Stitch Fix Bundle

How Did Stitch Fix Revolutionize the Fashion Industry?

Imagine a world where your wardrobe is curated just for you, delivered right to your doorstep. That's the promise of Stitch Fix SWOT Analysis, a company that has dramatically reshaped how we shop for clothes. Founded in 2011, Stitch Fix pioneered the fusion of data science and personal styling, creating a unique online styling service. This brief history explores the journey of Stitch Fix, from its inception to its current standing in the competitive fashion landscape.

From its early days as a personal shopping website, Stitch Fix, a fashion subscription box, has evolved, adapting to the ever-changing demands of the e-commerce world. Stitch Fix company's journey reflects the broader trends in the fashion industry, showcasing the impact of personalized retail. Understanding the Stitch Fix history, including its financial performance and innovative strategies, provides valuable insights into the future of online fashion and the challenges faced by companies in this dynamic market.

What is the Stitch Fix Founding Story?

The story of the Stitch Fix company begins in 2011 with Katrina Lake, who saw an opportunity to transform how women shop for clothes. She envisioned an online styling service that combined data science with personal styling, a concept she believed was missing in the retail market. Lake's background, including experience in venture capital consulting and an MBA from Harvard Business School, gave her the foundation to pursue this innovative idea.

Lake's initial steps were very hands-on. She used SurveyMonkey to gather customer preferences and personally delivered clothing selections, accepting a $20 styling fee. This early approach, though not scalable, was crucial for validating the concept. This early validation was key to the company's future growth and success, setting the stage for what would become a significant player in the fashion industry.

The Stitch Fix history is marked by key partnerships and strategic decisions. A pivotal moment came in early 2012 when Lake connected with Eric Colson, formerly of Netflix. By 2013, with Colson as chief algorithms officer, the company began to leverage his expertise to collect extensive customer data. This data-driven approach was central to the company's early success.

The original Stitch Fix business model involved customers completing styling profiles. A stylist then selected five items for the customer. Customers had three days to decide what to keep, with a 25% discount for keeping all five items. This 'Fix' service could be scheduled regularly.

- The company achieved profitability in 2014.

- Only $42.5 million in total capital was invested.

- The company focused on a data-driven approach to personal styling.

- The model provided a personalized shopping experience.

Stitch Fix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Stitch Fix?

The early growth of the company, a prominent player in the online styling service market, was marked by rapid expansion and strategic diversification. Following its 2011 founding and 2012 website launch, the company achieved profitability by 2014. This success stemmed from its innovative approach to personal styling, blending data science with human stylists to offer tailored recommendations.

In 2014, the company broadened its reach by introducing a men's styling service, followed by the launch of its Kids styling service in 2018. These additions expanded its product offerings and customer base. The company also ventured into new categories, including petite, maternity, and plus sizes to cater to a wider audience.

From 2014 to 2017, the company experienced substantial revenue growth, increasing from $73 million to $977 million, reflecting a 137% compound annual growth rate. In fiscal year 2024, the company's net revenue reached $1.34 billion, demonstrating its continued presence in the fashion subscription box market. For more information about the company's marketing strategies, consider reading the Marketing Strategy of Stitch Fix.

The company made strategic shifts in its business model, such as the introduction of 'Freestyle' in 2021, which allowed customers to directly purchase individual items. Despite growth in the men's business and Freestyle channel, overall active clients and revenues have declined in recent fiscal periods. The company ceased its UK business operations in the first quarter of fiscal year 2024 to focus on the U.S. market.

As of February 1, 2025, the number of active clients was approximately 2,371,000, a decrease from 2,805,000 as of January 27, 2024. This decline indicates challenges in maintaining customer engagement and retention within the competitive landscape of the personal styling industry.

Stitch Fix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Stitch Fix history?

