Spartan Delta Bundle

Who Really Owns Spartan Delta?

Understanding the ownership of a company is crucial for investors and stakeholders alike, and in the case of Spartan Delta Corp., the picture is particularly dynamic. The company's strategic shifts, including the significant sale of assets in 2023, have likely reshaped its shareholder base, making a deep dive into its current ownership structure essential. Knowing who controls the reins of Spartan Delta can significantly impact your investment decisions.

This analysis of Spartan Delta ownership will explore the evolution of its shareholder base, from its inception by Rick McHardy as Return Energy Inc. to its current status as a publicly traded entity. We'll examine the key players, including major institutional investors and individual shareholders, to provide a comprehensive understanding of who owns Spartan Delta and how this impacts the company’s future. For those seeking a deeper dive, consider reviewing our Spartan Delta SWOT Analysis to understand the company's strengths and weaknesses within the context of its ownership.

Who Founded Spartan Delta?

The origins of Spartan Delta Corp. trace back to 2005, when it was founded by Rick McHardy. The company's early structure and ownership were significantly shaped by the founders' extensive experience in the oil and gas industry. This foundation set the stage for the company's development and its later strategic shifts.

Richard F. McHardy, the founder, brought a wealth of experience from his involvement in several public oil and gas ventures. His background included roles as President, CEO, and director in companies such as Spartan Energy, Spartan Oil, and Spartan Exploration. Fotis Kalantzis, also a co-founder, contributed his expertise in oil and gas exploration and development, having served as a senior officer in similar capacities within the Spartan group of companies.

The initial ownership structure of the company, then known as Return Energy Inc., is not explicitly detailed in available records. However, the November 2019 reorganization and investment agreement with Fotis Kalantzis and Richard F. McHardy, identified as 'Initial Investors,' marked a key moment in establishing the company's ownership. This agreement included a non-brokered private placement that raised up to $25.0 million, which brought in a new management team and board, signaling a strategic realignment under the Spartan brand.

Rick McHardy founded the company in 2005.

Fotis Kalantzis is also recognized as a co-founder.

Richard F. McHardy has a significant background in the oil and gas industry.

Fotis Kalantzis has extensive experience in oil and gas exploration and development.

The November 2019 reorganization and investment agreement was a key event.

A non-brokered private placement raised up to $25.0 million.

The 2019 agreement brought in a new management team and board.

This reflected a strategic re-alignment and recapitalization under the Spartan brand.

The non-brokered private placement was for gross proceeds of up to $25.0 million.

This investment was a significant step in the company's financial restructuring.

Details of early backers or angel investors beyond the key founders are not available.

Focus is on the founders and the 2019 investment agreement.

Understanding the Spartan Delta ownership structure is crucial for investors. The early Spartan Delta shareholders included founders Rick McHardy and Fotis Kalantzis, with the 2019 agreement involving significant investment. The company's history and Spartan Delta company profile reveal a strategic evolution. For those interested in Spartan Delta stock, it's important to note that the company's Spartan Delta executives have played a key role in its development. To learn more about the market, consider reading about the Target Market of Spartan Delta.

- The initial founders, Rick McHardy and Fotis Kalantzis, laid the groundwork.

- The 2019 investment marked a significant shift in ownership and management.

- Information on Spartan Delta Delta Exploration Ltd ownership structure can be found in company filings.

- Details on Who owns Spartan Delta are available through public records and investor relations.

