Stepan Bundle

How Did Stepan Company Become a Chemical Industry Giant?

Journey back in time to uncover the Stepan SWOT Analysis of Stepan Company's remarkable transformation. From a modest beginning distributing chemicals in 1932, Stepan's Stepan history is a testament to strategic vision and adaptability. Explore the Stepan Corporation's evolution, from its founding to its current status as a global chemical powerhouse.

This exploration of the Stepan Company's Stepan timeline will highlight key milestones. Learn about the Stepan founder and the company's expansion. Discover the Stepan products and its impact on the chemical manufacturing sector, providing a comprehensive Stepan Company business overview.

What is the Stepan Founding Story?

The story of the Stepan Company began in 1932, a testament to entrepreneurial spirit during the Great Depression. Alfred C. Stepan, Jr., launched the business with a mere $500, borrowed from his mother. This marked the beginning of what would become a significant player in the chemical manufacturing sector.

Alfred C. Stepan, Jr. came from a family with a strong background in chemistry, which significantly influenced his path. His father's expertise provided a foundation for the future Stepan Company's focus on chemical innovation. The company's early focus was on meeting the needs of the time, setting the stage for its future growth and diversification.

Initially, Stepan operated as a jobber, distributing cleaning solvents and refrigeration gas from a small office in Chicago. The Stepan history is a story of adaptability and strategic foresight.

Alfred C. Stepan, Jr. started the Stepan Company in 1932. He used $500, borrowed from his mother, to start the business. The company's initial focus was on distributing cleaning solvents and refrigeration gas.

- The company's first product addressed the need to control road dust in Illinois.

- For the first three years, Stepan concentrated on building a customer base.

- In 1935, the company began manufacturing 'fishy oils and fatty acids'.

- The company was named after the founder's family name, Stepan.

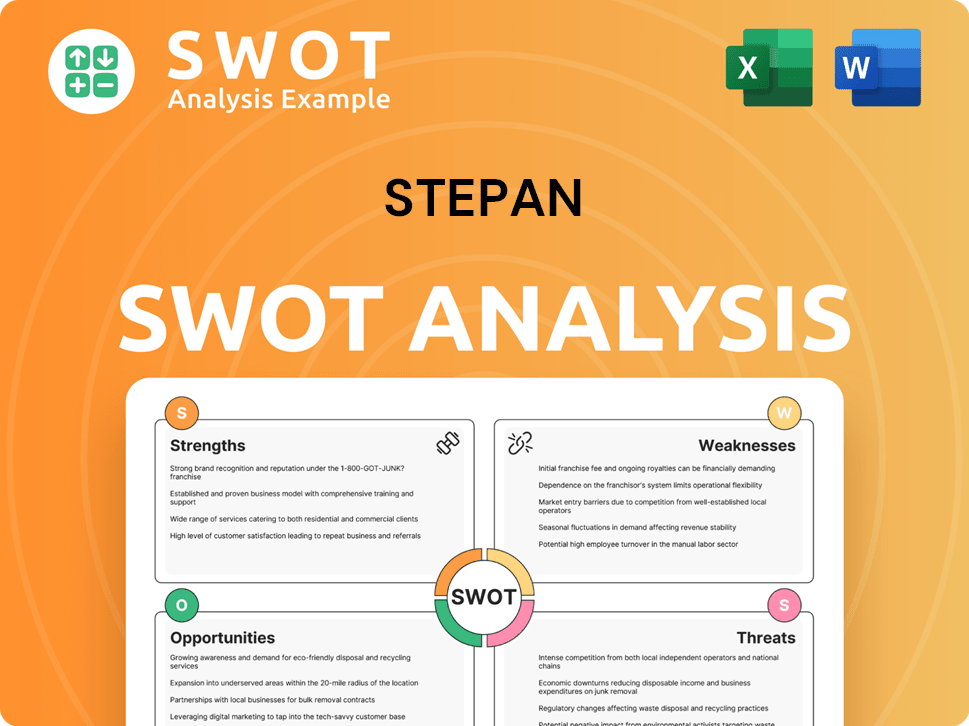

Stepan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Stepan?

The early growth of the Stepan Company, a key part of the Stepan history, was marked by strategic decisions and significant expansion. Under Alfred Stepan, Jr., the company focused on the detergent industry, building a customer base that included major Fortune 500 companies. This approach proved successful, leading to substantial growth and paving the way for its initial public offering.

During the 1950s, the company focused on the detergent industry, viewing it as recession-proof. This strategy helped build a strong customer base, which included nearly 2,000 customers. This early focus was crucial for establishing a solid foundation for the company.