The Stitch Fix company has achieved several significant milestones, shaping its journey in the online styling service industry. These achievements highlight its growth and impact on the fashion subscription box market.

| Year | Milestone |

|---|---|

| 2011 | Founded by Katrina Lake, marking the beginning of the personalized styling service. |

| 2013 | Eric Colson joined as Chief Algorithms Officer, enhancing data-driven personalization. |

| 2017 | Went public with an IPO, becoming the first female-led company in over a year to achieve this, valuing the company at $1.6 billion. |

| 2023 | Initiated a transformation strategy, including exiting the UK business and closing fulfillment centers. |

| 2024 | Increased the number of items in a 'Fix' to up to eight, enhancing the client experience. |

One of the key innovations of Stitch Fix was the integration of data science with human stylists, enabling highly personalized clothing recommendations. This data-driven approach, significantly bolstered by the addition of Eric Colson as chief algorithms officer in 2013, allowed it to collect extensive customer data to refine its styling recommendations.

The company leverages data science to understand customer preferences and provide personalized styling. This approach is crucial for the fashion subscription box business model.

Human stylists work alongside algorithms to curate selections, combining technology with personal expertise. This hybrid model enhances the personal styling experience.

Continuous collection and analysis of customer data refine the algorithms, improving the accuracy of styling recommendations. This iterative process is key to the Stitch Fix business model evolution.

Offering up to eight items in a 'Fix' provides customers with more choices and increases potential revenue per client. This strategic move enhances customer satisfaction.

Introducing new ways to build 'Fixes' allows customers more flexibility and control over their selections. This innovation caters to diverse customer preferences.

Collaborations with brands and influencers expand the product offerings and reach new customer segments. These partnerships boost brand visibility.

Despite its successes, Stitch Fix has faced considerable challenges, including market downturns and competitive threats. The company experienced widening declines in recent years, with fiscal year 2024 net revenue down 16% year-over-year.

Economic fluctuations and changing consumer spending habits impact the demand for subscription services. These factors affect the company's financial performance.

Increased competition from other online styling services and retailers challenges Stitch Fix's market share. The company needs to differentiate itself to stay relevant.

A decrease in net revenue reflects the challenges in maintaining customer engagement and sales. The company must adapt to reverse this trend.

A decline in active clients indicates issues with customer retention and acquisition. Stitch Fix needs to focus on strategies to attract and retain customers.

Exiting the UK business and closing fulfillment centers resulted in significant restructuring costs. These actions impact short-term profitability.

The Q2 fiscal year 2025 results showed a net revenue of $312.1 million, a 5.5% decrease year-over-year, and a net loss of $6.6 million. These figures highlight the financial challenges.

Stitch Fix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Stitch Fix?

The Stitch Fix company has a rich history, marked by significant milestones and strategic shifts. Founded by Katrina Lake in 2011, it quickly grew into a prominent player in the online styling service market. The company's journey includes key developments such as the launch of its website in 2012, the introduction of men's and kids' styling services, and its initial public offering (IPO) in 2017. The company adapted its business model during the COVID-19 pandemic and launched 'Freestyle,' allowing direct purchases. Recent financial results reflect the company's evolution, with ongoing efforts to return to revenue growth.

| Year | Key Event |

|---|---|

| 2011 | Katrina Lake founded Stitch Fix. |

| 2012 | The company launched its website, stitchfix.com. |

| 2013 | Eric Colson joined as Chief Algorithms Officer. |

| 2014 | Stitch Fix introduced men's styling and achieved profitability. |

| 2017 | The company went public (NASDAQ: SFIX). |

| 2018 | Stitch Fix launched its Kids styling service. |

| 2020 | The company adapted its business model during the COVID-19 pandemic. |

| 2021 | Stitch Fix introduced 'Freestyle'. |

| Q1 FY2024 | Ceased UK operations; net revenue of $364.8 million. |

| Q4 FY2024 | Net revenue of $319.6 million, down 12.4% year-over-year; active clients 2,508,000. |

| Q1 FY2025 | Net revenue of $318.8 million, down 12.6% year-over-year; net loss of $6.3 million. |

| Q2 FY2025 | Net revenue of $312.1 million, down 5.5% year-over-year; net loss of $6.6 million. |

| Q3 FY2025 | Projected net revenue between $311 million and $316 million. |

Stitch Fix is focused on a transformation strategy to return to overall revenue growth by the end of fiscal year 2026. This includes initiatives to enhance the client experience and strengthen client-stylist relationships. The company is also leveraging AI-powered inventory management and optimizing marketing strategies.

