Transaction Capital Bundle

How Did Transaction Capital Become a South African Financial Powerhouse?

Embark on a journey through the Transaction Capital SWOT Analysis to uncover the remarkable story of a South African company that transformed the financial services landscape. From its humble beginnings, Transaction Capital has consistently demonstrated innovation and resilience, building a significant presence in the credit and related services sector. Discover the key milestones and strategic decisions that shaped this financial services giant.

This brief history of Transaction Capital explores its evolution, tracing its roots from a vision to disrupt traditional models to its current status as a key player. Understanding the Transaction Capital company background provides valuable insights into its business model and strategic focus. Explore the company's commitment to underserved markets and its impact on economic inclusion and financial stability in South Africa.

What is the Transaction Capital Founding Story?

The story of Transaction Capital, a prominent South African company, began in 2005. It was founded by Jonathan Jawno, Michael Mendelowitz, and Roberto Rossi. Their vision was to offer credit and related financial services to underserved markets within South Africa, marking the start of the Transaction Capital history.

The founders identified a significant gap in the market. Traditional financial institutions often avoided the informal sectors due to perceived risks. Their combined expertise in finance and business management was crucial. This allowed them to navigate a challenging yet opportunity-rich environment. This is a key part of the Transaction Capital company background.

The initial challenge was the lack of accessible financing options. This was especially true for individuals and small businesses. The minibus taxi industry, a cornerstone of South African public transport, was a primary focus. This led to Transaction Capital's business model of providing tailored credit solutions and debt collection services.

Transaction Capital's founding was driven by the need to serve underserved markets. The founders' backgrounds in finance and business management were crucial for navigating the complexities of the South African market. The company's initial focus was on providing credit solutions to the minibus taxi industry.

- Founding Year: 2005

- Founders: Jonathan Jawno, Michael Mendelowitz, and Roberto Rossi

- Initial Focus: Minibus taxi industry

- Key Services: Credit solutions and debt collection

The initial funding came from founder capital and early investment rounds. This demonstrated confidence in their business proposition. An important aspect of their approach was direct engagement with taxi operators. This helped build trust and understand their financial challenges. This direct engagement shaped their product offerings.

The economic context of post-apartheid South Africa played a significant role. It emphasized economic empowerment and development. This aligned with the national objective of inclusive economic growth. The Owners & Shareholders of Transaction Capital article provides further insights into the company's evolution.

As of 2024, the company has expanded its services. It now includes a range of financial solutions. These solutions cater to various sectors within South Africa. The company's growth reflects its ability to adapt to market needs. It also highlights its commitment to serving its target markets.

The Transaction Capital company overview reveals a history of strategic decisions. These decisions have driven its growth. The company's focus on underserved markets has been a key differentiator. This has allowed it to build a strong presence in the South African financial landscape. The Transaction Capital company timeline shows a consistent expansion of its services.

