Tiny Bundle

How Did Tiny Technologies Inc. Become a Force in the Internet Business Sector?

Ever wondered about the Tiny SWOT Analysis that shapes the strategies of a company built on acquiring and growing internet businesses? From its Canadian roots in 2007, Tiny has quietly amassed a diverse portfolio, focusing on sustainable growth rather than fleeting trends. This approach has allowed Tiny to carve out a unique position in the industry, focusing on sustainable growth and cash flow generation rather than rapid, speculative expansion.

This brief company history delves into the company origins, tracing the startup evolution from its foundational principles to its present-day status. We'll explore the business milestones that have defined Tiny's journey, examining key events and the challenges faced along the way. Discover the story behind Tiny Company and its significant moments, understanding its impact on the industry and its major achievements.

What is the Tiny Founding Story?

The story of the Tiny Company history began in 2007. Co-founders Andrew Wilkinson and Chris Sparling established the company in Victoria, Canada. Their approach diverged from the typical startup trajectory, focusing instead on acquiring and growing established internet businesses.

The founders aimed to create a diversified portfolio of companies. This strategy was designed to generate consistent cash flow and be held for the long term. This approach contrasted with the venture-backed startup model. The company's early focus was on acquiring businesses with recurring revenues and strong free cash flow potential.

The company's initial strategy was 'founder-friendly'. This approach emphasized fair valuations. It also highlighted the potential for recurring revenues and strong free cash flow within the acquired companies. While specific details about their first product or service are not readily available, their early efforts likely involved identifying and integrating their initial acquisitions into their portfolio. The focus has consistently been on capital allocation, collaborative management, and creating incentive structures within their operating companies to drive results.

The company's founding in 2007 marked the beginning of a unique approach to business. The founders' vision was to build a portfolio of profitable companies. This approach set the stage for the company's evolution and growth.

- Founded in 2007 in Victoria, Canada.

- Focused on acquiring established internet businesses.

- Emphasized long-term cash flow and portfolio diversification.

- Adopted a 'founder-friendly' acquisition strategy.

The early days of Tiny Company involved identifying and integrating their initial acquisitions into their portfolio. This process was crucial for setting the stage for their future growth. The company's strategy of acquiring profitable businesses allowed it to avoid the typical startup challenges. This approach enabled a focus on sustainable growth and long-term value creation. The early challenges faced by Tiny Company likely revolved around the complexities of integrating various businesses. The company's focus on capital allocation and collaborative management was key to its success.

The business model centered on acquiring and growing established internet businesses. This approach differed from the rapid scaling and fundraising model. The focus was on companies with recurring revenues and strong cash flow.

- Acquisition of established internet businesses.

- Emphasis on recurring revenues.

- Focus on strong free cash flow potential.

- Long-term holding strategy.

The company's approach to acquisitions was 'founder-friendly'. This approach was designed to build strong relationships with the acquired companies. The emphasis on fair valuations and recurring revenues was a key part of this strategy. The company's early milestones included identifying and integrating their initial acquisitions. The company's growth over time has been marked by its ability to acquire and integrate various businesses. The Competitors Landscape of Tiny reveals the company's unique position in the market.

