Spartan Delta Bundle

What's Next for Spartan Delta Corp. in the Canadian Energy Sector?

Spartan Delta Corp. has quickly become a key player in Western Canada's oil and gas industry, but what does the future hold for this exploration and production company? Its strategic focus on sustainable free funds flow and shareholder returns has been a cornerstone of its success. This analysis dives deep into Spartan Delta's growth strategy, examining its expansion plans and financial outlook.

This deep dive will explore Spartan Delta's Spartan Delta SWOT Analysis, outlining its potential for growth and the challenges it may face. We'll examine its exploration and production strategy within the context of the Canadian energy market, providing insights into its operational efficiency improvements and long-term investment potential. Understanding the company's future prospects, including its financial performance analysis and impact on the Canadian economy, is crucial for investors and industry watchers alike.

How Is Spartan Delta Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strategic acquisitions and optimizing its existing asset base within Western Canada. This approach is designed to complement current operations and boost production capabilities. The company's strategy centers on consolidating its position in key operating areas to achieve economies of scale and enhance capital efficiency.

These strategic moves aim to increase production volumes, diversify revenue streams through a balanced commodity mix, and ultimately, enhance shareholder value. The company's growth strategy also involves disciplined capital allocation towards high-return projects to ensure expansion contributes positively to its free funds flow.

The company aims to achieve sustainable growth by leveraging its operational expertise to efficiently integrate new assets and unlock their full potential. This includes continuous evaluation of new drilling opportunities and optimization of existing wells within Western Canada, demonstrating a commitment to long-term value creation. For more insights into the company's financial structure, consider exploring Revenue Streams & Business Model of Spartan Delta.

The company actively seeks acquisitions to expand its asset base. These acquisitions are strategically chosen to complement existing operations. The focus is on assets that enhance production capabilities and operational synergies. This strategy aims to consolidate its position in key operating areas.

The company emphasizes optimizing its existing assets. This includes continuous evaluation of new drilling opportunities. It also involves the optimization of existing wells to improve production. This approach enhances overall operational efficiency and capital allocation.

The company focuses on disciplined capital allocation. This involves prioritizing high-return projects to ensure positive contributions to free funds flow. The company’s approach to capital allocation supports sustainable growth. This strategy ensures that investments align with long-term value creation.

The company aims for sustainable growth by leveraging operational expertise. This includes efficient integration of new assets. The focus is on unlocking the full potential of acquired assets. This approach supports long-term value creation and market position.

The company's expansion strategy is centered on strategic acquisitions and operational optimization. This dual approach aims to enhance production, diversify revenue, and improve shareholder value. The company is focused on disciplined capital allocation to ensure sustainable growth and maximize returns.

- Strategic Acquisitions: Focused on assets that complement existing operations.

- Operational Optimization: Continuous evaluation of drilling opportunities and well optimization.

- Capital Discipline: Allocation to high-return projects for positive free funds flow.

- Sustainable Growth: Leveraging operational expertise for efficient asset integration.

