape of RiseSun Company.

| Year | Milestone |

|---|---|

| Early Years | Establishment and initial projects, focusing on residential and commercial properties. |

| Mid-Period | Expansion of the property portfolio, including diversification into different market segments and geographical areas. |

| Recent Years | Adaptation to changing market conditions, including strategic realignments and responses to regulatory changes within the Chinese real estate sector. |

While specific innovations are not widely publicized, RiseSun Real Estate has likely incorporated modern construction techniques and sustainable practices in its projects. The company has also likely adapted to digital marketing and sales strategies to enhance customer engagement and project promotion.

RiseSun Development likely adjusted its project designs and offerings to meet evolving consumer preferences and market demands, such as incorporating smart home technologies or green building features.

The company probably utilized digital platforms for marketing, sales, and customer relationship management, improving efficiency and reach. They may have also used Building Information Modeling (BIM) for project management.

RiseSun Company might have incorporated sustainable building materials and energy-efficient designs to reduce environmental impact and appeal to eco-conscious consumers. This could include LEED certifications or similar standards.

RiseSun Real Estate likely focused on specific market segments, such as luxury apartments, affordable housing, or commercial spaces, to cater to diverse consumer needs. This strategic focus aids in navigating market fluctuations.

Strategic alliances with construction firms, financial institutions, and technology providers would have been crucial for project success and market expansion. These partnerships are vital for land acquisition and project financing.

RiseSun Development probably employed financial strategies such as debt restructuring and asset sales to manage cash flow and maintain financial stability, especially during economic downturns. Prudent financial management is key.

RiseSun Company has faced challenges such as fluctuating market conditions and regulatory changes, which have impacted project timelines and financial performance. The company's ability to navigate economic downturns and maintain its market position has been a key test of its resilience.

The Chinese real estate market has experienced periods of slowdown, impacting sales and project profitability. These downturns have required strategic adjustments and financial prudence.

Changes in government policies, such as stricter lending rules and property purchase restrictions, have presented challenges. Adapting to these changes is crucial for compliance.

Intense competition from other real estate developers has required RiseSun Real Estate to differentiate its offerings and maintain a strong market presence. Market share battles are common.

Managing debt and securing financing during challenging economic times has been a key concern. Maintaining a healthy financial position is essential.

External factors, such as supply chain issues or construction delays, can impact project timelines and increase costs. Effective project management is vital.

Fluctuations in property values and consumer demand create uncertainty. RiseSun Development must adapt to changing market dynamics. For more insights, explore Mission, Vision & Core Values of RiseSun Real Estate Development.

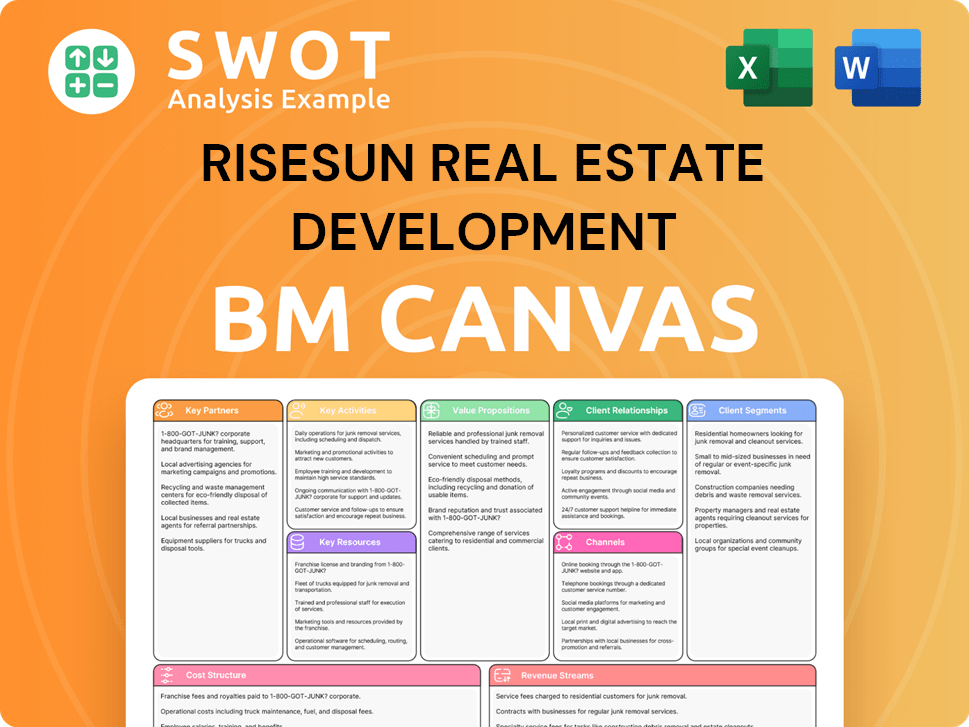

RiseSun Real Estate Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for RiseSun Real Estate Development?

