Scana Bundle

How Does Scana Navigate the Murky Waters of the Energy Market?

In an era defined by sustainable energy and technological leaps, understanding the Scana SWOT Analysis is crucial. Scana ASA, a prominent investment company, has strategically positioned itself within the dynamic energy and maritime sectors. This strategic shift from traditional shipbuilding to a focus on innovative technology companies demands a deep dive into its competitive standing.

To truly grasp Scana's potential, we must dissect its position within the Scana competitive landscape. This analysis will identify Scana competitors, evaluate Scana market analysis, and uncover Scana company competitive advantages. Furthermore, we will explore Scana's business strategy and Scana market share to provide a comprehensive understanding of its challenges and opportunities within the Scana industry, including its financial performance compared to competitors and its future outlook and competitive threats.

Where Does Scana’ Stand in the Current Market?

Scana ASA operates as an investment company, primarily focusing on the ocean industries. Its core operations revolve around investing in and developing companies that provide innovative technology and solutions for the energy and maritime sectors. This approach allows Scana to participate in the growth of these sectors through its portfolio companies, which offer specialized products and services.

The value proposition of Scana lies in its ability to identify and nurture high-growth potential companies within the ocean industries. By actively managing its portfolio, Scana aims to create value through strategic development, operational improvements, and financial optimization. This strategy is designed to generate returns for its shareholders by capitalizing on the increasing demand for sustainable and technologically advanced solutions in the energy and maritime sectors. Understanding the Marketing Strategy of Scana can provide further insights into its approach.

Scana's market position is shaped by the performance and strategic importance of its portfolio companies, which operate in the subsea equipment, offshore wind solutions, and maritime services sectors. The company's primary product lines are essentially its investments in these companies. While direct market share figures are not reported in the same way as for product-based companies, its influence is evident through the financial performance and strategic initiatives of its portfolio companies.

Scana's core business is centered on investing in and developing companies within the ocean industries. This strategic focus allows it to capitalize on the growth potential of the energy and maritime sectors. The company's investments span various segments, including subsea equipment, offshore wind solutions, and maritime services.

Scana's presence is primarily rooted in Norway, with its portfolio companies often having an international reach. These companies serve global customer segments, including energy companies, shipping firms, and offshore operators. This international reach is crucial for expanding its market presence and capitalizing on global opportunities.

Scana has strategically shifted from a traditional industrial company to an investment vehicle. This move aims to unlock value through active ownership and development of its portfolio companies. The strategic shift allows Scana to participate in various segments of the ocean economy without being tied to the operational cycles of a single industry.

Scana's financial performance reflects its strategic focus on profitable growth. For instance, the Q1 2025 report indicates a continued focus on strong order intake across its portfolio companies. The reported EBITDA of NOK 30 million in Q1 2025 demonstrates its financial health and ability to create value.

Scana holds a strong position in niche technology areas within the subsea and maritime sectors. Its strategic focus on high-growth segments within the ocean industries positions it as a key player in fostering innovation and sustainable development.

- Strong focus on ocean industries.

- Active portfolio management.

- Strategic investments in high-growth sectors.

- Financial health and profitable growth.

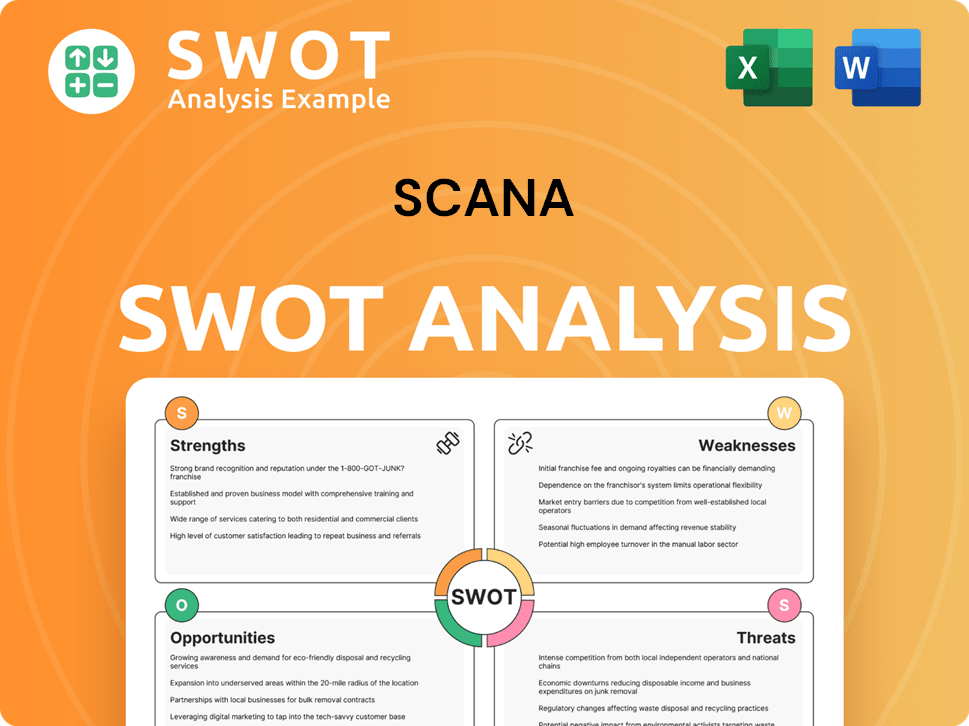

Scana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Scana?

