Stitch Fix Bundle

How Does Stitch Fix Stay Ahead in the Fashion Game?

Stitch Fix, a pioneering Stitch Fix SWOT Analysis, has redefined the retail landscape by blending data science with personalized styling. This innovative Stitch Fix SWOT Analysis model delivers curated fashion boxes directly to your doorstep, offering a unique alternative to traditional shopping. As a key player in the e-commerce and fashion technology sector, understanding How Stitch Fix works is crucial for investors and consumers alike.

This deep dive into Stitch Fix will explore its core operations, value proposition, and revenue streams. We'll examine the Stitch Fix review, its competitive advantages, and its ability to adapt to changing market dynamics. Whether you're curious about the Stitch Fix cost per item or wondering "Is Stitch Fix worth it?", this analysis provides comprehensive insights.

What Are the Key Operations Driving Stitch Fix’s Success?

The core of how Stitch Fix works revolves around a personalized online styling service, blending data science with human stylists' expertise. The service offers a curated 'Fix,' a box containing five clothing and accessory items delivered directly to customers. This approach caters to diverse customer segments, including women, men, and children, with options for various styles, sizes, and price points.

The operational process begins with a detailed style quiz, gathering customer preferences, size information, fit, and budget. This data feeds into Stitch Fix's algorithms, which identify potential items from its extensive inventory. Human stylists then review these algorithmic suggestions, making final selections and adding personalized notes to each Fix. This hybrid model is a key aspect of a Stitch Fix review.

The value proposition of Stitch Fix lies in its ability to offer a convenient and enjoyable way to discover new styles. It aims to reduce decision fatigue for shoppers. This unique approach directly translates into customer benefits and market differentiation, setting it apart in the competitive landscape of online fashion.

Customers start by completing a style quiz, providing crucial data about their preferences, size, and budget. Stitch Fix uses this data to inform its proprietary algorithms. These algorithms analyze the data to identify items from its extensive inventory that match the customer's style.

Human stylists review the algorithmic recommendations, adding a personal touch. They make final selections, ensuring the items align with the customer's style and preferences. Each Fix includes a personalized note from the stylist, enhancing the customer experience.

Stitch Fix sources apparel directly from over 1,000 brands, including established names and emerging designers. This allows for a diverse and constantly updated inventory. The wide range of brands and styles caters to various customer preferences and price points.

Fulfillment centers play a crucial role in packing and shipping the Fixes. A seamless return process is in place to ensure customer convenience. The efficient logistics and fulfillment system are critical to the overall customer experience.

Stitch Fix's operational effectiveness stems from integrating data science with human stylists. This hybrid approach allows for scalability and efficiency while maintaining personalization. Key aspects include inventory management, fulfillment, and customer service, all working together to deliver a seamless experience. For more details on the company's structure, you can read about the Owners & Shareholders of Stitch Fix.

- Data-Driven Personalization: Algorithms analyze customer data to suggest items, enhanced by stylist expertise.

- Inventory Management: Sourcing from a wide range of brands ensures a diverse and updated inventory.

- Efficient Fulfillment: Streamlined processes for packing, shipping, and returns enhance customer convenience.

- Customer Service: Focus on customer satisfaction through personalized styling and support.

Stitch Fix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stitch Fix Make Money?

The core of how Stitch Fix works revolves around its revenue streams and monetization strategies, primarily centered on the sale of apparel and accessories. This is achieved through curated 'Fixes' delivered to customers, who are charged only for the items they choose to keep. The company also offers a direct-buy option called 'Freestyle' to expand its revenue base.

The 'Fix' model includes a $20 styling fee per Fix, which is credited towards purchases, effectively making it a non-revenue generating charge if items are bought. Customers benefit from a 25% discount if they purchase all items in a Fix. In fiscal year 2024, Stitch Fix reported net revenue of $1.475 billion.

Stitch Fix leverages data analysis to refine inventory selection and pricing, aiming to maximize sales and minimize returns. The introduction of 'Freestyle' reflects an adaptation to evolving e-commerce trends, offering customers more flexibility and choice, and potentially diversifying its revenue streams over time. This shift is part of Stitch Fix's broader strategy to adapt to changing consumer behaviors and economic factors.

