Sonic Healthcare Bundle

How Did Sonic Healthcare Become a Global Healthcare Powerhouse?

Embark on a journey through the Sonic Healthcare SWOT Analysis to uncover the fascinating story of Sonic Healthcare, a company that has revolutionized healthcare diagnostics worldwide. From its humble beginnings in Australia, this medical laboratory giant has grown into a global leader, impacting millions with its comprehensive services in pathology and radiology. Discover the key milestones and strategic decisions that propelled Sonic Healthcare's rise.

This exploration of the Sonic Healthcare history will reveal how Sonic Healthcare, initially Sonic Technology Australia Ltd, expanded its pathology services and medical laboratories. Learn about the Sonic Healthcare company's strategic acquisitions and organic growth, which have cemented its position as a leading healthcare diagnostics provider. Delve into the financial performance history and understand Sonic Healthcare's global presence and impact on healthcare.

What is the Sonic Healthcare Founding Story?

The story of Sonic Healthcare, a major player in the healthcare diagnostics field, began in 1987. It started as Sonic Technology Australia Ltd, listed on the Australian Stock Exchange. This marked the beginning of what would become a global leader in medical laboratories and pathology services.

The company's roots lie in Douglass Laboratories Pty Ltd, a pathology practice in Sydney. A critical turning point came in 1992 when Michael Boyd, a young accountant, invested in the then-struggling company. His vision was to concentrate solely on pathology services, which set the stage for future growth. Dr. Colin Goldschmidt, a histo-pathologist, was appointed as CEO, a role he still holds as of 2024.

The initial challenge was the fragmented nature of the pathology market. The company saw an opportunity to use the Australian Medicare system for expansion. The core business model focused on providing comprehensive laboratory medicine and pathology services. The change from 'Sonic Technology Australia Ltd' to 'Sonic Healthcare Ltd' in 1995 clearly showed a shift towards healthcare services.

The company's early focus on pathology services and strategic leadership were essential for its growth.

- 1987: Sonic Technology Australia Ltd is listed on the Australian Stock Exchange.

- 1992: Michael Boyd invests in the company, focusing on pathology services.

- 1995: The company changes its name to Sonic Healthcare Ltd, signaling a clearer focus on healthcare.

- 2024: Dr. Colin Goldschmidt continues to serve as CEO and Managing Director.

Early financial details are not widely publicized, but early growth likely involved strategic investments and careful financial management. The expertise of the founding team, particularly Dr. Goldschmidt's medical background and Boyd's financial skills, was crucial. This strategic shift and leadership set the stage for Sonic Healthcare's expansion and success in medical diagnostics. For more insights into the company's structure, consider reading about the Owners & Shareholders of Sonic Healthcare.

