TreeHouse Foods Bundle

How Did TreeHouse Foods Rise to Private Label Dominance?

Ever wondered how a company can transform from a spin-off to a major player in the food industry? TreeHouse Foods, a leading name in private label foods, offers a fascinating case study. Its story begins with a strategic move in 2005, setting the stage for remarkable growth. Let's dive into the TreeHouse Foods SWOT Analysis to understand its journey.

From its founding as Bay Valley Foods, LLC, TreeHouse Foods has consistently focused on strategic TreeHouse Foods acquisitions to expand its TreeHouse Foods products portfolio and market reach. This commitment has solidified its position as a key TreeHouse Foods private label food manufacturer, offering cost-effective alternatives to national TreeHouse Foods brands. Exploring the TreeHouse Foods company timeline will reveal the key milestones that have shaped its success and current market share within the competitive landscape.

What is the TreeHouse Foods Founding Story?

The story of TreeHouse Foods began in 2005, marking its emergence from Dean Foods' Specialty Foods Group. This spin-off created an independent, publicly traded entity focused on the private label food market. The company quickly established itself, trading on the New York Stock Exchange under the ticker THS from June 2005.

The initial strategy of the TreeHouse Foods company centered on growth through acquisitions. This approach was facilitated by a low debt profile at its inception. The company saw a significant opportunity in the private label sector, which was experiencing consistent growth.

The first products offered by the new entity were primarily inherited from Dean Foods' Specialty Foods Group. These included items like pickles, dips, dressings, and nondairy creamers. Notably, Michelle Obama served on the board of directors from 2005 to 2007. The founding team, composed of former Keebler executives, aimed to build a substantial company through strategic acquisitions rather than organic product development.

TreeHouse Foods was founded in 2005 as a spin-off from Dean Foods.

- Initial debt at the end of 2005 was only $6.1 million.

- The company focused on the private label market.

- The first products included pickles, dips, and nondairy creamers.

- Michelle Obama was on the board of directors from 2005 to 2007.

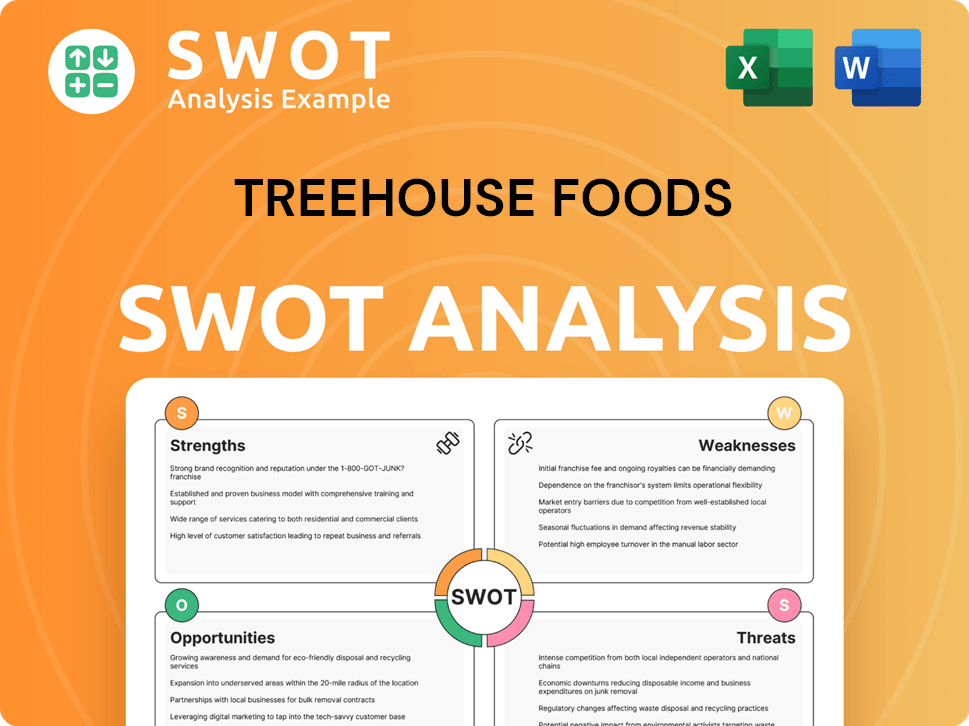

TreeHouse Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TreeHouse Foods?

