Tiny Bundle

How Does Tiny Company Thrive in the Tech World?

Tiny Ltd. has carved a niche in the tech sector by acquiring and nurturing profitable internet businesses. This Canadian holding company's strategic approach has yielded impressive results, with substantial revenue growth and a focus on recurring income. Understanding the Tiny SWOT Analysis is key to unlocking the secrets behind its success.

Tiny Company's unique structure and business model, focusing on small business acquisitions, offer a compelling alternative to traditional investment strategies. Its decentralized approach and long-term investment horizon provide a fascinating case study for anyone interested in startups and micro businesses. Exploring Tiny Company's operations reveals how it generates revenue and sustains growth in a competitive landscape, making it a noteworthy entity for investors and industry observers alike.

What Are the Key Operations Driving Tiny’s Success?

The core operations of Tiny Company revolve around acquiring and nurturing established internet businesses. This strategy focuses on long-term ownership and decentralized management, allowing acquired companies to operate with considerable autonomy. Tiny's business model hinges on identifying and integrating profitable ventures across various digital sectors.

The value proposition of Tiny Company is built on its diverse portfolio of digital assets and its unique approach to acquisitions. By acquiring majority stakes in profitable companies, Tiny Company offers a stable and hands-off ownership model that allows acquired businesses to flourish. This approach contrasts with traditional business models, emphasizing long-term value creation over short-term gains.

Tiny Company's structure is designed to support a wide range of digital products and services. The company's portfolio includes digital services, software and apps, and creative platforms. This diversification helps mitigate risk and provides multiple revenue streams. The decentralized management style allows each company to focus on its core competencies, fostering innovation and agility within the portfolio.

Tiny Company's Digital Services segment includes companies like MetaLab, which assists businesses in designing and developing digital products. These services are crucial for companies seeking to enhance their online presence and user experience. This segment contributes significantly to Tiny Company's overall revenue.

The Software and Apps segment is a key component of Tiny Company's portfolio, featuring applications and themes, particularly within the Shopify ecosystem. Recent acquisitions, such as MediaNet and Repeat Inc., enhance its offerings. This segment targets the growing e-commerce market, providing essential tools for merchants.

Tiny Company's Creative Platform segment is anchored by Dribbble and Creative Market. Dribbble is a social network for designers, while Creative Market is a marketplace for digital assets. These platforms provide resources and opportunities for creatives, contributing to Tiny Company's diverse revenue streams.

Tiny Company's operational processes are highly decentralized, enabling each portfolio company to operate independently. This approach allows for faster decision-making and agility within individual businesses. The corporate management team focuses on capital allocation and strategic oversight.

Tiny Company's operational model is characterized by a founder-friendly acquisition approach. This approach ensures the acquired businesses retain their unique identities and operational strategies. This hands-off approach is a key differentiator in the market.

- Focus on acquiring companies with simple business models.

- Emphasis on healthy profitability and strong free cash flow generation.

- Prioritizing high-quality management teams.

- Decentralized management structure.

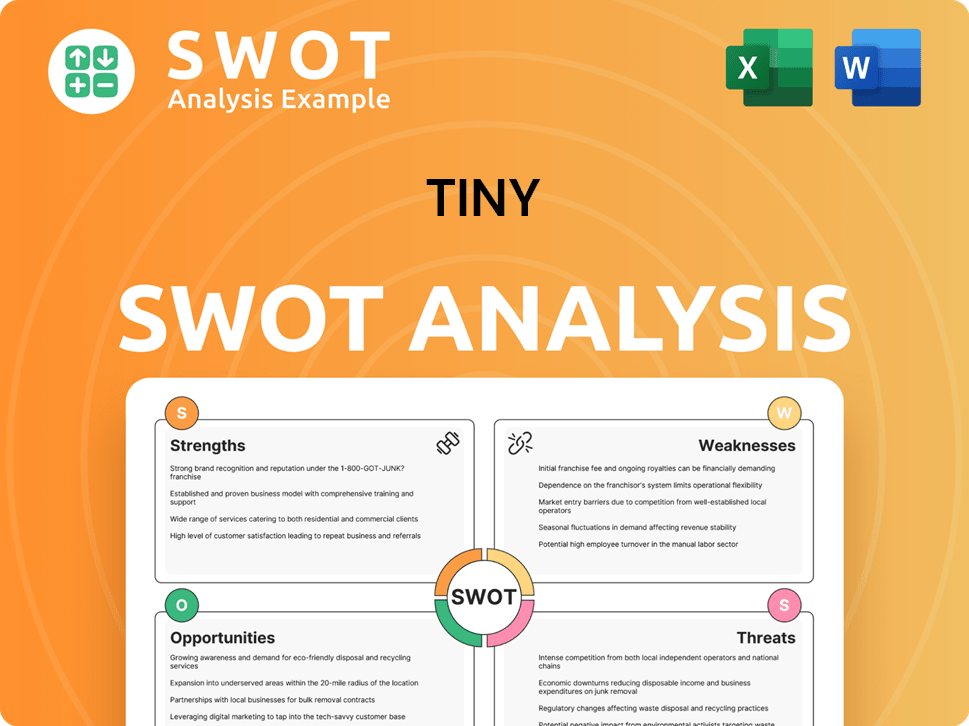

Tiny SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tiny Make Money?

