Synnovia Bundle

What's the Story Behind Synnovia's Success?

Ever wondered how a company becomes a leader in its industry? Discover the fascinating Synnovia SWOT Analysis, a journey of strategic evolution and sustainable innovation in the plastics sector. From its humble beginnings to its current status, Synnovia's story is a testament to adaptability and forward-thinking vision. Learn about the key milestones that shaped this prominent player.

This brief overview of Synnovia company delves into the Synnovia history, from its founding as Plastics Capital Trading PLC on December 2, 2002, to its transformation into Synnovia PLC and later Synnovia Limited. Explore Synnovia's growth and development, its focus on niche plastic products, and its commitment to sustainability. Understanding Synnovia's company background provides valuable insights for investors and industry professionals.

What is the Synnovia Founding Story?

The founding story of Synnovia, a company with a significant presence in medical diagnostics and healthcare technology, is marked by several key milestones. Understanding the Owners & Shareholders of Synnovia provides further context to its journey. The company's evolution reflects strategic shifts and a commitment to innovation within the healthcare sector.

Synnovia's early history began with its incorporation, which has seen a few changes over time. Originally incorporated on October 2, 2007, it was later renamed Synnovia PLC in December 2018, and then back to Synnovia Limited in September 2020. However, the company's website cites its incorporation date as December 2, 2002, highlighting consistent growth since then. The company was established by Faisal Rahmatallah and Arun Nagwaney.

Initially, Synnovia focused on niche plastic products. The business model was centered on organic development, market penetration, and new product development, alongside acquisitions. The company's headquarters are located in Knaresborough, United Kingdom. From its inception, Synnovia aimed to provide innovative and sustainable plastic solutions. Early strategies also included reducing business risk by replacing third-party debt with shareholder loans.

Synnovia's journey is a testament to its adaptability and strategic vision. Here are some key points:

- Founding and Initial Focus: Established with a focus on niche plastic products.

- Strategic Business Model: Emphasis on organic growth, market penetration, and acquisitions.

- Financial Strategy: Early efforts to reduce risk through shareholder loans.

- Headquarters: Based in Knaresborough, UK.

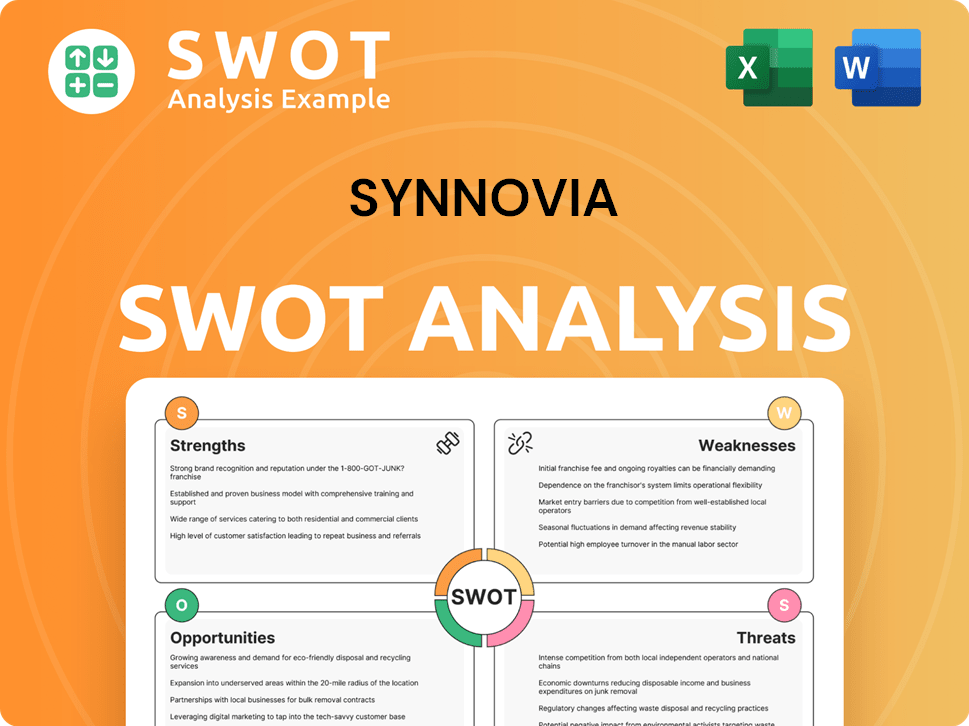

Synnovia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Synnovia?

