Synnovia Bundle

Can Synnovia Shape the Future of Sustainable Plastics?

Synnovia Limited, a key player in plastic compounding and recycling, is navigating a dynamic market. This Synnovia SWOT Analysis offers a glimpse into their strategic adaptation to evolving environmental demands. Established in 2002, the company, formerly known as Plastics Capital, has evolved, focusing on innovative and sustainable plastic solutions.

This report delves into Synnovia's Synnovia growth strategy and Synnovia future prospects, examining its Synnovia business model and market position. We'll explore how the company aims to achieve Synnovia revenue growth strategy through expansion, innovation, and strategic financial planning, including a look at Synnovia company analysis 2024. Understanding Synnovia's market share and expansion plans is crucial for assessing its Synnovia long-term growth potential within the competitive plastics industry, particularly in the context of Synnovia sustainability initiatives.

How Is Synnovia Expanding Its Reach?

The Synnovia growth strategy focuses on boosting sales volumes and optimizing its cost base, according to its financial reports from March 31, 2024. This approach aims to capitalize on increased volumes while maintaining a lower fixed-cost structure and updated pricing strategies. The company anticipates a recovery in sales volumes over the next two years, which should positively impact its Synnovia financial performance.

While specific details regarding new geographical markets or product expansions for 2024-2025 are not extensively detailed in recent public documents, the company's historical growth strategy included acquisitions. For example, in 2012, the company was actively seeking acquisition opportunities to support revenue growth. This suggests a potential for future strategic moves to enhance its market presence.

The company’s emphasis on innovative and sustainable plastic solutions indicates a continued expansion within these product areas, driven by market demand for environmentally conscious materials. Synnovia's future prospects are also tied to its existing international footprint, with engagement in approximately 80 countries, presenting opportunities for further expansion. This global presence provides a solid foundation for growth.

The core of Synnovia's growth strategy involves increasing sales volumes and optimizing its cost structure, as highlighted in its financial reports. This dual approach aims to enhance profitability by leveraging higher sales while controlling expenses. This strategy is expected to drive Synnovia revenue growth strategy in the coming years.

With operations spanning approximately 80 countries, the company has a significant international footprint. This existing global presence provides a strong base for further expansion and market penetration. This global reach supports Synnovia market share and expansion.

The company's focus on innovative and sustainable plastic solutions suggests a continued expansion within these product areas. This strategic direction aligns with growing market demand for environmentally conscious materials. This emphasis on sustainability contributes to Synnovia's long-term growth potential.

The company's subsidiary, Flexipol, passes through price movements to customers, which indicates a flexible pricing mechanism that can support expansion into new markets by adapting to local cost structures. Efforts to optimize the international supply chain and reduce material air miles contribute to a more efficient and sustainable operational model, which can facilitate future international growth.

The company's expansion initiatives are centered around increasing sales volumes, optimizing costs, and leveraging its international presence. Synnovia's business model is further enhanced by its focus on sustainable products and flexible pricing strategies, positioning it for growth. For a more detailed Synnovia company analysis 2024, consider reading the article on the company.

- Increase Sales Volumes: Focus on boosting sales to drive revenue growth.

- Cost Optimization: Streamline operations to reduce expenses and improve profitability.

- International Footprint: Leverage existing presence in approximately 80 countries for expansion.

- Sustainable Products: Expand offerings in environmentally conscious materials.

- Flexible Pricing: Adapt pricing strategies to local market conditions.

Synnovia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Synnovia Invest in Innovation?

The company's approach to innovation and technology is central to its Synnovia growth strategy, focusing on providing innovative and sustainable plastic solutions. This commitment is demonstrated through its pursuit of carbon neutrality and proactive measures to reduce its carbon footprint. The company's dedication to technological advancements and in-house development is key to its Synnovia future prospects.

Synnovia company analysis reveals a strategic emphasis on leveraging technology to drive sustained growth. The company's subsidiaries, such as BNL and Flexipol, showcase specialized technical capabilities and in-house development, which are crucial for maintaining its market position. The integration of plastic gears into molded plastic bearing designs and the focus on high-performance industrial packaging exemplify this approach.