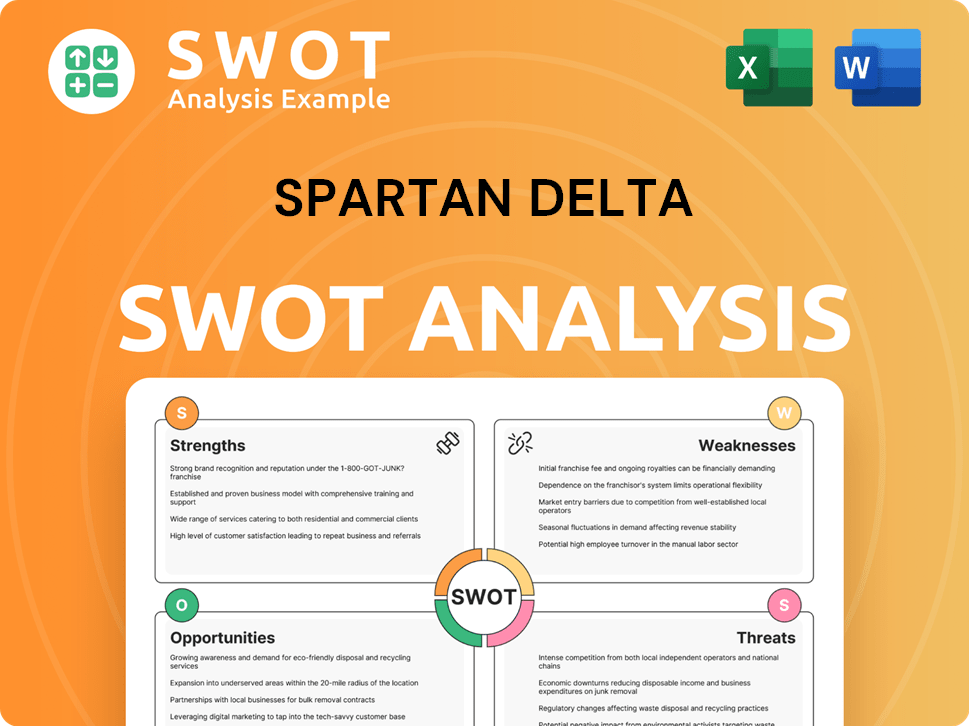

Spartan Delta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Spartan Delta Invest in Innovation?

The company's growth strategy heavily relies on the strategic application of technology and innovation. This approach aims to enhance operational efficiency, optimize resource recovery, and minimize environmental impact. This focus is crucial for sustained growth within the dynamic energy sector.

While not investing heavily in cutting-edge technologies like AI or IoT in the same way as a tech company, the company strategically applies proven technologies. This includes improving drilling and completion techniques, optimizing well performance, and enhancing environmental stewardship. Their approach to digital transformation is geared towards data-driven decision-making to improve field operations and reduce costs.

The company emphasizes responsible resource development, integrating technological advancements to minimize emissions and improve energy efficiency. This commitment to operational excellence and environmental performance through technology significantly contributes to its growth objectives and industry standing, which is vital for its future prospects.

The company uses advanced seismic imaging to better understand reservoirs. Modern drilling technologies are also utilized to reduce the environmental impact of operations. This integration supports both efficiency and sustainability goals.

Digital transformation is a key element, focusing on data-driven insights. This approach aims to improve field operations and reduce overall costs. Data analytics play a critical role in optimizing performance.

Responsible resource development is a core value, integrating technology to minimize emissions. The focus is on improving energy efficiency and reducing the environmental footprint. This is essential for long-term sustainability.

The company is committed to operational excellence through the strategic application of technology. This contributes significantly to its growth objectives and industry standing. Continuous improvement is a key focus.

The company focuses on applying proven technologies to improve drilling and completion techniques. Optimizing well performance is also a priority. This approach drives both efficiency and environmental benefits.

The strategic use of technology enhances the company's position within the industry. This contributes to its ability to achieve its growth targets. It also supports investor confidence and long-term value.

The company's approach to innovation and technology is fundamental to its Marketing Strategy of Spartan Delta and overall success. By focusing on practical applications and data-driven insights, the company aims to improve operational efficiency, reduce environmental impact, and drive sustainable growth within the Canadian energy market. This strategy is supported by the adoption of advanced seismic imaging and modern drilling technologies, which contribute to better reservoir understanding and reduced operational impact. The emphasis on responsible resource development and digital transformation further strengthens its position, allowing the company to adapt to evolving industry demands and maintain a competitive edge. As of Q1 2024, the company reported a production of approximately 80,000 barrels of oil equivalent per day (boe/d), demonstrating the effectiveness of its operational strategies. Furthermore, the company's commitment to reducing emissions and improving energy efficiency aligns with the growing emphasis on environmental, social, and governance (ESG) factors, making it an attractive investment for environmentally conscious investors.

The company's technological initiatives are focused on improving operational efficiency and environmental performance. These initiatives are crucial for long-term growth and sustainability.

- Advanced seismic imaging for improved reservoir understanding.

- Modern drilling technologies to reduce operational impact.

- Data-driven decision-making for optimized field operations.

- Integration of technology to minimize emissions and enhance energy efficiency.