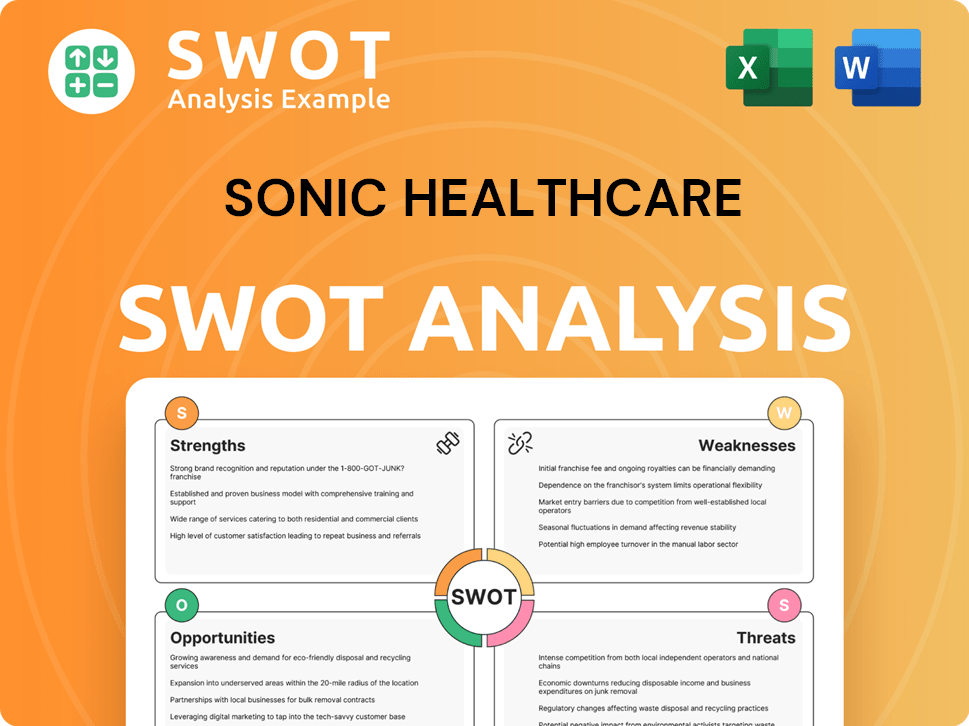

Sonic Healthcare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sonic Healthcare?

Following its strategic shift to focus on pathology services, the early growth and expansion of Sonic Healthcare was substantial. This period saw the company's sales increase dramatically, driven by strategic acquisitions and consolidation within the pathology sector. The company's expansion strategy included entering international markets, significantly broadening its reach and impact in the healthcare diagnostics industry.

Between 1992 and 1999, Sonic Healthcare's sales grew from A$12 million to A$175 million. The 'roll-up' strategy involved acquiring and consolidating pathology practices, with key acquisitions including Pathlab in 1995, and Hanly Moir Pathology and Barratt and Smith Pathologists in 1996. By 1996, Sonic Healthcare had become Australia's largest pathology group, solidifying its position in the medical laboratories market.

The acquisition of SGS Medical Group in 1999 was a defining step, propelling Sonic Healthcare into the diagnostic providers 'big league'. Expansion beyond Australia began in 2002 with entry into the United Kingdom, followed by Germany in 2004, and the USA in 2005. This internationalization was driven by increasing demand for diagnostic services due to aging populations and new tests, impacting the overall healthcare diagnostics landscape.

Dr. Colin Goldschmidt's leadership focused on a 'Medical Leadership' culture, emphasizing high-quality medical practice. This approach fostered competitive advantages and market share growth. For the financial year 2024, Sonic Healthcare reported strong base business revenue growth of 16%, including 6% organic growth, augmented by targeted business acquisitions, reflecting its continued financial performance history.

The establishment of Sonic Clinical Trials during this period was another key milestone. The company's growth strategy combined organic expansion with strategic acquisitions, leading to significant scale and infrastructure improvements. These efforts facilitated synergy capture and improved margins, contributing to Sonic Healthcare's impact on healthcare.

