Tiny Bundle

Can a "Tiny Company" Revolutionize the Internet?

Tiny Technologies Inc. is rewriting the rules of the game in the digital world, proving that strategic acquisitions can be a powerful growth strategy. Forget the traditional startup model; Tiny's unique approach involves acquiring and nurturing established, profitable internet businesses. Founded in 2007, this Tiny SWOT Analysis reveals how they've built a diverse portfolio and are poised for future success.

This article dives deep into the future prospects of this tiny company, exploring its innovative business development strategies and how it plans to navigate the ever-changing digital landscape. We'll examine Tiny's growth strategy, including its expansion initiatives, technology strategy, and financial planning, all while considering the challenges faced by tiny companies in today's market. Discover how Tiny is positioning itself for long-term success in the competitive world of small business.

How Is Tiny Expanding Its Reach?

The growth strategy of a tiny company, such as Tiny Technologies Inc., hinges on strategic expansion initiatives. These initiatives are designed to strengthen market position and diversify revenue streams, ensuring long-term sustainability and growth. The company's approach focuses on both organic growth and strategic acquisitions to achieve its objectives.

A core element of Tiny's expansion strategy involves entering new product categories through acquisitions. This is particularly evident in its interest in expanding software holdings, specifically in niche SaaS verticals. These verticals are attractive due to their recurring revenue models and strong customer retention rates, which provide a stable foundation for growth. The company's focus on identifying profitable businesses in the software space indicates a proactive approach to expansion.

Geographical expansion is indirectly achieved through the global reach of the acquired businesses. This strategy allows Tiny to expand its footprint without directly investing in international operations. By acquiring companies with established customer bases, Tiny leverages existing infrastructure and market presence. This approach aligns with the company's focus on efficiency and scalability.

Tiny aims to complete several strategic acquisitions in 2025. The focus is on companies generating between $5 million and $50 million in annual revenue. This targeted acquisition strategy allows for controlled growth and integration.

The company is exploring new business models within its existing portfolio. This includes fostering partnerships between its e-commerce and digital services companies. The goal is to create integrated solutions for clients.

Tiny encourages cross-pollination of best practices and the development of complementary services. This helps to leverage the collective expertise and resources within the company. This approach enhances overall operational efficiency.

The company's emphasis remains on acquiring companies that already possess a broad customer base. This expands Tiny's indirect global footprint. This strategy allows for faster market penetration and growth.

The Marketing Strategy of Tiny is closely aligned with its expansion initiatives, focusing on acquiring businesses that complement its existing portfolio. This approach allows Tiny to leverage synergies and achieve sustainable growth. The company's focus on SaaS and e-commerce businesses reflects current market trends, with SaaS projected to reach $208 billion in revenue by the end of 2024 and e-commerce continuing to grow, indicating a strong future for companies in these sectors. The strategic acquisition of companies generating between $5 million and $50 million in annual revenue is a key aspect of its growth strategy. This targeted approach allows for controlled expansion and integration, ensuring that Tiny can effectively manage its growing portfolio and capitalize on market opportunities.

Tiny's expansion strategy focuses on acquisitions and new business models to drive growth. The company aims to leverage its existing resources and expertise to maximize its market presence. This strategy includes both organic growth and strategic acquisitions.

- Strategic Acquisitions: Targeting companies with $5M-$50M in annual revenue.

- New Business Models: Fostering partnerships between e-commerce and digital services.

- Geographical Expansion: Leveraging the global reach of acquired businesses.

- Cross-Pollination: Sharing best practices across the portfolio.