The early years of TreeHouse Foods were marked by aggressive expansion through strategic acquisitions. This approach quickly transformed the company into a significant player in the private label food industry. These moves allowed the company to rapidly broaden its product offerings and increase its market presence across North America.

In March 2006,

The company continued its expansion in 2007 with the acquisition of the salsa and picante business of San Antonio Farms. Additionally, it acquired E. D. Smith, a producer of jams, jellies, syrups, and pie fillings. These acquisitions helped to broaden the company's product offerings.

A pivotal acquisition occurred in December 2009 when

By 2010, just five years after its creation,

In 2013,

These strategic acquisitions were central to

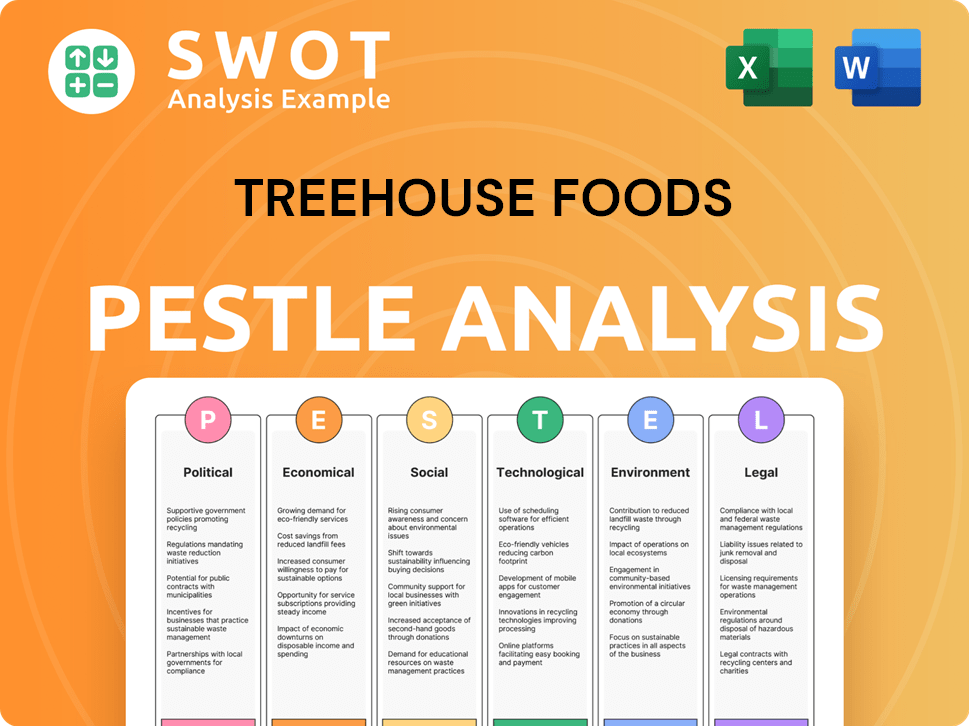

TreeHouse Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TreeHouse Foods history?

The TreeHouse Foods company has experienced significant milestones throughout its history, notably its strategic acquisitions and its evolution in the private label food and beverage sector. These key moments have shaped its market position and operational strategies.

| Year | Milestone |

|---|---|

| 2016 | Acquired Ralcorp, ConAgra Foods' private-brand business division, for $2.7 billion, significantly increasing its revenue. |

| 2016 | Initially faced integration challenges and weaker-than-expected performance from the acquired business, leading to a lowered full-year earnings forecast. |

| 2025 | The Brantford, Ontario facility involved in the waffle and pancake recall resumed shipping in the first quarter. |

TreeHouse Foods focuses on developing new products to meet evolving consumer preferences within the private label space. The company aims to be a top player in scale, growth, and platform-specific capabilities, supported by investments in operational efficiencies.

TreeHouse Foods continuously introduces new

Investments in operational efficiencies are a key focus for TreeHouse Foods. The company aims to streamline processes and reduce costs to improve profitability.

The company is actively working on improving its supply chain. This includes initiatives like the TreeHouse Management Operating System (TMOS) to enhance efficiency.

TreeHouse Foods is focused on sharpening procurement and optimizing its logistics and distribution network. This helps in managing costs effectively.

In early 2025, the company implemented organizational changes, including layoffs of approximately 150 corporate staff. This was done to streamline operations and improve profitability.

While not explicitly detailed in the provided text, TreeHouse Foods likely incorporates sustainability initiatives. This would involve efforts to reduce environmental impact across its operations.

