RiseSun Real Estate Development Bundle

How Does RiseSun Real Estate Thrive in China's Market?

Founded in 1996, RiseSun Real Estate Development Company has become a significant player in China's property development landscape. With a strong focus on residential and commercial projects, the company has completed over 200 large-scale projects, primarily in key regions like Beijing-Tianjin-Hebei and the Yangtze River Delta. Understanding the inner workings of RiseSun is crucial for investors and anyone interested in the dynamics of the Chinese real estate market.

This analysis explores RiseSun's operational strategies, revenue models, and competitive advantages, providing a comprehensive view of its performance. We'll examine its RiseSun Real Estate Development SWOT Analysis, financial health, and future prospects, offering insights into how this Real Estate Development Company navigates the complexities of property development in China, and what this means for RiseSun Investments. This deep dive will help you understand how RiseSun works and its potential for growth.

What Are the Key Operations Driving RiseSun Real Estate Development’s Success?

The core of RiseSun Real Estate Development's operations centers on creating value through the development, sale, leasing, and management of residential and commercial properties within China. The company's portfolio includes a variety of properties, such as luxury apartments, office buildings, and shopping centers. This diverse range caters to different customer segments, highlighting RiseSun's broad market approach.

RiseSun's operational processes are comprehensive, covering architectural design, property management, hotel management, commercial operation, and investment management. As a national grade 1 real estate developer, RiseSun focuses on large-scale commercial and residential projects, primarily in medium-sized cities. This strategic focus allows RiseSun to leverage its expertise and resources effectively.

The company strategically concentrates its business operations in key economic zones such as the Beijing-Tianjin-Hebei region and the Yangtze River Delta. Its projects are spread across cities in Hebei, Jiangsu, and Anhui provinces, demonstrating a strong regional presence. RiseSun's approach emphasizes 'sustainable urban operations and intelligent construction techniques,' integrating advanced technology and environmentally friendly practices.

RiseSun's primary offerings include luxury apartments, office buildings, and shopping centers. These properties are designed to meet the diverse needs of various customer segments. The focus on quality and sustainability is a key differentiator in the market.

The company's operational processes span architectural design, property management, hotel management, commercial operation, and investment management. This comprehensive approach ensures that all aspects of a project are managed efficiently. RiseSun's commitment to sustainable urban operations reflects its dedication to environmental responsibility.

RiseSun concentrates its projects in key economic circles, including the Beijing-Tianjin-Hebei region and the Yangtze River Delta. This strategic focus allows the company to capitalize on growth opportunities in these areas. Projects are located in cities across Hebei, Jiangsu, and Anhui provinces.

RiseSun integrates cutting-edge technology and environmentally friendly practices into its projects. Its approach includes 'sustainable urban operations and intelligent construction techniques'. The company's portfolio includes properties meeting China Green Building Standard requirements, with approximately 359 million square meters of properties.

RiseSun's value proposition lies in its ability to deliver high-quality, sustainable properties that meet the diverse needs of its customers. The company's focus on innovation and environmental responsibility enhances its market position. RiseSun also engages in investment and asset management to maximize stakeholder value.

- Focus on sustainable urban operations and intelligent construction.

- Diverse portfolio including luxury apartments, office buildings, and shopping centers.

- Strategic investments and partnerships to maximize stakeholder value.

- Strong presence in key economic circles in China.

RiseSun Real Estate Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RiseSun Real Estate Development Make Money?

The Real Estate Development Company generates revenue through multiple channels, with property development and sales being the primary drivers. Their business model encompasses a variety of property types, including residential buildings, industrial sites, commercial premises, and hotels, all contributing to the company's income streams. This diversified approach allows for multiple sources of revenue.

In 2024, residential properties made up a significant portion, accounting for approximately 70% of the total sales. This amounted to roughly CNY 40 billion, highlighting the importance of residential projects to the company's financial performance. This strong performance underscores the company's ability to capitalize on the demand for residential properties.

