Savills Bundle

How Does Savills Dominate the Real Estate Market?

The global real estate market is a complex arena, constantly reshaped by economic shifts and technological advancements. Savills, a titan in this sector, has a long history of adapting to these changes. Understanding the Savills SWOT Analysis is crucial to see how they maintain their competitive edge.

This analysis dives deep into the Savills competitive landscape, examining its key rivals and market strategies. We'll explore Savills' position within the commercial real estate and property services industries, providing a comprehensive Savills market analysis. This includes a look at Savills competitors, their strengths, weaknesses, and how Savills navigates the challenges to maintain its global presence and industry position.

Where Does Savills’ Stand in the Current Market?

Savills holds a robust market position in the global real estate services industry, providing a wide array of services across commercial, residential, and rural sectors. The company consistently ranks among the top global real estate consultancies. The company's diverse service offerings and global reach contribute to its strong standing in the competitive landscape.

The company's primary services include property management, sales, leasing, valuation, and advisory services. These services cater to a wide range of clients, including investors, developers, corporations, and private individuals. Savills' ability to offer comprehensive solutions positions it as a key player in the real estate market.

Savills has a significant global presence, operating in over 700 offices and with associates worldwide as of early 2024. This extensive network enables the company to serve multinational clients effectively. The company's strategic diversification into advisory, investment management, and property management has further strengthened its market position. For more information about the company, you can read about the Owners & Shareholders of Savills.

While precise market share figures vary, Savills consistently ranks among the top global real estate consultancies. The company competes directly with major players like CBRE, JLL, and Cushman & Wakefield. Savills' strong performance is reflected in its financial results and global presence.

Savills offers a comprehensive suite of services, including property management, sales, leasing, valuation, and advisory. These services cater to diverse client needs across commercial, residential, and rural sectors. The breadth of services allows Savills to serve a wide client base.

Savills has a significant presence across Europe, the Americas, Asia Pacific, Africa, and the Middle East. This global footprint enables the company to serve multinational clients effectively. The company's extensive network supports its competitive position.

Savills plc reported a revenue of £2.3 billion for the year ended December 31, 2023. Its investment management arm, Savills Investment Management, managed €27.8 billion in assets as of December 31, 2023. These figures highlight the company's financial scale and performance within the industry.

Savills' competitive advantages include its global presence, comprehensive service offerings, and strong brand reputation. The company's long-standing presence in key markets, particularly in the UK and Europe, gives it a significant edge. Savills' ability to provide integrated services and its focus on client relationships further enhance its market position.

- Extensive global network with over 700 offices and associates.

- Diversified service offerings across various real estate sectors.

- Strong financial performance, with £2.3 billion in revenue in 2023.

- Significant assets under management in its investment management arm.

Savills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Savills?

The Revenue Streams & Business Model of Savills operates within the dynamic global real estate services sector, facing intense competition. Understanding the Savills competitive landscape is crucial for assessing its market position and strategic direction. This involves a detailed analysis of its key rivals and the evolving dynamics of the real estate market.

The Savills market analysis must consider the broad range of services it offers, including advisory and transaction services, property management, and investment management. The company's ability to compete effectively is influenced by the size, global reach, and specialization of its competitors. Examining the financial performance and strategic initiatives of these rivals provides insights into the challenges and opportunities for Savills.

CBRE Group is a major competitor, offering a wide array of services similar to Savills. CBRE's 2023 revenues were approximately $31.8 billion, highlighting its significant scale and global presence.

JLL is another major global player in the commercial real estate market. JLL reported revenues of $20.9 billion in 2023, emphasizing its strong position in the industry. Its focus on technology and data analytics is a key differentiator.

Cushman & Wakefield competes directly with Savills, particularly in brokerage and property management. Cushman & Wakefield's 2023 revenues were $9.5 billion, showing its significant presence in key global cities.

Colliers International is a significant competitor in the property services sector. Colliers provides a full range of services, including brokerage, property management, and investment management, competing with Savills across various markets.

