Spartan Delta Bundle

How Did Spartan Delta Rise to Prominence?

Embark on a journey through the fascinating Spartan Delta SWOT Analysis. From its strategic beginnings in late 2019, Spartan Delta Company has rapidly become a significant force in Western Canada's energy sector. Discover how this oil and gas exploration and production company transformed itself, evolving from Return Energy Inc. to the dynamic entity it is today. Uncover the key milestones and strategic decisions that shaped Spartan Delta's remarkable ascent.

This brief history of Spartan Delta Company will delve into its formation, highlighting the pivotal recapitalization that set the stage for its growth. We'll explore its operational focus on sustainable free funds flow and shareholder returns, examining its key regions of operation across Western Canada. Understanding Spartan Delta's commitment to ESG principles is crucial, as it differentiates the company within the competitive landscape, impacting its long-term strategy and stakeholder value.

What is the Spartan Delta Founding Story?

The story of Spartan Delta Company began in December 2019, marking its emergence from the recapitalization of Return Energy Inc. The company's formation was driven by co-founders Richard F. McHardy and Dr. Fotis Kalantzis, who saw an opportunity in the Canadian energy sector.

Richard McHardy, a Director and co-founder, brought a wealth of experience from leadership roles in various public oil and gas companies. Dr. Fotis Kalantzis, the President, CEO, Director, and co-founder, contributed over 25 years of expertise in oil and gas exploration and development. Together, they aimed to capitalize on favorable market conditions.

The initial strategy focused on acquiring a diverse portfolio of high-quality oil and gas assets. These assets were intended to be restructured, optimized, and rebranded to maximize their potential and generate significant free cash flow. This approach was designed to enhance corporate metrics through the consolidation of underdeveloped or undercapitalized assets. For more information on the company's ownership, you can read about the Owners & Shareholders of Spartan Delta.

Spartan Delta's rapid growth from 200 barrels of oil equivalent per day (boe/d) to 75,000 boe/d after 10 acquisitions, even during the global pandemic, is a testament to its strategic approach.

- The founding team initially comprised nine members, expanding to 127 direct employees within two years.

- Initial funding involved strategic investment agreements, followed by various rounds, including a $59 million Post IPO round on January 14, 2025.

- The company's cultural emphasis was on leveraging internal expertise to identify, acquire, and develop diversified assets, particularly in Western Canada's Montney and Deep Basin areas.

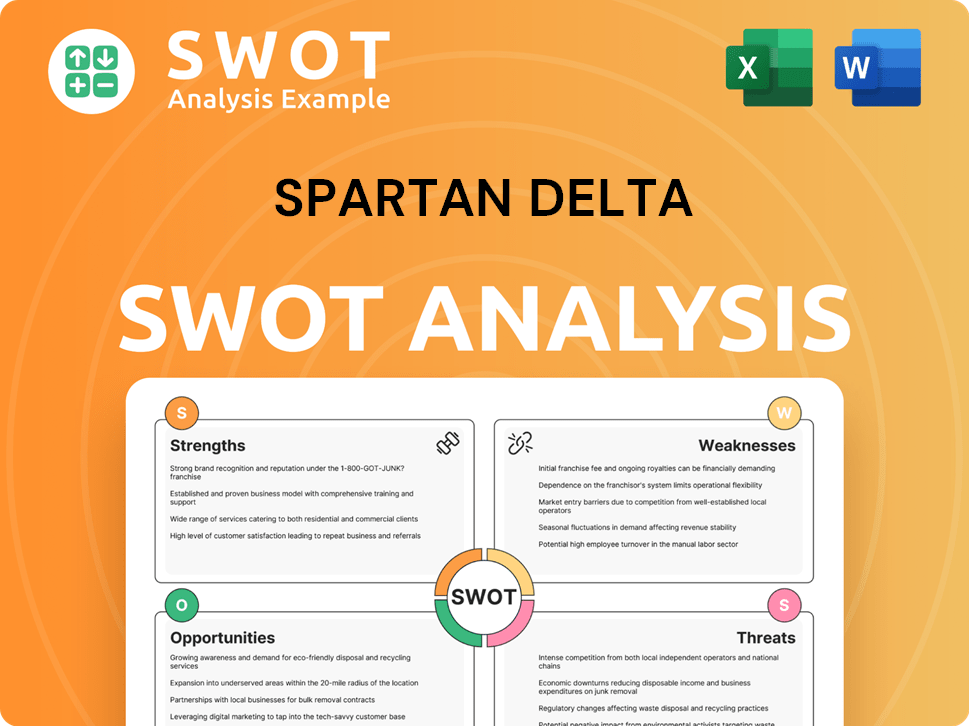

Spartan Delta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Spartan Delta?