The early growth and expansion of Synnovia, a prominent player in medical diagnostics and healthcare technology, involved both organic growth and strategic acquisitions. This approach allowed the Synnovia company to broaden its market reach and service offerings. The timeline of Synnovia history reflects a consistent pattern of strategic moves to strengthen its position in the healthcare sector.

Synnovia initiated its expansion with the acquisition of a 15% stake in Bell Plastics in January 2003, later acquiring the remaining 85% in November 2004. The acquisition of Trimplex in November 2005 further expanded its portfolio. These early acquisitions were crucial for establishing a strong foundation.

The period of 2007-2008 was marked by significant growth through acquisitions. Key acquisitions included Cobb Slater Limited, Sabre Plastics Limited, Channel Matrix Limited, and GKT Partnership Limited. These moves led to a threefold increase in sales and EBITDA within two years, showcasing the impact of these strategic investments.

The acquisition of Channel Creasing Matrix in 2007 significantly boosted Synnovia's market share in the global creasing matrix market. Admission to trading on AIM in December 2007, raising £16.2 million, facilitated further acquisitions and organic development. The company also invested in a molding and assembly factory in Thailand in 2008.

In July 2016, Synnovia acquired Synpac Limited, expanding its capabilities in specialized manufacturing. Recent financial performance has been affected by global economic factors, with sales volume fluctuations noted. For a broader understanding of the competitive landscape, consider reviewing the Competitors Landscape of Synnovia.

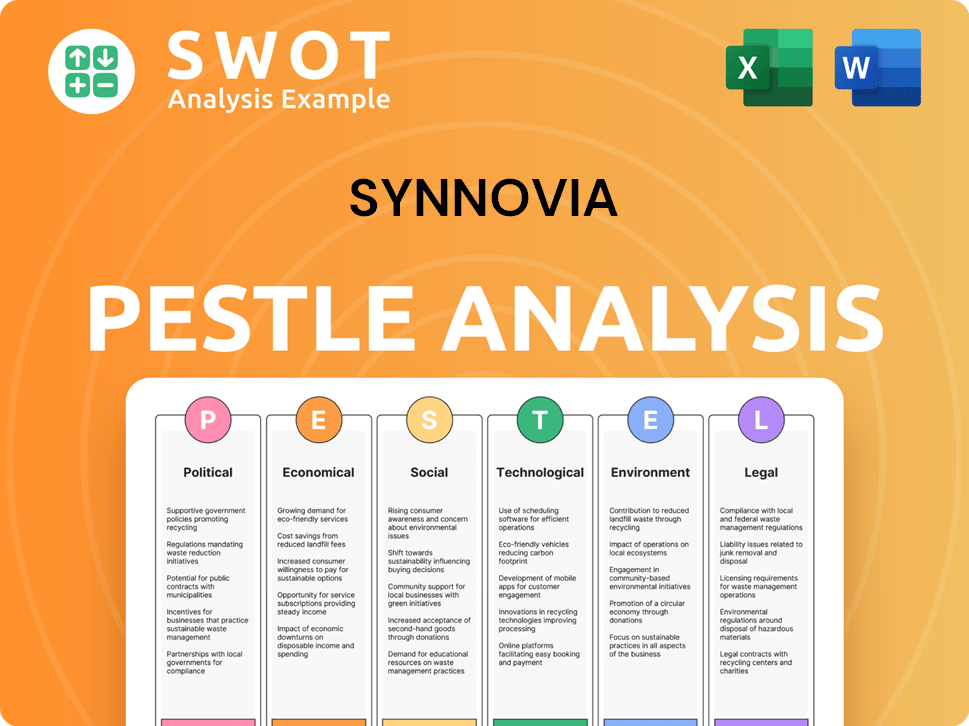

Synnovia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Synnovia history?

The Synnovia company has achieved several significant milestones throughout its history, demonstrating its growth and commitment to innovation, particularly in the healthcare sector. These achievements highlight the company's strategic vision and its ability to adapt to market changes.

| Year | Milestone |

|---|---|

| 2007 | Admission to trading on AIM facilitated further acquisitions and organic development for the company. |

| 2021 | Focused on increasing the recycling of internal plastic scrap, aiming to reach 7.5% of total plastic used. |

| 2024 | Achieved carbon neutral status for the year ended March 31, showcasing a commitment to sustainability. |

Synnovia has consistently focused on innovation, particularly in sustainable plastic solutions and diagnostic services. The company's dedication to research and development has led to advancements in healthcare technology, aiming to improve patient outcomes.

