Synchrony Bundle

How Does Synchrony Financial Dominate the Consumer Finance Landscape?

Synchrony Financial's journey is a masterclass in adapting to the ever-evolving consumer finance world. Their strategic partnerships and digital innovations, including the popular Synchrony Marketplace, have been instrumental in their growth. Curious about the secrets behind their success?

This exploration delves into the core of Synchrony's Synchrony SWOT Analysis, examining its sales and marketing strategies that fuel its success. We'll dissect their approach to acquiring customers, analyzing their digital marketing strategy, and evaluating their brand awareness strategies. The focus will be on understanding Synchrony's business model, key partnerships, and how they've achieved impressive sales growth, including a look at their marketing budget allocation and customer relationship management tactics within the competitive financial landscape.

How Does Synchrony Reach Its Customers?

The sales channels of Synchrony Financial are primarily built upon a partnership-centric business model. This approach enables the company to distribute its credit products through a wide array of partners. These partners include national and regional retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers. This strategy is a key component of the Growth Strategy of Synchrony.

Synchrony's sales channels have strategically evolved to embrace digital adoption and omnichannel integration. This shift is reflected in the expansion of its digital footprint, with products accessible through native apps, partner apps like Apple Pay, its Synchrony Marketplace, and Synchrony.com. This digital focus has led to substantial growth in unique active users of Synchrony's digital wallet, which saw an 85% increase in 2024 compared to 2023, contributing to more than double the digital wallet sales in 2024.

Key partnerships and exclusive distribution deals are critical to Synchrony's growth and market share. The company has renewed and added numerous partnerships in 2024 and 2025, including significant extensions with long-term partners like Sam's Club and JCPenney. These relationships extend Synchrony's reach into new markets and distribution channels, putting more financing options at the point of sale.

Synchrony's sales strategy heavily relies on partnerships with retailers and service providers. This model allows them to offer private label credit cards, co-branded cards, and promotional financing directly at the point of sale. These partnerships are essential for reaching a wide customer base and driving sales growth.

The company has significantly invested in digital channels, including mobile apps, partner integrations, and its marketplace. This omnichannel approach ensures that customers can access Synchrony's financial products seamlessly, whether in-store or online. This strategy is critical for adapting to evolving consumer preferences.

Synchrony's success is closely tied to its strategic partnerships, which are continuously expanded and renewed. These partnerships provide access to new customer segments and distribution channels. Recent deals with brands like Virgin Red, Gibson, and BRP highlight the company's ability to diversify its reach.

Synchrony excels in providing financing options directly at the point of sale. This includes both physical locations and online platforms, making it easy for customers to access credit. This approach enhances the customer experience and drives sales for its partners.

Synchrony's sales and marketing plan emphasizes partnerships, digital integration, and point-of-sale financing. These strategies are designed to expand market reach and provide convenient financial solutions. The company's focus on customer relationship management and brand awareness is also crucial for sustained growth.

- Partnership Expansion: Continuously adding and renewing partnerships with major retailers and service providers.

- Digital Innovation: Enhancing digital platforms and integrating with partner apps to improve customer access.

- Point-of-Sale Focus: Offering financing options directly at the point of purchase, both online and in-store.

- Customer-Centric Approach: Prioritizing customer experience and building strong relationships through various channels.