The company's commitment to sustainability and innovation is a key component of its growth strategy, as highlighted in Brief History of Synnovia. This includes measuring and reducing its carbon footprint, with a focus on energy efficiency. The company's efforts to reduce Scope 1 usage in travel and LPG demonstrate a conscious drive towards energy efficiency.

The company actively works to measure and reduce its carbon footprint. In FY2024, the company emitted the equivalent of 3,675 tonnes of carbon dioxide.

The company's expertise in technology is crucial for maintaining its leading position in specialized plastic components.

Subsidiaries like BNL integrate plastic gears into molded plastic bearing designs, reducing component count and cost. Flexipol focuses on high-performance industrial packaging.

Efforts to reduce Scope 1 usage in travel and LPG demonstrate a conscious drive towards energy efficiency.

While specific R&D investments in AI or IoT are not explicitly detailed, the industry trend involves capitalizing on emerging technologies for predictive analytics and market targeting.

In 2023, the company emitted 3,244 tonnes of carbon dioxide.

The company's innovation strategy includes a focus on sustainability, technological know-how, and in-house development. These strategies are essential for Synnovia market position and Synnovia revenue growth strategy.

- Prioritizing carbon footprint reduction through independent assessments and efficiency measures.

- Leveraging technological expertise in specialized plastic components to maintain a competitive edge.

- Utilizing subsidiaries like BNL and Flexipol to drive innovation in product design and packaging solutions.

- Monitoring industry trends in emerging technologies like AI for potential future applications.

- Focusing on in-house development to meet bespoke customer needs and enhance product performance.

Synnovia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Synnovia’s Growth Forecast?

The financial outlook for the company is centered around a strategy to boost sales volumes and enhance profitability. This approach is supported by the confidence of the Board and shareholders in the company's ability to improve its financial performance in the coming years, following a comprehensive restructuring. This focus on Synnovia growth strategy is key to its future success.

Despite a decrease in turnover for the year ended March 31, 2024, the company's profitability has improved significantly. This improvement is due to an efficient cost structure established during the restructuring process. The company’s Synnovia business model is now geared towards sustainable growth.

The adjusted EBITDA increased from £2.15 million in FY2023 to £2.26 million in FY2024, even with reduced turnover. The EBITDA as a percentage of turnover rose to 3.0% in FY2024 from 2.4% the previous year. The gross margin also saw an increase, reaching 25.6% in FY2024 compared to 25.3% in FY2023. Read more about the company's values in Mission, Vision & Core Values of Synnovia.

The company's financial performance is marked by key indicators. Adjusted EBITDA increased to £2.26 million in FY2024, and the EBITDA margin improved to 3.0%. These figures highlight the company's efforts to improve its Synnovia financial performance.

Third-party net debt decreased by £3.6 million, from £14.6 million to £11.0 million. Working capital as a percentage of sales decreased from 10.6% to 7.4%. These improvements reflect a focus on reducing financial risk and improving efficiency.

Forecasts anticipate a recovery in sales volumes over the next two years. This recovery is expected to generate good profit returns and cash. This is a critical aspect of the Synnovia future prospects.

The company has no concerns regarding its funding position. This financial stability supports the company's ability to pursue its growth strategy. This is a positive sign for Synnovia investment opportunities.

The company's financial health is demonstrated through several key points:

- Adjusted EBITDA increased to £2.26 million in FY2024.

- EBITDA as a percentage of turnover improved to 3.0%.

- Gross margin increased to 25.6%.

- Third-party net debt decreased by £3.6 million.

- Working capital as a percentage of sales decreased to 7.4%.

Synnovia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Synnovia’s Growth?

Understanding the potential risks and obstacles is crucial for any thorough Synnovia company analysis. These challenges can influence the company's Synnovia future prospects and overall Synnovia growth strategy. A proactive approach to risk management is essential for sustained success in a dynamic market.

Several key areas present potential risks. These range from external factors like currency fluctuations and raw material costs to internal aspects such as intellectual property protection and supply chain vulnerabilities. The company's ability to navigate these challenges will significantly impact its performance.

The company faces several operational risks that could impede its progress. These risks require careful management and strategic planning to mitigate their impact. This section will outline the principal risks identified and how Synnovia addresses them.

