Stepan Bundle

Unveiling Stepan Company: How Does It Thrive?

Stepan Company, a global powerhouse in specialty chemicals, is a key player in countless industries, but how does it actually work? In 2024, the company showcased its strength with a 25% increase in net income, reaching $50.4 million, alongside a 1% rise in global sales. Understanding the inner workings of Stepan is essential for anyone looking to navigate the complexities of the market.

From surfactants in your shampoo to crucial components in industrial applications, Stepan products are everywhere. This deep dive will explore the Stepan SWOT Analysis, its core operations, and how it generates revenue, offering valuable insights for investors and industry professionals alike. Discover the Stepan business model and how Stepan Corporation has built a strong global presence through its Stepan manufacturing processes.

What Are the Key Operations Driving Stepan’s Success?

The core operations of Stepan Company revolve around the creation and delivery of value through its diverse portfolio of specialty and intermediate chemicals. This involves serving various customer segments across consumer, industrial, and agricultural markets. Stepan Corporation focuses on producing essential ingredients like surfactants, crucial for cleaning and personal care products, and polymers, which are primarily used in rigid foam for thermal insulation and in coatings, adhesives, sealants, and elastomers (CASE) industries.

Stepan's business model is built on a foundation of efficient manufacturing, global sourcing, and robust distribution networks. The company operates a network of modern production facilities strategically located across North and South America, Europe, and Asia. This strategic positioning enables efficient service to its global customer base. A key aspect of its operational effectiveness is its supply chain and distribution network, enabling efficient service to a wide variety of customers.

Stepan products are integral to many everyday items and industrial applications. The company's continuous stream of value-added applications and the development of new processes for existing products contribute to its competitive edge, translating into customer benefits through innovative solutions and market differentiation. The company's technical expertise and long history as a market leader in its niche further bolster its unique operational capabilities.

Stepan Company focuses on several key product categories. These include surfactants, essential in cleaning and personal care, and polymers, crucial for insulation and various industrial applications. Additionally, they produce specialty products like medium-chain triglycerides for nutritional and pharmaceutical uses.

Stepan manufacturing benefits from a global presence with strategically located facilities. Their robust supply chain and distribution networks are critical for serving a diverse customer base efficiently. Continuous innovation in applications and processes provides a competitive edge.

Stepan delivers value through its diverse product portfolio, serving multiple markets. They offer innovative solutions and differentiate themselves through technical expertise. Their focus on customer needs and efficient operations enhances their market position.

Stepan Company's global presence is supported by manufacturing facilities in key regions. This allows for efficient service and responsiveness to customer needs worldwide. The company's market share is influenced by its ability to adapt and innovate.

In recent financial reports, Stepan has demonstrated consistent performance. For example, in 2024, the company reported revenues of over $2.4 billion. Their operational efficiency is reflected in their gross profit margins, which have remained stable, indicating effective cost management. The company's strategic investments in research and development continue to drive innovation in their product offerings.

- Stepan Company has a global presence with manufacturing facilities in key regions.

- The company's focus on surfactants and polymers generates a significant portion of its revenue.

- Stepan's commitment to sustainability includes initiatives to reduce its environmental footprint.

- For more insights into the competitive landscape, consider reading about the Competitors Landscape of Stepan.