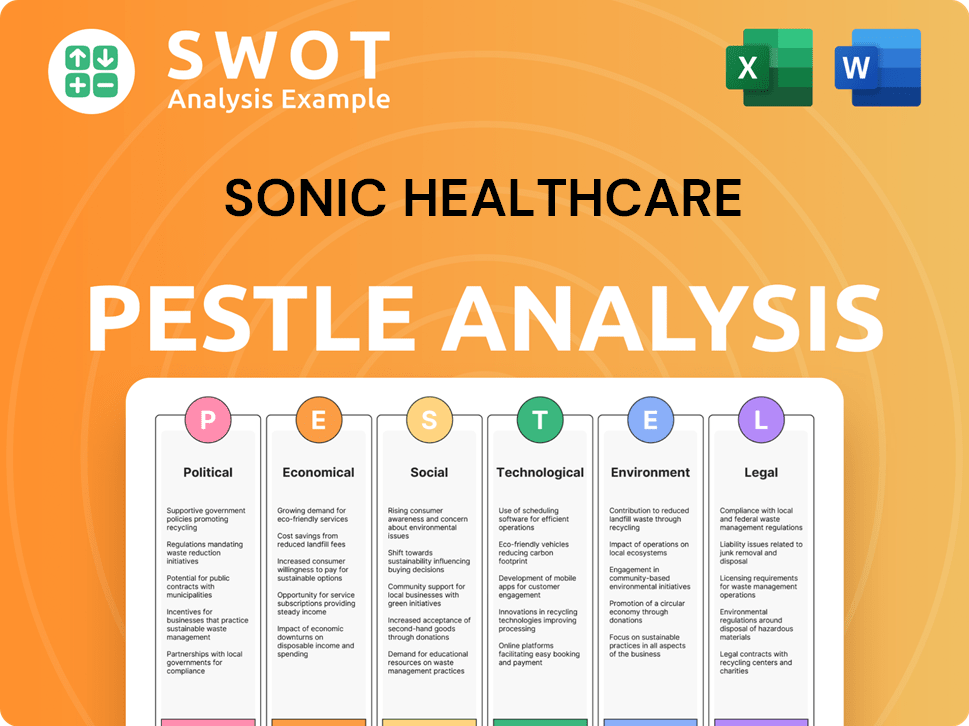

Sonic Healthcare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sonic Healthcare history?

The Sonic Healthcare company has a history marked by significant achievements. A key element of its success has been the formalization of its 'Core Values' in early 2000, which has helped unify its diverse practices and guide its business strategy. This cultural framework, combined with its unique federation model, has been a major determinant of its success.

| Year | Milestone |

|---|---|

| 2000 | Formalized and embedded its 'Core Values' to guide ethical principles and business strategy. |

| 2023 | Acquired PathologyWatch in the USA, expanding its market presence. |

| 2025 (Expected) | Anticipated completion of the LADR Laboratory Group acquisition in Germany. |

Sonic Healthcare actively embraces technological advancements, particularly in the realm of healthcare diagnostics. The company is investing heavily in digital pathology and associated IT infrastructure, with a focus on Artificial Intelligence (AI) to enhance efficiency and quality.

Sonic Healthcare is strategically investing in AI to improve healthcare diagnostics. This includes an 18% stake in Harrison.ai and the establishment of Franklin.ai, a joint venture focused on developing AI diagnostic tools for pathology.

The company is accelerating its transition to digital pathology. The rollout of the PathologyWatch platform in its US Dermatopathology division is a key part of this initiative.

Despite its successes, Sonic Healthcare has faced various challenges, including the impact of the COVID-19 pandemic on revenue. The company also navigates labor cost inflation and regulatory risks, demonstrating resilience and strategic adaptability.

The financial year 2024 saw an 87% decrease in COVID-19 related revenues. Despite this, the company demonstrated resilience with strong base business revenue growth.

Labor cost inflation has been a concern, though it has decreased from earlier peaks. The company has managed these rising costs through headcount reduction and other efficiency initiatives.

Sonic Healthcare continues its 'roll-up' strategy through acquisitions. Recent examples include LADR Laboratory Group in Germany and PathologyWatch in the USA, aimed at market expansion.

The company faces regulatory risks, such as potential changes in government and healthcare regulations. Sonic Healthcare mitigates this by leveraging its market leadership to help shape healthcare systems.

