Scana Bundle

How Does Scana Company Thrive in the Ocean Industries?

Scana ASA is a prominent investment company making waves in the ocean industries, focusing on energy and maritime sectors. Its strategic approach centers on acquiring and nurturing innovative technology and solutions, positioning it as a key driver of sustainable growth. Understanding the intricacies of Scana SWOT Analysis is vital for anyone seeking to understand its market influence and future trajectory.

This exploration of Scana operations will uncover its core investment strategies and diverse revenue streams. We'll examine how the Scana business model identifies, acquires, and develops companies, ultimately generating profit and sustaining its growth. By understanding Scana's commitment to innovation in the energy transition and maritime sustainability landscapes, investors and industry observers can gain valuable insights into its future potential.

What Are the Key Operations Driving Scana’s Success?

The core of Scana Company's operations centers on its role as an investment entity that actively cultivates its portfolio companies. The company's value creation stems from identifying promising ventures within the ocean industries, particularly energy and maritime sectors, that showcase innovative technologies and solutions. Investing in these companies, Scana provides capital, strategic direction, and operational support to foster growth and enhance value.

Scana's distinct approach involves a hands-on role in developing its holdings, differentiating it from passive investment firms. Its primary offerings aren't direct products or services for end-users but rather the amplified capabilities and market reach of its portfolio companies. These companies cater to a diverse clientele within the energy and maritime sectors, including oil and gas, renewable energy, shipping, and offshore services. Key operational processes involve thorough due diligence for potential investments, active portfolio management, and strategic planning.

The value proposition of Scana lies in its ability to identify undervalued or high-potential companies and, through active ownership, unlock their full potential. This is achieved by leveraging its industry expertise, network, and financial resources. Scana's unique operational model blends investment acumen with operational development, aiming to create robust and sustainable businesses. This translates into accelerated growth and market penetration for its portfolio companies, boosting asset value and returns for Scana itself.

Scana's operations are focused on investing in and developing companies within the energy and maritime sectors. The company provides capital, strategic guidance, and operational support to its portfolio companies to foster growth. This active approach distinguishes Scana from passive investment firms, highlighting its commitment to hands-on development.

Scana creates value by identifying and investing in undervalued or high-potential companies. It leverages its industry expertise, network, and financial resources to unlock the full potential of its portfolio companies. This strategy leads to accelerated growth and market penetration for its holdings, ultimately increasing asset value and returns.

Scana's core offerings are not direct products or services to end-users but the enhanced capabilities and market reach of its portfolio companies. These companies provide services across various sectors, including oil and gas, renewable energy, shipping, and offshore services. Their operational processes involve rigorous due diligence, active management, and strategic planning.

Operational processes at Scana involve rigorous due diligence for potential investments, active management of its portfolio, and strategic planning. This includes facilitating technology development, optimizing supply chains, enhancing sales channels, and improving customer service within its portfolio companies. The goal is to maximize synergies and market potential.

Scana's business model is unique because it combines investment acumen with operational development, fostering sustainable businesses. This approach results in accelerated growth and market penetration for its portfolio companies. The company's focus on identifying and nurturing high-potential companies allows it to create significant value.

- Active investment and development of portfolio companies.

- Focus on the energy and maritime sectors.

- Leveraging industry expertise and financial resources.

- Strategic planning to maximize market potential.

