Synchrony Bundle

How Did Synchrony Company Become a Financial Powerhouse?

Embark on a journey through the Synchrony SWOT Analysis to uncover the fascinating story of Synchrony Financial, a company that has reshaped the consumer finance landscape. From its roots as a spin-off to its current stature, Synchrony's evolution is a testament to strategic foresight and adaptability. Discover the key milestones and pivotal decisions that have shaped Synchrony Bank into a leading provider of financial services.

The brief history of Synchrony Financial begins with its incorporation in 2003, though its operational launch occurred later, marking the start of its journey from GE Capital's retail financing arm. Understanding Synchrony's relationship with GE is crucial to grasping its early history and subsequent growth. Today, Synchrony Bank stands as a significant player, offering a wide array of financial services and private-label Synchrony credit cards to millions of customers.

What is the Synchrony Founding Story?

The Synchrony Company, now known as Synchrony Financial, has a history rooted in the consumer financing landscape. Its formal establishment occurred on September 12, 2003, when it was incorporated in Delaware as GE Capital Retail Finance Corporation. However, the origins of Synchrony Bank trace back to 1932, when General Electric began offering consumer financing solutions.

The company's early years were marked by its integration within GE Capital. The primary goal was to provide specialized credit programs tailored for various retail and healthcare settings. This allowed consumers to finance significant purchases seamlessly. The business model was built on partnerships, offering credit products like private-label and co-branded credit cards.

A significant turning point in the History of Synchrony was its spin-off from GE Capital. This strategic move was part of GE's plan to reduce its financial arm's footprint. The spin-off enabled Synchrony Financial to become a publicly traded company. Today, Brian Doubles leads the company as CEO, with Margaret M. Keane serving as Executive Chairman. For more details on the company's ownership structure, you can explore Owners & Shareholders of Synchrony.

Synchrony Financial was formally founded in 2003 but has roots dating back to 1932.

- The company originated as GE Capital Retail Finance Corporation.

- It focused on providing customized credit solutions for retailers and healthcare providers.

- The business model centered on partnerships to offer credit products.

- The spin-off from GE Capital was a pivotal moment, making it a publicly traded company.

Synchrony SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Synchrony?

The early growth and expansion of the Synchrony Company, formerly part of GE Capital, marked a significant period following its initial public offering. This phase focused on strategic partnerships and the expansion of its product offerings. The company's growth strategy included deepening existing relationships and forging new alliances across various sectors. Synchrony Financial has evolved significantly since its inception, adapting to market changes and consumer needs.

Following its spin-off from GE Capital, Synchrony Financial went public in July 2014. The initial public offering raised $2.88 billion, which fueled its early growth. This marked a crucial step in the Marketing Strategy of Synchrony and its expansion plans.

Synchrony Company focused heavily on establishing and maintaining partnerships across different sectors. In 2023, Synchrony added over 25 new partners and renewed more than 30 existing relationships. By 2024, the company further grew and deepened over 45 existing partner programs and added more than 45 new ones, including collaborations with companies like Generac.

Synchrony strategically expanded its product categories and digital capabilities to meet evolving consumer demands. The acquisition of Ally Financial Inc.'s point-of-sale financing business in March 2024 strengthened its Home & Auto platform. Digital channels accounted for 29% of its total interest and fees on loans for the year ended December 31, 2024.

As of Q1 2025, Synchrony reported 69 million average active accounts. Loan receivables totaled $100 billion. Despite these figures, there was a 2.1% year-over-year decline in loan growth as of May 2025, reflecting tighter underwriting and moderated consumer spending.

Synchrony PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Synchrony history?