TreeHouse Foods has faced challenges including supply chain issues, inflationary pressures, and macroeconomic impacts on consumer behavior. In 2024, the company's net sales decreased, and it experienced a decline in net income due to these factors.

Supply chain headwinds have negatively impacted TreeHouse Foods. This included issues at a broth facility and a significant product recall.

Inflationary pressures have affected the company's financial performance. Rising costs have impacted profitability.

Broader macroeconomic concerns have influenced consumer behavior. This has led to changes in purchasing patterns and demand.

In 2024, net sales fell 2.3% to $3.35 billion. Net income was $26.9 million, down from $53.1 million in 2023.

A major recall of frozen waffle and pancake products occurred in October 2024 due to potential Listeria monocytogenes contamination. This impacted sales and profitability.

TreeHouse Foods aims to achieve $250 million in gross supply chain savings by 2027. In 2024, the company reported $60 million in savings.

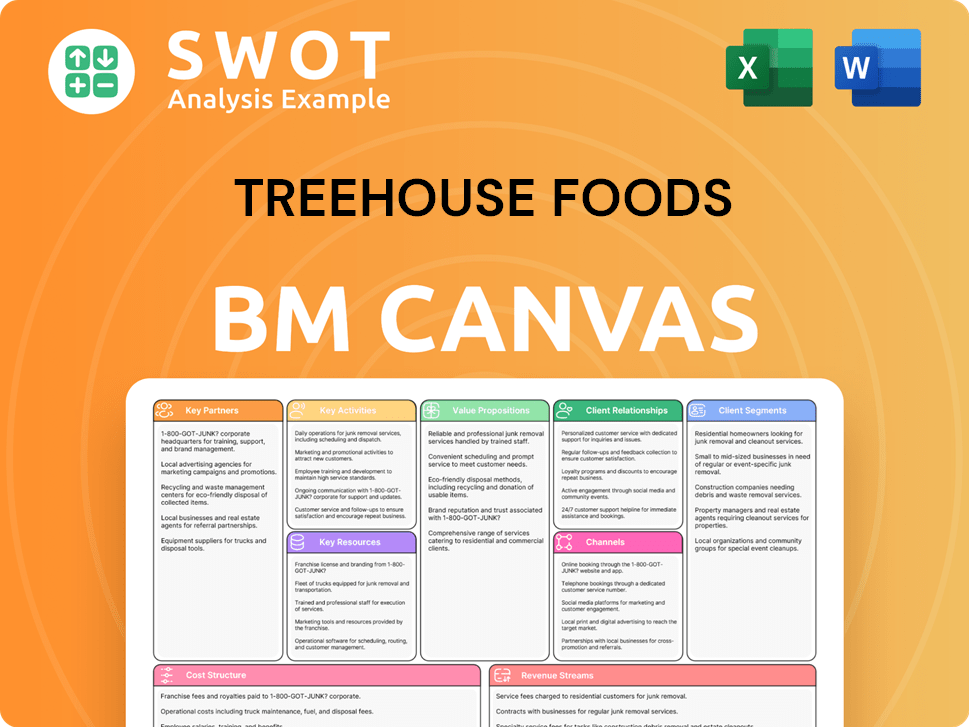

TreeHouse Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TreeHouse Foods?

The Owners & Shareholders of TreeHouse Foods have witnessed a significant evolution since its inception. Initially spun off from Dean Foods in 2005, the company quickly expanded through strategic acquisitions, transforming itself into a major player in the private label food industry. This journey, marked by both growth and strategic realignments, has shaped the company's current position and future outlook.

| Year | Key Event |

|---|---|

| 2005 | TreeHouse Foods was founded as a spin-off from Dean Foods and began trading on the NYSE. |

| 2006 | Acquired Del Monte Foods Company's private-label and foodservice soup businesses. |

| 2007 | Acquired the salsa and picante business of San Antonio Farms and E. D. Smith. |

| 2009 | Acquired Sturm Foods, significantly expanding its dry grocery offerings. |

| 2010 | Achieved $2 billion in sales and was named '2010 Processor of the Year' by Food Processing magazine. |

| 2013 | Acquired Naturally Fresh, Inc., Cains Foods, and Associated Brands. |

| 2014 | Acquired Protenergy Natural Foods and Flagstone Foods, entering the healthy snacks category. |

| 2016 | Acquired Ralcorp, ConAgra Foods' private-brand business division, for $2.7 billion. |