Knight Frank is a global real estate consultancy that competes with Savills, especially in the high-end residential and commercial property markets. Knight Frank's global network and client relationships make it a key player.

BNP Paribas Real Estate is a major competitor, particularly in Europe, offering a comprehensive suite of real estate services. BNP Paribas Real Estate's focus on European markets and its financial backing are key strengths.

The Savills competitors landscape also includes smaller, specialized firms and new entrants leveraging technology. These new players, such as online brokerage platforms and proptech solutions, are challenging traditional agency models. The Savills market share analysis must consider these disruptive forces. Mergers and acquisitions continue to reshape the industry, leading to larger, more integrated service providers, impacting Savills's industry position. Understanding Savills's competitive advantages and challenges in the market, along with its investment strategies and customer base analysis, is essential for a comprehensive assessment of its future outlook. Key considerations include a Savills SWOT analysis and a Savills financial performance comparison against its main rivals, such as Savills vs. CBRE and Savills vs. JLL. The company's global presence and service offerings comparison are also critical factors. The Savills key competitors 2024 landscape is dynamic, influenced by market trends, technological advancements, and strategic decisions.

Savills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Savills a Competitive Edge Over Its Rivals?

Analyzing the Target Market of Savills, it's clear that its competitive advantages are key to its success in the real estate market. Savills' strategic positioning, global presence, and comprehensive service offerings set it apart. Understanding these advantages is crucial for anyone assessing the company's performance and potential.

The company's strength lies in its extensive global network and diverse service lines, providing a broad spectrum of real estate solutions. Savills' brand equity and commitment to market intelligence further enhance its competitive edge. This analysis will delve into the specific advantages that enable Savills to maintain a strong position in a competitive landscape.

Savills' ability to offer seamless cross-border services and leverage local market insights is a significant advantage. This is particularly important for multinational clients and complex transactions. Its deep expertise across various property sectors and service lines provides a comprehensive offering that many competitors may not match.

Savills boasts a vast global network, with over 700 offices and associates. This extensive reach allows for seamless cross-border transactions and local market expertise. This global presence is a key differentiator in the competitive real estate market.

The company offers a wide range of services, including agency, valuation, property management, and investment management. This comprehensive approach caters to various client needs. This diversified service portfolio enhances its market position.

Savills has a strong brand reputation built over nearly 170 years, signifying trust and high-quality service. This long-standing reputation fosters client loyalty. The brand's prestige attracts both clients and top talent.

Savills benefits from a robust talent pool, with experienced professionals providing tailored advice. Their local market knowledge and specialist expertise are critical. This expertise is essential for achieving optimal outcomes for clients.

Savills' competitive advantages include its global network, diverse service offerings, strong brand equity, and a talented workforce. These elements contribute to its success in the real estate market, allowing it to compete effectively with other major players.

- Extensive global network with over 700 offices.

- Comprehensive service offerings across various property sectors.

- Strong brand reputation built over nearly 170 years.

- A robust talent pool with local market knowledge.

Savills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Savills’s Competitive Landscape?

The Marketing Strategy of Savills is significantly influenced by the evolving dynamics of the global real estate market. The company's competitive landscape is shaped by industry trends, future challenges, and available opportunities. Understanding these elements is crucial for assessing Savills' position and potential for growth.

Analyzing the Savills competitive landscape involves assessing its position within the commercial real estate sector, evaluating its competitors, and understanding the broader real estate market trends. This includes examining its market share, service offerings, and financial performance in comparison to key competitors like CBRE and JLL. The future outlook for Savills depends on its ability to adapt to these changes and capitalize on emerging opportunities.

Technological advancements, particularly in proptech, are reshaping the industry. Regulatory changes related to sustainability and ESG factors are increasingly influencing investment decisions. Global economic shifts, including interest rate fluctuations and geopolitical uncertainties, continue to impact investment volumes and market sentiment.

Traditional business models face disruption due to the rise of AI and other digital solutions. Navigating economic headwinds, such as higher interest rates, requires agile advisory services. Adapting to evolving client demands for sustainable properties and transparent reporting is essential.

