Savills Bundle

How did Savills Rise to Become a Global Real Estate Giant?

Journey back in time to uncover the captivating Savills SWOT Analysis, a story of ambition, adaptation, and global expansion. From its inception in 1855, Savills, a global real estate services provider, has navigated economic shifts and market trends to become a leading force in the industry. Discover the pivotal moments and strategic decisions that shaped the Savills company into the international powerhouse it is today.

This brief history of Savills plc will explore the Savills company origin story, examining its early years in real estate and key milestones. We'll delve into Savills' expansion over time, highlighting notable acquisitions and mergers that fueled its growth. Understanding Savills' history provides valuable context for its current market share analysis and its impact on the real estate market, offering insights into its global real estate services and company values.

What is the Savills Founding Story?

The story of the Savills company origin story began on July 22, 1855. Alfred Savill, a surveyor and land agent, established the firm in London, England. This marked the beginning of what would become a global real estate leader.

Alfred Savill saw an opportunity to provide specialized property services. This was during a period of significant land ownership and agricultural activity in Britain. His expertise in surveying gave him the technical skills needed, while his entrepreneurial drive led him to start his own company.

The initial focus of the business was land agency. This included valuations, sales, and management of rural estates. The company's early success laid the foundation for its future expansion and diversification into various real estate services.

Alfred Savill chose to use his own name for the company. This was common for professional service firms at the time. His personal commitment to service quality was clear.

- Initial funding likely came from Alfred Savill's personal capital.

- The mid-19th century in Britain saw the Industrial Revolution and a growing middle class.

- This created demand for professional property management and advisory services.

- Savills was well-positioned to meet this demand.

Savills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Savills?

The early growth of the Savills company focused on expanding its land agency and rural estate management services within the UK. By the 20th century, it had built a strong reputation in the agricultural and landed gentry sectors. The post-World War II era marked a significant shift as Savills diversified into commercial and residential real estate. This strategic move allowed the company to capitalize on growing urban development.

The 1970s and 1980s saw the beginning of international expansion for Savills, initially in Europe and then extending to Asia and North America. Key acquisitions played a vital role in consolidating its market position. The acquisition of a controlling stake in First Pacific Davies in 1995 significantly boosted its presence in Asia. Leadership transitions guided the company through these growth periods.

Savills' expansion strategy included strategic acquisitions and mergers to broaden its service offerings. The company's financial performance in 2023 showed continued growth. Savills reported a 3% increase in underlying profit to £117.4 million, demonstrating its strong financial health and growth trajectory.

Savills established a global presence through strategic international expansion. This included entering European markets and later expanding into Asia and North America. This global footprint enabled Savills to offer comprehensive real estate services worldwide. Savills' ability to adapt and grow internationally has been a key factor in its success.

Savills diversified its services beyond rural properties to include commercial and residential real estate. The company offers a wide range of property services. These services include property management, valuation, and consultancy. This diversification positioned Savills to meet the evolving needs of the real estate market.

Savills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Savills history?

The Savills company has a rich history marked by significant milestones, reflecting its growth and evolution in the global real estate market. From its early beginnings to its current status as a leading real estate advisor, Savills' journey has been characterized by strategic decisions and a commitment to client service.

| Year | Milestone |

|---|---|

| 1855 | Founded in the UK, marking the beginning of the Savills timeline. |

| 19th Century | Expanded its services to include land and estate management, broadening its scope in the real estate sector. |

| Early 20th Century | Established a strong presence in the UK market, solidifying its reputation for expertise in property services. |

| 1970s | Began its international expansion, a key step in establishing its global real estate services. |

| 1980s-1990s | Continued its global expansion through strategic acquisitions and establishing offices in key international markets. |

| 2000s | Further expanded its global footprint, particularly in Asia, and diversified its service offerings. |

| 2020s | Focus on sustainability and ESG considerations in its services, reflecting evolving market demands. |

Throughout its history, the company has consistently embraced innovation to stay ahead in the competitive real estate market. This includes early adoption of technology and a proactive approach to meet the changing needs of its clients.

Savills was among the first to establish a strong presence in international markets, particularly in Asia, setting it apart from many competitors. This early move provided a significant advantage in terms of market share and global reach.

The company has consistently integrated technology for property valuation and management, improving efficiency and service quality. This has involved adopting new tools and platforms to enhance client experiences and streamline operations.

Savills has diversified its service lines to include a wide range of offerings, such as investment advisory, property management, and consultancy. This diversification has helped the company adapt to changing market conditions and client needs.

In recent years, Savills has increasingly focused on integrating sustainability and ESG considerations into its advisory services. This reflects a commitment to addressing environmental and social responsibilities.

Savills has strategically used acquisitions to expand its market presence and service offerings. These acquisitions have provided access to new markets and expertise.

The company has maintained a strong focus on client relationships and market expertise. This approach has helped to build trust and long-term partnerships.

The journey of the

The global financial crisis of 2008 significantly impacted the real estate market, posing a major challenge for Savills. The company had to navigate market fluctuations and adapt its strategies.