The revenue streams and monetization strategies of the company are multifaceted, designed to capitalize on diverse market opportunities. This approach is central to the Tiny Company business model, ensuring financial resilience and growth across various segments.

In FY2024, the company reported a total revenue of $194.2 million, marking a 5% increase from the previous year. A key element of its strategy is the expansion of recurring revenue, which grew by 30% in FY2024, reaching $38.7 million and accounting for 20% of total revenue.

The company's revenue is generated through three primary segments: Digital Services, Software and Apps, and Creative Platform, along with distributions from its private equity fund. This diversification helps mitigate risks and fosters sustainable growth, especially important for a or

The company's focus on recurring revenue is a significant aspect of its monetization strategy. In Q1 2025, recurring revenue was $9.8 million, representing 20% of total revenue and showing a 6% increase over Q1 2024. This growth is driven by strategic acquisitions and the expansion of existing platforms.

- In Q1 2025, the company received $1.0 million in distributions from Tiny Fund I, in which it holds a 20.34% ownership stake.

- The Tiny Fund, with a total committed capital of US$150 million, provides cash distributions for the company.

- Dribbble launched its Products and Services offerings in Q1 2025, allowing direct transactions and expanding its monetization channels.

- The acquisition of Serato is expected to boost recurring revenue by approximately 45%, projecting an ARR of $55 million to $57 million.

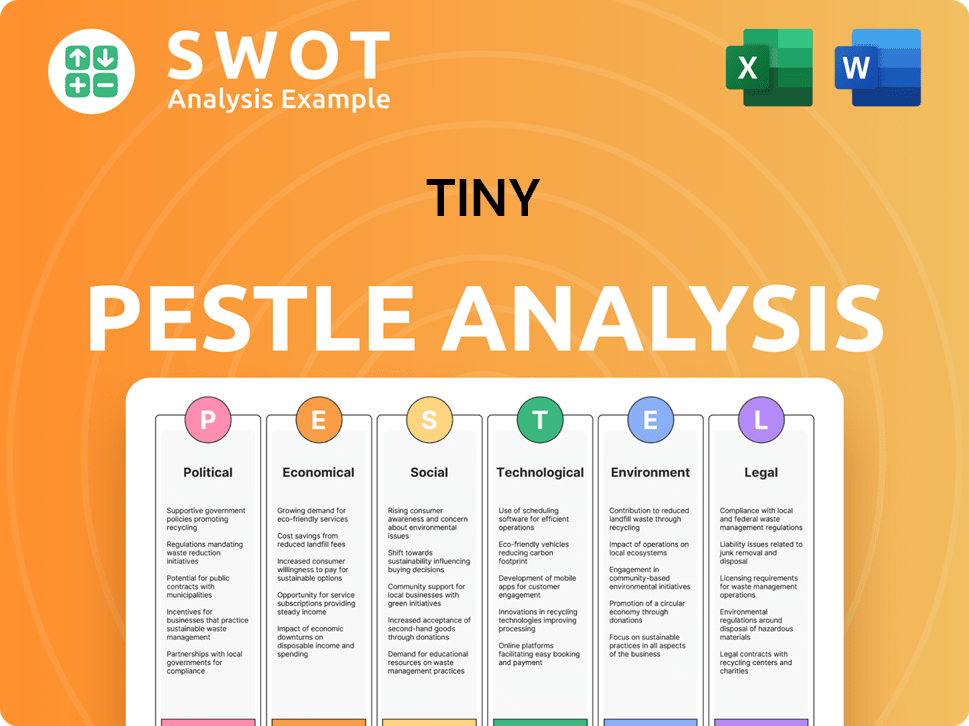

Tiny PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tiny’s Business Model?

The evolution of the [Company Name], or Tiny Company, has been marked by significant milestones, strategic maneuvers, and a distinct approach to building its portfolio. A key event was the amalgamation with WeCommerce in April 2023, which led to Tiny becoming a publicly traded entity. This move was pivotal in shaping its operational structure and financial performance. The company's focus on debt reduction and strategic acquisitions further highlights its growth strategy.