The early growth of Spartan Delta Company, following its recapitalization, was marked by strategic acquisitions and a focus on high-potential assets. This expansion strategy quickly established the company's presence in key regions. These moves were central to the company's growth, setting the stage for its position in the market.

In June 2020, Spartan Delta acquired the assets of Bellatrix Exploration Ltd. This acquisition provided its first core operating area in the Deep Basin. The assets included high-quality, multi-zone oil and gas production, a large land base, and strategic infrastructure. This acquisition was a key step in Spartan Delta’s early growth.

Further expansion continued with the acquisition of Inception Exploration in March 2021 and Velvet Energy in August 2021. The Velvet Energy acquisition, valued at CAD$750 million, was particularly significant. It helped Spartan Delta become a market leader in the Montney region by acreage and production. These acquisitions were central to the company's strategy of growth through targeted strategic acquisitions in a challenging market, as discussed in Competitors Landscape of Spartan Delta.

Spartan Delta focused on integrating acquired assets and demonstrating the productive potential of areas like Gold Creek and Karr through drilling programs. The company also prioritized accelerating debt repayment. In December 2024, Spartan Delta's Duvernay position exceeded 250,000 net acres, with production surpassing 5,000 BOE/d (77% liquids) in that region.

As of March 31, 2025, the company reported a trailing 12-month revenue of $227 million. Despite a net loss in Q1 2025, Spartan achieved a 196% increase in crude oil production compared to the previous year. The company maintained a strong financial position with a net debt to annualized adjusted funds flow ratio of 0.4x. Spartan Delta’s stock price as of May 27, 2025, was $2.23, with a market cap of $447 million.

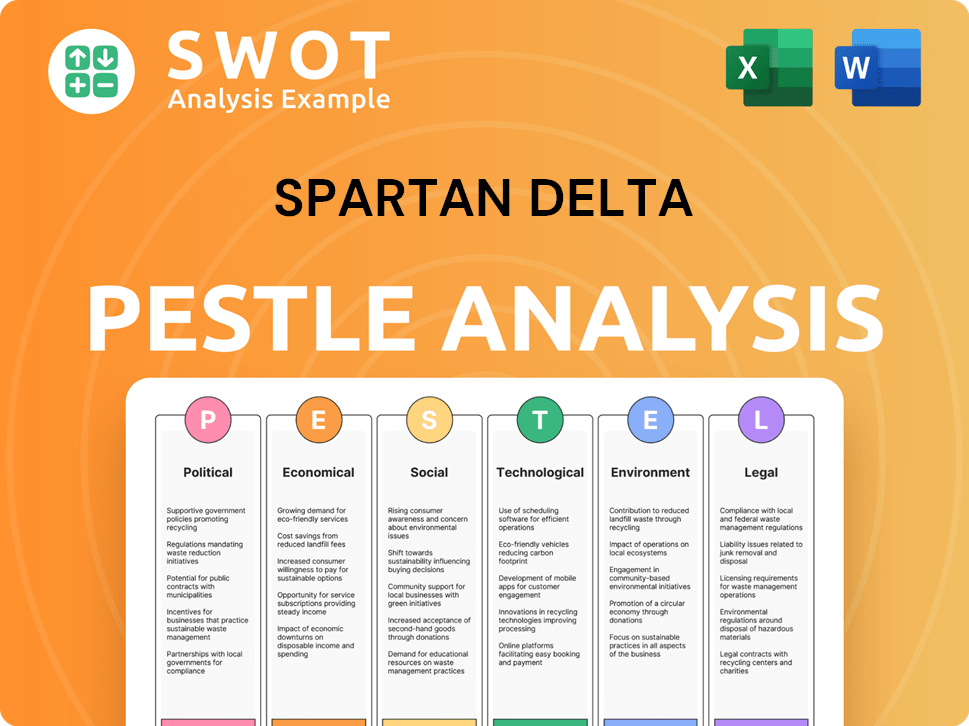

Spartan Delta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Spartan Delta history?

The Spartan Delta Company has experienced significant growth and strategic shifts since its formation. This Spartan Delta history is marked by rapid expansion, strategic acquisitions, and a focus on shareholder value, making it a notable player in the energy sector. The company's journey reflects its adaptability and resilience in a dynamic market.

| Year | Milestone |

|---|---|

| 2020-2023 | Rapid production growth from 200 boe/d to 75,000 boe/d following 10 acquisitions. |

| 2024 | Commenced inaugural Duvernay program, drilling four wells and achieving 5,000 BOE/d of Duvernay production, with 77% liquids. |

| 2023 | Creation and distribution of Logan Energy Corp. at $0.35 per share to Spartan shareholders. |

| 2025 | Allocating approximately $200 to $215 million of capital to the Duvernay, targeting an annualized production growth rate of 180% and aiming for 25,000 BOE/d in Duvernay production. |

| 2025 | Maintained a strong financial position, with a net debt of $81.9 million and a 0.4x net debt to annualized adjusted funds flow ratio as of March 31, 2025. |

A key innovation for Spartan Delta has been its accelerated development program in the West Shale Basin Duvernay. This strategic pivot towards increasing oil and condensate production is a significant move. The company's focus on internal efficiencies, improving well costs, and leveraging its technical expertise also demonstrates innovation.