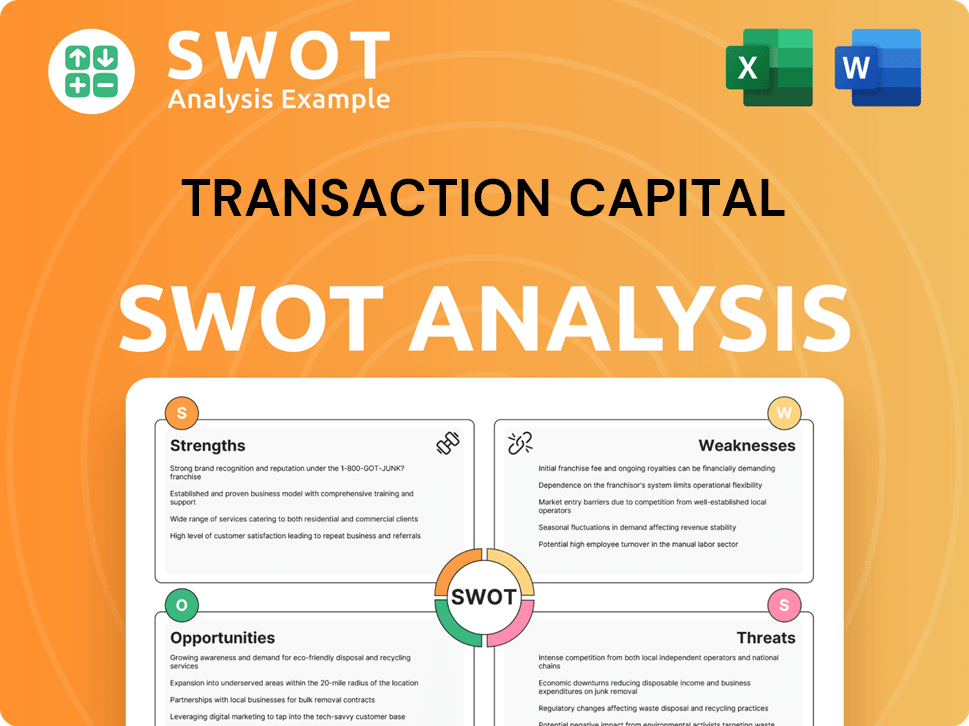

Transaction Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Transaction Capital?

The early growth of Transaction Capital, a South African company, was marked by focused expansion in credit and debt collection, especially within the minibus taxi industry. Founded in 2005, the Transaction Capital company quickly established SA Taxi, a division providing financing and insurance to taxi operators. This specialization allowed the company to build expertise and a strong reputation in a key economic sector.

Key developments included refining credit assessment models for the minibus taxi industry, leading to more efficient lending. Team expansion focused on credit specialists and risk analysts. Transaction Capital's initial milestones involved significant market penetration in taxi financing and robust debt collection capabilities.

Strategic growth continued with acquisitions and expanded service offerings. The 2021 acquisition of WeBuyCars broadened revenue streams. Significant capital raises funded operations and acquisitions. Leadership transitions brought in seasoned executives. For a deeper dive, explore the Competitors Landscape of Transaction Capital.

Market reception was largely positive due to the value proposition in an underserved market, despite the competitive landscape. These shifts in the business model, especially through acquisitions like WeBuyCars, were pivotal. By the end of 2023, SA Taxi's vehicle finance portfolio was at R17.3 billion.

The Transaction Capital company evolved from a specialized credit provider to a broader financial services group. This transformation was driven by strategic acquisitions and a focus on expanding its service offerings. The early focus on the SA taxi industry provided a strong foundation for this expansion.

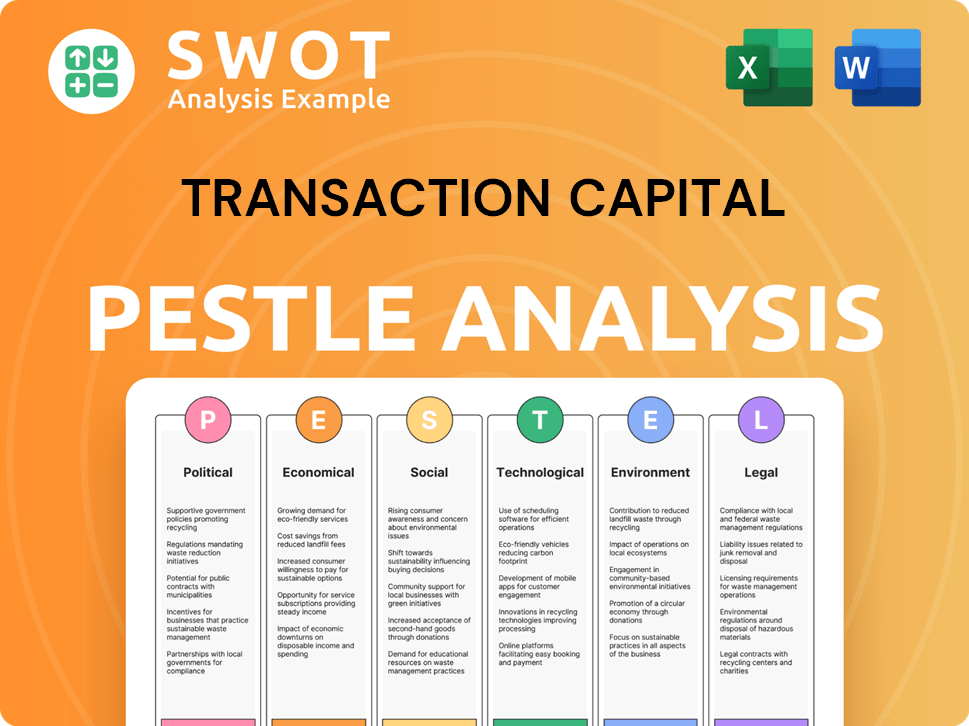

Transaction Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Transaction Capital history?