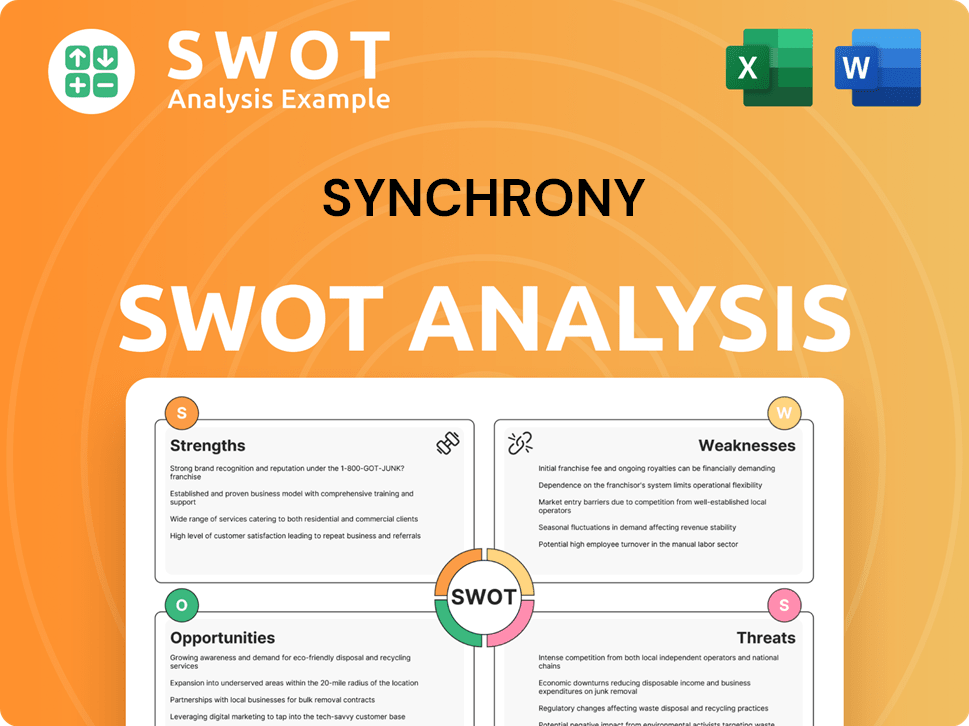

Synchrony SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Synchrony Use?

The marketing tactics employed by Synchrony Financial are a blend of digital strategies and data-driven personalization, designed to boost brand awareness, generate leads, and drive sales. Their approach is heavily reliant on digital channels, leveraging data analytics to refine customer segmentation and create personalized experiences. This comprehensive strategy supports the company's overall Synchrony sales strategy and Synchrony marketing strategy.

Synchrony's digital marketing strategy includes content marketing, search engine optimization (SEO), paid advertising, email marketing, influencer partnerships, and social media. A standout example is their innovative mobile customer experience, such as the 'Podcast Live Stream promotion,' which significantly increased views. These efforts are crucial for understanding and engaging with their target audience and are a key part of their Synchrony financial approach.

Data-driven marketing, customer segmentation, and personalization are core components of Synchrony's strategy. They use interactive in-app experiences to gather customer data, refine segmentation, and tailor engagement strategies. The Personalization Center of Excellence manages campaigns, improving offer engagement and card applications. Predictive models help identify segments likely to engage with new services, ensuring targeted messaging across various channels.

Synchrony uses a robust digital strategy including SEO, content marketing, and social media to reach its target audience. They focus on innovation in mobile customer experience, as seen in their successful 'Podcast Live Stream promotion'. This is a critical aspect of their digital marketing strategy.

Data-driven marketing is a core element, with customer segmentation and personalization at the forefront. They gather customer insights through interactive in-app experiences, refining engagement. This approach enables them to improve offer engagement and card applications.

Technology platforms and analytics tools are key to Synchrony's marketing efforts. Collaborations with companies like Airship and Movable Ink have led to groundbreaking campaigns. They invest in employee training in AI and automation to enhance customer experience and efficiency.

Synchrony prioritizes growth through personalization, which has proven successful in boosting customer engagement. They tailor messaging and offers across multiple channels, including TV, radio, print, direct mail, and digital. This approach ensures targeted and effective communication.

Synchrony invests in training its employees in emerging technologies like AI and automation. With over 20,000 employees, this investment boosts customer experience and employee efficiency. This is a key component of their data-driven marketing capabilities.

Synchrony's partnerships, such as those with Airship and Movable Ink, enable groundbreaking campaigns. These collaborations set new standards for personalized engagement. These partnerships are key to their marketing success.

Synchrony's marketing tactics are diverse, utilizing digital channels, data analytics, and strategic partnerships to reach its target audience effectively. These tactics support their Synchrony sales and marketing plan.

