Synovus Bundle

How has Synovus shaped the Southeastern banking landscape?

Journey back in time to uncover the Synovus SWOT Analysis, a financial powerhouse with deep roots in the American South. From its humble beginnings in Columbus, Georgia, in 1888, Synovus has witnessed and adapted to over a century of financial evolution. Discover how this financial services company transformed from a local savings bank into a leading regional player.

This exploration of Synovus history reveals a story of resilience and strategic growth within the dynamic banking industry. Understanding the Synovus Company's origins and development offers valuable insights into its present-day operations and market position. Delving into the brief history of Synovus Bank provides a comprehensive understanding of its journey, from early banking services to its current status as a major financial institution across the Southeast.

What is the Synovus Founding Story?

The story of the Synovus Company, a major player in the financial services sector, begins in Columbus, Georgia. Its roots trace back to a time when accessible banking was a pressing need for a growing industrial city. Understanding the Synovus history provides insights into its evolution and impact on the banking industry.

Synovus Financial Corp. was established on October 25, 1888, initially named Columbus Savings Bank. The founders, a group of local business leaders, aimed to provide essential financial services. Their vision was to foster local economic development by offering secure deposit options and capital for local growth.

The initial focus was on providing savings accounts and basic lending services, primarily for real estate and local commerce. The bank's establishment was influenced by post-Reconstruction economic growth in the South, which increased industrial activity and the demand for financial infrastructure. Learn more about the Owners & Shareholders of Synovus and how they have shaped the company's trajectory.

Columbus Savings Bank was founded in 1888 to address the limited financial services available in Columbus, Georgia.

- The founders were local businessmen who understood the community's financial needs.

- The primary goal was to provide a safe place for deposits and offer loans.

- Initial services included savings accounts and basic lending for real estate and local businesses.

- The bank's formation was influenced by the economic growth in the post-Reconstruction South.

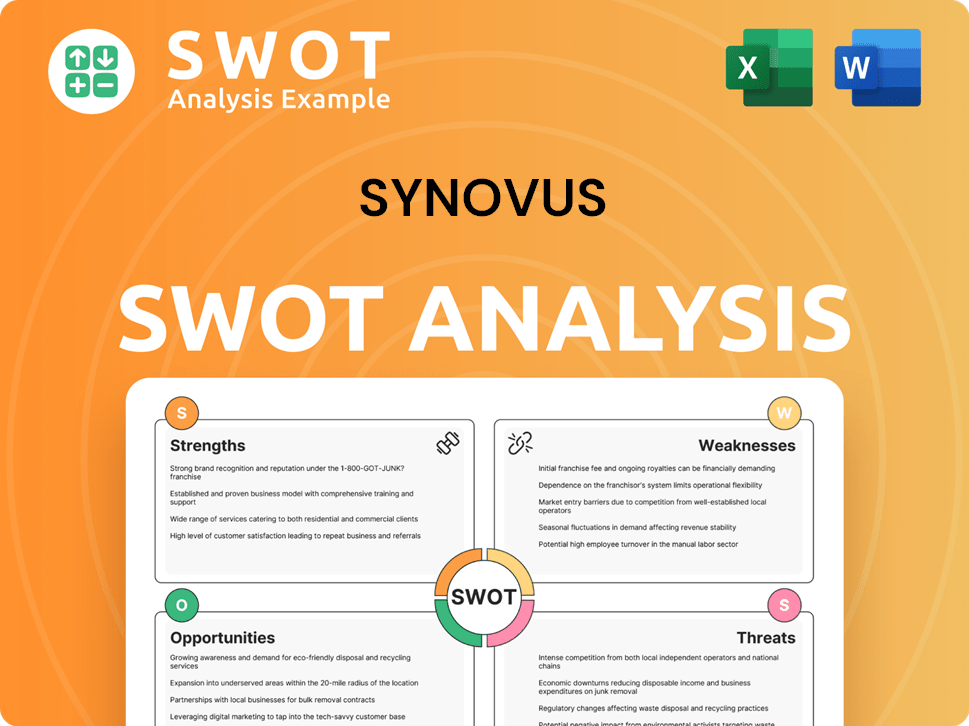

Synovus SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Synovus?

