Rogers Communications Bundle

How Did Rogers Communications Become a Canadian Telecom Giant?

Embark on a journey through the Rogers Communications SWOT Analysis and discover how a single radio station transformed into a Canadian telecom behemoth. From its inception in 1960 with Ted Rogers' acquisition of CHFI, the company's story is one of innovation and strategic expansion. Explore the pivotal moments that shaped Rogers Communications, a company that now dominates the Canadian market.

This brief history of Rogers Communications Canada reveals how the company, founded by Edward Samuel 'Ted' Rogers Jr., evolved from a small radio station into a leading provider of Rogers services. The company's early years were marked by a vision to inform, inspire, and innovate, which fueled its growth in the Canadian telecom landscape. Key milestones and acquisitions have solidified its position, making it a significant player in the Canadian media and wireless markets.

What is the Rogers Communications Founding Story?

The story of Rogers Communications begins in 1960, with a young entrepreneur named Edward Samuel 'Ted' Rogers Jr. Ted, fueled by a strong entrepreneurial drive, took a significant step into the world of broadcasting. This marked the official start of a company that would become a major player in the Canadian telecom industry.

Ted Rogers Jr.'s vision was clear: to transform how Canadians communicated and accessed media. His initial focus was on radio broadcasting, with CHFI being the first product offered. This early venture laid the foundation for what would become a vast network of services. The company's roots trace back to Edward S. Rogers Sr., who founded Rogers Vacuum Tube Company in 1914.

Ted Rogers Jr. acquired CHFI, an FM radio station, with $85,000 in borrowed funds. This bold move signaled the beginning of Aldred-Rogers Broadcasting.

- The company's initial focus was on radio broadcasting.

- Ted Rogers Jr. recognized the potential of FM radio and cable television early on.

- The family's background in electronics influenced the venture.

- Aldred-Rogers Broadcasting also became a part-owner of Baton Aldred Rogers Broadcasting (BARB), which launched CFTO-TV.

The company's early success was built on recognizing and capitalizing on emerging technologies. Ted Rogers Jr. saw the potential in both radio and cable television, setting the stage for future growth. This early focus on innovation helped Rogers Communications become a leader in the Canadian telecom market.

Understanding the competitive environment is also crucial. For a deeper dive into how Rogers Communications stacks up against its rivals, check out this analysis of the Competitors Landscape of Rogers Communications.

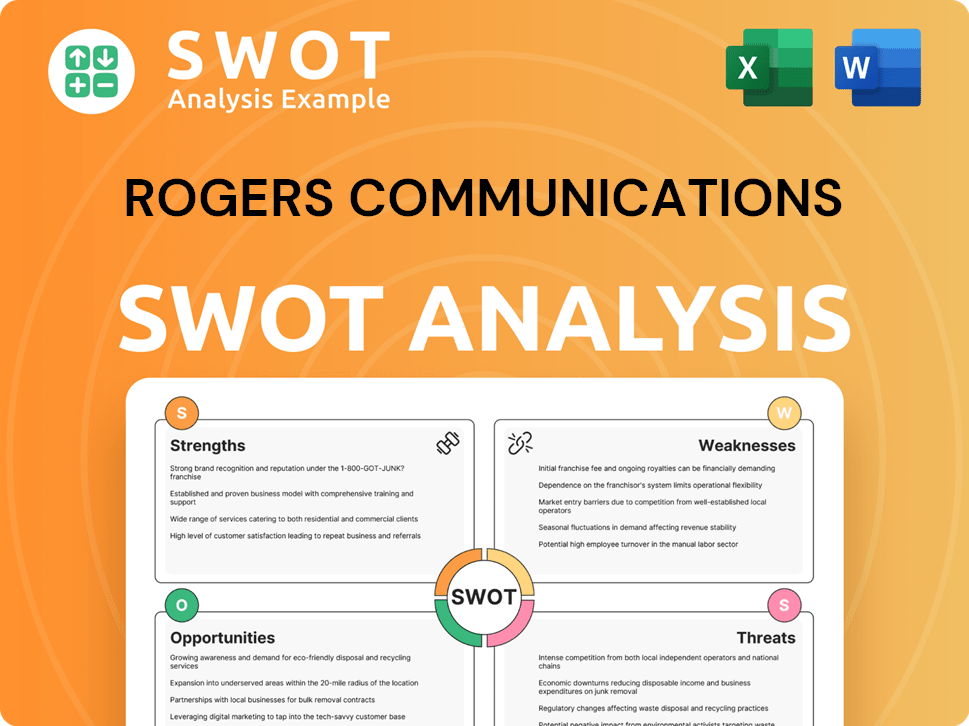

Rogers Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Rogers Communications?