Stitch Fix employs several strategies to generate revenue and monetize its services. These include the traditional 'Fix' model and the newer 'Freestyle' option.

- Fix Model: Customers receive curated selections of clothing and accessories, paying only for what they keep. A styling fee applies but is credited towards purchases.

- Freestyle: Customers can directly purchase individual items from the online shop, offering a broader shopping experience.

- Data-Driven Optimization: Utilizing data to improve inventory selection, pricing, and overall customer experience.

- Discount Incentives: Offering a 25% discount for purchasing all items in a Fix.

- Focus on Retention: Adapting to macroeconomic factors and consumer behavior to maintain customer loyalty.

Stitch Fix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stitch Fix’s Business Model?

Since its inception, Stitch Fix has navigated critical milestones and strategic shifts. A significant move was its initial public offering (IPO) in 2017, which provided substantial capital for expansion. The company continuously invested in its data science capabilities, establishing a core competitive advantage, enabling increasingly precise personalization. The launch of 'Freestyle' in 2021 marked a strategic pivot, offering a direct-buy option and broadening its appeal beyond the traditional Fix model.

Operational challenges have included managing inventory effectively in a dynamic fashion market and adapting to shifts in consumer spending habits, particularly during economic uncertainties. The company has responded by focusing on improving the client experience, optimizing inventory management, and enhancing its technological infrastructure. The company's competitive advantages lie in its proprietary data science algorithms, which create a highly personalized shopping experience that is difficult for traditional retailers to replicate.

The company's hybrid model, combining AI with human stylists, offers a unique value proposition. Brand strength and customer loyalty, built on convenience and personalized discovery, also contribute to its edge. The company continues to adapt to new trends, such as the increasing demand for sustainable fashion, and strives to leverage its data insights to stay ahead in a competitive retail landscape. For more insights, consider exploring the Growth Strategy of Stitch Fix.

Stitch Fix went public in 2017, raising significant capital for growth. This IPO was a pivotal moment, allowing the company to scale its operations and invest in technology. The IPO provided the financial resources needed to expand its customer base and enhance its service offerings.

The introduction of 'Freestyle' in 2021 was a strategic shift, allowing customers to directly purchase items. This move broadened its appeal beyond the traditional 'Fix' model. This expansion aimed to increase transaction volume and customer lifetime value, adapting to evolving e-commerce trends.

Stitch Fix's proprietary data science algorithms create a highly personalized shopping experience. This is difficult for traditional retailers to replicate. The hybrid model, combining AI with human stylists, provides a unique value proposition.

Managing inventory effectively and adapting to shifts in consumer spending are ongoing challenges. The company focuses on improving client experience and optimizing inventory management. Enhancing its technological infrastructure is also a key priority.

Stitch Fix uses a combination of data science and human stylists to curate personalized clothing selections. Customers complete a style quiz to provide information about their preferences, sizes, and budget. The stylists then select items based on the data and customer feedback.

- Personal Styling Service: Customers receive curated boxes of clothing and accessories.

- Online Clothing Subscription: Offers a convenient way to discover and purchase new fashion items.

- Fashion Box: Provides a personalized shopping experience with items selected by stylists.

- Stitch Fix review: The service is known for its personalized approach and convenience.

Stitch Fix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stitch Fix Positioning Itself for Continued Success?

The company operates within the competitive online apparel retail market, distinguishing itself as a leader in personalized styling services. Its unique hybrid model, combining data science and human stylists, sets it apart from traditional e-commerce giants and fast-fashion retailers. Customer loyalty is built on the convenience and personalized discovery that the service offers. However, the company faces several key risks, including intense competition from both established retailers and emerging direct-to-consumer brands.

Economic downturns and shifts in consumer spending can also impact revenue. Technological advancements in AI-driven styling tools and changing consumer preferences also pose ongoing challenges. The company's ability to adapt to these dynamic conditions is crucial for its continued success. For more information on how the company approaches its marketing, see the Marketing Strategy of Stitch Fix.