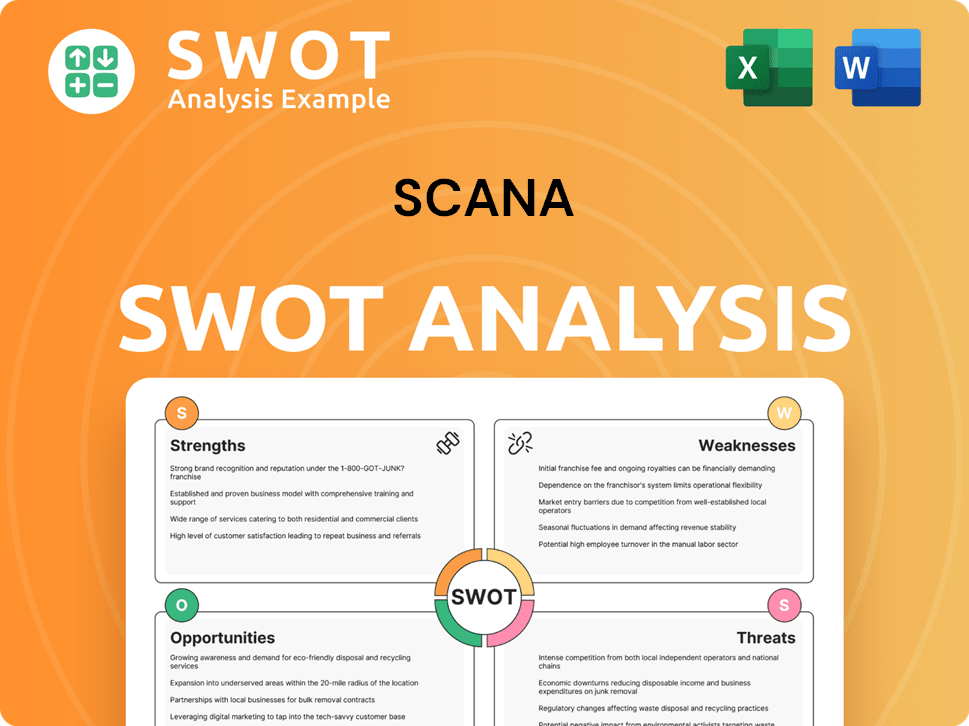

Scana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Scana Make Money?

The primary revenue streams for the investment company, Scana ASA, are rooted in the success of its portfolio companies. These include capital gains from sales, dividends, and potentially fees for services. In 2024, Scana demonstrated its operational profitability, reporting a positive EBITDA of NOK 31 million in Q4 and NOK 91 million for the full year.

Scana's monetization strategies focus on enhancing the value of its investments through growth and eventual sales. This involves nurturing portfolio companies to increase their market share, making them attractive for future acquisitions or IPOs. The company's order intake of NOK 407 million in Q4 2024 showcases ongoing business activities within its portfolio. The company's goal is to build a solid foundation for future growth and value creation.

The company's revenue sources may shift over time, reflecting changes in its investment focus within the ocean industries, and adapting to emerging technologies or market demands in energy and maritime sectors. As of early 2025, Scana continues to focus on its 'Scana-model' to grow its portfolio companies, suggesting a consistent approach to generating value and, subsequently, revenue. To learn more about the company, you can read a Brief History of Scana.

Scana's Scana operations are designed to create value through strategic investments. The Scana business model centers on identifying and growing promising companies within the ocean industries, with a focus on capital appreciation over time. The Scana Company aims to optimize the operational efficiency of its holdings, which directly boosts their financial performance and, consequently, Scana's revenue.

- Capital Gains: Revenue from selling portfolio companies at a profit.

- Dividends: Income from the dividends paid out by the portfolio companies.

- Operational Efficiency: Improving the performance of portfolio companies.

- Strategic Growth: Focusing on increasing the market share of portfolio companies.

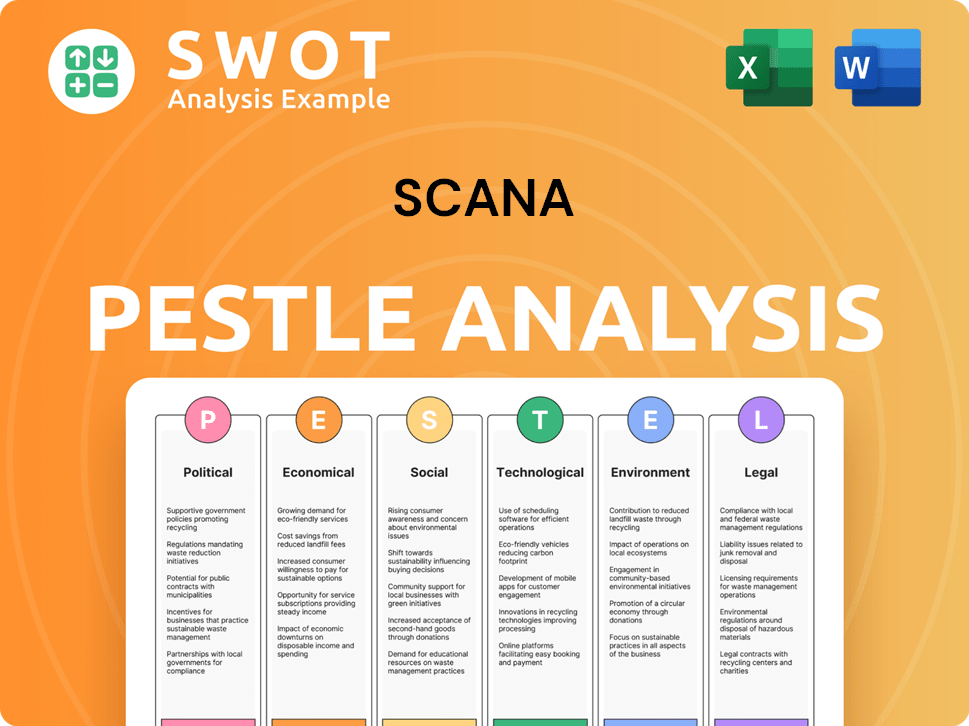

Scana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Scana’s Business Model?

