Scana Bundle

What's the Story Behind Scana Company's Transformation?

Journey back in time to explore the Scana SWOT Analysis of Scana Company, a Norwegian investment powerhouse with roots stretching back to the early 1900s. From its humble beginnings in the industrial sector, Scana has charted an impressive course, evolving into a key player in the ocean industries. This brief history of Scana Corporation will uncover its strategic pivots and enduring commitment to innovation.

Understanding Scana's history is crucial for grasping its present-day strategies. The company's evolution reflects its ability to adapt to changing market dynamics, particularly within the energy and maritime sectors. This exploration of Scana history will provide insights into its core values, business ventures, and the factors that shaped its success, including its role in South Carolina energy and its eventual merger with Dominion Energy.

What is the Scana Founding Story?

The Scana Company's story began with the formation of Broad River Power Company in 1924, though its roots extend back to 1846 with the Charleston Gas Light Company. The direct predecessor, Scana Industrier, was established in 1987. This evolution reflects a long history of adapting to the changing energy landscape.

The company's headquarters are located in Bergen, Norway. The initial vision was to provide technology and solutions for tomorrow, a mission reflected in its slogan, 'Industrial history – solutions for tomorrow'. This forward-thinking approach has guided its operations throughout its history.

The original business model was likely centered on industrial activities, given its historical roots in areas like steel production. The company’s early funding would have stemmed from its operational revenues and potentially from capital raises as it expanded. For more detailed information about the company's business model, consider reading Revenue Streams & Business Model of Scana.

Scana's history is marked by significant milestones and strategic shifts.

- The company's name, 'Scana,' was derived from 'South Carolina' in 1984, highlighting a strategic shift.

- Scana's early ventures included operations in steel production, demonstrating its industrial focus.

- The company's evolution reflects a continuous adaptation to the energy sector's changing demands.

- The company's headquarters are located in Bergen, Norway.

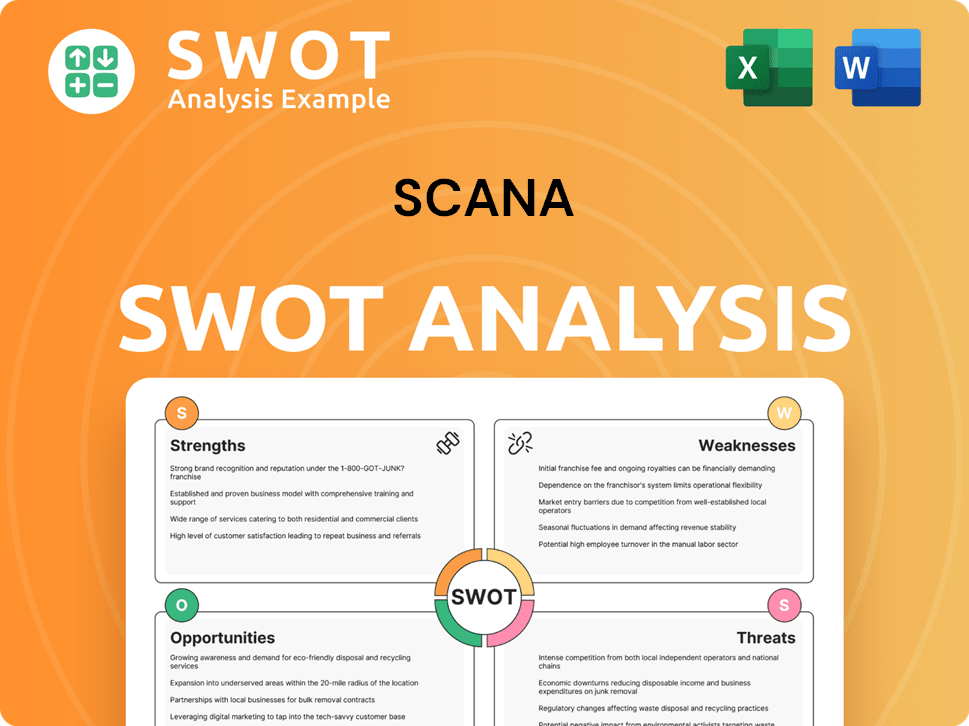

Scana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Scana?