The Transaction Capital history is marked by strategic pivots and responses to market dynamics, establishing itself as a key player in the South African financial services sector. The company has demonstrated resilience and adaptability, consistently evolving its business model to meet the challenges and opportunities within the credit and transport industries.

| Year | Milestone |

|---|---|

| Early 2000s | Transaction Capital was founded, focusing on providing financial services within the informal transport sector. |

| 2006 | SA Taxi was established, offering financing, insurance, and other services to taxi operators, creating a vertically integrated platform. |

| 2010s | Transaction Capital expanded its services and market reach, adapting to changing economic conditions and regulatory landscapes. |

| 2022 | Acquisition of WeBuyCars, diversifying revenue streams and expanding into the used car market. |

| 2023 | Restructuring efforts within SA Taxi to improve profitability and efficiency, addressing challenges in the minibus taxi industry. |

A significant innovation for Transaction Capital has been its data-driven approach to credit assessment, particularly within the informal transport sector. This approach allowed for financing solutions where traditional banks often hesitated.

Utilizing data analytics to assess risk and provide financing to the informal transport sector, a segment often underserved by traditional financial institutions. This approach enabled the company to make informed lending decisions.

Establishing SA Taxi as a vertically integrated platform, offering financing, insurance, vehicle tracking, and maintenance services, creating a comprehensive ecosystem for taxi operators. This model provided a holistic solution.

The acquisition of WeBuyCars, a strategic move to diversify revenue streams and reduce reliance on the taxi industry. This expansion demonstrated the company's adaptability.

Transaction Capital has faced challenges, including market downturns and regulatory shifts in the credit and transport sectors. The economic pressures of 2023 significantly impacted the SA Taxi division, leading to a decline in earnings.

Economic pressures and market fluctuations, such as those experienced in 2023, have impacted the SA Taxi division, affecting earnings and requiring strategic adjustments. The company has had to navigate challenging economic conditions.

Changes in regulations within the credit and transport sectors have presented challenges, requiring the company to adapt its strategies and operations. These shifts have influenced the company's strategic direction.

Rising fuel costs and operational expenses within the minibus taxi industry have put pressure on the core business. These factors have necessitated strategic responses.

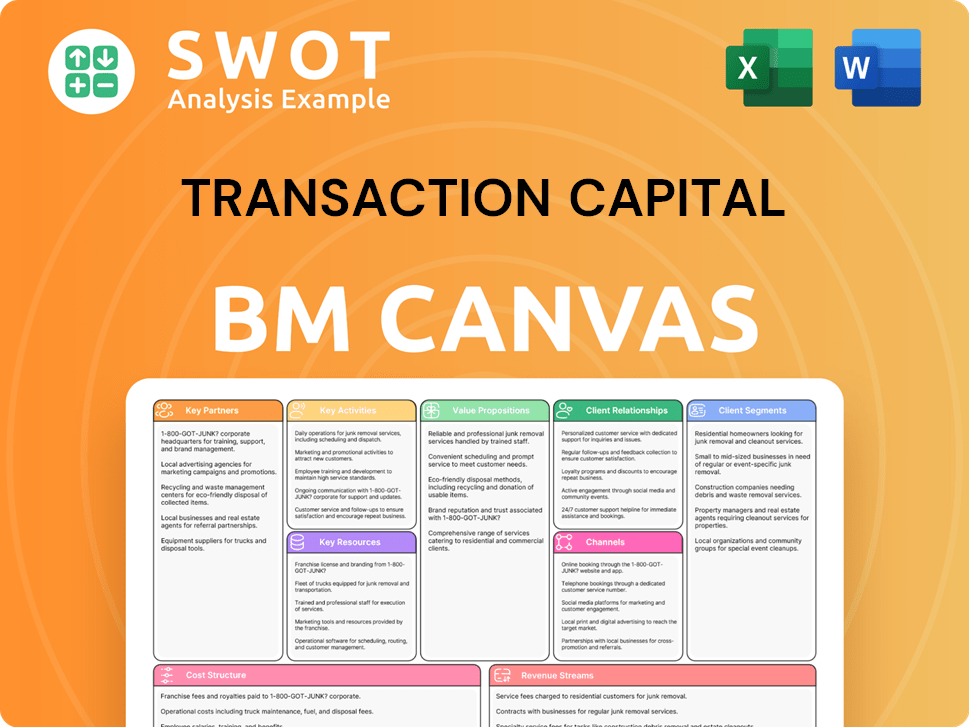

Transaction Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Transaction Capital?

