Trip.com Group Bundle

How Did Trip.com Group Conquer the Travel World?

Ever wondered how a Chinese startup became a global travel giant? Trip.com Group, formerly Ctrip.com, has revolutionized the way we explore the world. From its humble beginnings in Shanghai in 1999, this Trip.com Group SWOT Analysis reveals a fascinating journey.

This brief history of Trip.com Group unveils its evolution from a 'click-and-brick' model to the largest online travel agency in China. The company's strategic acquisitions and technological advancements have propelled its growth, establishing a significant market share and global presence within the competitive travel industry. Understanding the Trip.com history provides valuable insights into its business model and its impact on how we travel today.

What is the Trip.com Group Founding Story?

The story of the Trip.com Group, formerly known as Ctrip.com, began in June 1999 in Shanghai, China. This Trip.com history is one of innovation and adaptation in the dynamic travel industry. The company's foundation was built on identifying a gap in the market and leveraging technology to meet unmet needs.

The Trip.com company was established by a team of four co-founders: James Liang, Neil Shen, Min Fan, and Qi Ji. Their combined expertise and vision were crucial in navigating the early challenges of the online travel landscape. Their initial focus was on providing a centralized platform for travel bookings, a service that was largely unavailable at the time.

The company, originally named Ctrip, was founded in June 1999 in Shanghai, China.

- The founders included James Liang, Neil Shen, Min Fan, and Qi Ji.

- James Liang brought technological expertise, while Neil Shen provided initial funding.

- Min Fan contributed travel industry insights.

- The company secured $5 million in venture capital from IDG Capital and Softbank in 1999.

The founders recognized the potential of the online travel agency model in China, aiming to offer a convenient solution for travelers. Their business approach combined online technology with traditional travel services, a 'click-and-brick' strategy. The first services included hotel and flight bookings, addressing a significant market need. The name 'Ctrip' was chosen to reflect core values such as customer focus and teamwork.

In 1999, Ctrip received $5 million in venture capital from IDG Capital and Softbank. This seed funding was critical for launching operations and establishing a presence in a developing market. This investment helped Ctrip overcome early hurdles and set the stage for its future growth and expansion.

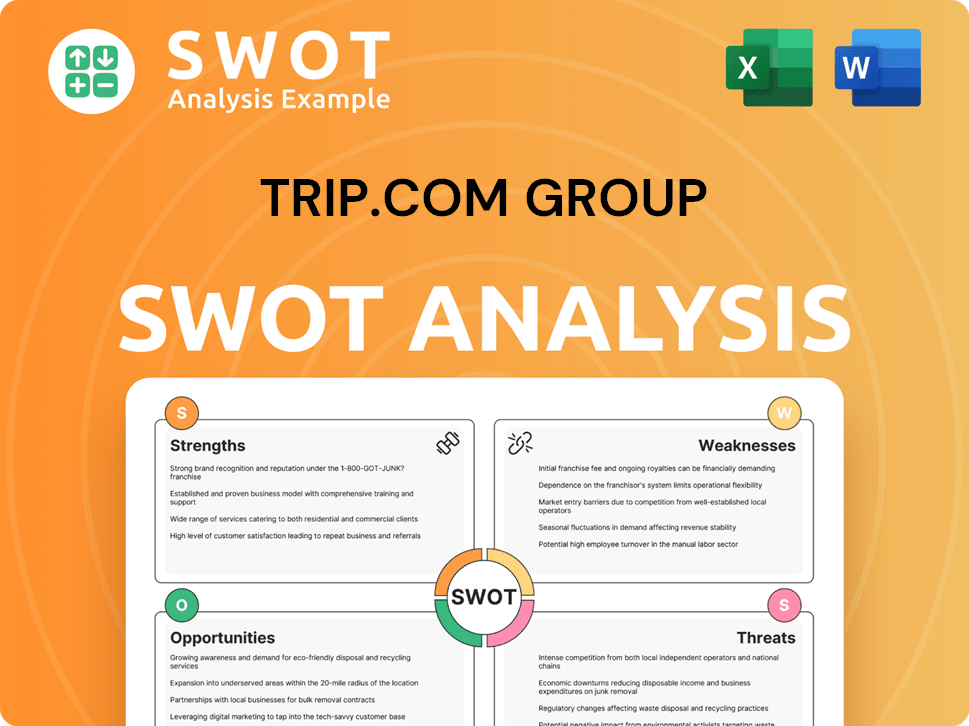

Trip.com Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Trip.com Group?