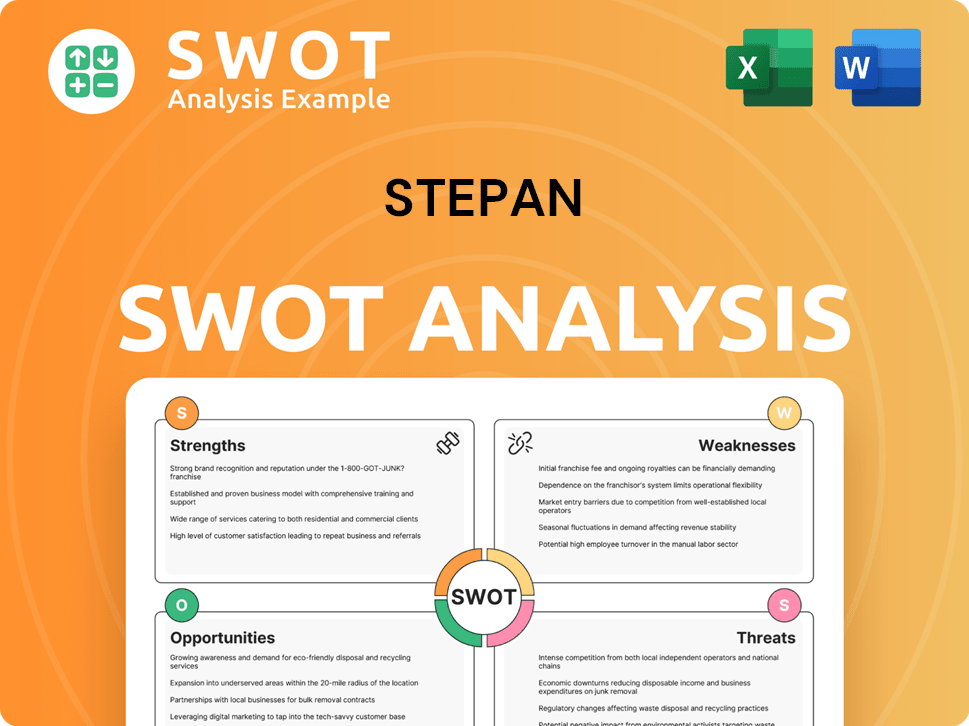

Stepan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stepan Make Money?

The Stepan Company's revenue streams are primarily derived from the sale of surfactants, polymers, and specialty products. The Stepan business model focuses on these core product categories to generate income. In 2024, the company's total revenue reached $2.18 billion, reflecting its market position and operational scope.

The Stepan Corporation strategically diversifies its revenue sources through three main segments. These segments include surfactants, polymers, and specialty products, each contributing differently to the company's financial performance. This diversification helps mitigate risks and ensures a broad market presence.

The company employs various monetization strategies to maximize revenue. These strategies include leveraging its end-market diversification and expanding its customer base. The Stepan products are used across multiple industries, providing recession resistance.

In the fourth quarter of 2024, the Surfactants segment saw a 3% year-over-year increase, with net sales of $378.8 million. The Polymers segment experienced a 12% decrease in net sales, totaling $129.8 million in Q4 2024. Specialty Products showed a 10% increase in net sales to $17.0 million in Q4 2024, driven by higher sales volume and selling prices.

- The Surfactants segment is the largest, accounting for approximately 57.3% of total sales in 2023.

- Polymers contributed 28.8% to total revenue in 2023.

- Specialty Products accounted for 13.9% of total revenue in 2023.

- The company added over 1,700 new customers in 2024, particularly in its Surfactant business.