Synnovia is committed to developing sustainable plastic solutions and increasing the recycling of internal plastic scrap. This focus reflects a broader industry trend toward environmentally friendly practices.

The company actively participates in R&D programs with other companies and higher education institutions. These programs aim to create more environmentally friendly compounds and materials, fostering innovation in the industry.

Despite its successes, Synnovia has faced challenges, including economic downturns and volatile raw material prices. These challenges have required strategic responses to maintain profitability and manage operational risks.

Between October 2022 and August 2023, the business experienced a drop in sales volumes due to a global economic slowdown and the energy crisis in the UK. This downturn significantly impacted the financial results for both 2023 and 2024.

Synnovia implemented a full restructuring process to improve profitability and reduce business risk. This included replacing third-party debt with shareholder loans and reducing the working capital cycle across all businesses.

The company has faced challenges related to raw material and energy price volatility. Synnovia mitigates these issues by implementing price increases and utilizing variable price energy contracts to pass on costs to customers.

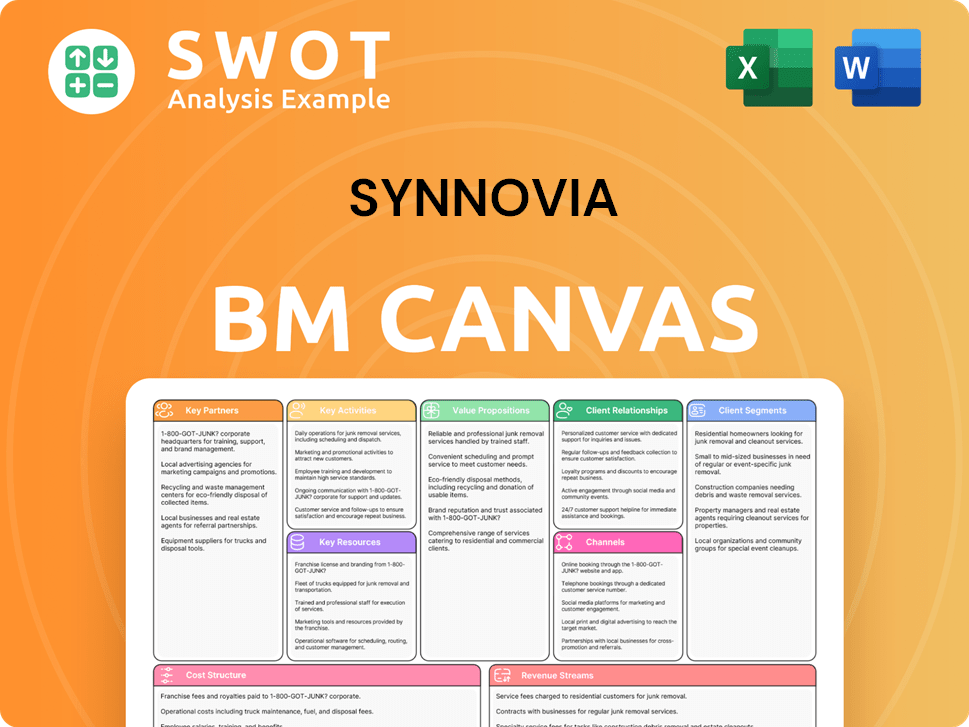

Synnovia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Synnovia?

The Synnovia company has a rich history marked by strategic acquisitions, name changes, and a focus on growth and sustainability within the healthcare sector. The company, initially named Plastics Capital Trading, has evolved significantly since its inception in 2002, adapting to market changes and expanding its operations through various strategic moves, including entering the medical diagnostics and healthcare technology fields.

