TreeHouse Foods Bundle

Unpacking TreeHouse Foods: How Does This Food Giant Operate?

TreeHouse Foods, a major player in the North American private label food market, boasts a vast portfolio and a significant market presence. With impressive Q1 2024 net sales, the TreeHouse Foods SWOT Analysis is crucial for understanding its operations. This deep dive explores the inner workings of a company that shapes the consumer packaged goods landscape.

For anyone interested in the food manufacturing sector, understanding the TreeHouse Foods business model is essential. This analysis will reveal how TreeHouse Foods generates revenue, its strategic moves, and its competitive advantages within the private label food industry. Whether you're tracking TreeHouse Foods stock or simply curious about its product categories, this exploration offers valuable insights into its financial performance and future trajectory.

What Are the Key Operations Driving TreeHouse Foods’s Success?

The core operations of the TreeHouse Foods company revolve around the manufacturing and distribution of private label food and beverage products. This business model allows the company to serve a wide array of retail grocery and foodservice clients across North America. TreeHouse Foods specializes in creating products that meet the specific branding needs of its customers, enabling them to offer their own branded goods to consumers.

The company's offerings span a broad spectrum, including baked goods, beverages, condiments, and snack items. TreeHouse Foods' focus on private label production distinguishes it from branded food manufacturers, positioning it as a strategic partner for retailers looking to expand their own-brand offerings. This approach allows retailers to build their own brands, enhance customer loyalty, and improve profit margins.

TreeHouse Foods' operational process is highly efficient and vertically integrated. It encompasses careful sourcing of raw materials, advanced manufacturing processes across its network of production facilities, stringent quality control, and a robust logistics and distribution network. The company leverages its scale to achieve economies of scale in procurement and production, which translates into competitive pricing for its private label partners. Its supply chain is designed to be agile and responsive to customer demands and market trends, ensuring timely delivery of products.

TreeHouse Foods utilizes advanced manufacturing processes across its network of production facilities. The company focuses on efficiency and quality control to meet the specific requirements of its customers. This includes careful sourcing of raw materials and a robust supply chain to ensure timely delivery.

The value proposition of TreeHouse Foods lies in its ability to provide high-quality, cost-effective private label solutions. This allows retailers to build their own brands, enhance customer loyalty, and improve profit margins. The company's focus on private label production sets it apart from branded food manufacturers.

TreeHouse Foods serves a wide array of retail grocery and foodservice clients across North America. The company's customer base includes major retailers seeking private label food and beverage products. The company's ability to meet diverse customer needs is a key factor in its success.

The supply chain of TreeHouse Foods is designed to be agile and responsive to customer demands and market trends. This ensures timely delivery of products. The company's efficient supply chain management is crucial for maintaining its competitive edge.

In recent years, TreeHouse Foods has demonstrated resilience in the private label food market. The company's financial performance reflects its strategic focus on private label offerings. For detailed insights into the company's ownership structure and financial performance, consider exploring the information at Owners & Shareholders of TreeHouse Foods.

- 2023: The company's focus on private label brands allowed it to navigate economic challenges.

- Market Position: TreeHouse Foods holds a significant position in the North American private label food market.

- Revenue: The company's annual revenue figures reflect its strong market presence and operational efficiency.

- Strategic Initiatives: TreeHouse Foods continues to pursue strategic initiatives to enhance its market position.