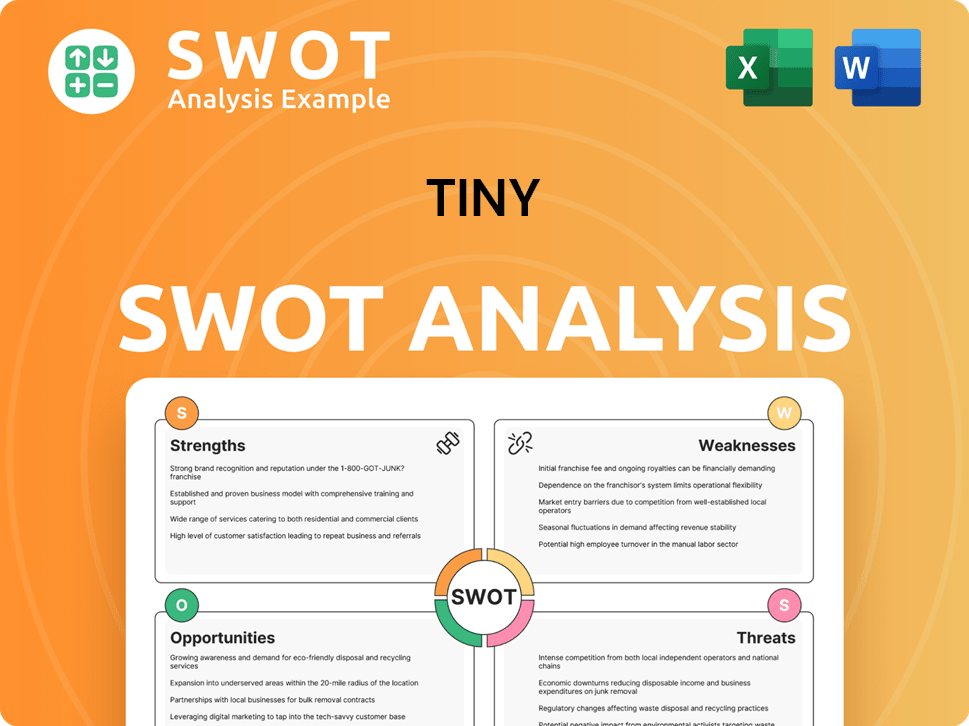

Tiny SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tiny?

The early growth and expansion of Tiny, since its incorporation in January 2016, has been marked by strategic acquisitions. The Owners & Shareholders of Tiny have focused on acquiring majority stakes in businesses across various internet sectors. This approach has fueled significant revenue growth and shaped the company's trajectory. The company's brief company history shows it has been focused on building a diverse portfolio.

Tiny has made over 35 investments or acquisitions, including subsidiaries and equity-accounted investees. In 2024, the company completed three major acquisitions: Repeat Inc., MediaNet Solutions Inc., and Wholesale Pet. MediaNet Solutions, founded in 1997, was acquired in June 2024. These acquisitions align with Tiny's strategy of acquiring high-quality businesses within its areas of expertise.

The company's revenue has nearly doubled, growing from $110.8 million in 2021 to $194.2 million in 2024. Recurring revenue in FY2024 reached $38.7 million, accounting for 20% of total revenue, which is an increase of $9.2 million compared to FY2023. This growth was partly due to the full-year inclusion of WeCommerce and the acquisitions of MediaNet and Repeat.

In Q1 2025, Tiny reported total revenue of $48.1 million, a 6% increase over Q1 2024, excluding divested entities. Recurring revenue in Q1 2025 was $9.8 million, also a 6% increase compared to Q1 2024, primarily due to the MediaNet acquisition. These business milestones showcase the company's continued expansion.

Tiny has demonstrated a commitment to debt reduction, repaying $24.5 million in debt, net of drawings, in FY2024. This resulted in net debt of $94.1 million as of December 31, 2024. This strategic financial management, combined with its acquisition strategy, has allowed Tiny to strengthen its balance sheet. This is a key event in Tiny Company's history.

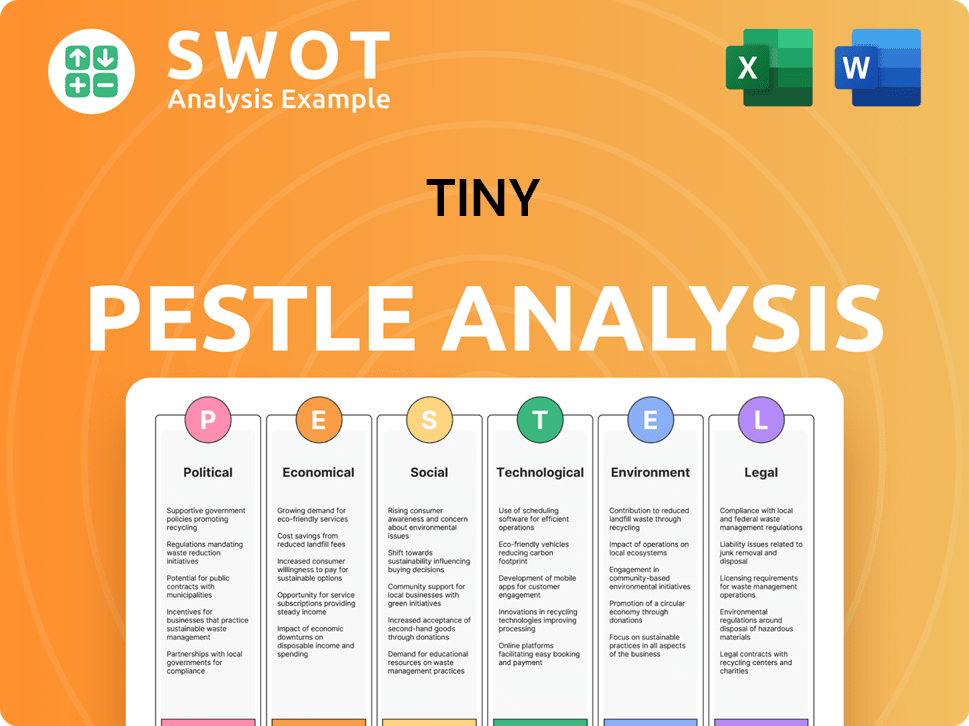

Tiny PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tiny history?