The Scana's Revenue Streams & Business Model competitive landscape is shaped by its dual role as an investment firm and the parent of various portfolio companies. This structure means that Scana faces competition on two fronts: directly from other investment entities for capital allocation and indirectly through its portfolio companies, which compete in their respective markets. Understanding the competitive dynamics is crucial for evaluating Scana's strategic positioning and future prospects.

The primary focus of this analysis is to identify the key players challenging Scana in both its investment activities and the operational performance of its portfolio companies. This involves examining the financial strength, market expertise, and strategic initiatives of its rivals. This approach provides a comprehensive view of the competitive environment, helping to assess Scana's ability to create value and sustain growth.

As an investment company, Scana ASA's competitive landscape is multifaceted, encompassing other investment firms and private equity funds targeting ocean industries, as well as the direct competitors of its portfolio companies. Direct competitors for Scana, in terms of capital allocation and deal flow, include investment entities like Aker ASA, which also has significant holdings in offshore and maritime sectors, and various private equity funds specializing in energy and maritime technology. These entities compete for promising investment opportunities, often based on their financial capacity, industry expertise, and network.

On the level of its portfolio companies, the competition is more granular. For example, within the subsea technology space, Scana's holdings might compete with established players like TechnipFMC, Saipem, and Subsea 7, which offer integrated subsea production systems and services globally. In the offshore wind sector, competitors could include large industrial conglomerates such as Siemens Gamesa, Vestas, and GE Renewable Energy, as well as specialized offshore service providers. These competitors challenge Scana's portfolio companies through technological advancements, pricing strategies, global presence, and established customer relationships.

- Market Analysis: Understanding the competitive landscape requires a detailed market analysis of the sectors in which Scana's portfolio companies operate.

- Financial Performance: Comparing Scana's financial performance with its competitors is essential to assess its market share and profitability.

- Strategic Initiatives: Analyzing Scana's strategic initiatives, such as acquisitions, partnerships, and new product development, provides insights into its competitive advantages.

- Regulatory Environment: The regulatory environment significantly impacts Scana's operations, especially in the energy and maritime sectors.

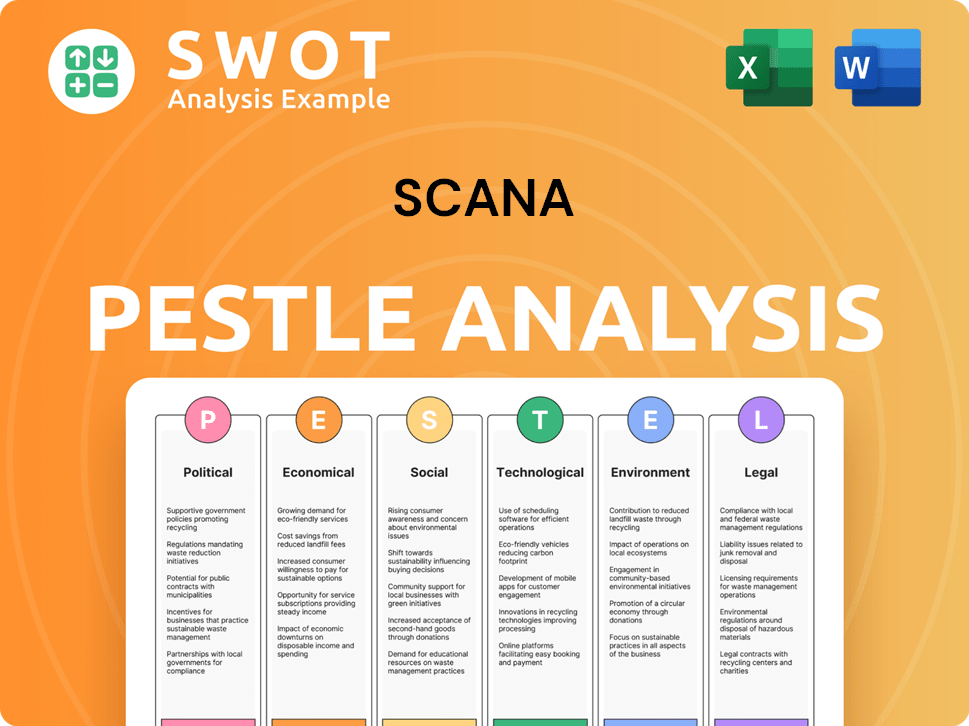

Scana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Scana a Competitive Edge Over Its Rivals?