Enhancing efficiency and service delivery through the integration of digital solutions. Leveraging expertise in sustainability consulting and green building certifications to appeal to environmentally conscious investors. Capitalizing on growth in emerging markets and niche sectors, such as data centers and logistics.

Continuous adaptation to market changes through strategic investments in technology and talent. Diversifying service offerings and geographic presence to capitalize on new opportunities. Providing agile and responsive advisory services to help clients make informed decisions.

Savills' competitive advantages include its global presence and diverse service offerings. The company faces challenges such as adapting to technological disruptions and economic uncertainties. Investment strategies should focus on technology integration, sustainability, and geographic diversification. The customer base analysis reveals a demand for both traditional and innovative real estate solutions.

- Market Share Analysis: Savills' market share is constantly evolving, with recent data showing fluctuations in key regions. In the UK, for example, Savills holds a significant share in the commercial property market.

- Financial Performance Comparison: Comparing Savills' financial performance with CBRE and JLL reveals insights into profitability and revenue growth. Data from 2024 indicates varying performance across different segments.

- Service Offerings Comparison: Savills' service offerings include property management, investment advisory, and research. A comparison with competitors highlights strengths in specific areas, such as sustainability consulting.

- Global Presence: Savills' global presence is a key advantage, with operations spanning across Europe, Asia-Pacific, and the Americas. This widespread presence allows for diverse revenue streams and market access.

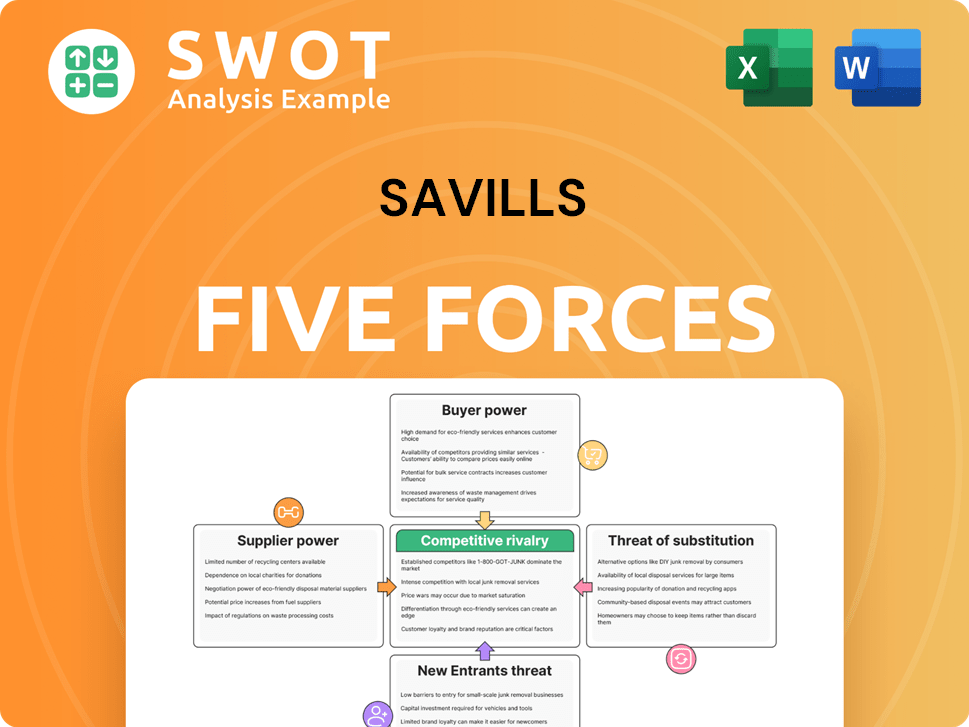

Savills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Savills Company?

- What is Growth Strategy and Future Prospects of Savills Company?

- How Does Savills Company Work?

- What is Sales and Marketing Strategy of Savills Company?

- What is Brief History of Savills Company?

- Who Owns Savills Company?

- What is Customer Demographics and Target Market of Savills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.