The Scana Company has navigated various milestones and strategic shifts, primarily through its active management of portfolio companies. Its core strategy involves acquiring and developing companies with innovative technologies within the ocean industries. A key strategic move has been its focus on consolidating and improving its portfolio, as seen in its financial reports.

Scana's operational model has demonstrated resilience, as shown by an order intake of NOK 407 million in Q4 2024, despite potential industry challenges. The company's competitive edge stems from its deep industry expertise in ocean industries. The 'Scana-model' of active ownership and development of its portfolio companies gives it an advantage by actively cultivating growth and synergy among its holdings.

Scana continually adapts to new trends and technology shifts, particularly within the energy transition and maritime sustainability sectors. Its investment strategy is forward-looking, seeking out companies that develop solutions for these evolving industries. This proactive approach positions Scana to capitalize on future market demands and maintain its competitive edge.

Scana has achieved several significant milestones, often linked to developments within its portfolio companies. These milestones reflect the company's ability to identify and nurture promising ventures in the ocean industries. The company's strategic focus has led to positive financial outcomes, including improved EBITDA figures, highlighting operational efficiency.

Strategic moves include consolidating and improving its portfolio companies, as well as adapting its investment focus. The company's ability to generate a strong order intake in Q4 2024 indicates a successful operational model. Scana's strategic decisions are guided by its deep understanding of the ocean industries and the evolving needs of the energy transition.

Scana's competitive advantages come from its industry expertise in ocean industries. The 'Scana-model' of active ownership and development gives it an edge. Continuous adaptation to new trends and technologies within the energy transition and maritime sustainability sectors further strengthens its position.

Scana's operations are centered around active portfolio management. This approach allows Scana to identify promising ventures and provide targeted strategic guidance. Scana's operational model has shown resilience, with a strong order intake in Q4 2024. The company focuses on sustainable practices and innovative technologies.

Scana's financial performance in 2024 reflects its strategic focus on operational efficiency and portfolio development. The company's ability to secure significant order intake in Q4 2024 demonstrates its strong market position and resilience. Scana's commitment to the energy transition and maritime sustainability sectors positions it well for future growth.

- Positive EBITDA in 2024 indicates improved operational efficiency.

- Order intake of NOK 407 million in Q4 2024 highlights a strong market position.

- Focus on innovative technologies within the ocean industries and energy transition.

- Active ownership model driving growth and synergy within portfolio companies.

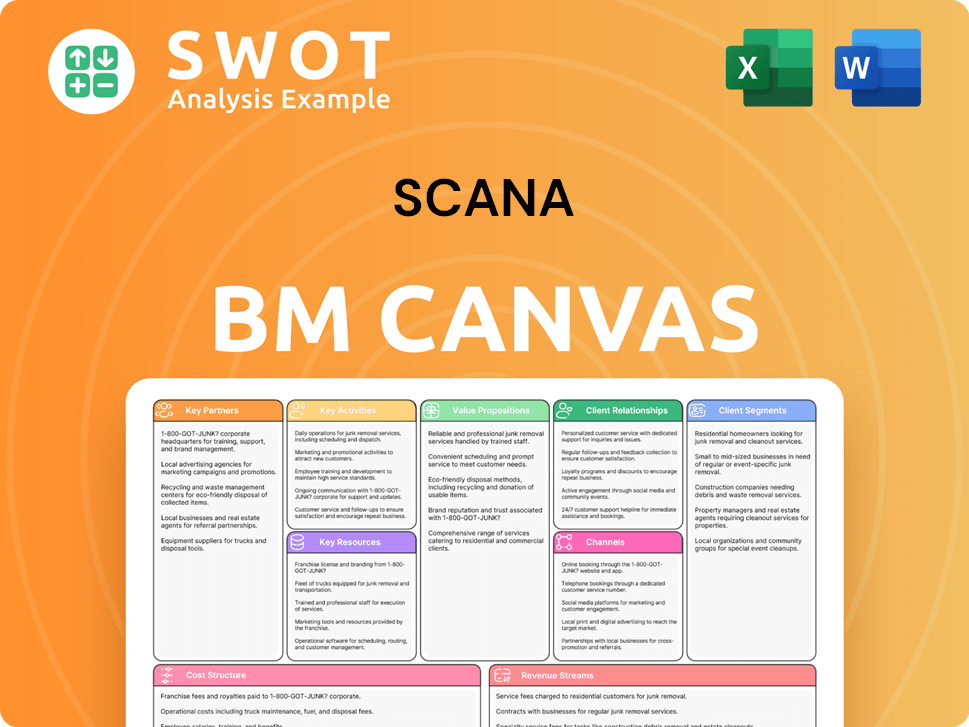

Scana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Scana Positioning Itself for Continued Success?