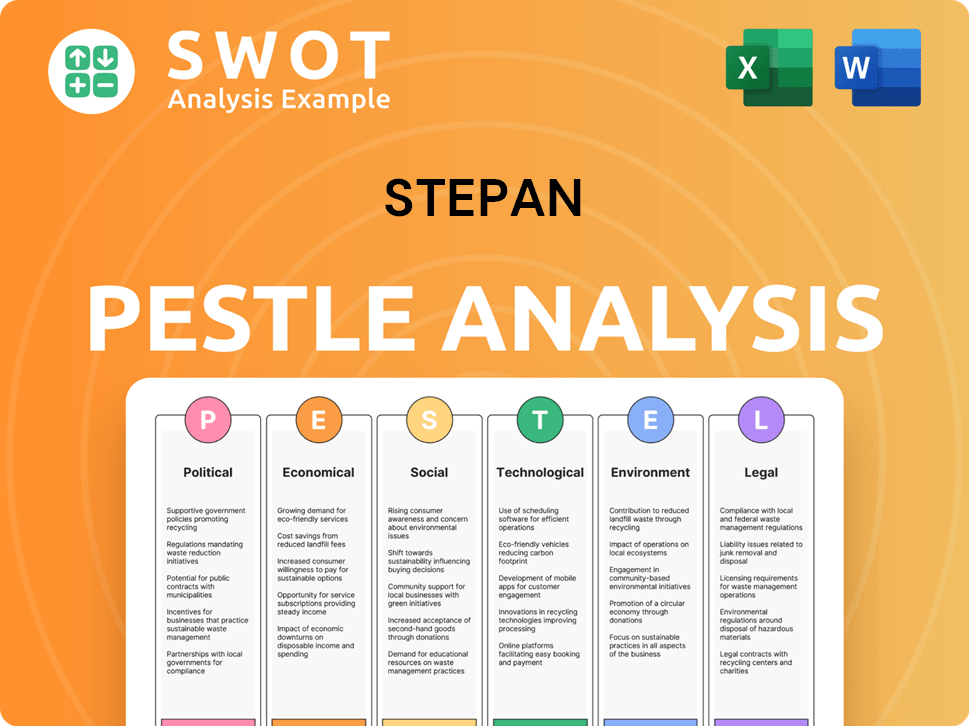

Stepan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stepan’s Business Model?

The operational and financial trajectory of the Stepan Company, also known as the Stepan Corporation, has been significantly shaped by strategic initiatives and key milestones. A notable investment is the new alkoxylation facility in Pasadena, Texas, which began operations in the first quarter of 2025. This facility is anticipated to boost volume growth and generate supply chain savings in the second half of 2025. Furthermore, the company achieved $48 million in cost savings in 2024, demonstrating its commitment to operational efficiency.

Despite facing challenges, including a flood event at its Millsdale site in the first half of 2024 and a criminal fraud event at a subsidiary in Asia, Stepan maintained a positive financial outlook. The company's strategic moves and resilience are evident in its ability to navigate these obstacles while focusing on long-term growth and efficiency. These actions are indicative of the company's adaptive approach to market dynamics and its commitment to sustainable business practices.

Stepan's competitive advantages are rooted in its diverse customer base and end-market diversification, its global supply chain and distribution network, and its technical expertise. The company's ability to engineer custom solutions for its customers further solidifies its market position. For a deeper dive into the company's origins and development, consider reading the Brief History of Stepan.

The alkoxylation facility in Pasadena, Texas, commenced operations in Q1 2025, contributing to volume growth. Stepan delivered $48 million in cost savings in 2024, highlighting operational efficiency. The company's strategic investments and cost-saving measures are central to its financial strategy.

Stepan's focus includes product innovation, with a projected investment increase of 7.5% in 2024. The company is also focused on sustainability and compliance, enhancing its competitive edge. These strategic moves are designed to adapt to new trends and competitive threats.

Stepan's strengths lie in its diverse customer base and end-market diversification. The company's global supply chain and distribution network are also key. Technical expertise and custom solutions further solidify its market position.

Despite challenges like the Millsdale flood and fraud in Asia, Stepan maintained a positive free cash flow of $39.3 million for the full year 2024. This demonstrates the company's financial resilience and ability to manage risks effectively. The company's financial performance reflects its strategic adaptability.

Stepan's business model is built on several key strengths that contribute to its sustained success. These include a diversified customer base and end markets, a robust global supply chain, and a commitment to innovation.

- Diverse Customer Base and End-Market Diversification: Reduces reliance on any single market.

- Global Supply Chain and Distribution Network: Ensures efficient product delivery.

- Technical Expertise: Enables the development of custom solutions for customers.

- Focus on Sustainability and Compliance: Enhances market reputation and competitive edge.