The early growth and expansion of Rogers Communications, a prominent player in the Canadian telecom sector, was marked by strategic acquisitions and technological advancements. From its radio broadcasting beginnings, the company rapidly diversified into cable television and wireless services. This expansion phase was crucial in establishing Rogers Communications as a leading media and telecommunications conglomerate. This article about Rogers Communications offers further insights into the company's core values.

In 1960, Rogers Communications acquired CHFI, setting the stage for further media ventures. The company then established CHFI (AM) in 1962, later known as CFTR. A significant move was the launch of Rogers Cable TV in 1967, in partnership with BARB, which marked its entry into the cable television market.

By 1971, regulatory changes led to BARB selling its stake in Rogers Cable TV, giving Rogers greater control. A major milestone was the 1979 acquisition of a controlling interest in Canadian Cablesystems Limited (CCL), which created the largest single cable system globally at the time.

Ted Rogers' investment in wireless telephone technology in 1983 was a pivotal moment. Rogers made the first cellular call in Canada from Toronto's Nathan Phillips Square in 1985, showcasing its commitment to innovation in the wireless sector.

The 1990s saw key acquisitions like Unitel and Maclean Hunter, which strengthened Rogers' position and diversified its media holdings. The company continued to expand its wireless business throughout the 1990s and early 2000s, building a robust cellular network.

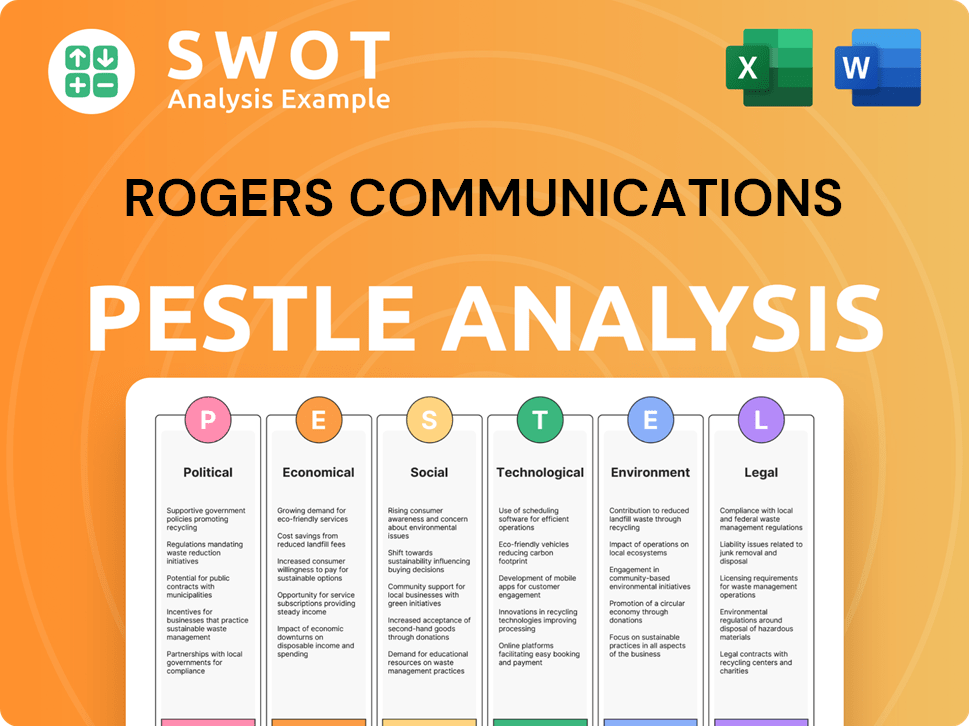

Rogers Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Rogers Communications history?