Adverse currency movements pose a significant risk. Synnovia operates in multiple currencies, including USD, EUR, and JPY. These fluctuations can impact profitability.

Rising raw material costs are a concern. Synnovia addresses this by implementing price increases to offset costs. This strategy is crucial for maintaining margins.

Protecting intellectual property is vital. Synnovia relies on trade secrets and contractual provisions to safeguard its technological know-how. Legal action is pursued against infringements.

Sales across 80 countries create bad debt risk. Management uses internal credit limits and external credit reports to mitigate this. Historically, bad debts have remained low.

Supply chain issues are a broader industry concern. Geopolitical instability and cybersecurity threats can increase costs and cause disruptions. While not detailed for Synnovia, it's an industry-wide risk.

Internal risks include IT and security software challenges. Each subsidiary has a disaster recovery plan. The company continues to invest in IT and security software to mitigate these risks.

Between October 2022 and August 2023, the company experienced a downturn in sales volumes due to a global economic slowdown and the UK energy crisis. This led to a significant restructuring exercise in FY2024. The restructuring aimed to realign the cost base and correct pricing structures to address the challenges posed by the economic climate. This demonstrates Synnovia's ability to adapt and respond to changing market conditions.

The company's approach to managing these risks is critical for its Synnovia market position. For example, currency risk is partially mitigated by matching currency receipts with supplier payments and using forward hedges. This proactive approach helps protect profitability. For more details on the business model, you can refer to Revenue Streams & Business Model of Synnovia.

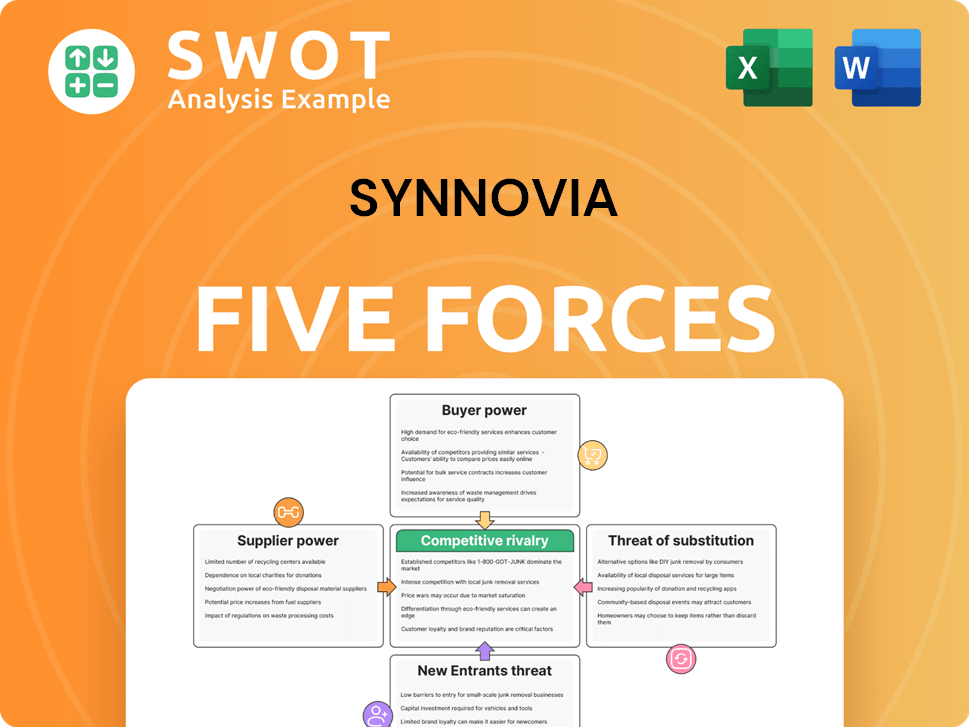

Synnovia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synnovia Company?

- What is Competitive Landscape of Synnovia Company?

- How Does Synnovia Company Work?

- What is Sales and Marketing Strategy of Synnovia Company?

- What is Brief History of Synnovia Company?

- Who Owns Synnovia Company?

- What is Customer Demographics and Target Market of Synnovia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.