Competition from other global real estate firms has always been a challenge. The company has responded by focusing on its strengths and differentiating its services.

The increasing digitalization of property services has necessitated strategic responses, including investments in technology and online platforms. This has required constant adaptation to stay relevant.

Market fluctuations in the commercial and residential real estate sectors have presented ongoing challenges. The company has aimed to maintain stability and profitability.

Geopolitical events and economic instability have impacted global real estate markets. Savills has had to adjust to changing conditions.

Changing client needs and preferences have required Savills to continuously adapt its services and strategies. This includes providing more customized and specialized advice.

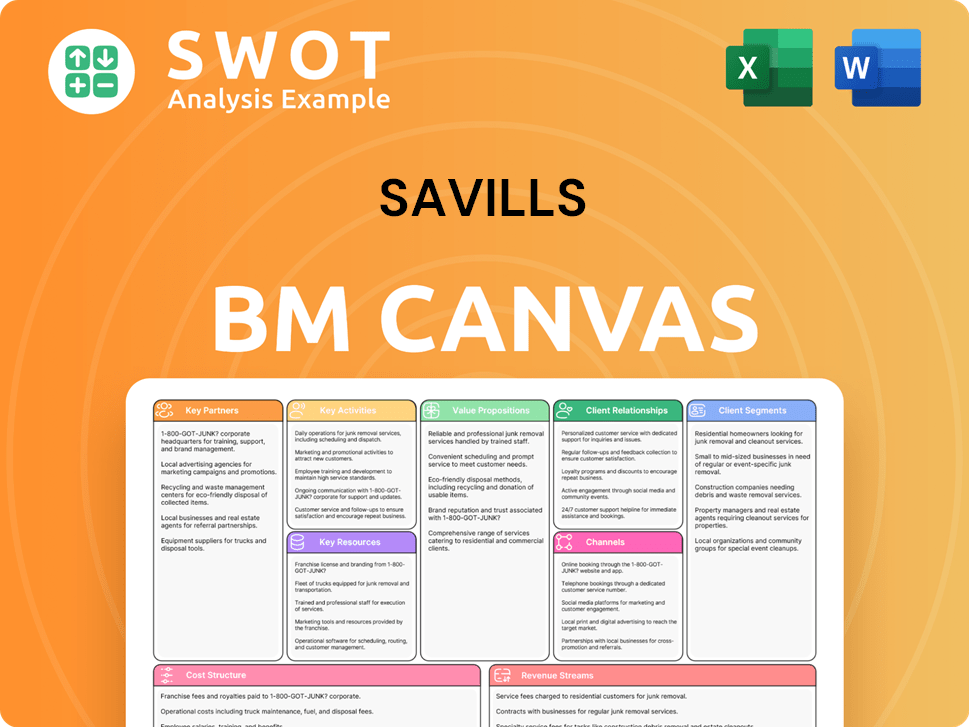

Savills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Savills?

The Savills company has a rich history, evolving from a small London-based firm to a global real estate leader. This evolution reflects its adaptability and strategic vision within the dynamic property market. Understanding the Savills history provides valuable insights into its current position and future prospects. The Savills real estate journey showcases a commitment to innovation and client service.

| Year | Key Event |

|---|---|

| 1855 | Alfred Savill establishes the company in London, marking the beginning of the Savills company origin story. |

| Early 1900s | Expansion of land agency and rural estate management across the UK, showcasing Savills early years in real estate. |

| Post-WWII | Diversification into commercial and residential real estate, adapting to changing market demands. |

| 1970s-1980s | Initial international expansion into Europe and Asia, establishing a global footprint. |

| 1995 | Acquisition of a controlling stake in First Pacific Davies, strengthening its Asian presence. |

| 2000s | Continued global expansion, including into the Americas, demonstrating Savills expansion over time. |

| 2015 | Savills acquires Earlsmead, a residential property management company, to enhance its services. |

| 2016 | Savills acquires Nickerson Whittle, a specialist planning consultancy, to expand its planning services. |

| 2023 | Savills reports underlying profit increase to £117.4 million, reflecting strong financial performance. |

| 2024 | Savills continues to focus on integrating ESG into its services and expanding its global advisory capabilities. |

Savills is focused on further global expansion, specifically targeting emerging markets. This strategic move aims to capitalize on new growth opportunities. The company's global reach is a key element of its strategy.

Enhancing technological capabilities to provide more efficient and data-driven services is a priority. This includes leveraging data analytics and digital tools. The goal is to improve client service and market insights.

Savills is committed to strengthening its advisory services in sustainability and smart buildings. This aligns with the industry's growing emphasis on ESG factors. They are adapting to evolving client needs.

A continued focus on client-centricity and leveraging its global network is crucial. The company aims to provide comprehensive real estate solutions. This approach is at the core of their strategy.

Savills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Savills Company?

- What is Growth Strategy and Future Prospects of Savills Company?

- How Does Savills Company Work?

- What is Sales and Marketing Strategy of Savills Company?

- What is Brief History of Savills Company?

- Who Owns Savills Company?

- What is Customer Demographics and Target Market of Savills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.