The brief history of Rogers Communications is marked by significant milestones, from its early ventures in radio to its current status as a leading Canadian telecom provider. The company's journey is a testament to its adaptability and its commitment to innovation within the dynamic landscape of the Canadian telecom market. Understanding the Target Market of Rogers Communications is crucial to grasp its strategic moves.

| Year | Milestone |

|---|---|

| 1960s | Rogers pioneered FM radio and cable television in Canada, changing how Canadians accessed media. |

| 1980s | Ted Rogers invested in wireless communication, making the first cellular call in Canada. |

| 2023 | The acquisition of Shaw Communications closed in April, expanding its footprint. |

| 2024 | Rogers invested a record $3.9 billion in capital infrastructure, boosting 5G and cable networks. |

| Q1 2025 | Launched Rogers Xfinity Storm-Ready WiFi nationally and Rogers Xfinity App TV. |

Rogers has consistently been at the forefront of technological advancements, shaping the Canadian telecom industry. The company's early adoption of digital cable services and high-speed internet showcases its dedication to providing cutting-edge services.

Rogers was a pioneer in introducing and expanding FM radio and cable television across Canada, fundamentally altering how Canadians consumed media. This early move set the stage for the company's future innovations in the telecommunications sector.

In the 1980s, Rogers made a groundbreaking investment in wireless technology, leading to the first cellular call in Canada. This strategic move positioned the company as a leader in the rapidly evolving mobile communications market.

Rogers consistently invested in advanced networks, including early adoption of digital cable services and high-speed internet. These advancements improved the quality and speed of services offered to customers.

In 2024, Rogers invested heavily in capital infrastructure, with a record $3.9 billion allocated to expanding 5G services and its cable network. This investment underscores Rogers' commitment to providing advanced communication services.

Rogers launched Rogers Xfinity Storm-Ready WiFi nationally, marking Canada's first home Internet backup solution. This innovation enhances reliability and provides continuous connectivity for customers.

Rogers introduced Rogers Xfinity App TV, an app-only bundle offering live and on-demand TV and streaming services. This caters to the evolving preferences of consumers who prefer streaming options.

Despite its successes, Rogers has faced several challenges in the competitive Canadian telecom market. Intense pricing wars and evolving market dynamics have impacted subscriber growth and financial performance.

The Canadian telecom sector is highly competitive, leading to pricing wars that can impact subscriber growth and profitability. This environment requires Rogers to constantly innovate and optimize its offerings.

In Q4 2024, Rogers' media revenue was softer than expected, leading to a revision of its 2024 service revenue guidance. This highlighted the challenges in the media sector.

The company has experienced a decline in video subscribers, reflecting changing consumer preferences and the shift towards streaming services. This decline requires strategic adjustments.

Declining market size and lower immigration rates have influenced overall demand in the industry. Rogers must adapt to these changing demographics and market conditions.

Rogers has responded to these challenges through strategic pivots, such as the acquisition of Shaw Communications, which closed in April 2023, to leverage a coast-to-coast wireless and wireline footprint. This expansion aimed to increase its market reach.

Rogers aims to optimize its cost structure and expand offerings in high-growth areas like streaming and digital services in 2025. This focus on operational efficiencies and new services is vital for future growth.