Scana ASA, operating within the ocean industries, distinguishes itself as an investment company focused on actively developing its portfolio. Unlike companies with direct product offerings, Scana's market position is evaluated through the collective influence and market penetration of its investments within the energy and maritime sectors. The firm's dedication to innovative technology and sustainable solutions positions it in a growth segment of the market. For the full year 2024, Scana reported an EBITDA of NOK 91 million, indicating a solid operational base for its portfolio companies.

The Competitors Landscape of Scana reveals that the company navigates the inherent volatility of the ocean industries. These industries are subject to fluctuations in energy prices, geopolitical events, and regulatory changes impacting maritime and offshore operations. Technological advancements also pose a risk, potentially rendering existing solutions obsolete and necessitating continuous adaptation and investment in new innovations. The success of Scana is directly tied to the performance of its portfolio companies, making it susceptible to their individual operational and market challenges.

Scana's industry position is unique as an investment company in the ocean industries. It focuses on developing its portfolio, contributing to the energy and maritime sectors. The company's emphasis on innovation and sustainability aligns with market growth.

Key risks include the volatility of the ocean industries, influenced by energy prices and geopolitical events. Technological disruption poses a threat to existing solutions. The success of Scana depends on its portfolio companies' performance.

Scana's strategic initiatives focus on developing its 'Scana-model' and investing in sustainable growth within the ocean industries. The company aims to capitalize on the energy transition and demand for sustainable maritime solutions.

Scana's financial performance, with an EBITDA of NOK 91 million for 2024, demonstrates a robust operational foundation. This performance supports the company's continued investment and active portfolio management.

Scana is focused on the continued development of its 'Scana-model', identifying and investing in companies supporting sustainable growth in the ocean industries. The company's leadership emphasizes building a foundation for future value creation. The goal is to generate revenue by leveraging the energy transition and the demand for sustainable maritime solutions.

- Active portfolio management is a key strategy for Scana.

- Emphasis on sustainable growth and innovation in the energy and maritime sectors.

- Capitalizing on the energy transition and demand for sustainable maritime solutions.

- Building a solid foundation for future value creation through strategic investments.

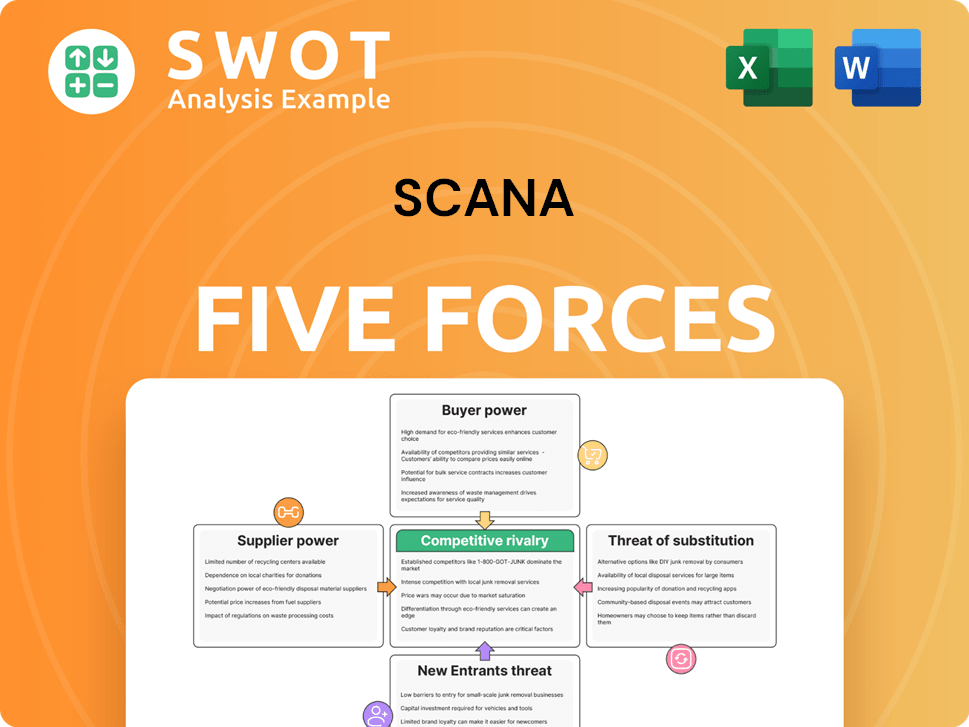

Scana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Scana Company?

- What is Competitive Landscape of Scana Company?

- What is Growth Strategy and Future Prospects of Scana Company?

- What is Sales and Marketing Strategy of Scana Company?

- What is Brief History of Scana Company?

- Who Owns Scana Company?

- What is Customer Demographics and Target Market of Scana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.