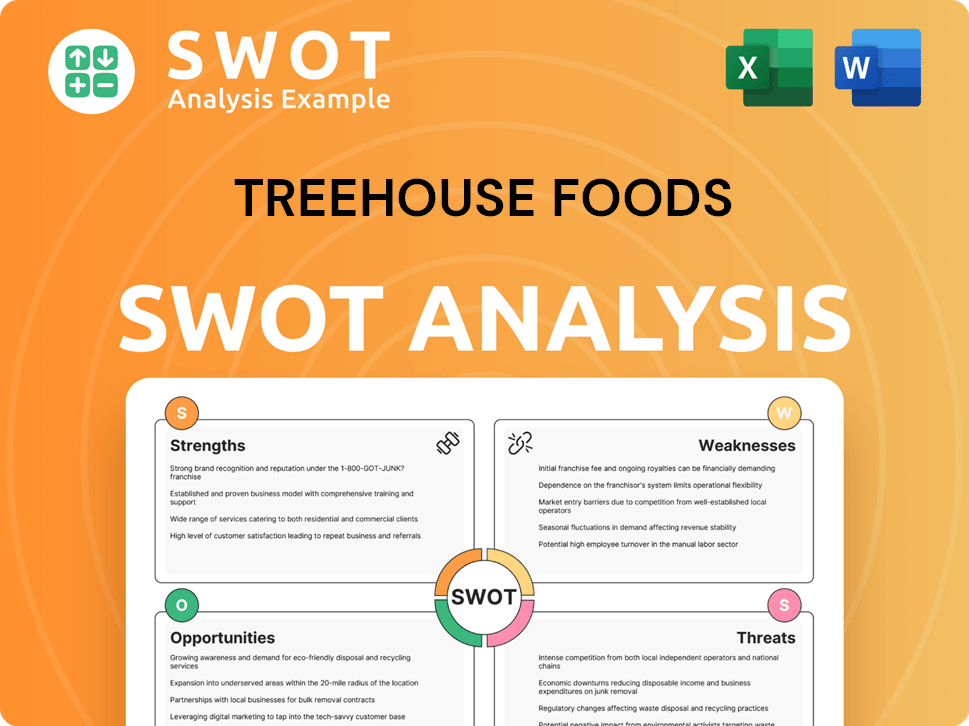

TreeHouse Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TreeHouse Foods Make Money?

The primary revenue stream for the TreeHouse Foods company is the sale of private label food and beverage products. These products are sold to retail grocery and foodservice customers. The company's financial performance is heavily reliant on its ability to generate sales across its diverse product categories.

In the first quarter of 2024, TreeHouse Foods reported net sales of $904.5 million. This figure underscores the significance of its core product offerings in driving revenue. The company's monetization strategy focuses on providing a comprehensive range of private label solutions.

TreeHouse Foods' monetization strategy centers on offering a wide array of private label solutions. This allows customers to source various products from a single, dependable supplier. The company leverages its manufacturing capabilities and supply chain efficiencies to provide competitive pricing, a key differentiator in the private label market.

TreeHouse Foods generates revenue by selling private label products. They focus on providing a wide range of products to their customers. The company's approach includes optimizing product mix and operational efficiencies.

- Product Sales: The main source of revenue comes from selling private label food and beverage products.

- Customer Base: Customers include retail grocery and foodservice businesses.

- Competitive Pricing: TreeHouse Foods uses manufacturing and supply chain efficiencies to offer competitive prices.

- Operational Efficiency: The company continuously works on improving its product mix and operational efficiency to maximize profitability.

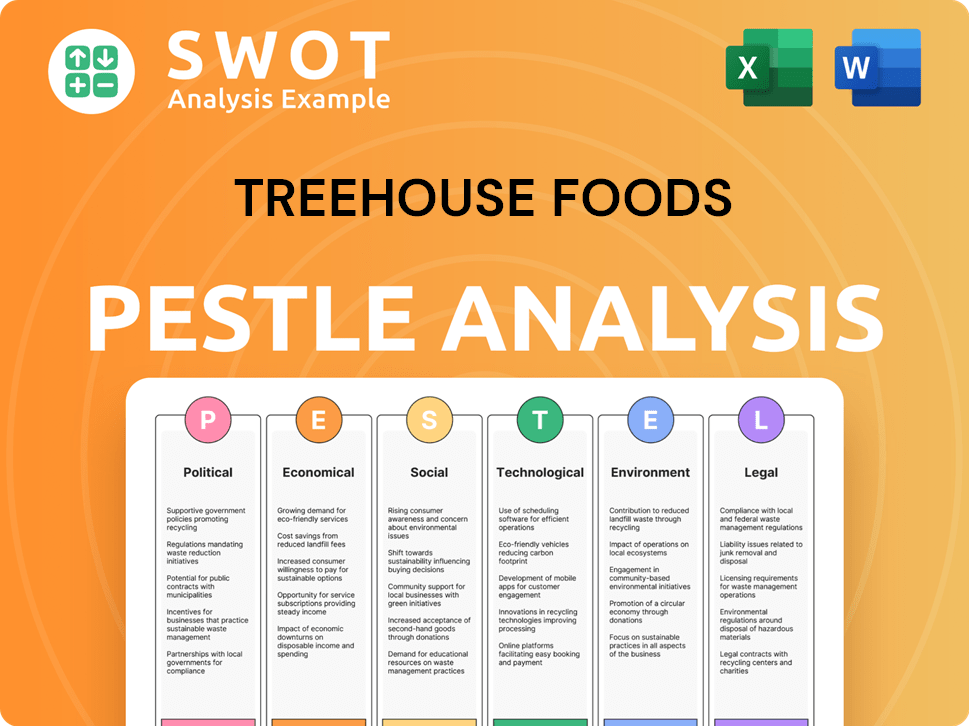

TreeHouse Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TreeHouse Foods’s Business Model?