The early growth of the Synovus Company, initially known as Columbus Savings Bank, centered on establishing a strong presence in Columbus, Georgia. As the local economy grew, the bank expanded its offerings beyond savings and loans. Early milestones included reaching significant deposit thresholds and extending credit to key local industries, contributing to the city's development.

Synovus history began with a focus on Columbus, Georgia, expanding its financial services to meet the needs of the growing local economy. The initial strategy involved offering basic savings and loans, gradually adding more services. This approach helped the bank build a solid foundation and establish relationships within the community.

A crucial moment in Synovus Company's growth was the 1930 acquisition of First National Bank of Columbus. This move significantly broadened its reach and solidified its market position. This acquisition marked the beginning of a strategy that would define much of Synovus's early and sustained growth: acquiring community banks across the Southeast.

Throughout the mid-20th century, Synovus continued to expand geographically, entering new markets in Georgia and neighboring states through strategic mergers and acquisitions. This decentralized model, where acquired banks often retained their local branding and leadership, fostered strong community ties. This approach was key to its expansion across the Southeast.

The market generally responded positively to Synovus's community-focused approach, allowing it to carve out a niche against larger, more centralized banks. The competitive landscape was characterized by numerous small, independent banks, and Synovus's strategy of acquiring and nurturing these local entities proved effective. These efforts shaped Synovus into a regional powerhouse, laying the groundwork for its diverse financial services offerings today.

Major capital raises were typically conducted through private placements and later, public offerings, supporting its acquisition strategy. Leadership transitions saw the company evolve from a founder-led institution to one managed by professional bankers, adapting to the increasing complexity of its operations. For more insights, explore the Revenue Streams & Business Model of Synovus.

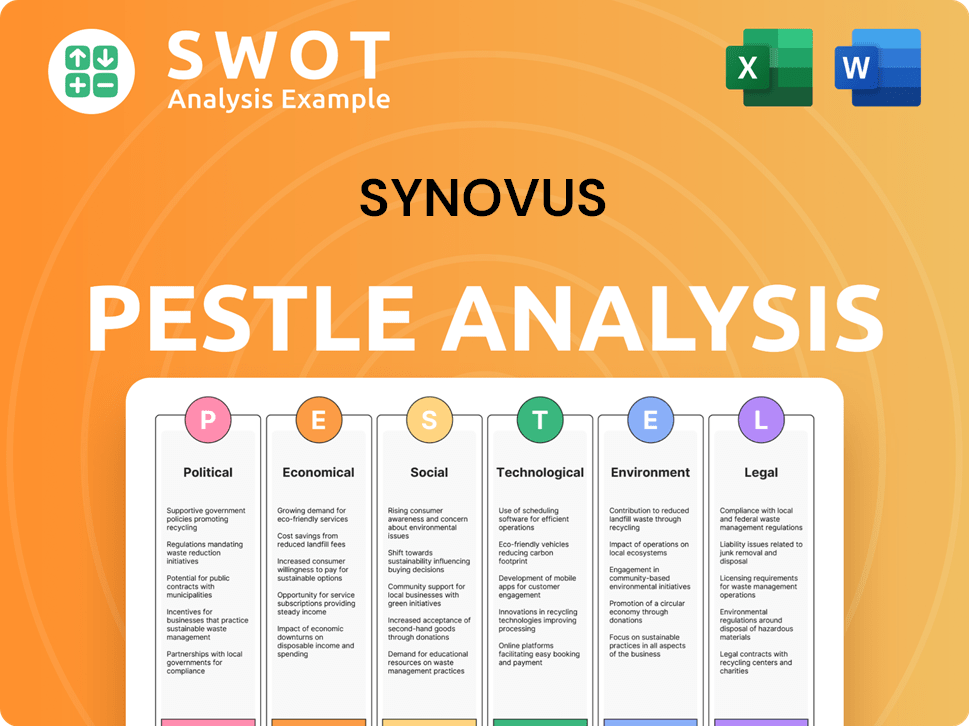

Synovus PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Synovus history?