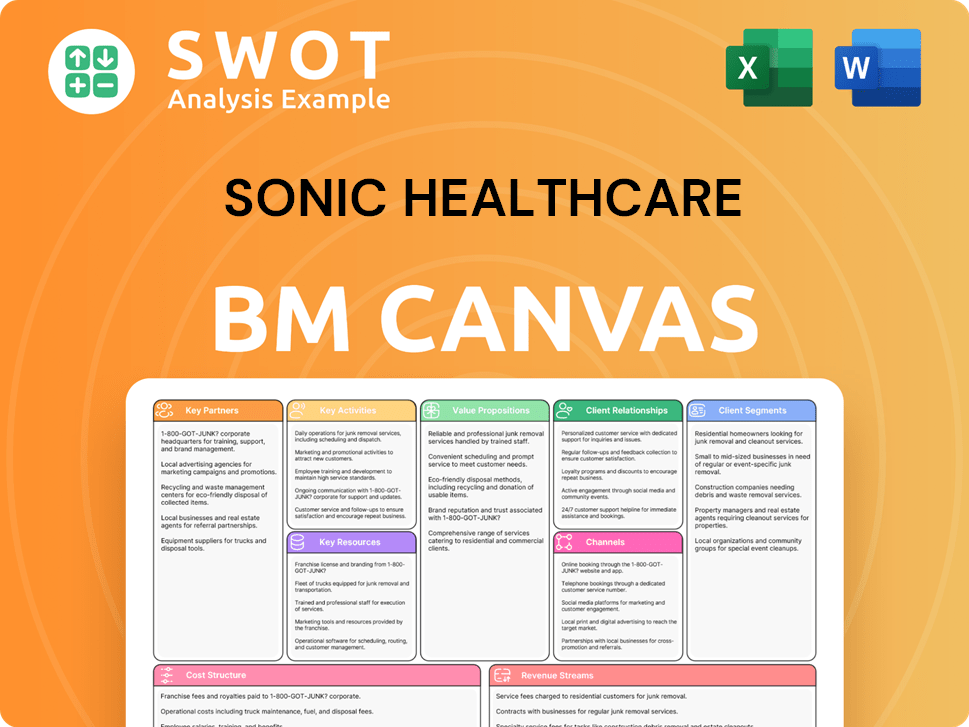

Sonic Healthcare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sonic Healthcare?

The Sonic Healthcare company has a rich history, marked by strategic expansion and a focus on providing high-quality diagnostic services. From its beginnings in Australia, the company has grown into a global leader in healthcare diagnostics, with a presence in multiple countries. Key milestones include significant acquisitions and a commitment to innovation, positioning it well for future growth in the healthcare industry.

| Year | Key Event |

|---|---|

| 1987 | Listed on the Australian Stock Exchange as Sonic Technology Australia Ltd. |

| 1992 | Michael Boyd invests, and Dr. Colin Goldschmidt is appointed CEO, focusing on pathology. |

| 1995 | Company name formally changes to Sonic Healthcare Limited. |

| 1996 | Becomes Australia's largest pathology group through acquisitions. |

| 1999 | Acquisition of SGS Medical Group, a significant step in its evolution. |

| 2000 | Establishes its Core Values, formalizing its corporate culture. |

| 2002 | Enters the United Kingdom market. |

| 2004 | Expands into Germany with the acquisition of Schottdorf Group. |

| 2005 | Enters the USA market by acquiring Clinical Pathology Laboratories (CPL) Inc. |

| 2015 | Acquires Medisupport S.A. (Switzerland) and Klinisch Laboratorium Declerck (Belgium). |

| 2023 | Acquires Diagnosticum and PathologyWatch. |

| 2024 | Achieves A$9.0 billion in revenue and A$511 million in net profit. Commences 10-year NHS laboratory outsource contract in Whittington Health NHS Trust, UK. Releases 2024 Sustainability Report. Signs agreement to acquire LADR Laboratory Group in Germany. |

| 2025 (H1) | Expects LADR Laboratory Group acquisition to complete. |

Looking ahead, the company anticipates continued growth, driven by strategic initiatives. Management expects operating profits of A$1.70 billion - A$1.75 billion in 2025, an increase of 7-10%. The company's strong balance sheet and ongoing acquisitions are expected to contribute to this growth. The company is well-positioned for additional expansion.

The company is focused on market consolidation in fragmented markets like the USA and Germany. Further acquisitions are likely, with opportunities also targeted in Switzerland and Belgium. Investments in digital pathology and AI tools are planned to enhance efficiency and quality. These moves will aid in the company's long-term success.

Investments in digital pathology and AI tools are expected to enhance efficiency, quality, and capacity. The company is committed to integrating the latest technologies. These advancements will support its mission of providing essential and high-quality diagnostic services. This will improve patient care.

Analysts project earnings per share to grow to A$1.30 by 2026 as recent acquisitions begin to deliver. The company anticipates continued organic growth averaging about 5% per annum over the long term. This growth is supported by increasing demand for diagnostic services. The financial outlook is positive.

Sonic Healthcare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sonic Healthcare Company?

- What is Growth Strategy and Future Prospects of Sonic Healthcare Company?

- How Does Sonic Healthcare Company Work?

- What is Sales and Marketing Strategy of Sonic Healthcare Company?

- What is Brief History of Sonic Healthcare Company?

- Who Owns Sonic Healthcare Company?

- What is Customer Demographics and Target Market of Sonic Healthcare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.