| 2020 | Acquired the majority of Ebro's Riviana Foods U.S. branded pasta business. |

| 2022 | Divested a significant portion of its Meal Preparation business to focus on higher-growth snacking and beverage categories. |

| October 2024 | Initiated a voluntary recall of frozen griddle products due to potential Listeria monocytogenes contamination. |

| December 2024 | Completed the acquisition of Harris Tea, bolstering its private label tea category. |

| February 2025 | Reported full-year 2024 results, with net sales of $3.35 billion and adjusted EBITDA of $337.4 million, and outlined a plan to boost profitability. |

| April 2025 | Implemented planned operational enhancement actions, including centralizing corporate support functions and eliminating approximately 150 roles, and reaffirms its 2025 financial outlook. |

| May 2025 | Reported first-quarter 2025 results with net sales of $792 million and adjusted EBITDA of $57.5 million, despite a net loss of $31.8 million. |

For fiscal year 2025, the company anticipates adjusted net sales to be in the range of $3.34 billion to $3.40 billion. This projection indicates a possible 1% decrease to a 1% increase compared to the $3.35 billion in net sales reported in 2024.

Adjusted EBITDA for 2025 is forecasted between $345 million and $375 million. This would represent a growth of 2% to 11% from the $337.4 million recorded in 2024, indicating a focus on improving profitability through operational efficiencies.

TreeHouse Foods expects to generate at least $130 million in free cash flow during 2025. This financial metric is crucial for evaluating the company's ability to fund operations and pursue strategic investments.

The company's strategy includes enhancing the supply chain and optimizing costs, aiming for $250 million in gross supply chain savings by 2027. Investments in organic and inorganic growth, along with a strong balance sheet, are key priorities.

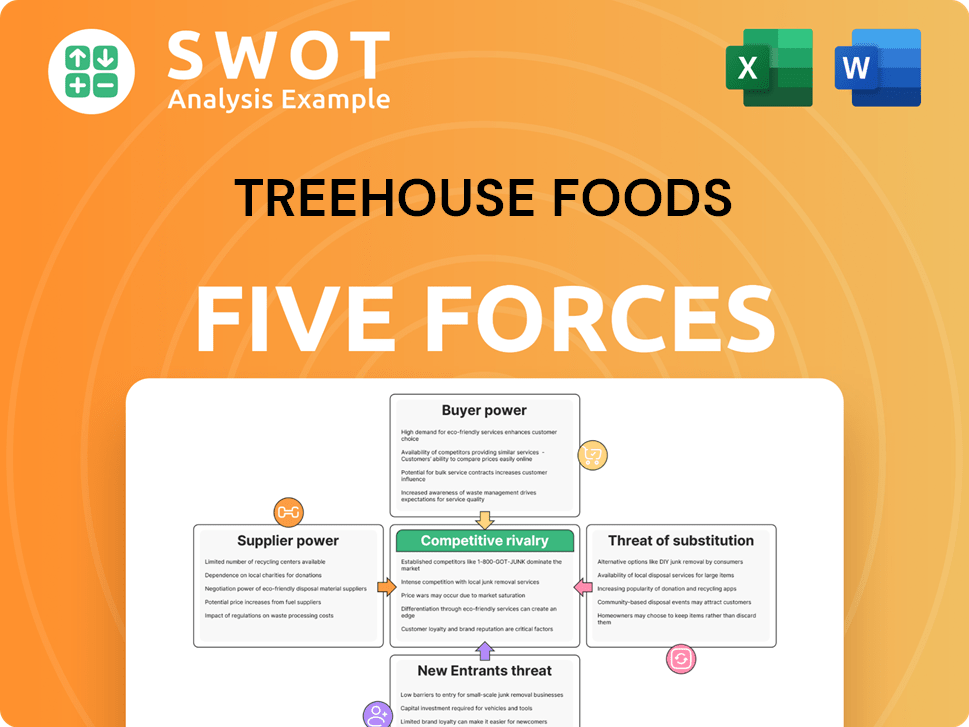

TreeHouse Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TreeHouse Foods Company?

- What is Growth Strategy and Future Prospects of TreeHouse Foods Company?

- How Does TreeHouse Foods Company Work?

- What is Sales and Marketing Strategy of TreeHouse Foods Company?

- What is Brief History of TreeHouse Foods Company?

- Who Owns TreeHouse Foods Company?

- What is Customer Demographics and Target Market of TreeHouse Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.