The Tiny Company history reveals a journey marked by strategic decisions and responses to market dynamics. The company's evolution includes significant financial achievements and strategic pivots. The following table highlights key business milestones.

| Year | Milestone |

|---|---|

| 2024 | Successful execution of a cost rationalization initiative in Q3, expected to reduce annualized operating expenses by over $4.0 million. |

| Q4 2024 | Adjusted EBITDA reached $10.1 million, a 38% increase over Q3 2024. |

| 2024 | Full-year Adjusted EBITDA increased by 13% to $31.0 million compared to $27.4 million in 2023. |

| May 12, 2025 | Acquisition of a majority interest in Serato, a global leader in DJ software, for US$66 million (CAD$94.5 million). |

| Q1 2025 | Dribbble officially launched its Products and Services offerings. |

Tiny Company has consistently sought to enhance its offerings and adapt to market needs. The acquisition of Serato in 2025 is a prime example of this, designed to bolster recurring revenue and profitability. This strategic move demonstrates Tiny Company's commitment to strengthening its software portfolio.

The acquisition of Serato in May 2025 is a key innovation, enhancing the software portfolio. This acquisition is expected to increase recurring revenue by approximately 45%.

Dribbble's launch of Products and Services in Q1 2025 is a significant innovation. This allows designers and clients to transact directly on the platform.

The startup evolution has encountered various challenges, including market valuation dynamics. Despite a net loss of $47.6 million in 2024, the company has demonstrated resilience. The company's focus on cost discipline and strategic acquisitions highlights its ability to navigate difficulties.

Market valuation dynamics have impacted goodwill. The company addressed this through cost rationalization.

The Creative Platform segment experienced a decline in Q4 2024. Digital Services and Software & Apps showed modest growth.

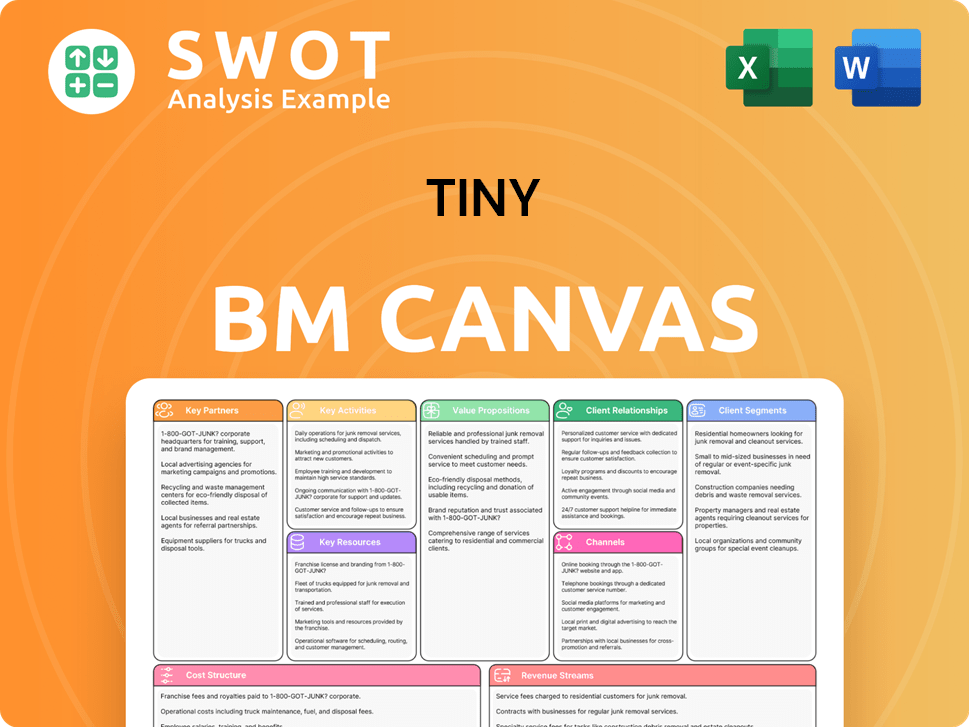

Tiny Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tiny?