Beyond direct sales, the company employs various monetization strategies. These include property management services, hotel operations, and commercial operations, which contribute to a steady stream of income. Additionally, housing renovation and housing loans further diversify the revenue base, providing additional financial stability. To understand more about the company's strategy, you can read about the Target Market of RiseSun Real Estate Development.

The primary source of revenue comes from the sale of developed properties. This includes residential, commercial, and industrial projects.

Income generated from leasing out properties such as residential units, commercial spaces, and hotels contributes to the revenue.

Fees earned from managing properties on behalf of owners, ensuring efficient operations and tenant satisfaction.

Revenue from operating hotels, including room rentals, food and beverage sales, and other guest services.

Income from commercial activities within properties, such as retail spaces and office rentals.

Additional revenue streams from housing renovations and providing housing loans to buyers.

The company is focusing on operational efficiency and talent retention to indirectly support revenue generation. This includes performance-based bonuses and increased investment in competitive salaries and benefits.

- Smart Living Initiative: Launched in 2024, integrating IoT devices into residential projects.

- Energy Efficiency: Enhancements of up to 20% compared to standard homes.

- Value Proposition: Creating new benefits for buyers through technological integration.

RiseSun Real Estate Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped RiseSun Real Estate Development’s Business Model?

Founded in 1996, the journey of the RiseSun Real Estate Development Company has been marked by significant achievements, solidifying its position in China's property market. By 2024, the company had successfully completed over 200 large-scale projects across more than 100 cities, showcasing its extensive reach and operational capabilities. This expansion reflects a strategic focus on scaling operations and diversifying its project portfolio to meet the evolving demands of the real estate market.

A crucial strategic move in 2024 was the launch of the 'Smart Living' initiative, integrating cutting-edge technology and IoT devices into its residential projects. This initiative, which included 5,000 smart homes, aimed to enhance energy efficiency by 20%, demonstrating the company's commitment to technological innovation and sustainable development. Furthermore, in 2023, the company invested $10 million in research and development, focusing on smart building technologies and advanced construction methodologies, resulting in a 20% improvement in construction timelines and a 10% reduction in overall costs for new projects.

The company's strategic moves and competitive advantages are crucial for understanding How RiseSun Works and its approach to Property Development. Despite facing market volatility and reduced bank lending, the company has maintained a strong market presence. The company’s commitment to quality and sustainability, along with its focus on scale commercial residential projects in medium-sized cities, provides a competitive edge in the market. For more information on the company's financial structure, explore Owners & Shareholders of RiseSun Real Estate Development.

Completed over 200 large-scale projects by 2024.

Expanded operations across more than 100 cities.

Launched the 'Smart Living' initiative in 2024, integrating technology into residential projects.

Investment of $10 million in R&D in 2023, focusing on smart building technologies.

Emphasis on sustainable urban operations and intelligent construction techniques.

Focus on scale commercial residential projects in medium-sized cities.

Established brand strength, recognized with numerous awards.

Commitment to quality and sustainability in all projects.

Focus on environmentally friendly practices and community betterment.

Achieved a 20% improvement in construction timelines through R&D.

Reduced overall project costs by 10% due to advanced methodologies.

Enhanced energy efficiency by 20% in smart home projects.

The company faces challenges common in the Chinese property sector, including market volatility and reduced bank lending, impacting funding and sales. Despite these headwinds, RiseSun leverages its established brand and commitment to quality.

- Adaptation to market fluctuations through diversified project types.

- Focus on strategic partnerships for funding and resource management.

- Continuous innovation in construction and smart building technologies.

- Emphasis on sustainable practices to meet evolving consumer preferences.

RiseSun Real Estate Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is RiseSun Real Estate Development Positioning Itself for Continued Success?

RiseSun Real Estate Development Company holds a significant position in the Chinese real estate market. It is recognized as a leading company and consistently ranks among the top developers in China. Its market share is primarily driven by its strong presence in key regions such as Beijing-Tianjin-Hebei and the Yangtze River Delta.