The journey of Synovus, rooted in Columbus, Georgia, spans over a century, marked by significant milestones that have shaped its identity in the banking industry. From its early days to its current standing as a prominent financial services provider, Synovus has demonstrated resilience and adaptability, navigating various economic cycles and industry shifts. The company's history reflects a commitment to community banking, technological innovation, and strategic growth, solidifying its position in the financial landscape.

| Year | Milestone |

|---|---|

| 1888 | The company was founded in Columbus, Georgia, laying the groundwork for what would become a significant player in the financial services sector. |

| 1985 | Introduced the 'Synovus Way' of banking, a community banking model that empowered local bank presidents, fostering strong client relationships and local market responsiveness. |

| Late 1990s | Became one of the first regional banks to offer online banking services, enhancing customer convenience and operational efficiency. |

| 2008-2009 | Navigated the Great Recession, undertaking major restructuring efforts, including capital raises and strategic asset dispositions, to fortify its balance sheet. |

| 2024 | Continued investments in digital platforms and payment solutions to meet evolving customer expectations and compete effectively in the modern financial landscape. |

Innovation has been a cornerstone of Synovus's strategy, driving its evolution in the financial services sector. The early adoption of online banking and ongoing investments in digital transformation initiatives highlight its commitment to enhancing customer experience and operational efficiency. These advancements include mobile banking, artificial intelligence for customer service, and data analytics for personalized financial solutions.

This unique community banking model empowered local bank presidents with significant autonomy, fostering strong client relationships and local market responsiveness, which continues to influence its operations.

Synovus was among the first regional banks to offer online banking services in the late 1990s, enhancing customer convenience and operational efficiency.

Ongoing investments in digital platforms, mobile banking, AI for customer service, and data analytics for personalized financial solutions are key initiatives.

Continued focus on enhancing payment solutions to meet evolving customer expectations and compete effectively in the modern financial landscape.

Prioritizing customer experience through technological advancements and personalized financial solutions to meet the changing needs of clients.

Leveraging technology to streamline operations and improve efficiency, ensuring a competitive edge in the banking industry.

Synovus has faced significant challenges throughout its history, particularly during the Great Recession of 2008-2009. The company experienced substantial loan losses, especially in real estate, necessitating major restructuring efforts. These challenges led to strategic asset dispositions and a temporary dividend suspension, highlighting the need for robust risk management and diversified revenue streams.

Significant loan losses, particularly in real estate, during the 2008-2009 financial crisis, impacted the company's financial performance.

Undertook major restructuring, including capital raises and strategic asset dispositions, to fortify its balance sheet and ensure financial stability.

A temporary dividend suspension was implemented as part of the financial restructuring, reflecting the severity of the economic downturn.

Renewed emphasis on risk management and diversified revenue streams to mitigate future financial risks and ensure long-term sustainability.

Adapting to increased regulatory scrutiny in the financial services sector, ensuring compliance and maintaining operational integrity.

Continued investments in digital platforms and payment solutions to meet evolving customer expectations and compete effectively in the modern financial landscape.