The Mission, Vision & Core Values of Tiny is a story of strategic acquisitions and financial growth. Founded in 2007 by Andrew Wilkinson and Chris Sparling, the company has evolved through consistent investments and smart financial management. The company's early days saw the establishment of a strong foundation for future acquisitions and growth. The business has consistently added new companies to its portfolio. The company has made several acquisitions in the last few years, expanding its reach and influence.

| Year | Key Event |

|---|---|

| 2007 | The company was founded in Victoria, Canada, by Andrew Wilkinson and Chris Sparling. |

| January 2016 | Tiny Capital was incorporated, marking a pivotal step in its organizational structure. |

| December 15, 2021 | Acquisition of Frosty. |

| September 29, 2023 | Acquisition of Letterboxd for $50 million. |

| January 25, 2024 | Acquisition of WholesalePet for $9.25 million. |

| February 29, 2024 | Acquisition of REPEAT Inc. |

| June 18, 2024 | Acquisition of MediaNet Solutions Inc. |

| November 15, 2024 | Reported Q3 2024 results, with Adjusted EBITDA at $7.3 million. |

| December 31, 2024 | Total revenue for FY2024 reached $194.2 million, and recurring revenue grew 30% from FY2023. |

| May 12, 2025 | Completion of the acquisition of a majority interest in Serato. |

| May 15, 2025 | Reported Q1 2025 results, with total revenue of $48.1 million and Adjusted EBITDA of $9.7 million, a 63% increase over Q1 2024. |

The company is focusing on reducing its net debt to Adjusted EBITDA ratio, targeting 2.5x or less. This financial strategy aims to strengthen the company's balance sheet and improve its financial flexibility. These financial targets are a key part of the company's long-term growth strategy.

The acquisition of Serato is expected to significantly boost annual recurring revenue by approximately 45%, to between $55 million and $57 million. It's also projected to increase Adjusted EBITDA by 30%, reaching a range of $38 million to $40 million. This acquisition represents a major step in expanding the company's market presence.

The company plans to continue evaluating additional acquisition opportunities. The company is focused on organic growth and disciplined cost management. The company intends to drive long-term value for its shareholders.

The company anticipates improved revenue and EBITDA in Q2 2025 due to the Serato acquisition. This positive outlook reflects the company's strategic investments. This growth is expected to contribute to the company's overall financial performance.

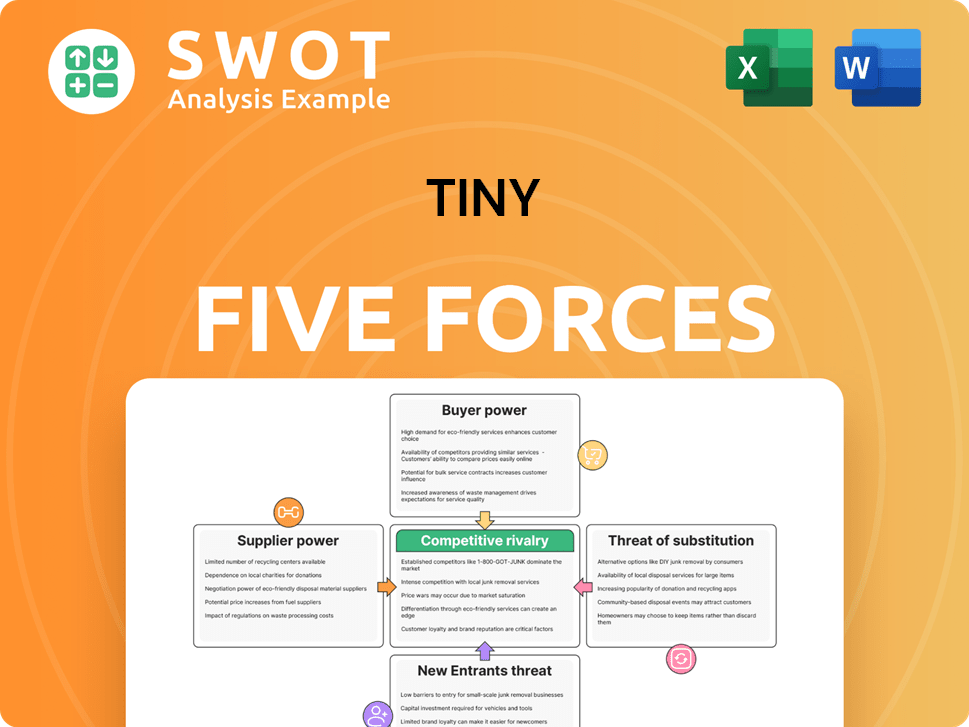

Tiny Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tiny Company?

- What is Growth Strategy and Future Prospects of Tiny Company?

- How Does Tiny Company Work?

- What is Sales and Marketing Strategy of Tiny Company?

- What is Brief History of Tiny Company?

- Who Owns Tiny Company?

- What is Customer Demographics and Target Market of Tiny Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.