The early growth and expansion of the Scana Company involved strategic acquisitions and significant financial maneuvers. This period saw the company broaden its portfolio and enhance its market position. These moves were critical in shaping Scana's trajectory within the energy sector and its impact on the South Carolina economy.

In January 2022, Scana significantly expanded its operations by acquiring the PSW Group, which included PSW Technology, PSW Solutions, and PSW Power & Automation. This acquisition was a key step, increasing its company count from three to seven. The merger positioned Scana as a key player in electrification and shore power within the offshore and maritime industries, aligning with the 'green shift' toward sustainable operations.

Following the PSW Group acquisition, Scana added Trans Construction to its portfolio in January 2022. These acquisitions broadened Scana's service offerings to include the design and integration of electrical power systems, energy storage systems, and control systems. This expansion enhanced the company's ability to serve a wider range of energy needs.

Scana achieved commercial breakthroughs in 2022 with mobile battery systems for industrial use, particularly in Germany and Holland. The company also expanded its shore power and fast-charging solutions across Europe, including Sweden and Iceland. This expansion highlighted Scana's commitment to innovative energy solutions.

Financially, Scana raised NOK 452 million through private placements in January and December 2022. Revenue in 2024 reached NOK 1,970.1 million, up from NOK 1,606 million in the previous year, with net income increasing to NOK 83.3 million from NOK 71.6 million. However, Q1 2025 saw a revenue drop of 32% to NOK 368 million and a negative EBITDA of -7 million NOK, attributed to lower order intake and activity levels. Despite these challenges, the order backlog remained solid at NOK 1,166 million in Q1 2025.

For more insights into the core values that guided the company during this period, you can explore the Mission, Vision & Core Values of Scana.

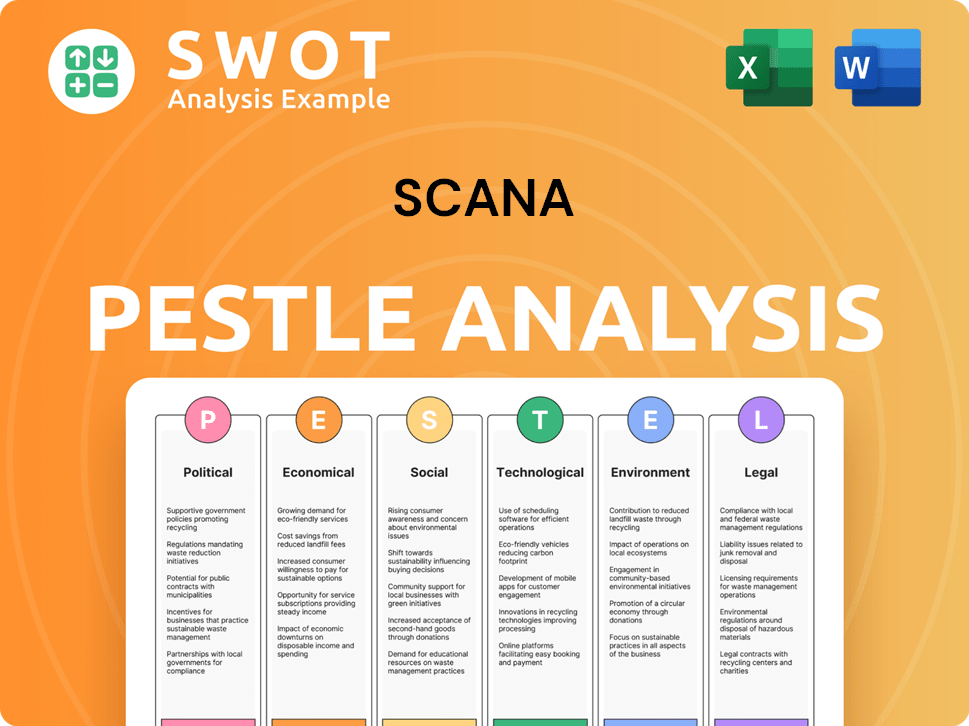

Scana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Scana history?