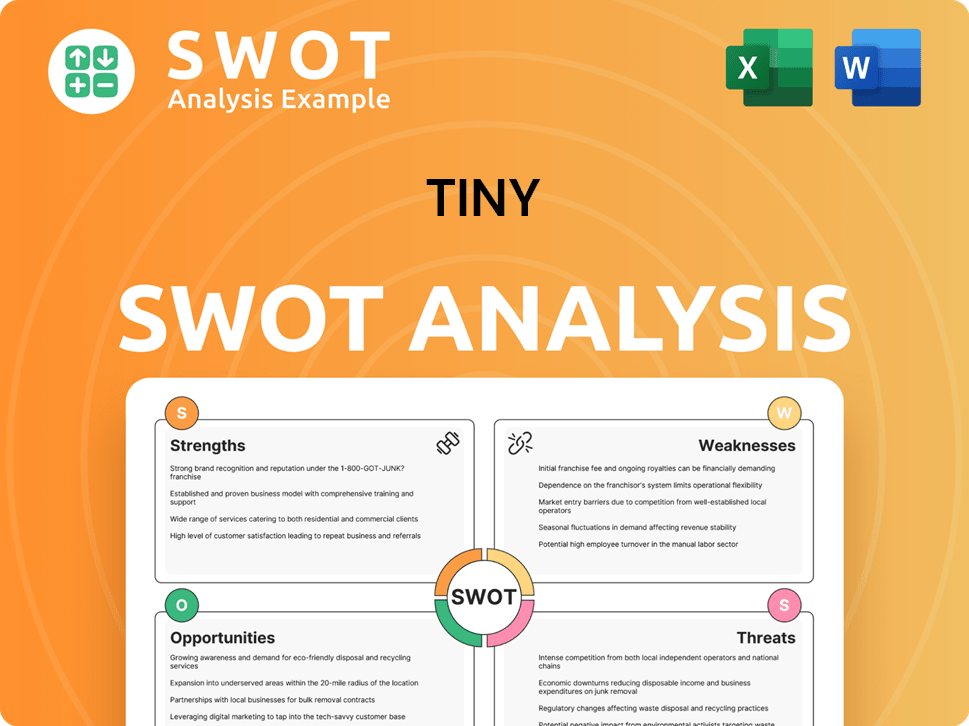

Tiny SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tiny Invest in Innovation?

The innovation and technology strategy of Tiny Technologies Inc. is centered around fostering growth across its diverse portfolio. As a holding company, Tiny empowers its individual portfolio companies to drive innovation through investments in research and development and the adoption of cutting-edge technologies. This decentralized approach allows each entity to focus on its specific market and leverage technology to gain a competitive edge. This strategy is crucial for the Brief History of Tiny and its future prospects.

Within the software segment, portfolio companies are actively integrating AI-driven functionalities. This includes the use of machine learning algorithms for data analysis and personalized recommendations, particularly in e-commerce ventures. Such initiatives aim to improve user experience, automate processes, and enhance overall efficiency. The focus on digital transformation also extends to digital services companies, where advanced automation tools are being implemented to streamline operations and boost service delivery.

Tiny's strategy emphasizes efficiency and scalability through digital transformation. The company encourages collaboration among its holdings to share technological insights and best practices. The goal is to create a synergistic effect that elevates the overall innovation capacity of the Tiny ecosystem. This collaborative environment is designed to accelerate the adoption of new technologies and drive continuous improvement across all business segments.

AI is being integrated into various software platforms to improve user experience and automate processes. Machine learning algorithms are used for data analysis and personalized recommendations, particularly in e-commerce. This helps in enhancing customer engagement and operational efficiency.

Advanced automation tools are implemented in digital services companies to streamline operations. These tools enhance service delivery and improve profit margins. Automation is a key driver for scalability and efficiency in the digital landscape.

Tiny encourages collaboration among its holdings to share technological insights and best practices. This fosters a synergistic environment where technological advancements contribute to growth objectives. Sharing knowledge enhances the overall innovation capacity.

Portfolio companies are encouraged to invest in research and development. This investment is crucial for adopting cutting-edge technologies and maintaining a competitive edge. R&D spending is a key indicator of a company's commitment to innovation.

Digital transformation is a central theme, with a focus on efficiency and scalability. This involves adopting new technologies and processes to improve operations and enhance service delivery. Digital transformation is critical for long-term growth.

The goal is to create a synergistic effect that elevates the overall innovation capacity of the Tiny ecosystem. Collaboration and knowledge sharing are key to achieving this. This approach aims to maximize the impact of technological advancements.

The growth strategy of Tiny and its portfolio companies is heavily influenced by technological trends. Here are some key areas:

- AI and Machine Learning: Used for data analysis, personalized recommendations, and process automation. The global AI market is projected to reach $1.8 trillion by 2030, according to estimates.

- Automation: Implementation of advanced tools to streamline operations and enhance service delivery. The automation market is expected to grow significantly.

- Cloud Computing: Adoption of cloud services for scalability and efficiency. The cloud computing market is expanding rapidly, with a projected value of over $1 trillion by 2025.