However, the company's market position is subject to the broader economic climate in China. The real estate sector faces various risks, including regulatory changes and the volatility of the Chinese property market. These factors can affect profitability and project completion.

Regulatory changes, like controls on property prices, can impact profit margins. Reduced bank lending and concerns over project completion also pose challenges. In Q1 2025, RiseSun reported a net loss of 895.3 million Yuan.

As of March 2025, RiseSun's annualized return on capital was 0.01%. The return on capital (calculated using TTM income statement data) was -1.22%, indicating that returns do not match the cost of capital.

RiseSun aims to sustain revenue generation through strategic initiatives. The company focuses on integrating smart building solutions and investing in proprietary smart technology systems. This is aimed at enhancing operational efficiency by at least 20% across its portfolio in 2024.

- Focus on smart building solutions.

- Investment in proprietary smart technology systems.

- Building regional headquarters and R&D centers.

- Supported by local government policies.

For more details on the company's strategy, you can read about the Growth Strategy of RiseSun Real Estate Development.

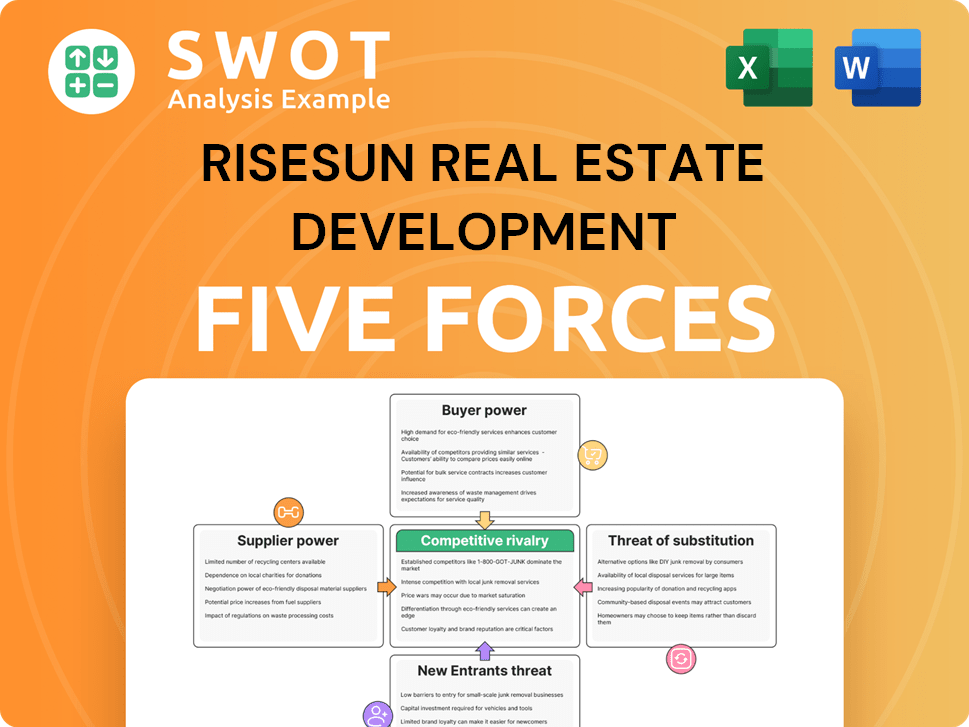

RiseSun Real Estate Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RiseSun Real Estate Development Company?

- What is Competitive Landscape of RiseSun Real Estate Development Company?

- What is Growth Strategy and Future Prospects of RiseSun Real Estate Development Company?

- What is Sales and Marketing Strategy of RiseSun Real Estate Development Company?

- What is Brief History of RiseSun Real Estate Development Company?

- Who Owns RiseSun Real Estate Development Company?

- What is Customer Demographics and Target Market of RiseSun Real Estate Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.