The Scana Company has marked several significant milestones throughout its history, shaping its trajectory in the energy sector. These achievements reflect its adaptability and strategic vision in a dynamic market.

| Year | Milestone |

|---|---|

| January 2022 | Strategic merger with PSW Group, expanding capabilities in electrification and shore power, crucial for the maritime industry's green transition. |

| 2022 | Expansion of shore power and fast charging solutions across Europe, including contracts in Sweden and Iceland. |

| Q1 2025 | Secured an extension of a frame agreement with Equinor for maintenance at Mongstad, ensuring recurring revenue. |

Innovations at Scana Corporation have included breakthroughs in mobile battery systems for industrial use, particularly in Germany and Holland. The company has also developed advanced capping stack units, which are marketed for rental and sale, showcasing its commitment to technological advancement.

Developed mobile battery systems for industrial applications, notably in Germany and Holland.

Expanded shore power and fast-charging solutions across Europe, including projects in Sweden and Iceland.

Developed advanced capping stack units available for rental and sale.

Secured an extension of a frame agreement with Equinor for maintenance at Mongstad, ensuring recurring revenue.

Signed an exclusive frame agreement for steel parts supply for subsea production.

Signed a mooring contract for an FLNG project.

The Scana history has faced challenges, particularly in recent periods, impacting its financial performance. Q1 2025 results revealed a 32% decrease in revenue, totaling NOK 368 million, and a negative EBITDA of -7 million NOK, marking a 107% year-over-year decrease.

Revenue dropped by 32% to NOK 368 million in Q1 2025 due to lower order intake and delayed project activity.

EBITDA turned negative at -7 million NOK in Q1 2025, a 107% decrease year-over-year, significantly impacting profitability.

The Energy division experienced declines in revenues and negative EBITDA in Q1 2025, partly due to a cancelled BESS project in Sweden.

A strategic review for PSW Power & Automation AS is underway, expected to conclude within the first half of 2025.

The company is adapting its business model to maintain competitiveness amidst market fluctuations.

Initiated cost and efficiency initiatives across both Offshore and Energy divisions to address the challenging operating environment.