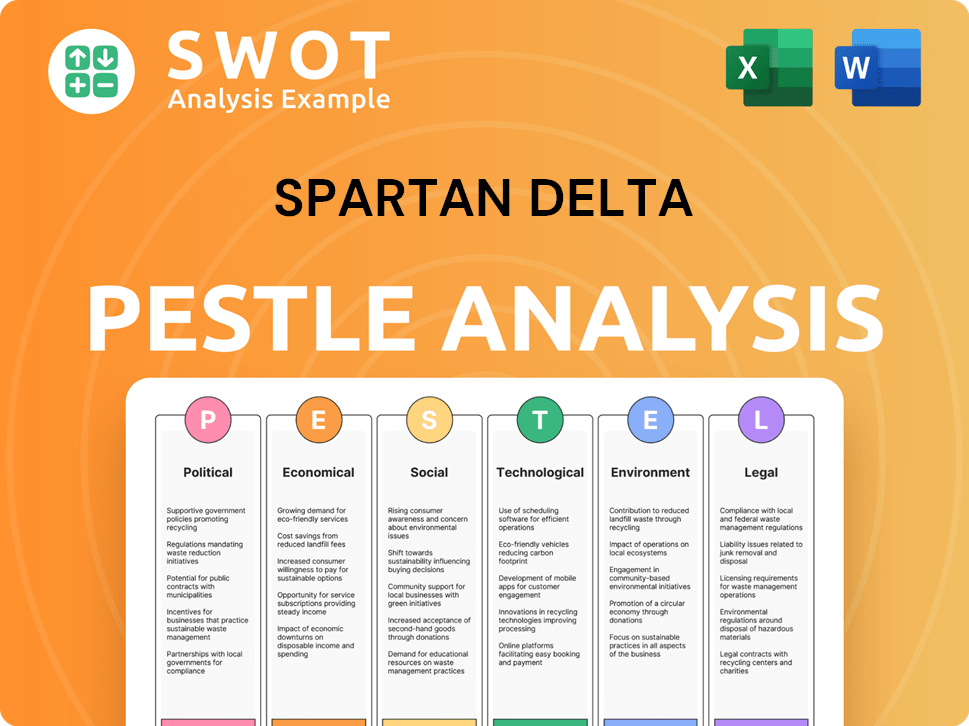

Spartan Delta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Spartan Delta’s Growth Forecast?

The financial outlook for Spartan Delta Corp. is shaped by its strategic focus on generating sustainable free cash flow and delivering returns to shareholders. This approach is closely tied to commodity prices and operational efficiency within Western Canada. The company's strategy, detailed in Mission, Vision & Core Values of Spartan Delta, emphasizes a strong balance sheet and disciplined capital allocation, which are key for navigating market volatility and supporting growth.

Spartan Delta's financial performance is significantly influenced by its operational efficiency and its ability to adapt to fluctuations in the energy market. For instance, the company's Q1 2024 results showed an average production of 67,613 BOE/d and generated $153.2 million in adjusted funds flow. Capital expenditures for the same period were $103.7 million, highlighting a focus on strategic investment.

Analyst forecasts and company guidance often highlight Spartan Delta's commitment to maximizing shareholder value through share buybacks and debt reduction. In March 2024, the company announced an issuer bid to purchase up to $150.0 million of its common shares. This financial strategy, combined with prudent financial management, aims to support growth initiatives and effectively manage market changes within the oil and gas sector.

Spartan Delta's capital allocation strategy is designed to balance investment in production with returns to shareholders. This approach helps in maintaining financial flexibility and resilience against market volatility. The company's focus on share buybacks and debt reduction demonstrates its commitment to enhancing shareholder value.

Operational efficiency is a critical factor in Spartan Delta's financial performance. The company's ability to manage production costs and optimize operations directly impacts its profitability. Continuous improvements in operational efficiency are essential for sustaining growth and profitability in the competitive energy market.

Spartan Delta prioritizes delivering returns to its shareholders through dividends and share buybacks. The company's financial strategy includes initiatives aimed at increasing shareholder value. These actions reflect a commitment to rewarding investors and building long-term shareholder confidence.

The energy sector outlook and the Canadian energy market significantly influence Spartan Delta's financial performance. The company actively monitors and responds to market dynamics, including commodity prices and regulatory changes. Adapting to these market conditions is crucial for sustained growth and profitability.