- Digital Marketing: SEO, content marketing, paid advertising, email marketing, influencer partnerships, and social media.

- Data-Driven Personalization: Using customer data to tailor offers and messaging.

- Technology Platforms: Leveraging tools like Airship and Movable Ink for innovative campaigns.

- Employee Training: Investing in employee skills in AI and automation.

- Partnerships: Collaborating with other companies to enhance marketing efforts.

- Customer Segmentation: Dividing the customer base into groups based on their behavior.

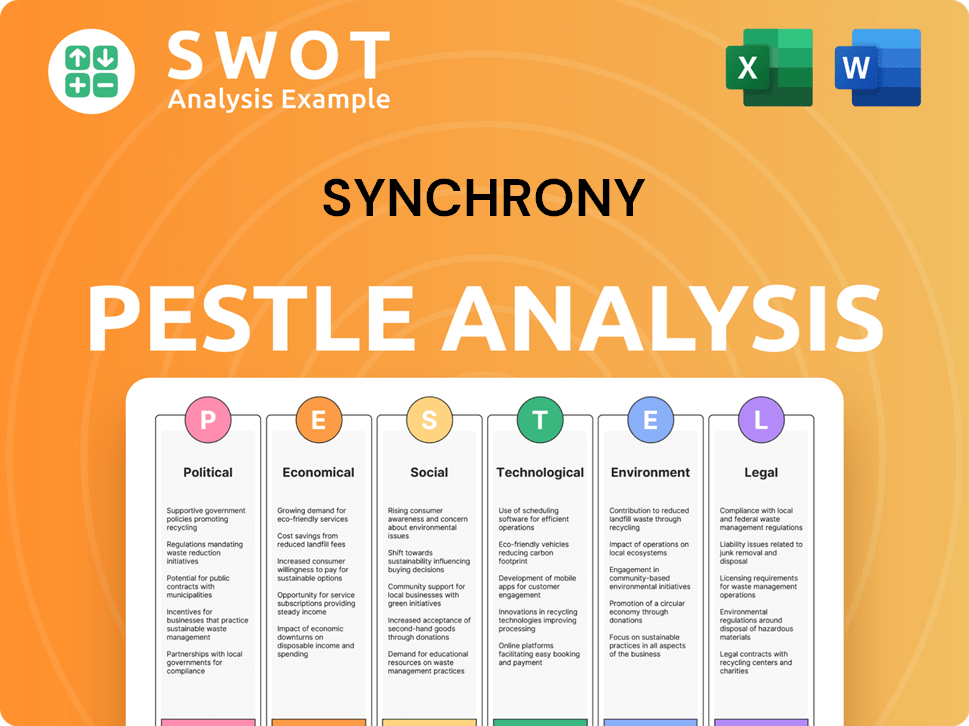

Synchrony PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Synchrony Positioned in the Market?

The brand positioning of Synchrony Financial centers on its role as a premier consumer financial services provider. It aims to empower customers by facilitating purchases and supporting healthcare expenses. Simultaneously, it positions itself as essential to businesses and providers, emphasizing relationships and a customer-centric approach within its Synchrony sales strategy.

Synchrony's core message focuses on enabling possibilities for both customers and partners. This is achieved through consistent branding across all channels, which is crucial for building trust and recognition. Brands with high consistency often see revenue growth of 10% or more, highlighting the importance of a unified brand presence in their Synchrony marketing strategy.

Synchrony distinguishes itself through strategic partnerships and integrating financial solutions across various industries. This includes retail, healthcare, and telecommunications. This approach provides customized credit programs and innovative financing products, driving growth for its partners. This is a key element of the Synchrony business model.

Synchrony excels in forming strategic partnerships across diverse sectors. These collaborations allow the company to integrate financial solutions directly into the broader strategies of its clients. This approach is vital for expanding its market reach and offering tailored financial products.

A customer-centric approach is at the core of Synchrony's operations. This involves understanding and responding to customer needs through customized credit programs and innovative financing options. This focus helps build strong customer relationships and drives loyalty.