The Synchrony Company has achieved significant milestones over the years, solidifying its position in the financial services sector. These achievements showcase the company's growth and strategic initiatives, contributing to its evolution into a leading financial institution.

| Year | Milestone |

|---|---|

| 2017 | Synchrony acquired GPShopper, enhancing its digital capabilities. |

| 2018 | Synchrony acquired Loop Commerce, adding the GiftNow digital gifting platform. |

| 2018 | Synchrony Bank became the exclusive issuer for the PayPal Credit point-of-sale financing program through 2028. |

| 2025 (April) | CareCredit was accepted at 100% of public veterinary university hospitals nationwide. |

Synchrony Financial has consistently innovated to meet the evolving needs of its customers. The company has focused on developing digitally-enabled product suites, providing seamless omnichannel experiences.

Synchrony has developed digitally-enabled product suites to provide customers with seamless omnichannel experiences. This innovation allows customers to manage their accounts and make transactions easily.

The acquisition of GPShopper in 2017 enhanced Synchrony's digital capabilities. This strategic move helped improve the company's mobile offerings and customer engagement.

In 2018, Synchrony acquired Loop Commerce, which provided the GiftNow digital gifting platform. This acquisition expanded Synchrony's digital offerings and enhanced the customer experience.

Synchrony has expanded its CareCredit offering, increasing its acceptance and availability. By April 2025, CareCredit was accepted at 100% of public veterinary university hospitals nationwide.

The company has formed strategic partnerships to diversify its portfolio and reach new customers. These partnerships include collaborations with Venmo and Verizon.

Synchrony is expanding its own buy now/pay later (BNPL) option through Clover. The in-house BNPL platform is present at 20% of surveyed partners, including Lowe's.

Synchrony Financial has encountered several challenges, including the loss of major partners and market downturns. The company has responded to these challenges by diversifying its portfolio and focusing on disciplined risk management.

The loss of significant partners like Walmart in 2018 and Gap in 2021 impacted Synchrony's receivables. These losses prompted the company to diversify its partnerships and reduce reliance on individual retailers.

Market downturns and evolving credit trends have presented obstacles for Synchrony. Net charge-offs rose sharply industrywide in 2023 and the first half of 2024, impacting the company's financial performance.

Synchrony faces potential new regulations on late fees, which could impact its revenue. The company is adapting to these changes by focusing on disciplined risk management and strategic adjustments.

In response to challenges, Synchrony has focused on disciplined risk management. This includes improving delinquency rates and maintaining a strong Common Equity Tier 1 (CET1) ratio of 13.2% in Q1 2025.

As of December 2024, Synchrony's allowance for bad loans was more than 10.44% of existing receivables. This reflects the company's proactive approach to managing credit risk.

The company is expanding its own buy now/pay later (BNPL) option through Clover. Synchrony is also gaining traction with its in-house BNPL platform, which is present at 20% of surveyed partners, including Lowe's.

Synchrony Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Synchrony?

The brief history of Synchrony Financial showcases its evolution from its origins to its current status as a leading financial services company. Initially incorporated as GE Capital Retail Finance Corporation, it later became Synchrony Financial, marking a significant transition in its operational focus and market presence. The company has achieved several milestones, including a successful IPO and strategic acquisitions, which have shaped its growth and market position. Synchrony Bank has consistently adapted to market dynamics, expanding its services and partnerships to meet evolving consumer needs.

| Year | Key Event |

|---|---|

| 2003 | Incorporated in Delaware as GE Capital Retail Finance Corporation. |

| 2013 | Began active operations, concentrating on co-branded credit products. |

| July 2014 | Went public, raising $2.88 billion in its IPO. |

| 2017 | Acquired GPShopper. |

| 2018 | Acquired Loop Commerce (GiftNow platform) and PayPal's $7.6 billion credit receivables portfolio. |

| 2020 | Navigated the global pandemic, racial injustice, and a CEO transition, as detailed in its 2020 annual report. |

| March 2024 | Acquired Ally Financial Inc.'s point-of-sale financing business. |

| October 16, 2024 | Announced Q3 2024 results. |

| January 28, 2025 | Announced Q4 2024 results, reporting net earnings of $774 million. |

| February 2025 | Partnered with NATM to offer special financing options for members. |

| April 22, 2025 | Reported Q1 2025 results, with net earnings of $757 million, and announced a $2.5 billion share repurchase program and a 20% increase in quarterly cash dividend to $0.30 per share. |

| April 24, 2025 | Released its Q1 2025 Form 10-Q report. |

| May 2025 | Loan growth declined by 2.1% year-over-year. |

Synchrony anticipates low single-digit growth in ending loan receivables. Net revenue is projected to be between $15.2 billion and $15.7 billion. The company expects net charge-offs to range between 5.8% and 6.0% for fiscal year 2025. These projections reflect the company's strategic focus on sustainable growth.