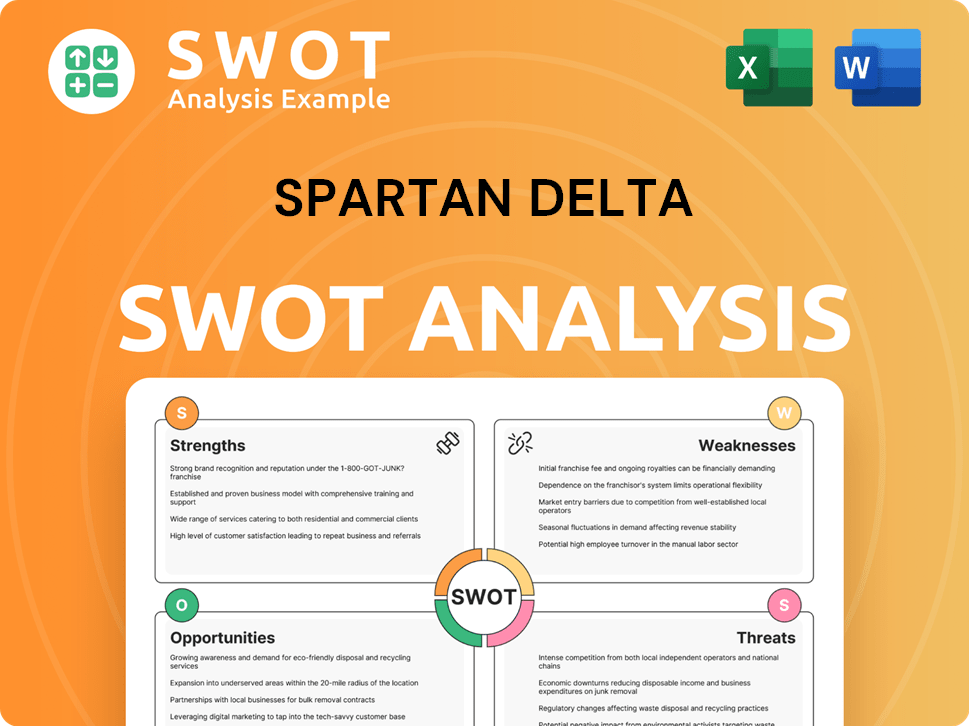

Spartan Delta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Spartan Delta’s Ownership Changed Over Time?

The evolution of ownership at Spartan Delta Corp. reflects significant shifts since its inception as Return Energy Inc. The company, trading on the Toronto Stock Exchange (TSX) under the symbol 'SDE', had approximately 200.0 million common shares outstanding as of March 31, 2025. This structure is key to understanding the distribution of power and influence within the company, especially when considering major shareholders and their impact on strategic decisions.

A pivotal moment in the company's ownership history was the sale of 15 million shares, representing 9.8% of the company, by Areti Energy SPV, owned by Igor Makarov, in early 2022. This transaction significantly altered the shareholder landscape, reducing Areti's stake and redistributing ownership among other investors. Such changes can influence the company's strategic direction and governance.

| Shareholder Type | Shareholder | Shares Held |

|---|---|---|

| Institutional Owners | Avantis International Small Cap Value ETF (AVDV) | Data not available |

| Institutional Owners | The Canadian Small Company Series (DFA INVESTMENT TRUST CO) | Data not available |

| Institutional Owners | iShares Core MSCI Total International Stock ETF (IXUS) | Data not available |

As of June 11, 2024, Spartan Delta Corp. had 30 institutional owners and shareholders who have filed with the SEC, collectively holding 2,930,269 shares. The major shareholders include institutional investors like Avantis International Small Cap Value ETF (AVDV), The Canadian Small Company Series (DFA INVESTMENT TRUST CO), and iShares Core MSCI Total International Stock ETF (IXUS). Individual insiders also hold a significant portion of the stock. As of June 8, 2025, insiders owned 12.43% of Spartan Delta stock. Key individual shareholders include Fotis Kalantzis, Richard McHardy, Donald Archibald, and Reginald Greenslade. GMT Capital Corp. is also a major shareholder, with 20.68% of the shares, totaling 41,191,765 shares. Understanding the dynamics of these ownership structures is crucial for anyone looking into the Brief History of Spartan Delta.

The ownership of Spartan Delta is divided between institutional investors and individual insiders, with significant shifts impacting the company's structure.

- Institutional investors hold a notable portion of shares, influencing company strategy.

- Individual insiders, including key executives, also hold substantial stakes.

- Major shareholder changes, such as the sale by Areti Energy SPV, can significantly alter the ownership landscape.

- Understanding the shareholder structure is vital for assessing the company's direction and potential.