- Data Analytics: Leveraging data to gain insights and make informed decisions. The data analytics market is experiencing substantial growth.

- Cybersecurity: Investing in cybersecurity measures to protect data and ensure operational continuity. The cybersecurity market is valued at hundreds of billions of dollars.

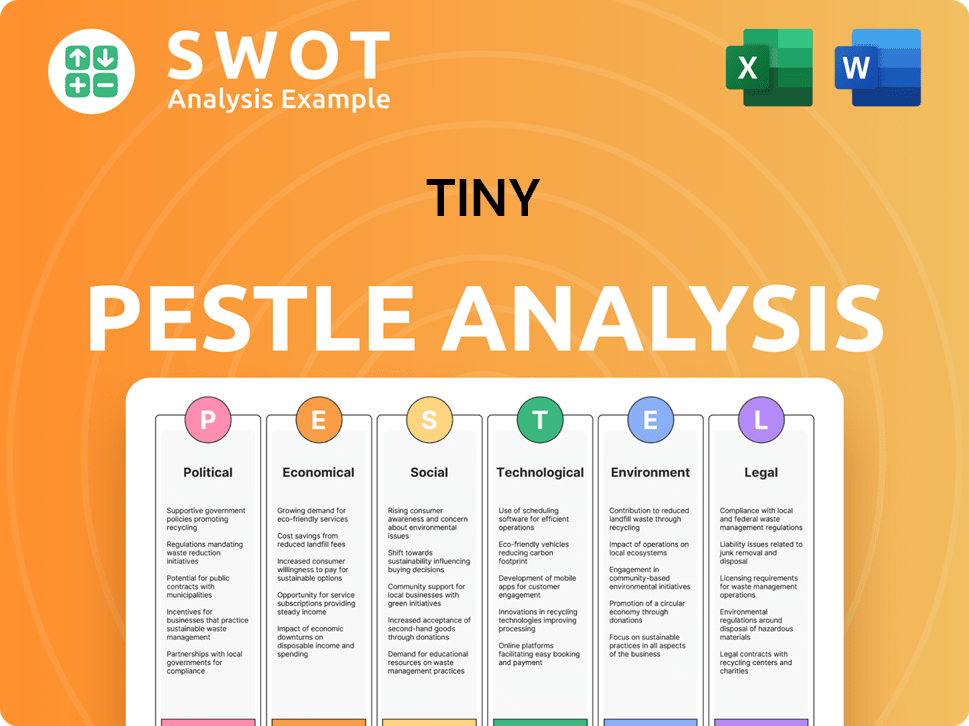

Tiny PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Tiny’s Growth Forecast?

The financial outlook for Tiny Technologies Inc. appears robust, driven by its strategic approach to acquisitions and a focus on profitable internet businesses. As a private entity, detailed financial reports aren't publicly available, unlike publicly traded companies. However, industry analysis consistently highlights Tiny's strong financial performance and its potential for long-term growth. This growth strategy centers on acquiring businesses with established revenue streams, contributing to a stable and expanding revenue base.

Tiny's financial model emphasizes acquiring businesses that are already generating positive cash flow. This approach helps to ensure that the company has a solid financial foundation. The company's investment strategy is primarily focused on making new acquisitions and strategically investing in existing holdings to boost growth and improve operational efficiency. The company's financial strategy prioritizes long-term value creation over short-term gains, aligning with its vision of building a durable portfolio of internet businesses.

While specific revenue targets for 2025 aren't disclosed, Tiny's historical performance indicates consistent growth. The company's investment levels are primarily geared towards new acquisitions and strategic investments within its existing holdings. Funding for these initiatives typically comes from retained earnings and, when strategic opportunities arise, through private capital raises. This financial strategy prioritizes long-term value creation, aligning with its vision of building a durable portfolio of internet businesses. For a deeper dive, you can explore the business development strategies in an article about Tiny.

Tiny's revenue growth is primarily driven by its acquisition strategy. The company acquires businesses with established revenue streams, leading to a steady increase in overall revenue. This approach enables Tiny to expand its financial base and achieve consistent growth rates. The focus is on acquiring profitable businesses that contribute to a stable and growing revenue stream.

Investment in new acquisitions and strategic investments within existing holdings is a key focus. Funding for these initiatives comes from retained earnings and private capital raises when strategic opportunities arise. This financial model supports the company's long-term value creation strategy. The company's financial strategy prioritizes long-term value creation over short-term gains.