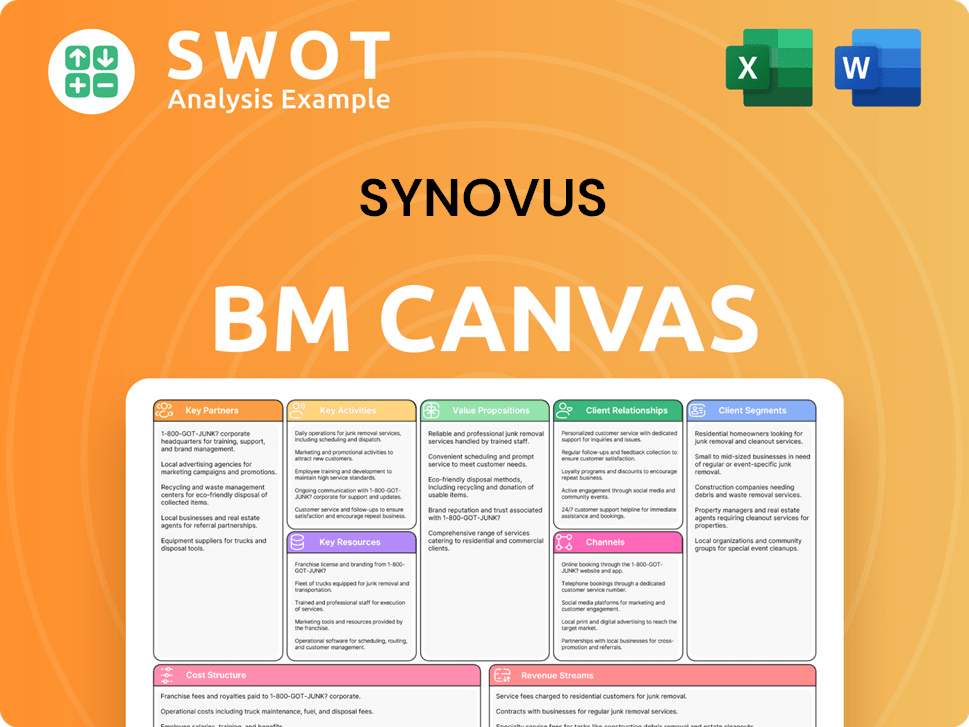

Synovus Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Synovus?

The Synovus Company, a major player in the financial services sector, has a rich history rooted in Columbus, Georgia. From its humble beginnings as Columbus Savings Bank in 1888, Synovus has evolved through strategic acquisitions, name changes, and adaptation to economic challenges. The company's journey reflects its commitment to community banking and its ability to embrace technological advancements, positioning it for continued growth in the ever-changing banking industry.

| Year | Key Event |

|---|---|

| 1888 | Founded as Columbus Savings Bank in Columbus, Georgia. |

| 1930 | Acquired First National Bank of Columbus, starting its acquisition strategy. |

| 1972 | Changed its name to Synovus Financial Corp., reflecting its diversified financial services. |

| 1985 | Introduced the 'Synovus Way' of community banking, empowering local bank presidents. |

| 1990s | Expanded significantly across the Southeast through a series of strategic acquisitions. |

| Late 1990s | Launched early online banking services, embracing digital innovation. |

| 2008-2009 | Faced significant challenges during the Great Recession, undergoing restructuring and recapitalization. |

| 2010s | Focused on rebuilding its balance sheet and strengthening its core banking operations. |

| 2018 | Completed the acquisition of Florida Community Bank, significantly expanding its presence in Florida. |

| 2020-2023 | Navigated economic uncertainties, including the COVID-19 pandemic, by adapting digital services and supporting customers. |

| 2024 | Continued investments in digital transformation, including AI and data analytics, to enhance customer experience and operational efficiency. |

Synovus continues to invest heavily in digital transformation, including AI and data analytics. This enhances customer experience and operational efficiency. These initiatives are crucial for staying competitive in the evolving financial landscape. The company is focused on enhancing mobile and online platforms.

The company plans to continue its disciplined growth, both organically and through potential acquisitions. Its focus is on attractive markets within the Southeast. This expansion includes strengthening commercial banking capabilities, such as specialized lending and treasury management solutions.

The banking industry faces increasing competition from fintech companies and rising interest rates. Synovus's community banking model and technological investments position it to adapt. Leadership is committed to sustainable growth and delivering shareholder value.

Synovus aims to remain a trusted financial partner with a modern, digitally-enhanced approach. This includes personalized financial advice and streamlined services. The company's core values and community-focused approach remain central to its mission.

Synovus Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Synovus Company?

- What is Growth Strategy and Future Prospects of Synovus Company?

- How Does Synovus Company Work?

- What is Sales and Marketing Strategy of Synovus Company?

- What is Brief History of Synovus Company?

- Who Owns Synovus Company?

- What is Customer Demographics and Target Market of Synovus Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.