TreeHouse Foods, a prominent player in the food manufacturing sector, has navigated significant strategic shifts and operational challenges. The company's journey reflects a commitment to adapting to market dynamics and enhancing its competitive position. A key element of its strategy involves focusing on core strengths, particularly in the private label food market.

One of the most impactful strategic moves for the TreeHouse Foods company was the divestiture of a substantial portion of its Meal Preparation business in 2022. This strategic realignment included the sale of its pasta, dry dinners, and hot cereal businesses. This move aimed to streamline operations and concentrate on higher-growth areas like snacks and beverages. This shift allowed the company to reduce complexity and improve its financial flexibility.

The TreeHouse Foods business model centers on its extensive manufacturing network, broad product portfolio, and strong relationships with major retailers. This structure allows the company to produce a wide array of private label products at scale, providing cost-effective solutions to its customers. Despite facing operational challenges, such as supply chain and labor issues, TreeHouse Foods has demonstrated resilience by optimizing its production and distribution strategies.

The divestiture of the Meal Preparation business in 2022 was a pivotal move, streamlining operations and focusing on core growth categories. This strategic shift aimed to improve financial flexibility and reduce debt. The company has consistently invested in its supply chain and manufacturing capabilities to adapt to evolving consumer preferences.

The company has focused on strengthening its position in the private label food market. This includes optimizing its product portfolio and enhancing operational efficiency. The strategic focus is on adapting to market demands and improving its competitive edge.

TreeHouse Foods competitive advantage lies in its extensive manufacturing network, broad product portfolio, and strong retailer relationships. The ability to produce private label products at scale and focus on operational efficiency allows the company to offer cost-effective solutions. Consistent investment in supply chain and manufacturing capabilities helps adapt to market changes.

In recent years, TreeHouse Foods has focused on improving its financial performance through strategic initiatives. The company's financial results reflect its efforts to streamline operations and improve efficiency. The company's financial health is influenced by its ability to manage costs and adapt to market conditions.

TreeHouse Foods has shown resilience in addressing supply chain and labor challenges. The company has implemented strategies to optimize production and distribution. The focus remains on enhancing its position in the private label food market through strategic initiatives.

- Divestiture of Meal Preparation business in 2022.

- Focus on higher-growth categories like snacks and beverages.

- Emphasis on operational efficiency and cost management.

- Investment in supply chain and manufacturing capabilities.

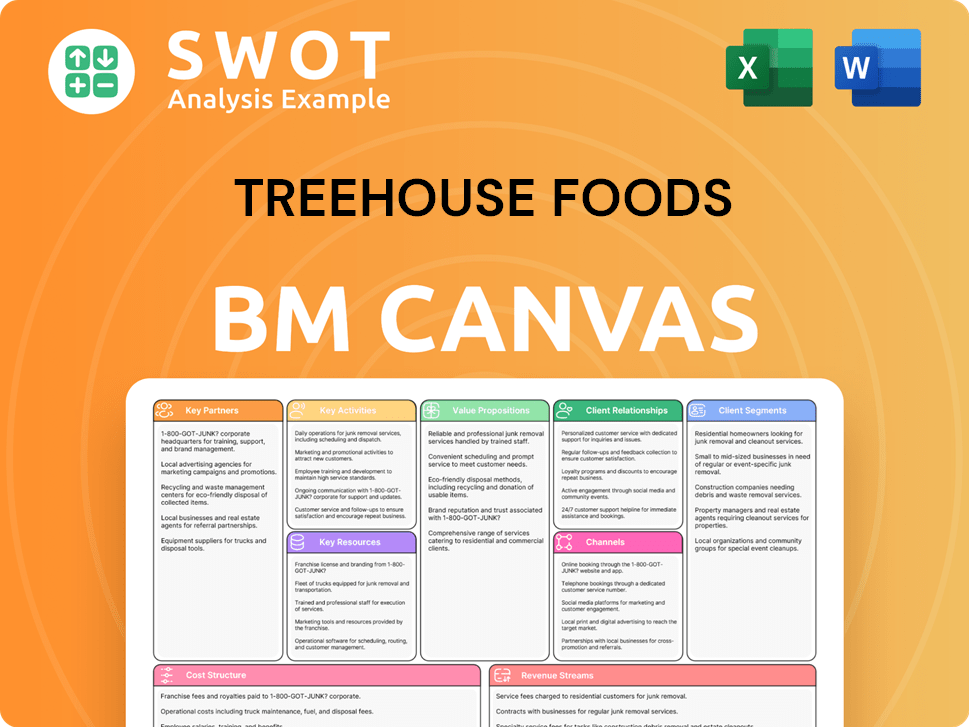

TreeHouse Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TreeHouse Foods Positioning Itself for Continued Success?