Understanding the Target Market of Scana involves a deep dive into its competitive strengths. The company's strategic focus as an investment firm within the ocean industries forms the foundation of its competitive advantages. This specialization allows it to concentrate on identifying and nurturing innovative technology companies within the energy and maritime sectors, which is a key element of its business strategy.

Scana's active ownership model distinguishes it from passive investment funds. This hands-on approach provides strategic guidance and operational support to its portfolio companies. This helps them scale and overcome challenges, enhancing their competitive edge. The company's commitment to sustainable growth within the blue economy aligns with global trends, attracting companies developing green technologies and investors seeking sustainable development. This focus is crucial for its market analysis and future outlook.

The brand equity and established relationships of Scana within the Norwegian and international maritime and energy sectors provide a strong foundation for its portfolio companies to access new markets and secure contracts. These advantages are continually evolving as Scana adapts its investment strategy to emerging technologies and market demands, such as offshore wind and carbon capture solutions. While these advantages are sustainable due to Scana's specialized focus and active management, they face threats from rapidly changing technological landscapes and the emergence of new, agile competitors in niche markets. The competitive environment factors are constantly shifting.

Scana's specialized knowledge in the energy and maritime sectors allows it to identify promising ventures. This focus helps the company to cherry-pick ventures with high growth potential. This approach is a core element of its competitive advantages.

Scana's active ownership model provides strategic guidance and operational support. This hands-on approach helps portfolio companies scale and overcome challenges. This model is a key differentiator.

The company's commitment to sustainable growth within the blue economy aligns with global trends. This focus attracts companies developing green technologies and investors. It also strengthens Scana's market position.

Scana's brand equity and established relationships provide a strong foundation for its portfolio companies. These companies can access new markets and secure contracts more easily. This is a significant competitive advantage.

Scana's competitive advantages are rooted in its strategic focus and active management approach. These advantages are enhanced by its expertise in niche markets and its commitment to sustainable growth. The company's ability to adapt to emerging technologies and market demands is also crucial.

- Specialized knowledge in energy and maritime sectors.

- Active ownership model for portfolio companies.

- Focus on sustainable growth and the blue economy.

- Strong brand equity and market relationships.

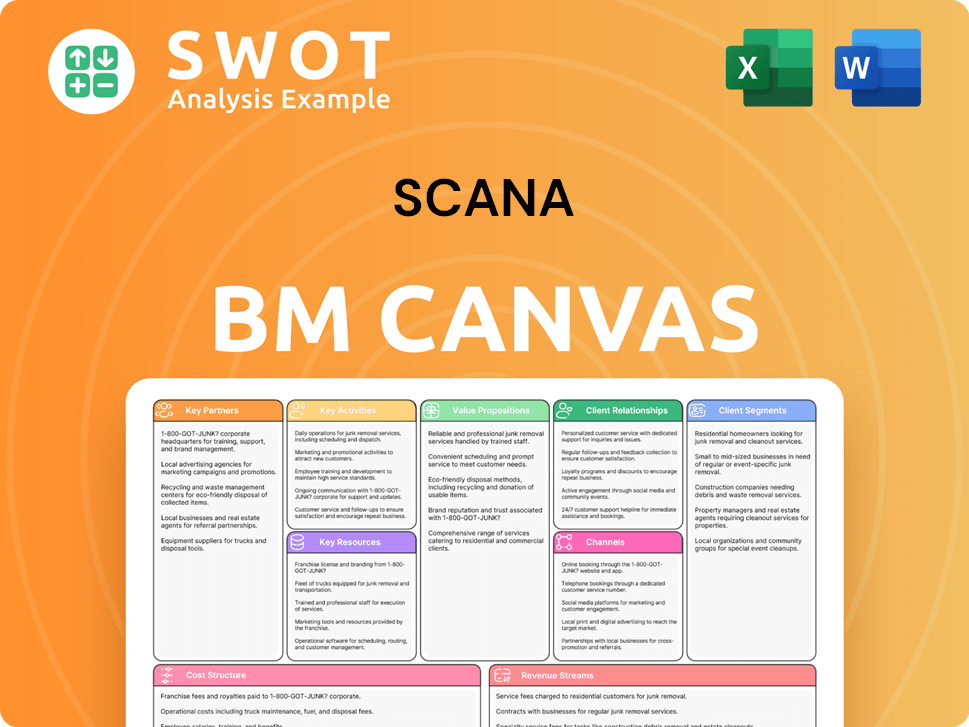

Scana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Scana’s Competitive Landscape?