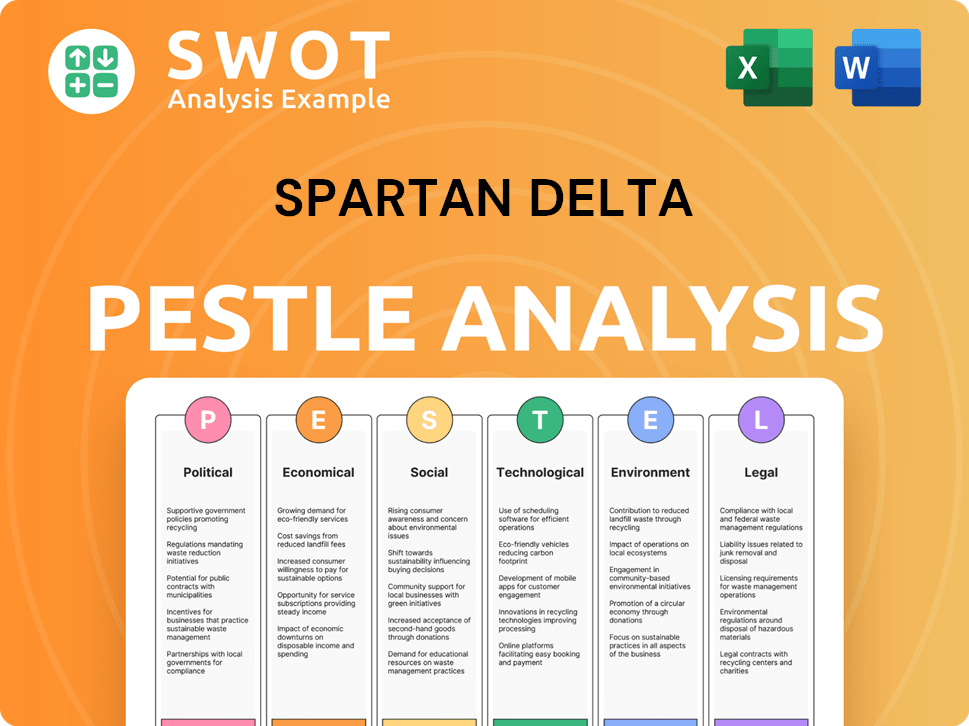

Spartan Delta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Spartan Delta’s Board?

The current board of directors of Spartan Delta Corp. plays a key role in the company's governance and strategic oversight. As of the annual general and special meeting held on May 23, 2025, six nominees were elected as directors. These include Fotis Kalantzis, Richard McHardy, Donald Archibald, Reginald Greenslade, Kevin Overstrom, and Tamara MacDonald. Fotis Kalantzis serves as the President, CEO & Director, while Richard F. McHardy holds the position of Executive Chairman. Donald Archibald and Reginald Greenslade are independent businessmen with prior directorships in other Spartan entities. Kevin Overstrom is an independent businessman and founder of KO Capital Advisors Ltd.

The composition of the board reflects a mix of executive leadership and independent oversight, designed to provide a balance of operational expertise and external perspectives. This structure is typical for publicly traded companies aiming for robust corporate governance. The presence of independent directors is crucial for ensuring unbiased decision-making and protecting shareholder interests. Understanding the board's composition is vital for anyone looking into the Growth Strategy of Spartan Delta.

| Director | Title | Affiliation |

|---|---|---|

| Fotis Kalantzis | President, CEO & Director | Spartan Delta Corp. |

| Richard McHardy | Executive Chairman | Spartan Delta Corp. |

| Donald Archibald | Director | Independent Businessperson |

| Reginald Greenslade | Director | Independent Businessperson |

| Kevin Overstrom | Director | Founder of KO Capital Advisors Ltd. |

| Tamara MacDonald | Director | Independent Businessperson |

The voting structure for Spartan Delta Corp. is based on one-share-one-vote for common shares. All elections of directors are conducted on an individual basis, not as a slate. Shareholders can vote in favor of, or withhold from voting for, each nominee separately. In an uncontested election, any director nominee who receives more 'withheld' votes than 'for' votes is required to promptly offer their resignation to the Chairman of the Board. This policy ensures a degree of accountability to shareholders. While specific individuals or entities with outsized control due to special voting rights or golden shares are not explicitly detailed, the significant holdings of individuals like Fotis Kalantzis and Richard McHardy, coupled with their executive and board roles, indicate their substantial influence over decision-making.