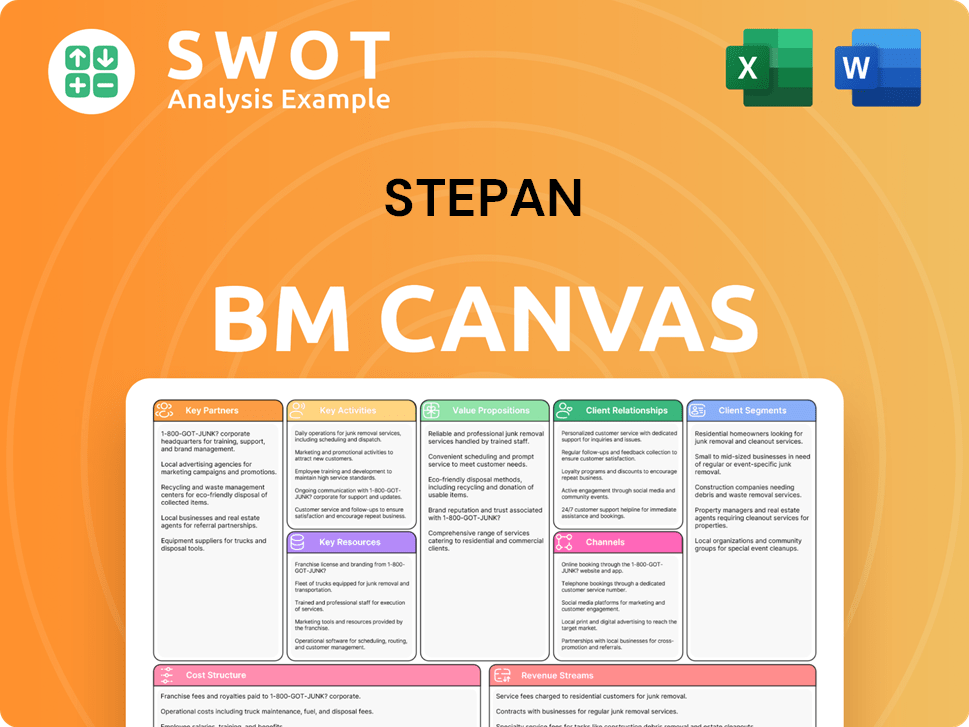

Stepan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stepan Positioning Itself for Continued Success?

The Stepan Company holds a strong position in the specialty chemicals market. It's a leading merchant producer of surfactants and a key supplier of polyurethane polyols. Its diverse customer and end-market portfolio across various industries, including agricultural products, construction, cleaning products, and personal care, provides it with a degree of resilience. As of January 2024, its market capitalization was approximately $2.3 billion.

However, several risks affect the company. These include market fluctuations in demand, raw material and finished product pricing, operational risks like unplanned production shutdowns, and competition from major players such as Dow Chemical and BASF. International business risks, including currency exchange rate fluctuations and legal restrictions, also pose challenges.

The Stepan Corporation is a significant player in the specialty chemicals sector. It is a leading merchant producer of surfactants and a key supplier of polyurethane polyols. Its diverse customer base spans various industries, offering a degree of stability against market fluctuations. The company's position is further detailed in an analysis of the Target Market of Stepan.

The company faces several risks that could impact its financial performance. These include market volatility in demand and pricing for raw materials and finished products. Operational risks, such as production shutdowns, and global competition, also pose challenges. International business risks, including currency exchange rate fluctuations and legal restrictions, are also significant.

The company anticipates adjusted EBITDA improvement across all segments in 2025, driven by volume growth, improved product mix, and cost reduction initiatives. Increased polymer demand and continued growth in its surfactant business are expected. The new Pasadena facility, expected to be fully operational in Q1 2025, is poised to deliver volume growth and supply chain savings.

Key strategic initiatives include accelerating business strategies through improved execution to drive consistent volume growth, margin improvement, and free cash flow generation. The company aims to achieve a $50 million cost reduction goal for 2024 and expects to deliver positive free cash flow for the full year 2025.

The company has set ambitious financial goals for the near future. These goals are designed to improve profitability and strengthen its market position. The focus is on achieving sustainable growth and enhancing shareholder value.

- Expects adjusted EBITDA improvement across all segments in 2025.

- Aims to achieve a $50 million cost reduction goal for 2024.

- Anticipates delivering positive free cash flow for the full year 2025.

- Focus on volume growth and improved product mix.

Stepan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stepan Company?

- What is Competitive Landscape of Stepan Company?

- What is Growth Strategy and Future Prospects of Stepan Company?

- What is Sales and Marketing Strategy of Stepan Company?

- What is Brief History of Stepan Company?

- Who Owns Stepan Company?

- What is Customer Demographics and Target Market of Stepan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.