Tiny focuses on acquiring profitable internet businesses. This strategy ensures a solid financial foundation and contributes to overall profitability. The emphasis on profitable businesses allows Tiny to maintain a stable financial position. The company aims to build a durable portfolio of internet businesses.

Tiny's financial strategy prioritizes long-term value creation over short-term gains. This approach aligns with the company's vision of building a durable portfolio of internet businesses. The focus on long-term value creation is a key aspect of Tiny's financial strategy. The company is focused on building a sustainable business model.

Tiny's financial strategies are centered around acquisitions, strategic investments, and long-term value creation. These strategies support the company's growth strategy and contribute to its positive financial outlook. The company focuses on building a sustainable and profitable business model.

- Acquisition of profitable businesses

- Strategic investments in existing holdings

- Prioritization of long-term value creation

- Use of retained earnings and private capital raises

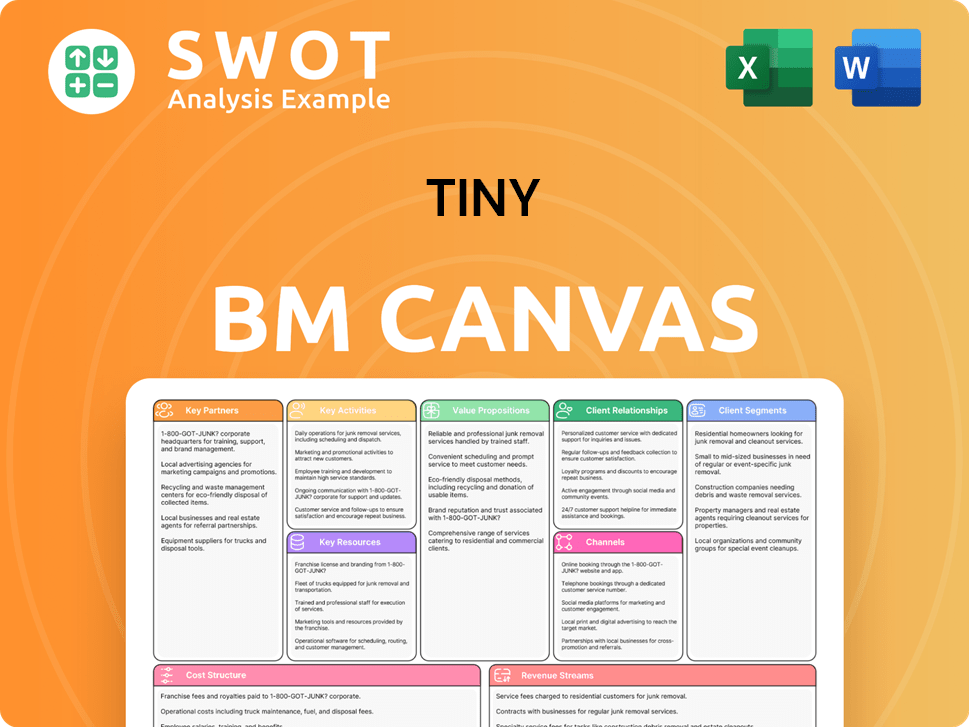

Tiny Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Tiny’s Growth?

The journey of a tiny company, while filled with potential, is not without its hurdles. Navigating the competitive landscape, adapting to technological shifts, and managing internal resources are all critical challenges. A robust understanding of these potential risks is crucial for informed decision-making and sustainable growth.

Market dynamics and regulatory changes present ongoing challenges. Tiny companies must stay agile and adaptable to maintain a competitive edge. Effective risk management and strategic planning are essential to mitigate potential threats and capitalize on emerging opportunities.

External factors such as economic volatility and supply chain disruptions can impact operations. Internal considerations, including talent acquisition and resource allocation, also require careful attention. Successfully addressing these risks is key to unlocking the future prospects of a tiny company.

The internet business landscape is highly competitive, with new entrants and established players constantly vying for market share. This intense competition requires continuous innovation and adaptation. Tiny companies need to differentiate themselves to succeed.

Changes in data privacy regulations and online commerce rules can create compliance burdens. These shifts can impact the profitability of portfolio companies. Staying informed and adapting to these changes is crucial.