Financial discipline is a cornerstone of Spartan Delta's strategy. The company maintains a strong balance sheet and practices prudent financial management. This approach supports its growth initiatives and helps navigate market fluctuations effectively. The company's focus on disciplined capital allocation is key.

Strategic investments are essential for supporting Spartan Delta's growth. The company focuses on investments that enhance its production capabilities and operational efficiency. These investments are carefully selected to maximize returns and support the company's long-term objectives.

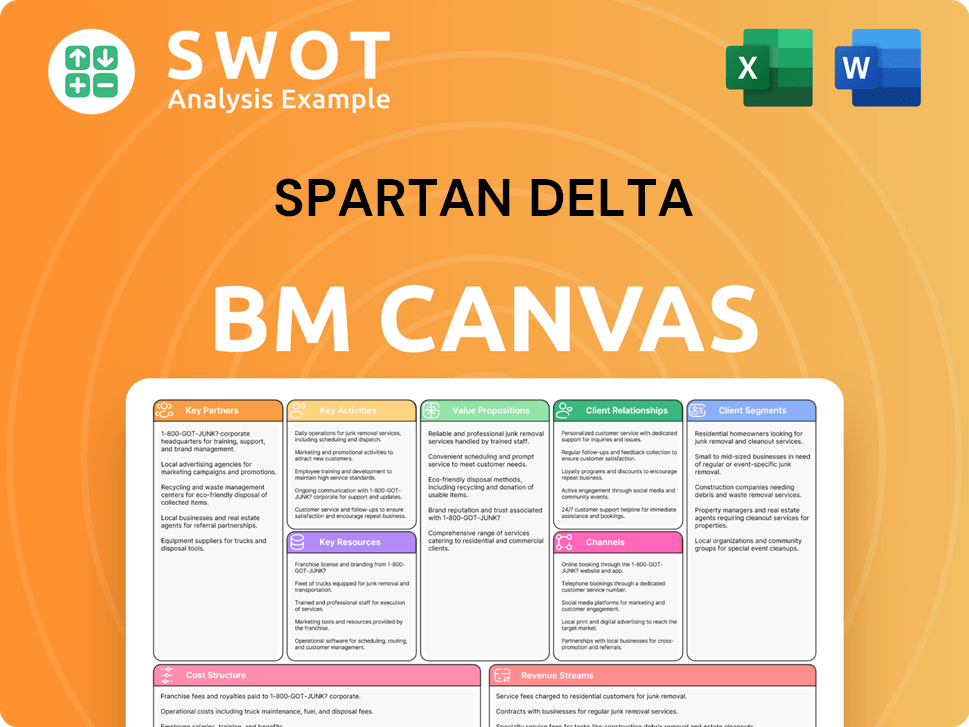

Spartan Delta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Spartan Delta’s Growth?

The growth strategy and future prospects of Spartan Delta face several potential risks and obstacles inherent in the oil and gas industry. These challenges include market competition, regulatory changes, supply chain vulnerabilities, and commodity price volatility. Addressing these risks is crucial for the company's sustained success and ability to capitalize on opportunities in the Canadian energy market.

Competition in the Western Canadian Sedimentary Basin (WCSB) is intense, with numerous companies vying for assets and market share. Evolving environmental regulations, particularly those related to carbon emissions, pose an ongoing risk. These regulations can increase operational costs and potentially impact project viability. The company must navigate these challenges effectively to maintain its competitive edge.

Supply chain disruptions and labor shortages can affect project timelines and costs. The inherent volatility of oil and natural gas prices also presents a significant financial risk, directly influencing revenue and profitability. To mitigate these risks, the company employs a diversified asset base and robust risk management frameworks.

The Canadian energy market is competitive, with many players vying for market share. This competition can affect profitability and market positioning. The company's ability to secure and develop attractive assets is essential for growth.

Environmental regulations, particularly those related to emissions, pose an ongoing risk. Compliance with these regulations can increase operational costs. Adapting to evolving environmental standards is crucial for long-term sustainability.

Disruptions in equipment availability and labor shortages can affect project timelines and costs. These vulnerabilities can impact the company's operational efficiency. Managing these risks is essential for project success.