In 2024, the company began its Duvernay program, drilling four wells. This initiative led to a production milestone of 5,000 BOE/d, with 77% liquids. This marked a strategic shift to boost oil and condensate output.

The company's growth was fueled by strategic acquisitions, increasing production to 75,000 boe/d. These acquisitions helped establish dominant positions in key areas. This rapid expansion highlights the company's growth strategy.

The monetization of assets and distributions, including dividends of $9.60 per share, created shareholder value. The creation and distribution of Logan Energy Corp. further enhanced shareholder returns. This demonstrates the company's commitment to financial performance.

Challenges faced by Spartan Delta Company include navigating a volatile global energy market and fluctuating oil prices. Despite these pressures, the company has maintained a strong financial position. For more insights into the company's values, consider reading about Spartan Delta's mission and values.

The company operates in a volatile global energy market, facing fluctuating oil prices. This requires adaptability and strategic financial planning. External pressures, such as natural gas price fluctuations in 2024, pose challenges.

The company has successfully navigated financial hurdles, maintaining a strong financial position. The net debt of $81.9 million and a 0.4x net debt to annualized adjusted funds flow ratio as of March 31, 2025, demonstrate resilience. This reflects effective financial management.

Strategic repositioning efforts, including monetizing assets, have been crucial. These actions, such as the monetization of Gold Creek and Karr Montney assets, have resulted in shareholder value creation. These efforts reflect the company's ability to adapt to market conditions.

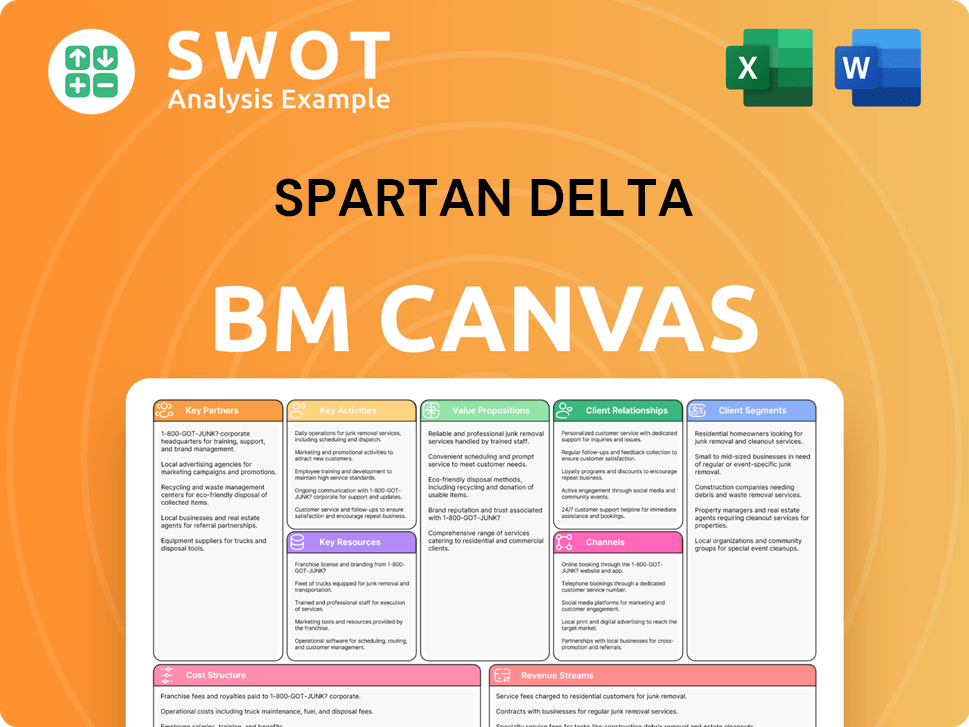

Spartan Delta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Spartan Delta?