Synchrony leverages technology, including its PRISM credit decisioning platform, to provide a comprehensive view of a consumer's creditworthiness. This allows for responsible financing and helps protect customers from overextension. This is a key aspect of their Synchrony products and services.

Maintaining a consistent brand voice and visual identity across all platforms is crucial. Synchrony ensures this consistency from social media to physical products. This consistency reinforces brand recognition and builds trust among consumers.

Synchrony's differentiation strategy includes strategic partnerships, a customer-centric approach, and technological innovation. These elements work together to provide value to both customers and partners, enhancing their competitive position in the market.

- Strategic Partnerships: Collaborations across various industries.

- Customer-Centric Approach: Customized credit programs and innovative financing.

- Technology-Driven: Advanced credit decisioning platform, PRISM.

- Brand Consistency: Uniform brand voice and visual identity.

- Personalization: Award-winning personalization efforts.

Synchrony's commitment to personalization has been recognized, as highlighted by its 2023 Personalization Award. The company continually monitors consumer sentiment and competitive threats, using data analytics and customer feedback to refine its strategies. For more details, explore the Synchrony financial performance and market strategies in this article: Analyzing Synchrony's Sales and Marketing Strategies.

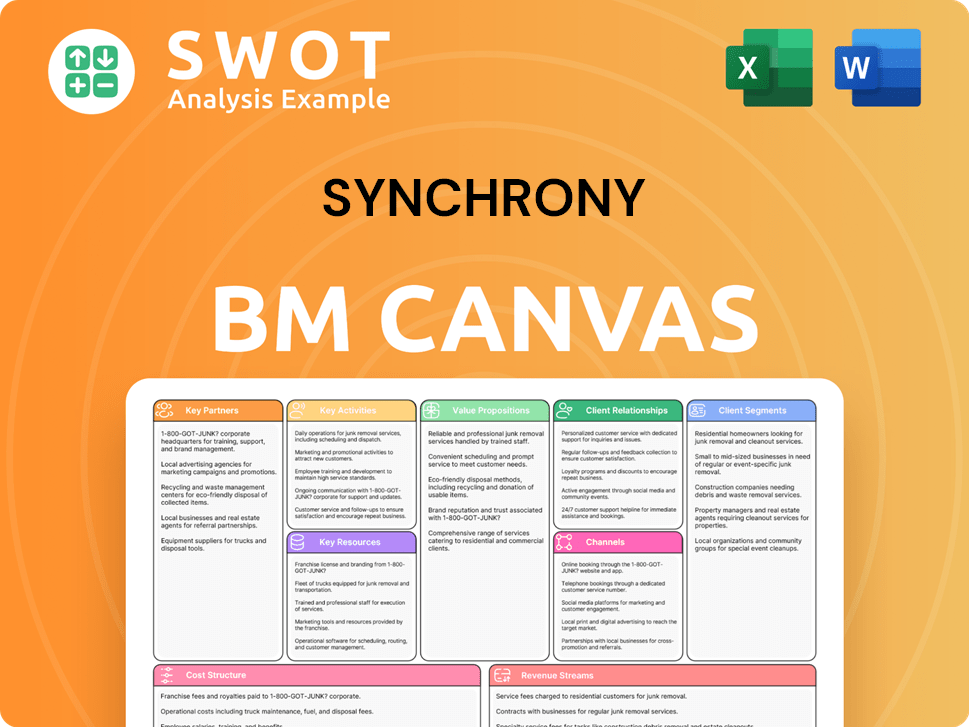

Synchrony Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Synchrony’s Most Notable Campaigns?

The sales and marketing strategies of Synchrony Financial are marked by key campaigns designed to boost customer engagement and drive financial outcomes. These initiatives leverage innovative approaches and strategic partnerships to enhance market presence. The company focuses on data-driven personalization and multichannel engagement to provide seamless customer experiences.

A significant aspect of Synchrony’s approach involves expanding and renewing strategic partnerships. These collaborations are vital for increasing purchase volume and market reach. Synchrony’s efforts consistently contribute to the growth of loan receivables, which analysts project to average around 4.6% from 2024 to 2029.