The volatility of oil and natural gas prices represents a primary financial risk. Fluctuations in commodity prices directly impact revenue and profitability. Effective hedging strategies and financial planning are vital.

Focusing on operational efficiencies is critical to manage costs and maintain profitability. Streamlining operations can help the company mitigate risks. This approach supports sustainable development goals.

Diversifying the asset base and implementing robust risk management frameworks are key strategies. These measures help the company prepare for various market conditions. Scenario planning is also essential.

The company's financial performance is closely tied to oil and gas prices. In 2024, the average price of West Texas Intermediate (WTI) crude oil was around $78 per barrel. Natural gas prices also fluctuated significantly. Understanding these price dynamics is crucial for evaluating the company's financial health. The company's quarterly earnings reports provide detailed insights into its financial performance.

Strategic partnerships can help the company mitigate risks and access new opportunities. Collaborations with other companies can enhance operational capabilities. These partnerships can also improve the company's market position. The company's investor relations team provides updates on these initiatives.

Analyzing the competitive landscape is essential for understanding the company's position in the market. Key competitors include other oil and gas companies operating in the WCSB. Assessing their strategies and performance is crucial for making informed decisions. This analysis informs the company's acquisition strategy and operational efficiency improvements.

Evaluating the long-term investment potential requires considering various factors. These include the company's growth initiatives, financial performance, and the overall energy sector outlook. The company's ability to adapt to changing market conditions will influence its long-term success. Investors should consider the company's stock price forecast and recent news updates.

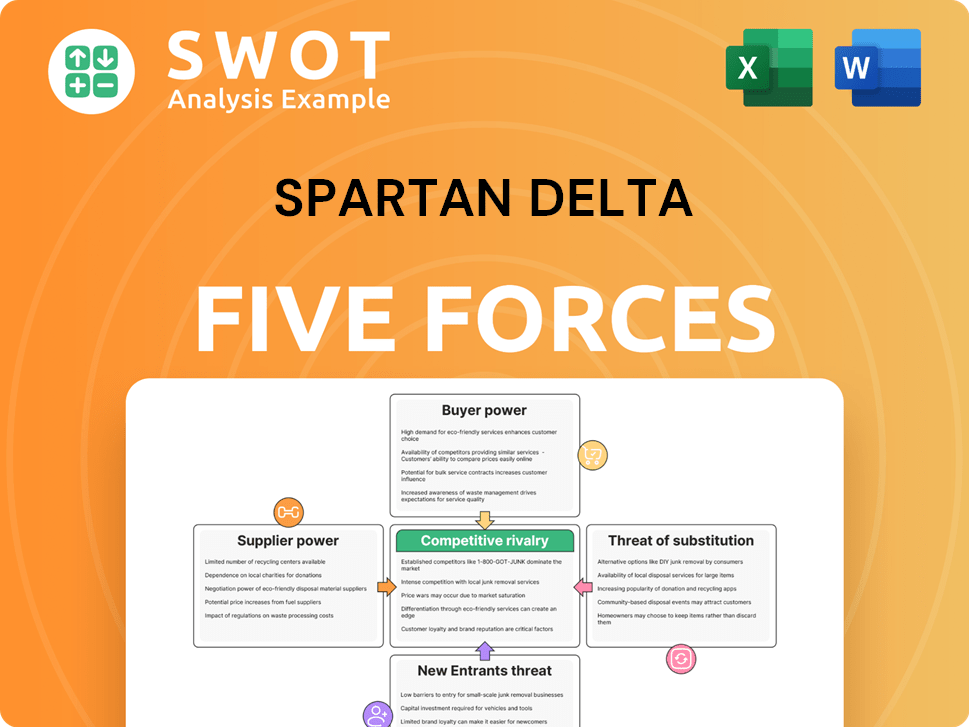

Spartan Delta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spartan Delta Company?

- What is Competitive Landscape of Spartan Delta Company?

- How Does Spartan Delta Company Work?

- What is Sales and Marketing Strategy of Spartan Delta Company?

- What is Brief History of Spartan Delta Company?

- Who Owns Spartan Delta Company?

- What is Customer Demographics and Target Market of Spartan Delta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.