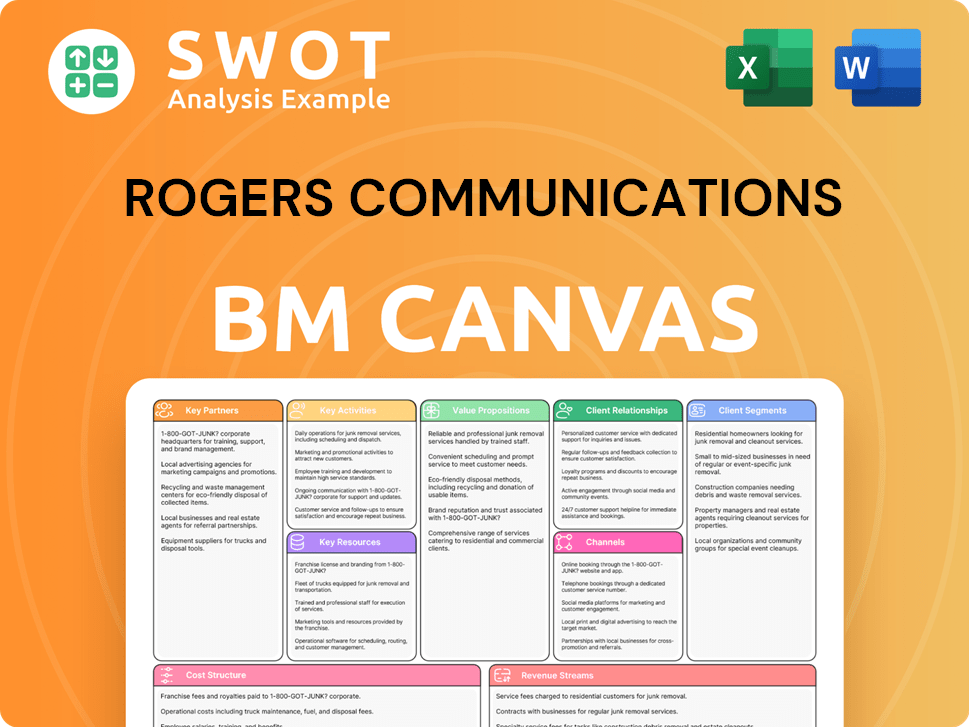

Rogers Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Rogers Communications?

The history of Rogers Communications is marked by significant milestones that have shaped it into a leading player in the Canadian telecom industry. From its inception with the acquisition of a radio station to its expansion into cable, wireless, and media, Rogers has consistently adapted to technological advancements and market demands. Revenue Streams & Business Model of Rogers Communications provides further insights into the company's evolution. The company's strategic acquisitions, including the purchase of Shaw Communications, have solidified its position in the market. Recent financial performance, including strong revenue and subscriber growth, underscores its continued success and strategic initiatives.

| Year | Key Event |

|---|---|

| 1960 | Ted Rogers Jr. acquired CHFI radio station, marking the founding of Rogers Communications. |

| 1967 | Rogers Cable TV Ltd. was established. |

| 1979 | Rogers Cable TV gained controlling interest in Canadian Cablesystems Limited (CCL), forming the world's largest single cable system. |

| 1983 | Ted Rogers invested in wireless telephone technology. |

| 1985 | Rogers made the first cellular call in Canada. |

| 1994 | Acquisition of Maclean-Hunter Limited. |

| 2008 | Death of founder Ted Rogers. |

| 2011-2013 | Rogers engaged in significant sports media deals, including with MLSE and the NHL. |

| 2019 | Sale of its publishing division. |

| 2021-2023 | Purchase of Shaw Communications, a major industry consolidation. |

| 2024 | Rogers topped $20 billion in annual revenue, with service revenue growth of 7% and adjusted EBITDA growth of 12%. The company added 623,000 combined mobile phone and internet net additions. |

| Q1 2025 | Rogers reported a 2% increase in total service revenue and adjusted EBITDA, and a 9% rise in net income. The company added 57,000 combined mobile phone and retail internet subscribers. Rogers launched Rogers Xfinity Storm-Ready WiFi and Rogers Xfinity App TV. |

| April 4, 2025 | Rogers announced a definitive agreement for a US$4.85 billion (approximately $7 billion CAD) equity investment from funds managed by Blackstone, aimed at deleveraging its balance sheet. |

For the full year 2025, Rogers anticipates total service revenue and adjusted EBITDA growth to be in the range of 0-3%. Capital expenditures are projected to be between C$3.8 billion and C$4 billion. Free cash flow is expected in the range of C$3-C$3.2 billion. These projections reflect a focus on sustainable growth.

Rogers plans to optimize its cost structure and expand offerings in high-growth areas such as streaming and digital services. The Blackstone equity investment is expected to reduce the debt leverage ratio by 0.7x upon closing in Q2 2025. The company aims to maintain its market leadership through strategic investments.

Rogers will continue its network investments and expansion across Canada, including its 5G network. The company focuses on balancing subscriber growth with financial performance. The launch of new services like Rogers Xfinity Storm-Ready WiFi and Rogers Xfinity App TV demonstrates this commitment.

The Blackstone equity investment strengthens Rogers' financial profile by reducing debt. The company's ability to add subscribers, such as the 57,000 combined mobile phone and retail internet subscribers in Q1 2025, demonstrates its strong market position. The focus remains on connecting and entertaining Canadians.

Rogers Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Rogers Communications Company?

- What is Growth Strategy and Future Prospects of Rogers Communications Company?

- How Does Rogers Communications Company Work?

- What is Sales and Marketing Strategy of Rogers Communications Company?

- What is Brief History of Rogers Communications Company?

- Who Owns Rogers Communications Company?

- What is Customer Demographics and Target Market of Rogers Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.