Synchrony continues to invest in its diversified portfolio and digital capabilities. The company is deepening partnerships in resilient sectors such as home, auto, and healthcare. These initiatives are designed to enhance its market position and provide value to its stakeholders. The company's focus remains on responsible growth.

Analysts project earnings per share (EPS) for fiscal year 2025 at $7.59 and for fiscal year 2026 at $9.06. These forecasts indicate expectations of continued earnings growth. This growth is supported by the company's strategic initiatives and market position.

Synchrony is committed to shareholder returns, demonstrated by consistent dividend payments and share buyback programs. The company has repurchased over 50% of its common stock and returned nearly $17 billion to shareholders through repurchases since 2016. This reflects a strong commitment to shareholder value.

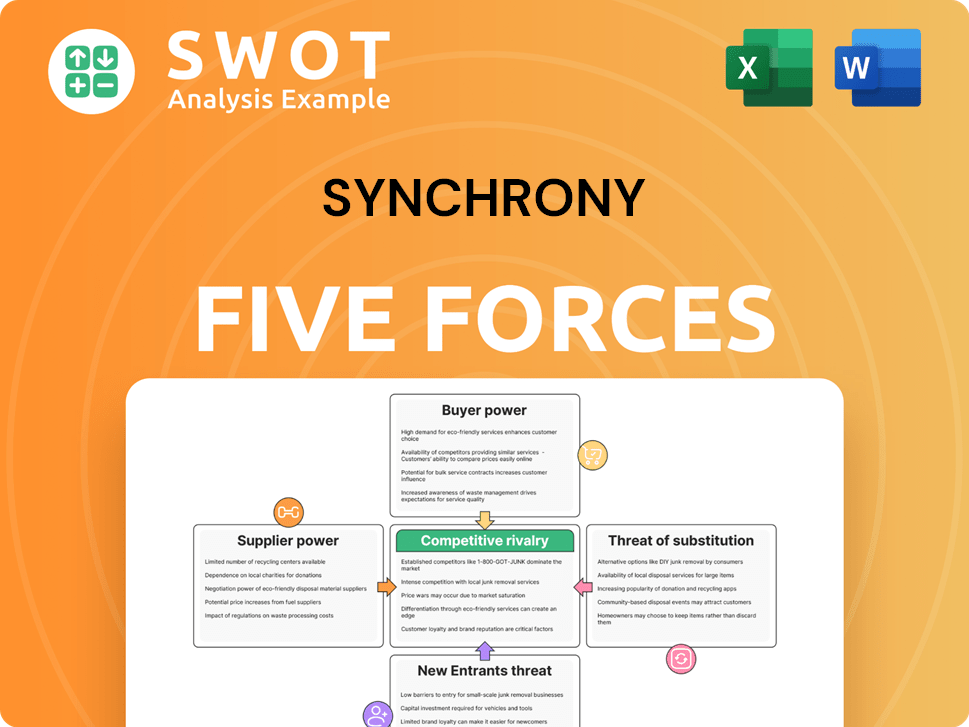

Synchrony Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Synchrony Company?

- What is Growth Strategy and Future Prospects of Synchrony Company?

- How Does Synchrony Company Work?

- What is Sales and Marketing Strategy of Synchrony Company?

- What is Brief History of Synchrony Company?

- Who Owns Synchrony Company?

- What is Customer Demographics and Target Market of Synchrony Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.