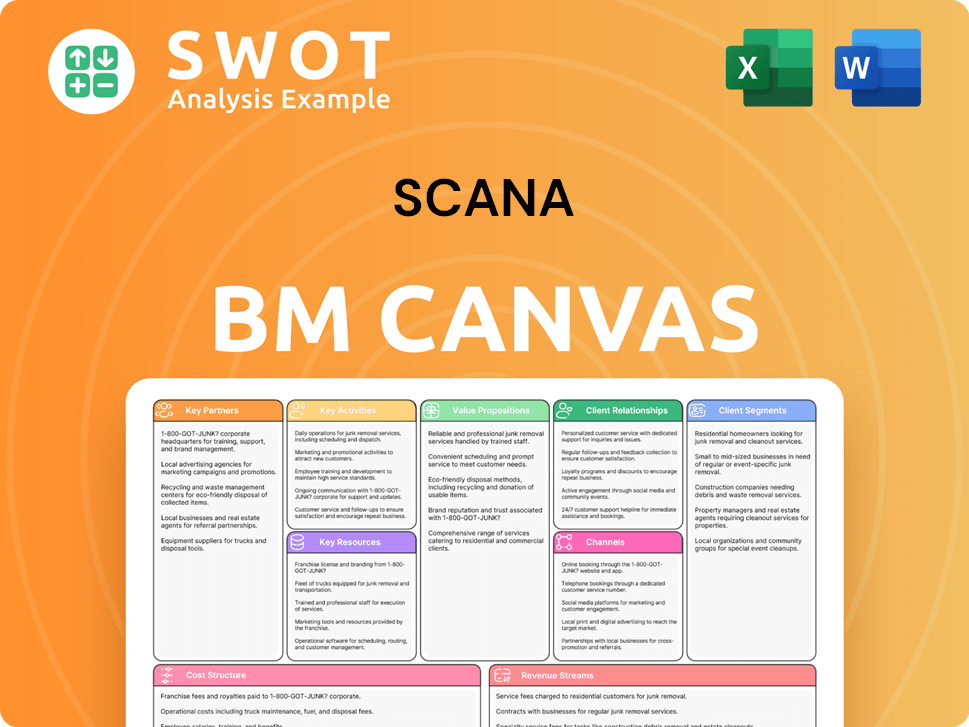

Scana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Scana?

The Scana Company, now known as Scana ASA, has a rich history, marked by strategic shifts and significant acquisitions. From its origins as Scana Industrier in 1987 to its current focus on ocean industries, the company has consistently evolved to meet market demands and expand its capabilities. Recent financial results and strategic initiatives highlight Scana's commitment to sustainable solutions and long-term value creation.

| Year | Key Event |

|---|---|

| 1987 | Scana Industrier, the direct predecessor to Scana ASA, is established. |

| May 2020 | Incus Investor ASA changes its name to Scana ASA, reflecting its renewed focus. |

| January 2022 | Scana acquires PSW Group and Trans Construction, significantly expanding its portfolio. |

| 2022 | Commercial breakthroughs are achieved for mobile battery systems in Germany and Holland, with expansions in shore power and fast-charging solutions. |

| January & December 2022 | Scana raises NOK 452 million through private placements. |

| June 2023 | Scana (Norway) completes a Merger/Acquisition with Wear Solutions. |

| January 2024 | Share capital increased to NOK 452,392,900 following the exercise of share options. |

| September 2024 | Share capital further increased to NOK 461,892,898. |

| December 2024 | Scana updates on a potential voluntary offer and continues marketing a capping stack. Oddbjørn Haukøy leaves the company. |

| February 2025 | Scana reports Q4 2024 revenue of NOK 448 million and EBITDA of NOK 26 million, with full-year 2024 revenue at NOK 1,970.1 million and EBITDA at NOK 261 million. |

| May 2025 | Scana reports Q1 2025 revenue of NOK 368 million and negative EBITDA of -7 million NOK. Baste Tveito is appointed Acting CEO. |

Scana aims for continued profitable growth and long-term value creation. This includes exploring investment opportunities in spend-based data collection systems. The company is focused on expanding its market presence and enhancing operational efficiency.

Scana is collaborating with suppliers to improve transparency and accuracy, with a goal to include Scope 3 emissions in its 2026 report. The ongoing strategic review for PSW Power & Automation AS is expected to conclude in the first half of 2025. They also plan to develop market opportunities in Namibia.

Despite recent challenges, Scana maintains a solid long-term order backlog of NOK 1,166 million. The company reported Q4 2024 revenue of NOK 448 million and a full-year 2024 revenue of NOK 1,970.1 million. The company is navigating market dynamics.

Scana is committed to achieving a 'net-zero' emission target by 2050 for itself and its portfolio companies. This commitment underscores its dedication to sustainable solutions and responsible business practices. This is a key part of its long-term strategy.

Scana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Scana Company?

- What is Growth Strategy and Future Prospects of Scana Company?

- How Does Scana Company Work?

- What is Sales and Marketing Strategy of Scana Company?

- What is Brief History of Scana Company?

- Who Owns Scana Company?

- What is Customer Demographics and Target Market of Scana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.