Tiny Company's strategic moves have been instrumental in its growth trajectory. The acquisition of Serato, finalized on May 12, 2025, is a prime example of its commitment to expanding its portfolio and boosting recurring revenue. This acquisition is expected to significantly increase both annual recurring revenue and Adjusted EBITDA. Additionally, the company's focus on cost rationalization, as seen in Q3 2024, demonstrates a commitment to operational efficiency.

The company's competitive edge lies in its unique business model and approach to acquisitions. Tiny Company's decentralized holding company model allows for efficient capital allocation and focused management across its diverse business portfolio. This structure, combined with a 'founder-friendly' acquisition strategy, sets it apart from traditional private equity firms, making it an attractive option for business owners.

The merger with WeCommerce in April 2023 was a pivotal event, transforming Tiny into a publicly traded company. In FY2024, the company focused on debt reduction, repaying $24.5 million. By the end of FY2024, net debt stood at $94.1 million. This commitment continued into Q1 2025, with an additional $5.2 million in debt repaid by March 31, 2025, bringing the total debt outstanding to $113.3 million.

Tiny Company has consistently pursued an acquisitive growth strategy, adding Repeat Inc., MediaNet Solutions Inc., and Wholesale Pet to its portfolio in FY2024. The acquisition of Serato, a leader in DJ software, closed on May 12, 2025. Cost rationalization initiatives in Q3 2024 are projected to reduce annualized operating expenses by over $4.0 million.

Tiny Company's decentralized holding company model enables efficient capital allocation and focused management. Its 'founder-friendly' acquisition approach and long-term holding strategy distinguish it from typical private equity firms. The company targets businesses with unique competitive advantages and predictable revenue streams. The ability to integrate operations, such as Stamped, Repeat, and KnoCommerce, enhances value for merchants. For more insights into the structure, you can read about Owners & Shareholders of Tiny.

The company's financial strategy focuses on debt reduction and strategic acquisitions. In FY2024, Tiny reduced its debt by $24.5 million, resulting in a net debt of $94.1 million. The acquisition of Serato is expected to significantly boost annual recurring revenue and Adjusted EBITDA. The focus on acquiring profitable businesses with strong cash flow contributes to stable returns and growth.

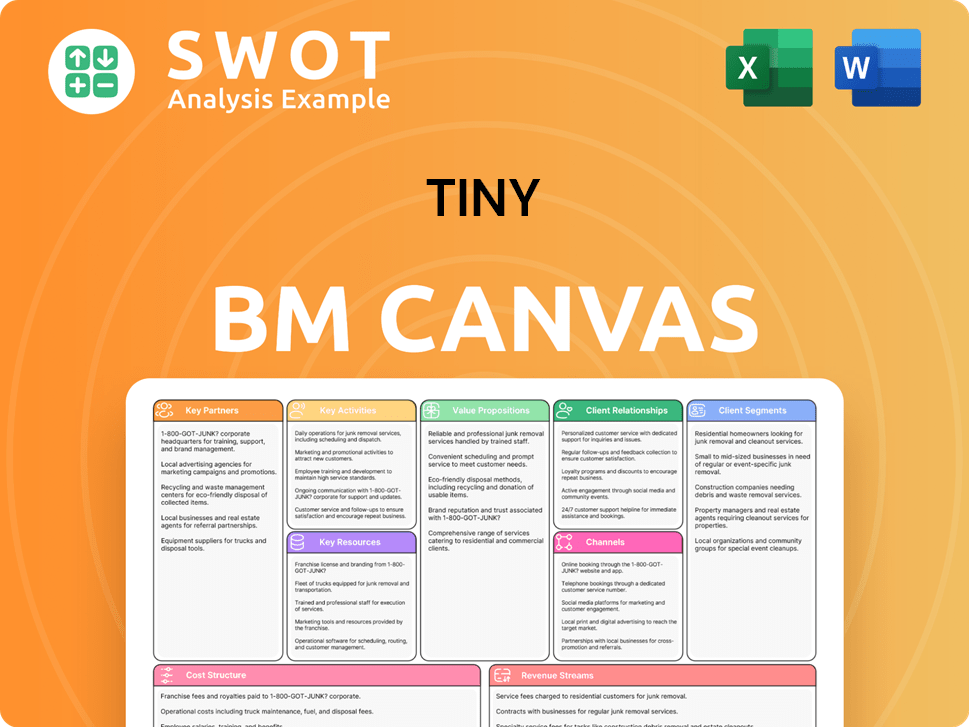

Tiny Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tiny Positioning Itself for Continued Success?

The [Company Name] distinguishes itself through its unique business model as a technology holding company. This structure allows it to acquire and operate a diverse portfolio of internet businesses, creating a broad presence across digital services, software, and creative platforms. Its market share is distributed among its individual portfolio companies, each competing in their respective sectors. Customer loyalty is tied to the strength of individual brands within the portfolio, such as Dribbble.