The evolving Scana competitive landscape is significantly influenced by dynamic industry trends, future challenges, and emerging opportunities. The company, with its focus on ocean industries, navigates a complex environment shaped by technological advancements, decarbonization efforts, regulatory changes, and global economic shifts. Understanding these factors is crucial for assessing Scana's market analysis and strategic positioning.

Scana's industry faces both considerable risks and promising prospects. Challenges include capital-intensive investments in new technologies, energy price volatility, and intense competition. However, opportunities abound in offshore wind, aquaculture technology, and sustainable shipping. Strategic foresight and adaptability are essential for Scana's business strategy to thrive in the years ahead.

The ocean industries are being reshaped by digitalization, automation, and artificial intelligence. Decarbonization efforts, including offshore wind and alternative marine fuels, are driving innovation. Stricter emissions standards and environmental regulations are also impacting the industry. Global economic shifts and supply chain disruptions further influence market dynamics.

Significant capital expenditure is needed for new green technologies. Energy price volatility and intense competition from established and new players pose challenges. Geopolitical instability and trade tensions could disrupt supply chains. Navigating these challenges requires strategic planning and financial resilience.

Emerging markets for offshore wind, aquaculture technology, and sustainable shipping offer growth opportunities. Product innovations in subsea robotics and energy storage systems provide avenues for diversification. Strategic partnerships and collaborations are increasingly crucial for sharing risks and leveraging expertise.

Scana's future likely involves a stronger focus on companies with both technological innovation and profitability in the sustainable ocean economy. Active ownership and fostering growth within its portfolio companies will be crucial. Adaptability and strategic foresight are key to navigating the evolving competitive landscape.

Scana's competitive advantages will depend on its ability to capitalize on trends like decarbonization and digitalization. Strategic initiatives, including partnerships and acquisitions, will be vital. Understanding Scana's market challenges and growth opportunities is essential for its long-term success. The company's ability to adapt to the evolving Scana competitive environment factors will be critical.

- Focus on sustainable technologies and renewable energy projects.

- Strategic partnerships to share risks and leverage expertise.

- Investment in innovative solutions like subsea robotics and energy storage.

- Adaptability to changing regulatory environments and global economic shifts.

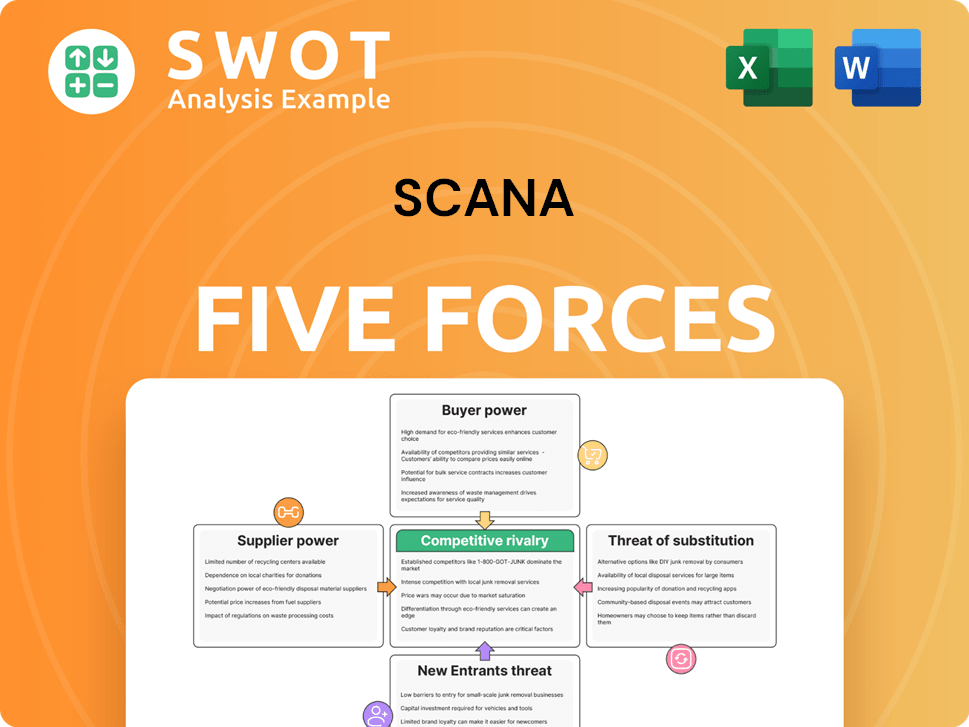

Scana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Scana Company?

- What is Growth Strategy and Future Prospects of Scana Company?

- How Does Scana Company Work?

- What is Sales and Marketing Strategy of Scana Company?

- What is Brief History of Scana Company?

- Who Owns Scana Company?

- What is Customer Demographics and Target Market of Scana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.