The Transaction Capital story is marked by strategic moves and adaptation. Founded in 2005, the

| Year | Key Event |

|---|---|

| 2005 | Transaction Capital founded, focusing on credit and related services. |

| 2008 | Establishment of SA Taxi, providing financing and services for the minibus taxi industry. |

| 2012 | Listing on the Johannesburg Stock Exchange (JSE). |

| 2015 | Expansion of SA Taxi's integrated services to include insurance and vehicle tracking. |

| 2019 | Acquisition of Transaction Capital Risk Services (TCRS), strengthening debt collection. |

| 2021 | Acquisition of a majority stake in WeBuyCars, diversifying into the used vehicle market. |

| 2023 | Challenging trading conditions for SA Taxi lead to strategic restructuring. |

| 2024 | Continued focus on optimizing SA Taxi's operations and leveraging the growth of WeBuyCars. |

The future of

WeBuyCars is a key driver for future performance, with plans for continued expansion in the used car market. In 2023, WeBuyCars showed strong growth in units sold and revenue. This underscores its potential as a significant growth engine for the company. The used vehicle market is a significant growth area.

Digitalization of financial services and changing vehicle ownership behaviors will impact Transaction Capital. The company plans to leverage technology to improve service offerings and operational efficiency. This includes enhancing customer experience and streamlining internal processes. The focus is on innovation.

Analyst predictions suggest a cautious but optimistic outlook for Transaction Capital. Recovery in the SA Taxi division and continued strong performance from WeBuyCars are expected. This will contribute to overall group profitability. The market anticipates positive developments.

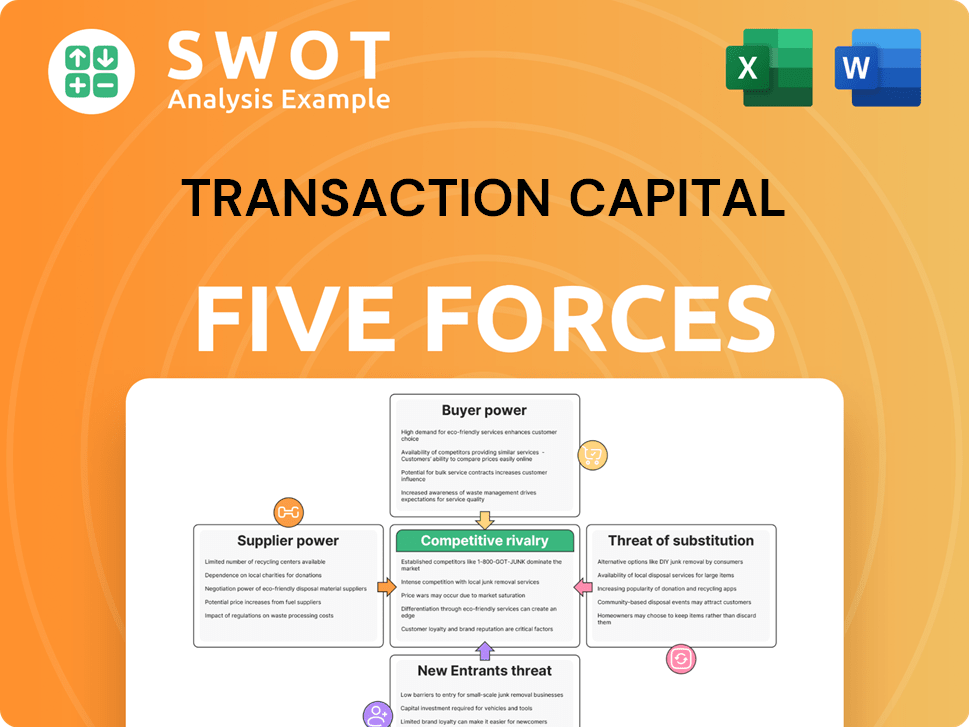

Transaction Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Transaction Capital Company?

- What is Growth Strategy and Future Prospects of Transaction Capital Company?

- How Does Transaction Capital Company Work?

- What is Sales and Marketing Strategy of Transaction Capital Company?

- What is Brief History of Transaction Capital Company?

- Who Owns Transaction Capital Company?

- What is Customer Demographics and Target Market of Transaction Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.