In 1958, Stepan Corporation, a key milestone in the Stepan timeline, made its initial public offering on the New York Stock Exchange (NYSE: SCL). This provided additional capital for expanding product lines and manufacturing facilities. This move was a significant step in the company's growth.

Under F. Quinn Stepan's leadership, the company saw substantial growth. Sales increased by 18% annually since 1968, and profits surged by 30% by the end of fiscal 1973. This period included strategic acquisitions and significant increases in sales figures.

Several acquisitions boosted the company's market share. These included the surfactants operation of Allied Chemical and the urethane foam systems division of Diamond Shamrock. By the end of fiscal 1985, sales reached a record high of $235 million, with surfactants accounting for approximately 70% of this figure.

Recent growth efforts continue to expand Stepan's manufacturing capabilities and market presence. The acquisition of Performanx Specialty Chemicals' surfactant business in September 2022 and INVISTA's aromatic polyester polyol business in January 2021 are examples of this. The new alkoxylation facility in Pasadena, Texas, became operational in early April 2025, with plans to ramp up production of over 60 products, contributing to volume growth and supply chain savings in the second half of 2025. For more insights into the company's business model, you can explore the Revenue Streams & Business Model of Stepan.

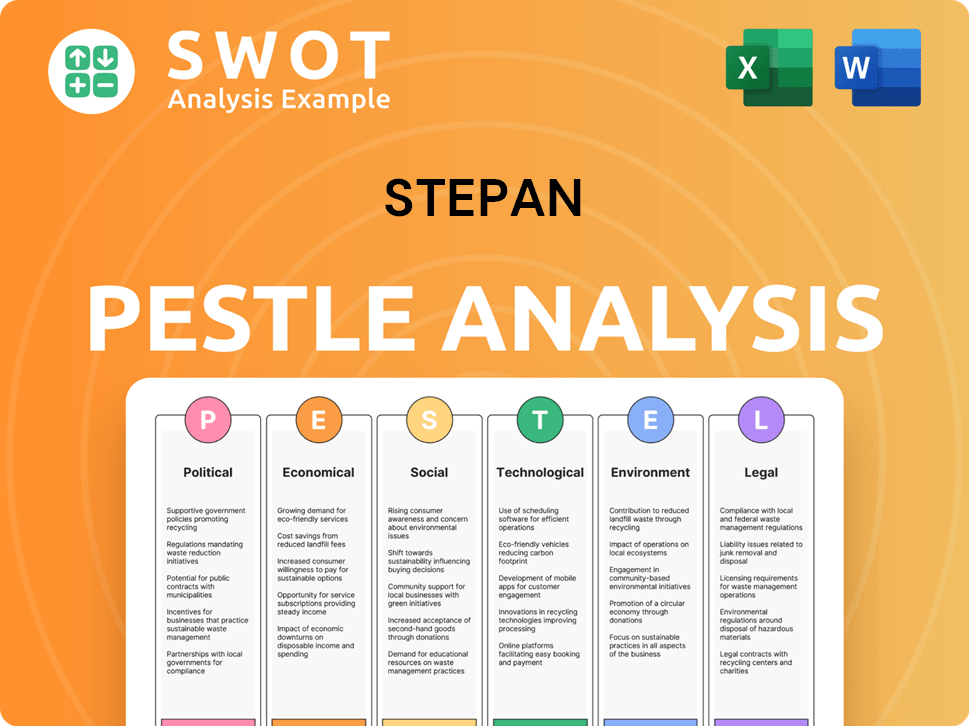

Stepan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Stepan history?

The brief history of Stepan Company includes numerous significant milestones reflecting its growth and evolution in the chemical manufacturing sector. From its early beginnings to its current status as a global player, Stepan Corporation has consistently adapted and expanded its operations.

| Year | Milestone |

|---|---|

| 1930s | The Stepan Company was founded, marking the beginning of its journey in the chemical industry. |

| Early Years | Stepan expanded its product offerings and manufacturing capabilities, establishing a solid foundation for future growth. |

| Ongoing | The company has continually expanded its production capacity and global presence, with a recent announcement of a 25% expansion in Alpha Olefin Sulfonates (AOS) production capacity. |

| October 2024 | Luis E. Rojo was appointed as the new President and CEO, succeeding Scott R. Behrens. |

Stepan has consistently focused on innovation, particularly in the development of surfactants and polyurethane polyols. These innovations have allowed Stepan products to meet the evolving needs of various industries, including consumer goods and construction.

Stepan has continuously developed surfactants, which are key ingredients in detergents, shampoos, and personal care products. This focus on surfactants has been a core element of the company's product portfolio.

The company has become a leading supplier of polyurethane polyols, which are vital for thermal insulation in construction and other CASE industries. This innovation has expanded Stepan's reach into new markets.