As a leading manufacturer of private label food and beverages in North America, the TreeHouse Foods company holds a strong industry position. The company's success hinges on its extensive product offerings and strong relationships with major retailers. This focus allows TreeHouse Foods business to capitalize on the growing consumer preference for private label brands, which often offer a more affordable alternative to national brands, making it a key player in the food manufacturing sector.

However, TreeHouse Foods faces various risks. These include supply chain disruptions, fluctuating raw material costs, and intense competition from other private label manufacturers and national brands. Additionally, shifts in consumer preferences and regulatory changes concerning food safety and labeling pose ongoing challenges. The company's ability to navigate these risks will be crucial for its future performance and sustained revenue generation. For further insights into its marketing approach, check out the Marketing Strategy of TreeHouse Foods.

TreeHouse Foods is a major player in the private label food market. It benefits from the increasing demand for store brands. The company's wide range of products and strong retail partnerships contribute to its market strength in the private label food sector.

Risks include supply chain disruptions and fluctuating raw material costs. Intense competition from other private label manufacturers and national brands also poses a challenge. Consumer preference shifts and regulatory changes impact the business.

The company focuses on optimizing its portfolio and improving operational efficiencies. TreeHouse Foods aims to drive sustainable growth and enhance profitability. Leadership is committed to strengthening the core private label business.

The company is focused on improving profitability and cash flow. It is adapting to market dynamics to sustain revenue generation. The commitment is to deliver value to stakeholders by strengthening the core private label business.

TreeHouse Foods has shown resilience in a competitive market. The private label market is growing, driven by consumer demand for value. Recent data indicates a focus on cost management and operational efficiency.

- The company is focused on improving profitability and cash flow.

- TreeHouse Foods is adapting to market dynamics to sustain revenue generation.

- The company is committed to delivering value to stakeholders.

- The company's strategic initiatives emphasize strengthening its core private label business.

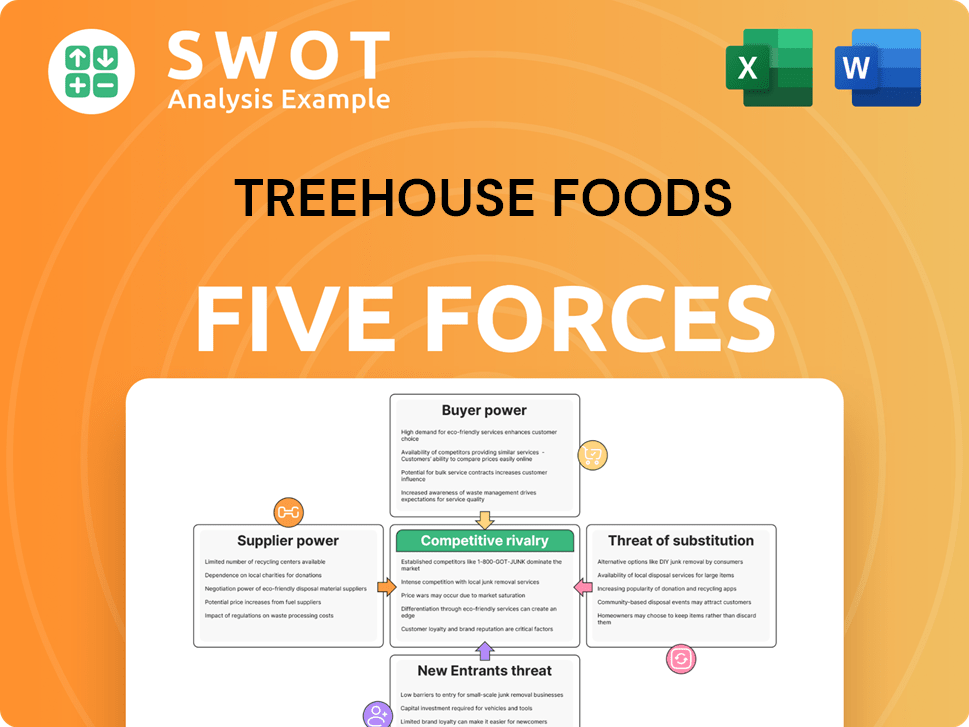

TreeHouse Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TreeHouse Foods Company?

- What is Competitive Landscape of TreeHouse Foods Company?

- What is Growth Strategy and Future Prospects of TreeHouse Foods Company?

- What is Sales and Marketing Strategy of TreeHouse Foods Company?

- What is Brief History of TreeHouse Foods Company?

- Who Owns TreeHouse Foods Company?

- What is Customer Demographics and Target Market of TreeHouse Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.