The company holds a notable position in the personal styling service market, offering a unique blend of data-driven insights and human stylist expertise. It competes with both traditional retailers expanding their online presence and emerging direct-to-consumer brands. The company's focus on personalization and convenience has helped it carve out a niche in a crowded market.

Key risks include intense competition, economic downturns, and shifts in consumer spending. Technological advancements, such as AI-driven styling tools, also pose challenges. Changes in consumer preferences for shopping channels and the potential for increased marketing costs are additional factors that could impact profitability.

The future outlook involves leveraging its data advantage to refine personalization, expand product offerings, and potentially explore new markets. The company aims to sustain and expand its ability to make money by continuing to innovate its styling services, attracting new clients, and increasing the lifetime value of existing ones. It plans to navigate the complexities of the retail industry through strategic initiatives.

In fiscal year 2024, the company reported net revenue of $1.475 billion, reflecting its scale but also highlighting market pressures. The company is focused on enhancing profitability and client engagement through cost optimization and refined marketing strategies. Leadership emphasizes improving the core Fix experience and growing the Freestyle offering.

The company is actively pursuing strategic initiatives to enhance profitability and client engagement. These include optimizing its cost structure and refining its marketing strategies. The focus is on improving the core Fix experience and growing the Freestyle offering to drive revenue and customer satisfaction.

- Optimizing cost structure.

- Refining marketing strategies.

- Improving the core Fix experience.

- Growing the Freestyle offering.

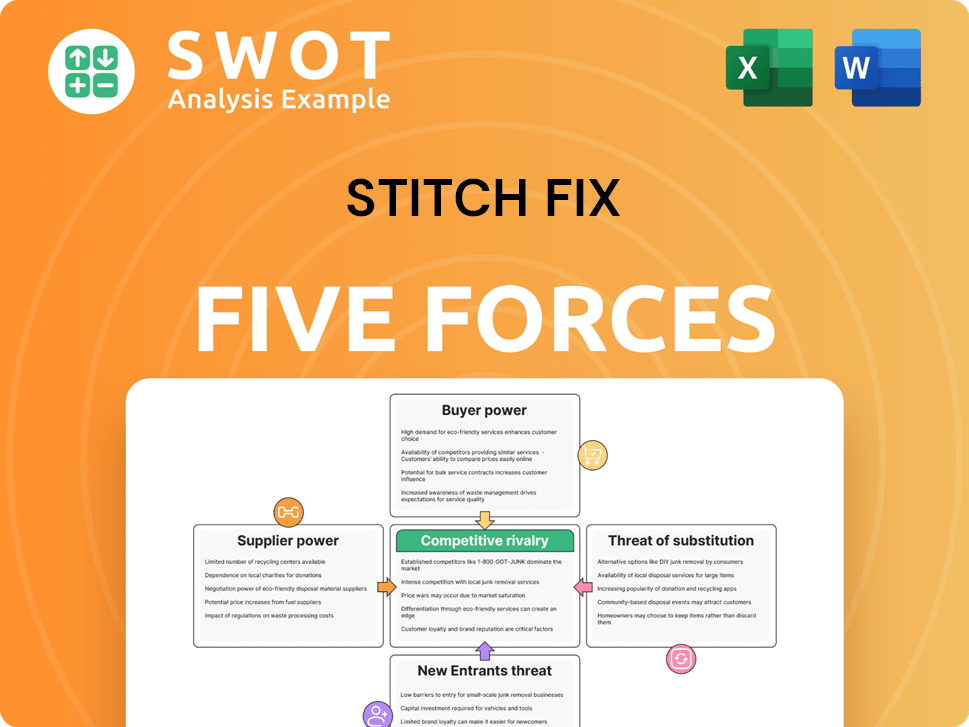

Stitch Fix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stitch Fix Company?

- What is Competitive Landscape of Stitch Fix Company?

- What is Growth Strategy and Future Prospects of Stitch Fix Company?

- What is Sales and Marketing Strategy of Stitch Fix Company?

- What is Brief History of Stitch Fix Company?

- Who Owns Stitch Fix Company?

- What is Customer Demographics and Target Market of Stitch Fix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.