The Spartan Delta Company has a relatively short but dynamic history, marked by strategic acquisitions and operational growth in the Canadian energy sector. The company's journey from inception to its current status showcases its ability to adapt and expand its asset base, particularly in the Duvernay and Deep Basin regions. Here is a chronological timeline of key events for Spartan Delta:

| Year | Key Event |

|---|---|

| December 2019 | Spartan Delta Corp. was established through the recapitalization of Return Energy Inc. |

| June 2020 | The company acquired Bellatrix Exploration Ltd. assets, establishing a core operating area in the Deep Basin. |

| August 2021 | Spartan Delta expanded its position in the Montney through the acquisition of Velvet Energy for CAD$750 million. |

| July 2023 | Completion of the spin-out transaction of Logan Energy Corp. |

| November 2023 | Duvernay asset acquisitions were completed for approximately $25 million, and preliminary 2024 guidance was announced. |

| December 2024 | The company's Duvernay position exceeded 250,000 net acres, and production surpassed 5,000 BOE/d (77% liquids). |

| January 2025 | Preliminary 2025 guidance was announced, with an initial capital budget of $300 to $325 million, targeting 40,000 BOE/d production, a 5% increase from 2024 guidance. An upsized equity offering of $85 million closed on January 30, 2025. |

| February 2025 | 2024 year-end results were announced, reporting production of 38,166 BOE/d and oil and gas sales of $301.6 million. |

| May 2025 | Q1 2025 results were reported, with a 196% increase in crude oil production compared to the previous year. All resolutions at the Annual General and Special Meeting of Shareholders were duly passed on May 23, 2025. |

The company plans to allocate approximately $200 to $215 million of its 2025 capital budget to the Duvernay region. This strategic investment aims for an impressive 180% annualized production growth. Spartan Delta targets to achieve 25,000 BOE/d in Duvernay production.

In the Deep Basin, approximately $100 to $110 million of capital is earmarked for 2025. The focus will be on liquids-rich targets, with plans to drill 19 (18 net) wells. This targeted approach is expected to optimize production and enhance profitability in this key area.

The company anticipates a significant increase in crude oil and condensate production. The forecast for 2025 indicates an approximate 75% increase compared to the 2024 guidance. This growth reflects the success of strategic acquisitions and operational efficiencies.

Analysts have a bullish outlook for Spartan Delta Company, with an average price target of $14.11 in 2025 and a potential rise to $21.66 by 2030. This positive outlook is supported by the company's focus on sustainable development and efficient resource management. Further insights into the company's performance can be found in a detailed analysis of the Spartan Delta history.

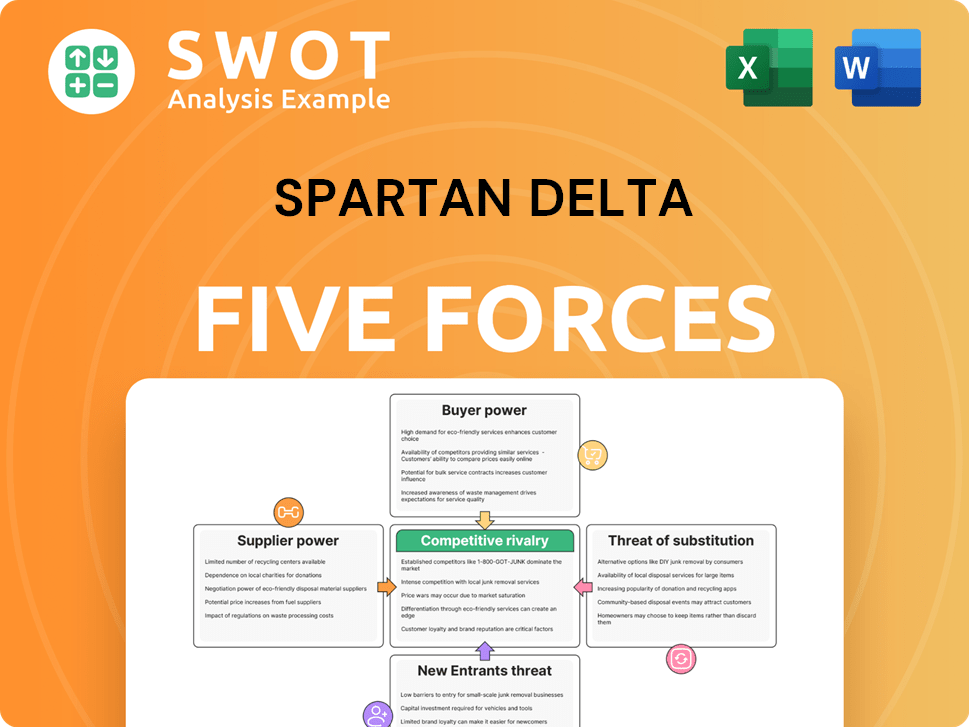

Spartan Delta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Spartan Delta Company?

- What is Growth Strategy and Future Prospects of Spartan Delta Company?

- How Does Spartan Delta Company Work?

- What is Sales and Marketing Strategy of Spartan Delta Company?

- What is Brief History of Spartan Delta Company?

- Who Owns Spartan Delta Company?

- What is Customer Demographics and Target Market of Spartan Delta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.