| Year | Key Event |

|---|---|

| December 2, 2002 | Plastics Capital Trading (later Synnovia) was incorporated. |

| January 2003 | Acquired 15% of Bell Plastics. |

| November 2004 | Acquired the remaining 85% of Bell Plastics. |

| November 2005 | Acquired Trimplex. |

| April 2007 | Acquired Cobb Slater Limited. |

| May 2007 | Acquired Sabre Plastics Limited. |

| August 2007 | Acquired Channel Matrix Limited. |

| October 2, 2007 | Synnovia Limited was incorporated. |

| December 2007 | Plastics Capital plc (Synnovia's former name) listed on AIM. |

| March 2008 | Acquired GKT Partnership Limited and Palagan Limited. |

| November 2013 | Acquired Beijing Higher Shengli Printing Science & Technology. |

| July 2016 | Acquired Synpac Limited. |

| December 2018 | Plastics Capital plc formally renamed as Synnovia plc. |

| October 2019 | Synnovia taken private by BPF1 Limited, owned by Camelot Capital Partners LLC and management team. |

| September 7, 2020 | Synnovia PLC renamed Synnovia Limited. |

| October 2022 - August 2023 | Experienced a drop in sales volumes due to global economic slowdown and energy crisis. |

| March 31, 2024 | Achieved carbon neutral status for the year. |

| July 17, 2024 | Channel Creasing Matrix, Inc. (a subsidiary of Plastics Capital Trading Ltd) entered into an agreement to sell substantially all its assets and liabilities. |

Synnovia is committed to providing sustainable products. They actively research and assess alternative materials to reduce their environmental impact. The company's focus on sustainability is evident in its achievement of carbon neutrality in 2024.

The company anticipates a recovery in sales volumes within the next two years. A well-managed cost structure is expected to generate good profit returns and strong cash flow. This positions Synnovia for continued success in the future.

Synnovia aims to increase the recycling of internal plastic scrap. They actively support a circular economy model for plastics. This initiative is part of their broader strategy to reduce waste and promote environmental responsibility.

The company is assessing new production processes to maximize energy efficiency. This includes exploring innovative technologies and practices to minimize energy consumption. These efforts contribute to Synnovia's sustainability goals.

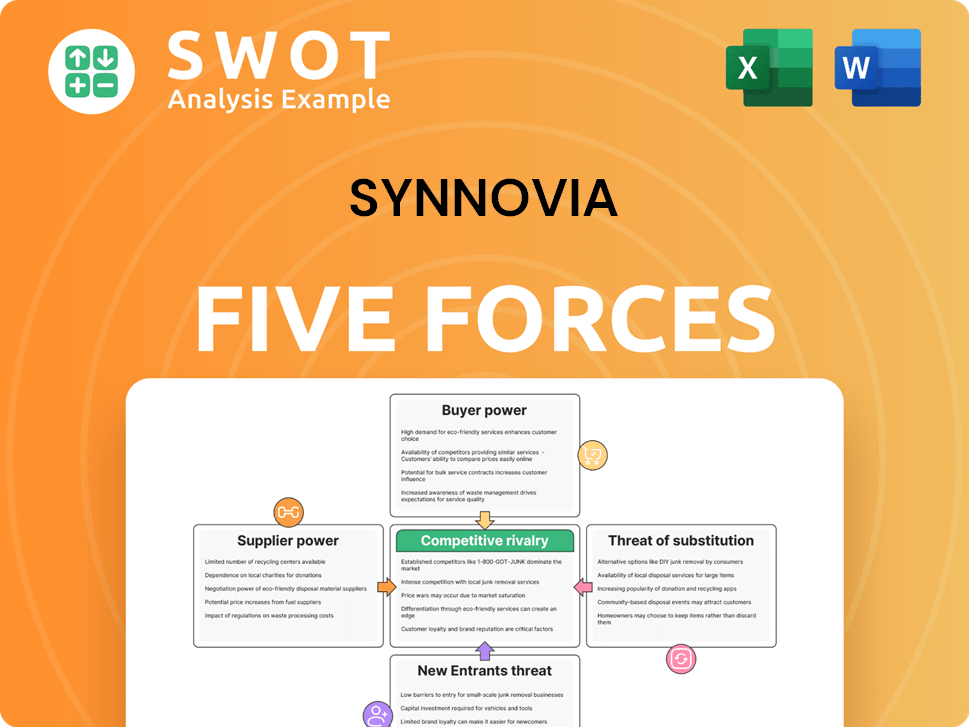

Synnovia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Synnovia Company?

- What is Growth Strategy and Future Prospects of Synnovia Company?

- How Does Synnovia Company Work?

- What is Sales and Marketing Strategy of Synnovia Company?

- What is Brief History of Synnovia Company?

- Who Owns Synnovia Company?

- What is Customer Demographics and Target Market of Synnovia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.