Stepan is focused on creating higher-value-added product applications and improving existing processes. This commitment to innovation is ongoing.

Stepan recently announced a 25% expansion in its Alpha Olefin Sulfonates (AOS) production capacity. This expansion demonstrates the company's commitment to growth.

The company makes strategic capital investments and process improvements across its North American facilities. These investments drive efficiency.

Stepan is actively pursuing cost-cutting measures and productivity improvements. The company delivered $48 million in cost savings in 2024.

Despite its successes, Stepan has faced challenges, including market downturns and operational issues. In Q4 2024, the company's adjusted net income was down 63% year-over-year, and global sales volume decreased by 1%.

Stepan has experienced market downturns, which have impacted its financial performance. Demand weakness in polymers offset growth in surfactants in Q4 2024.

The company has faced operational challenges, such as higher pre-commissioning expenses at the new Pasadena, Texas alkoxylation facility. These challenges have affected financial results.

Stepan has dealt with higher operating costs at its Millsdale site due to a flood event and costs related to a criminal fraud event at a subsidiary in Asia during the first half of 2024. These events have increased expenses.

In Q4 2024, the company's adjusted net income was down 63% versus the prior year. This decrease reflects the impact of various challenges.

Stepan is focused on expanding cost reduction activities and expects to deliver $50 million in pre-tax savings. These measures aim to offset future inflation and increased expenses.

The appointment of Luis E. Rojo as the new President and CEO in October 2024 signifies a strategic shift. This transition is part of the company's evolution.

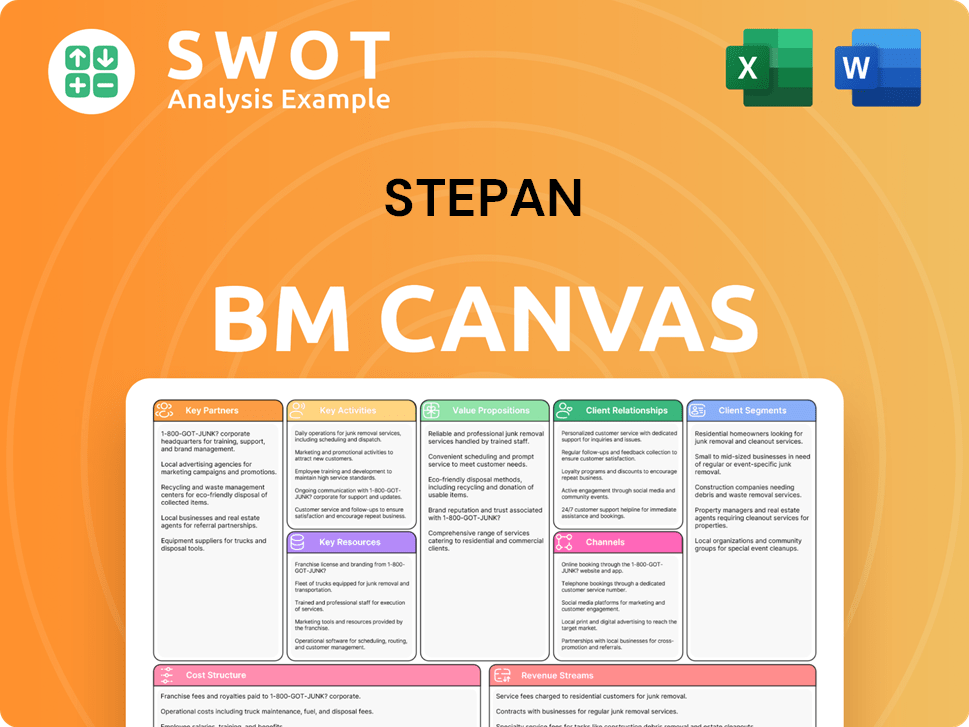

Stepan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Stepan?

The Stepan Company has a rich Stepan history, starting in 1932 when Alfred C. Stepan, Jr. founded the company in Chicago, Illinois. Initially focused on distributing chemical products, the company transitioned into manufacturing by 1935, producing 'fishy oils and fatty acids.' Over the years, Stepan Corporation has grown significantly, marked by key acquisitions and strategic leadership changes, including going public in 1958 and the leadership of F. Quinn Stepan who reported record sales of $235 million in 1985. Recent years have seen significant acquisitions and expansions, positioning Stepan for continued growth in the chemical manufacturing sector.