The RiseSun Real Estate journey showcases significant growth and adaptation within the dynamic Chinese real estate market. Founded with ambitions to become a major player in property development, the company has navigated economic cycles and market shifts, expanding its portfolio and influence over time. Its evolution reflects broader trends in the real estate history of China, including urbanization, policy changes, and shifts in consumer preferences.

| Year | Key Event |

|---|---|

| Early 2000s | The company was established, focusing on residential and commercial property development in key Chinese cities. |

| Mid-2000s | RiseSun Development expanded its project portfolio, capitalizing on the rapid urbanization and growing demand for housing. |

| Late 2000s - Early 2010s | The company started to diversify its investments, including expansion into new geographical areas and property types. |

| 2010s | RiseSun Company faced increased competition and market volatility, adapting its strategies to maintain growth and profitability. |

| 2020s | The company navigated the challenges of the COVID-19 pandemic and adjusted its business model to address changing market conditions and regulatory changes. |

RiseSun Real Estate is expected to continue its strategy of expanding its footprint across China. This includes both geographic expansion into new markets and diversification into different types of properties, like mixed-use developments and sustainable buildings. The company aims to capitalize on urbanization trends and rising demand for quality housing and commercial spaces.

The company is likely to embrace technology to improve efficiency and enhance customer experience. This includes using digital tools for project management, sales, and marketing. Smart home technologies and sustainable building practices are also expected to be integrated into new projects, aligning with consumer preferences and environmental goals.

RiseSun Company will need to manage its finances prudently, given the fluctuations in the real estate market. This involves careful planning of investments, managing debt levels, and ensuring healthy cash flow. Partnerships and joint ventures may be used to share risks and increase capital efficiency. The current financial climate requires strategic financial planning.

Adapting to changing regulations will be crucial for RiseSun Development. This includes compliance with new environmental standards, construction codes, and financial regulations. The company will need to maintain strong relationships with government bodies and industry associations to navigate these changes effectively. The focus will be on sustainable and compliant development practices.

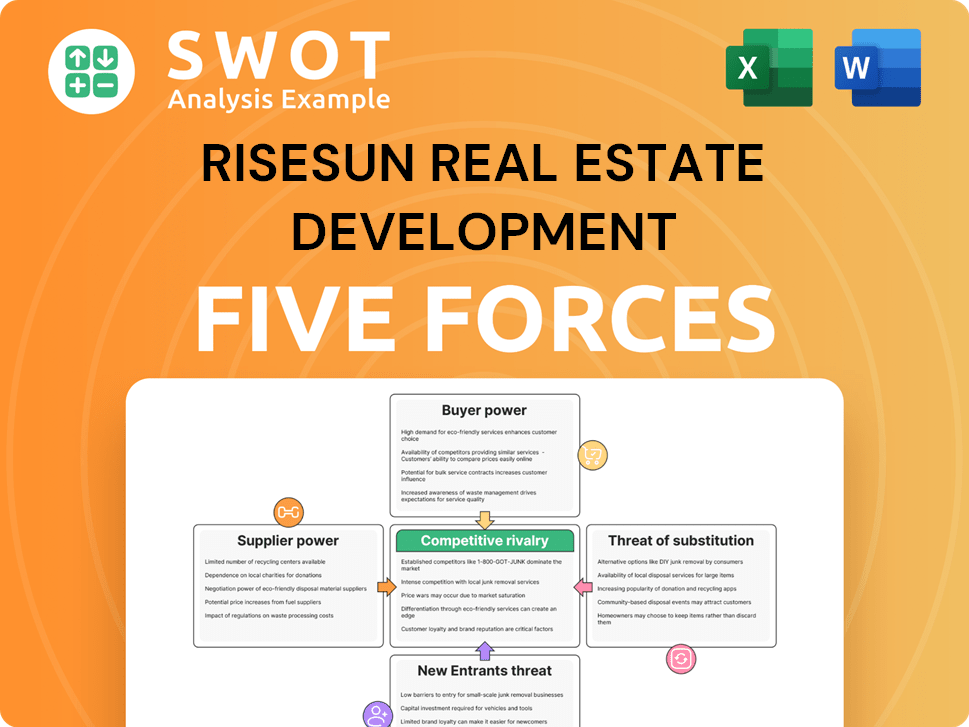

RiseSun Real Estate Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of RiseSun Real Estate Development Company?

- What is Growth Strategy and Future Prospects of RiseSun Real Estate Development Company?

- How Does RiseSun Real Estate Development Company Work?

- What is Sales and Marketing Strategy of RiseSun Real Estate Development Company?

- What is Brief History of RiseSun Real Estate Development Company?

- Who Owns RiseSun Real Estate Development Company?

- What is Customer Demographics and Target Market of RiseSun Real Estate Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.