For fiscal year 2025, the company anticipates net revenue between $1.225 billion and $1.240 billion. They expect adjusted EBITDA to be between $40 million and $47 million. Gross margin for both Q3 and the full fiscal year 2025 is projected to be approximately 44% to 45%.

The company is working on increasing newness in its assortment and expanding 'Fix' flexibility, such as offering eight items instead of five. These initiatives aim to provide a more personalized and client-centric shopping experience. These improvements are designed to boost customer satisfaction and retention.

Stitch Fix is leveraging AI-powered inventory management to optimize its operations. This includes improving the accuracy of inventory forecasting and reducing waste. This is a key part of the company's plan for sustainable and profitable growth.

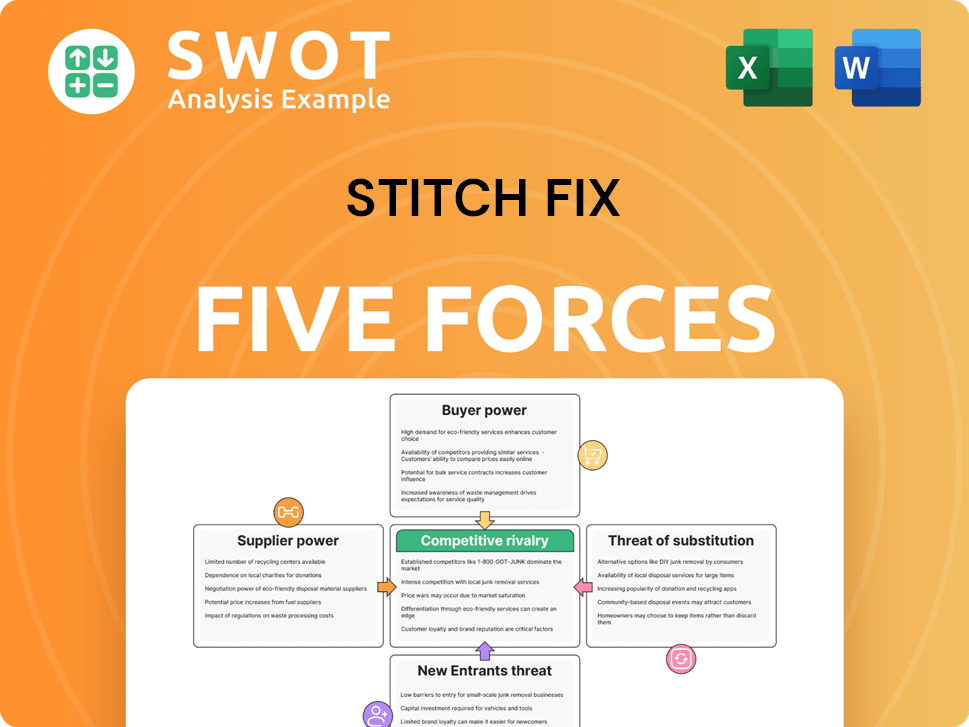

Stitch Fix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Stitch Fix Company?

- What is Growth Strategy and Future Prospects of Stitch Fix Company?

- How Does Stitch Fix Company Work?

- What is Sales and Marketing Strategy of Stitch Fix Company?

- What is Brief History of Stitch Fix Company?

- Who Owns Stitch Fix Company?

- What is Customer Demographics and Target Market of Stitch Fix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.