| Year | Key Event |

|---|---|

| 1932 | Alfred C. Stepan, Jr. founded Stepan Company in Chicago, Illinois, initially distributing chemical products. |

| 1935 | Stepan transitioned into manufacturing, producing 'fishy oils and fatty acids'. |

| 1958 | Stepan Corporation made its initial public offering on the New York Stock Exchange. |

| 1973 | F. Quinn Stepan assumed the role of president, initiating a strategic five-year growth plan. |

| 1985 | The company reported record-high sales of $235 million under Quinn Stepan's leadership. |

| 2006 | F. Quinn Stepan, Jr. became CEO. |

| 2020 | Acquisition of Clariant's anionic surfactant business in Santa Clara, Mexico. |

| 2021 | Acquisition of INVISTA's aromatic polyester polyol business and a fermentation plant in Lake Providence, Louisiana. |

| 2022 | Scott Behrens succeeded F. Quinn Stepan, Jr. as President and CEO. Acquisition of Performanx Specialty Chemicals' surfactant business. |

| 2024 (Q4) | Despite some challenges, Stepan added over 1,700 new clients and increased global volumes by 1%. |

| 2025 (Q1) | Stepan's new alkoxylation facility in Pasadena, Texas, became operational. Reported net income is $19.7 million, up 42% year-over-year, and adjusted EBITDA is $57.5 million, up 12% year-over-year. |

| 2025 (June) | Stepan announces a 25% expansion in Alpha Olefin Sulfonates (AOS) production capacity in North America. |

Stepan anticipates adjusted EBITDA improvement across all segments in 2025. The company expects continued volume growth and margin improvement, especially in its agricultural business. The new Pasadena facility is projected to contribute to volume growth and supply chain savings during the second half of 2025.

Management is focused on accelerating business strategies through improved execution. The goals include growing volume, enhancing product and customer mix, and accelerating free cash flow generation. Analysts forecast revenue and earnings growth for Q1 2025, and the shares are considered attractively priced compared to peers.

Stepan continues to pursue acquisitions in surfactants, polyols, and urethane systems to expand its manufacturing capabilities and market presence. The company's vision, 'to create innovative solutions for a cleaner, healthier, more energy efficient world,' guides its strategic initiatives.

In Q1 2025, Stepan reported a net income of $19.7 million, marking a 42% increase year-over-year, and an adjusted EBITDA of $57.5 million, up 12% year-over-year. The company’s performance reflects its strategic investments and operational efficiencies.

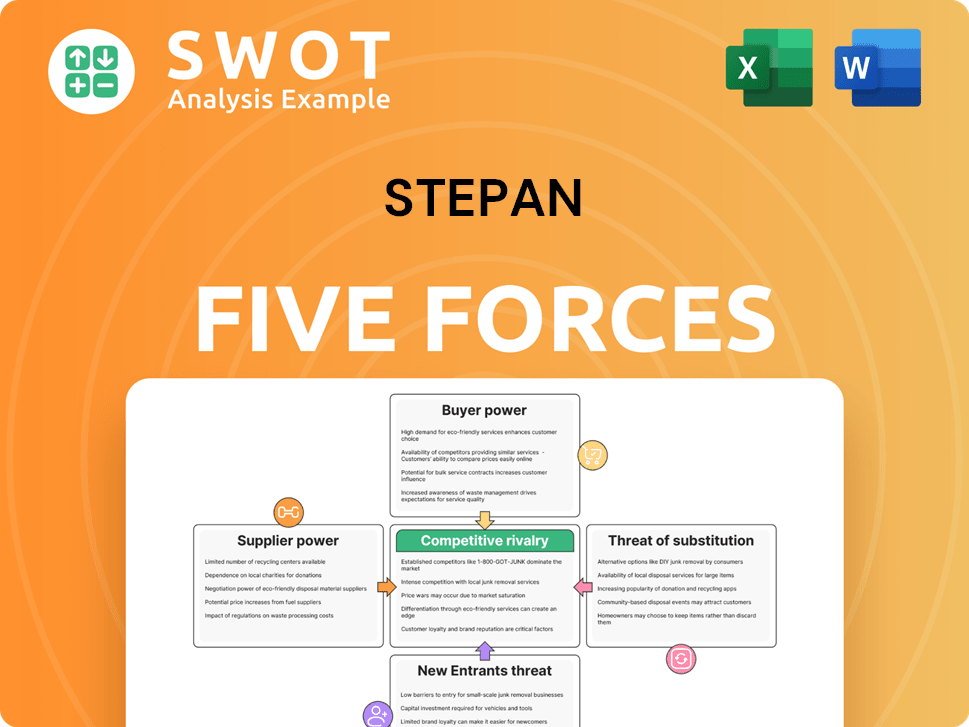

Stepan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Stepan Company?

- What is Growth Strategy and Future Prospects of Stepan Company?

- How Does Stepan Company Work?

- What is Sales and Marketing Strategy of Stepan Company?

- What is Brief History of Stepan Company?

- Who Owns Stepan Company?

- What is Customer Demographics and Target Market of Stepan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.