Geographically, [Company Name] primarily invests in North America and Europe, with the majority of its revenue generated from these regions. This focus allows the company to leverage established markets while managing its global operations. The company's success hinges on its ability to identify, acquire, and effectively manage a diverse range of internet businesses. Understanding the Marketing Strategy of Tiny is crucial for assessing its long-term growth potential.

The company faces risks including regulatory changes, new competitors, and technological disruptions. Reliance on the Shopify platform poses an additional risk. Fluctuations in foreign exchange rates, such as USD/CAD, also impact cash flow.

The company is focused on strategic initiatives to sustain and expand its ability to generate revenue. This includes debt reduction and evaluating acquisition opportunities. Management is committed to long-term growth through organic expansion, strategic acquisitions, and disciplined cost management.

In FY2024, [Company Name] reported a net loss of $47.6 million. However, operational metrics such as Adjusted EBITDA and cash flow from operations showed improvement. The company aims to increase its predictable, recurring revenue streams, which grew from $8.9 million in 2021 to $38.7 million in 2024.

The acquisition of Serato is expected to significantly enhance recurring revenue and Adjusted EBITDA. The leadership transition to a new CEO and CFO in 2024 is a key move aimed at positioning the company for long-term growth. The company's focus is on expanding its portfolio through strategic acquisitions and organic growth.

Understanding the [Company Name] business model requires a focus on its diverse portfolio and acquisition strategy. Key factors include managing risks associated with market changes and platform dependencies. Investors should monitor the company's financial performance and strategic initiatives, especially its ability to increase recurring revenue.

- Diversified Portfolio: The company operates across various sectors, reducing reliance on any single industry.

- Acquisition Strategy: The company actively seeks to acquire and integrate new businesses into its portfolio.

- Financial Performance: Focus on Adjusted EBITDA and cash flow from operations, despite net losses in FY2024.

- Recurring Revenue Growth: The company aims to increase predictable revenue streams, with significant growth from 2021 to 2024.

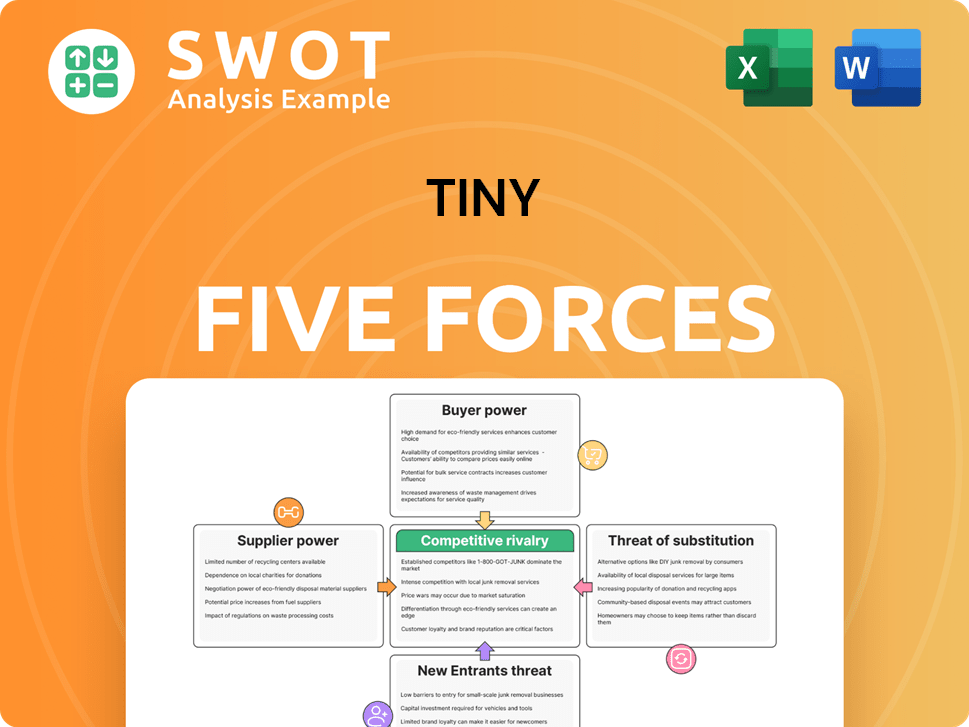

Tiny Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tiny Company?

- What is Competitive Landscape of Tiny Company?

- What is Growth Strategy and Future Prospects of Tiny Company?

- What is Sales and Marketing Strategy of Tiny Company?

- What is Brief History of Tiny Company?

- Who Owns Tiny Company?

- What is Customer Demographics and Target Market of Tiny Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.