Supply chain disruptions, especially in a volatile global economic climate, can affect e-commerce holdings. Diversifying suppliers and building resilient supply chains are essential strategies. The impact can be significant, as seen in recent years.

Rapid technological advancements can render existing business models obsolete. Tiny companies must be proactive in adopting new technologies. Investing in research and development is critical for long-term viability.

Internal resource constraints, such as skilled talent, can impede growth. Effective talent management and strategic partnerships are essential. Building a strong team is a key factor for success.

Economic downturns can impact consumer spending and investment. Tiny companies must prepare for economic fluctuations. Diversification and financial planning are essential for navigating economic uncertainties.

A robust risk management framework is crucial for a tiny company. This includes thorough due diligence before acquisitions, diversification across various internet sectors to mitigate industry-specific downturns, and ongoing scenario planning to anticipate and prepare for emerging challenges. The company's decentralized operational model also empowers individual portfolio companies to respond agilely to market shifts.

Market conditions can significantly affect a tiny company's performance. External factors such as economic downturns, changes in consumer behavior, and technological disruptions can create challenges. According to a 2024 report, the tech sector saw a decrease in funding, highlighting the impact of market volatility. Understanding these impacts is crucial for developing effective growth strategies.

Strategic planning and adaptability are essential for a tiny company's future. The ability to pivot and adjust to changing market conditions is critical. Analyzing market trends and anticipating future needs is essential for long-term success. In 2024, the focus on remote work and digital transformation continues to shape business strategies.

Effective financial planning and resource allocation are vital for navigating risks. Managing cash flow, securing funding, and making strategic investments are crucial. According to recent data, startups are increasingly focusing on profitability and sustainable growth models. For more insights, see the core values of Tiny.

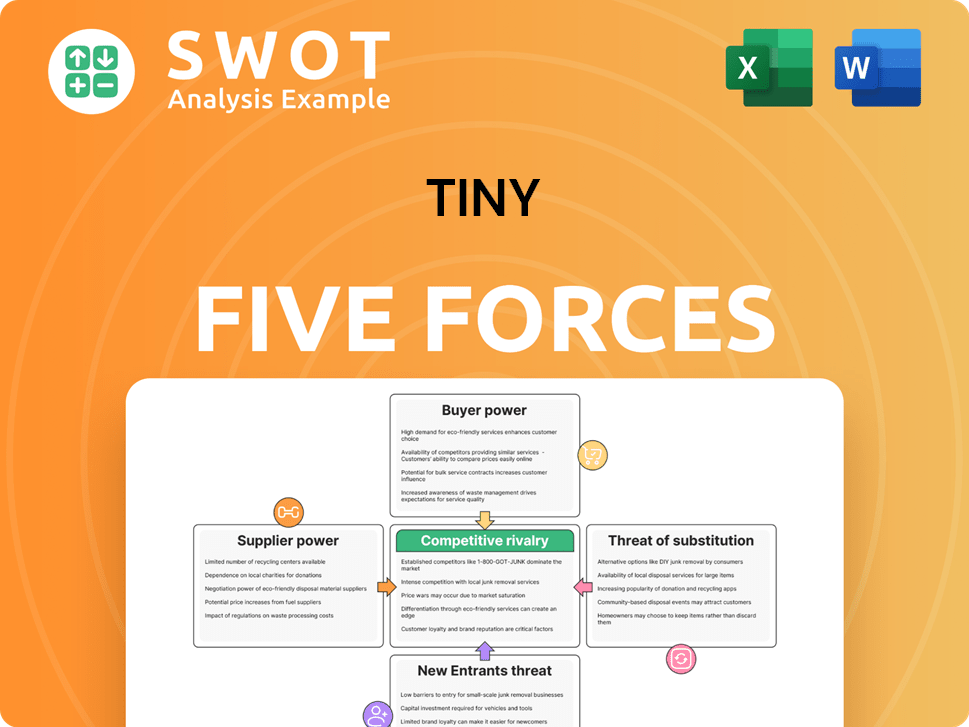

Tiny Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tiny Company?

- What is Competitive Landscape of Tiny Company?

- How Does Tiny Company Work?

- What is Sales and Marketing Strategy of Tiny Company?

- What is Brief History of Tiny Company?

- Who Owns Tiny Company?

- What is Customer Demographics and Target Market of Tiny Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.