Understanding the board of directors and voting power is crucial for assessing Spartan Delta's governance.

- The board includes a mix of executive and independent directors.

- Voting is based on one-share-one-vote, with individual director elections.

- Significant influence is held by key executives through their roles and shareholdings.

- Institutional investors also hold considerable voting power through their collective shareholdings.

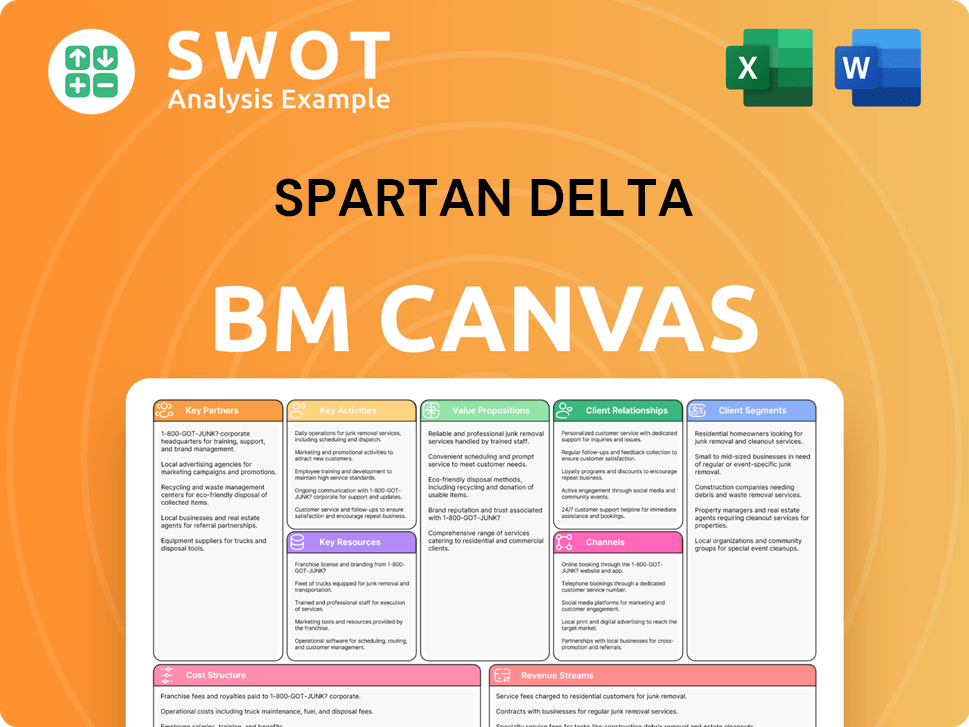

Spartan Delta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Spartan Delta’s Ownership Landscape?

Over the past few years, there have been notable shifts in the ownership of Spartan Delta. A significant event was the sale of its Montney assets to Crescent Point Energy Corp. for $1.7 billion in March 2023. This strategic move likely influenced the company's investor base and ownership structure. Recent equity offerings have also played a role, including a $97.8 million bought deal equity financing completed in January 2025, and a $50 million offering announced the same month, both aimed at supporting development in the Duvernay region. These offerings have led to a dilution of existing shareholders, with total shares outstanding increasing by approximately 15% in the last year, impacting the Spartan Delta shareholders.

Insider trading activity provides insight into the confidence levels within the company. As of June 8, 2025, Spartan Delta insiders have shown more interest in buying shares than selling, with C$50,091.00 in buying compared to C$24,522.00 in selling over the last three months. Over the last 24 months, insiders have purchased a total of 369,700 SDE shares for C$1,091,851.00, suggesting a positive outlook from within. Regarding Who owns Spartan Delta, industry trends show an increase in institutional ownership, with 30 institutional owners holding a total of 2,930,269 shares as of June 11, 2024. However, institutional ownership accounts for only 28.37% of the stock, while insiders hold 12.43%, indicating a significant insider stake.