Synchrony uses technology and partnerships to drive both customer engagement and financial outcomes. For example, in 2024, Synchrony’s 'Podcast Live Stream promotion' achieved a remarkable 7X increase in views. These campaigns reflect a strategic use of technology and partnerships, driving both customer engagement and financial results. To learn more about how Synchrony grows, check out this Growth Strategy of Synchrony.

In 2024, Synchrony launched a 'Podcast Live Stream promotion' that utilized in-app messages, push notifications, and YouTube integration. This multichannel approach boosted views by 7X compared to previous campaigns. The campaign highlighted Synchrony's ability to blend multiple mobile technologies to provide a seamless customer experience.

Synchrony consistently expands and renews its strategic partnerships to drive sales volume and market presence. Recent agreements include multi-year deals with American Eagle Outfitters and Discount Tire. These partnerships are crucial for increasing purchase volume, with Synchrony financing over $182 billion in purchase volume in 2024.

The expansion of the CareCredit Dual Card, which can be used for general purchases, has been a key initiative. This expansion led to a 16% increase in open accounts in the past year. Around 60% of its out-of-partner spend in 2024 occurred outside traditional health-and-wellness categories.

Synchrony’s Personalization Center of Excellence has achieved significant results through targeted messaging. This included a 136-point lift in app submissions and 150 incremental 'add authorized user' button clicks. These efforts demonstrate the strategic use of technology and partnerships to drive both customer engagement and financial outcomes.

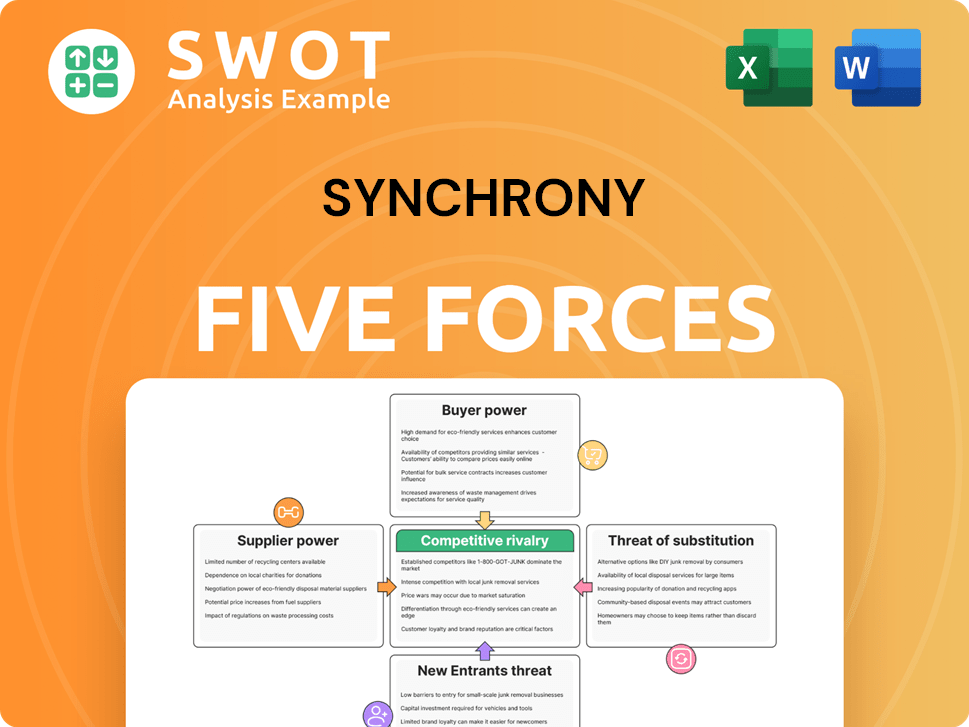

Synchrony Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synchrony Company?

- What is Competitive Landscape of Synchrony Company?

- What is Growth Strategy and Future Prospects of Synchrony Company?

- How Does Synchrony Company Work?

- What is Brief History of Synchrony Company?

- Who Owns Synchrony Company?

- What is Customer Demographics and Target Market of Synchrony Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.