The Spartan Delta company profile reveals that, as of the latest data, no public statements from the company or analysts have been identified regarding future ownership changes, planned succession, or potential privatization or public listing. For those interested in the financial aspects of the company, more details can be found by researching the Spartan Delta stock or by visiting the company's investor relations for more information.

The sale of Montney assets in March 2023 significantly altered the company's asset base. Recent equity financings, including a $97.8 million offering in January 2025, have diluted existing shareholders. Insider buying activity suggests internal confidence in the company's future.

Institutional ownership accounts for 28.37% of the stock as of June 11, 2024. Insiders hold 12.43% of the shares, indicating a strong internal stake. There have been no public announcements about future ownership changes.

Insiders have been net buyers of shares in the past three months, with C$50,091.00 in buying compared to C$24,522.00 in selling. Over the last 24 months, insiders have purchased 369,700 shares for C$1,091,851.00. This suggests confidence in the company's prospects.

No public statements detail future ownership changes. Investors should monitor financial reports and announcements for updates. The company's strategic moves and insider actions provide insights for investors.

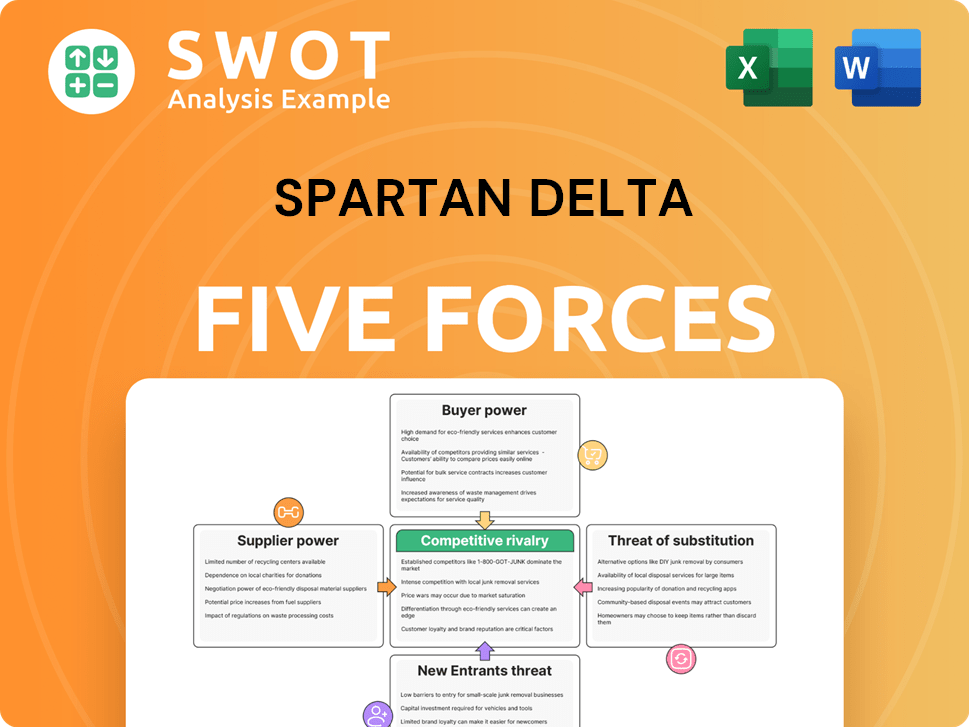

Spartan Delta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spartan Delta Company?

- What is Competitive Landscape of Spartan Delta Company?

- What is Growth Strategy and Future Prospects of Spartan Delta Company?

- How Does Spartan Delta Company Work?

- What is Sales and Marketing Strategy of Spartan Delta Company?

- What is Brief History of Spartan Delta Company?

- What is Customer Demographics and Target Market of Spartan Delta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.