During its early phase, Trip.com Group, then known as Ctrip, quickly gained popularity among Chinese travelers. This success was due to its user-friendly interface, competitive pricing, and strong customer service. The company's 'mobile-first' strategy in 2010 was a game-changer, allowing bookings via mobile devices, a trend that became standard in China and globally. This strategic shift was key to expanding its reach and adapting to changing consumer behavior.

By 2014, Ctrip had become the leading travel group in China. This period involved substantial inorganic growth through acquisitions and strategic investments. In 2010, Ctrip acquired Hong Kong Wing On Travel, extending its presence in the Hong Kong market and strengthening its packaged tour segment. Further consolidating its position, the company invested in Elong Travel between 2014 and 2015 and acquired eLong in 2015, eliminating key competitors and expanding its service offerings.

The company also began its international expansion, offering bookings for international flights, overseas hotels, and global attraction tickets. Early growth metrics showed the effectiveness of these strategies. The company achieved remarkable growth by 2003, the year it went public on NASDAQ. This IPO raised approximately $75.6 million, providing capital for further expansion and enhancing credibility. The stock appreciated by 86% on its first trading day, closing at $33.94 per ADR.

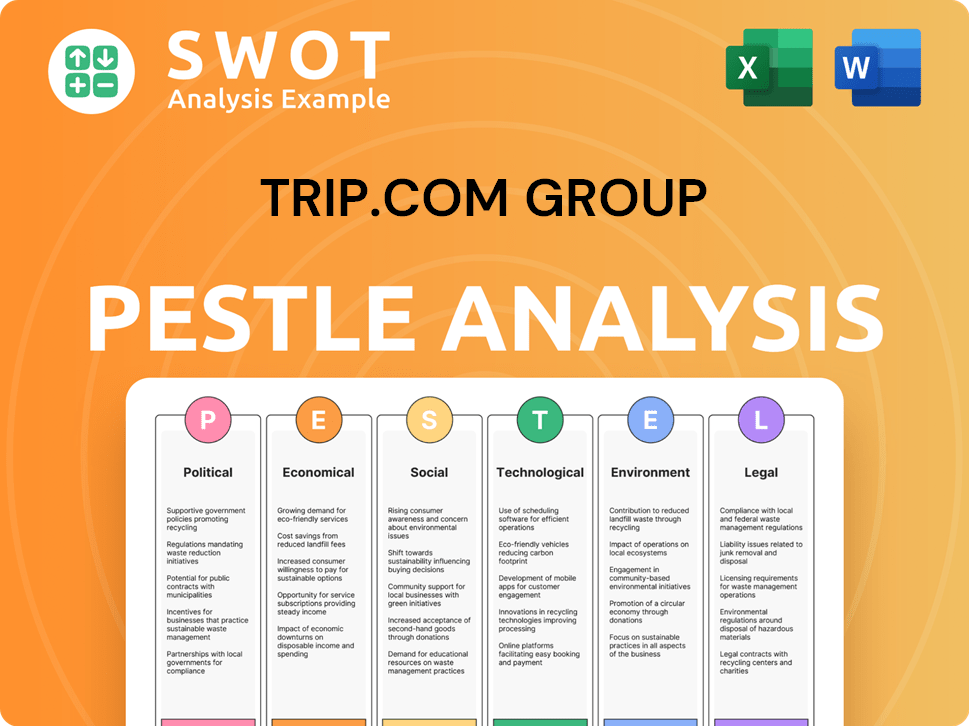

Trip.com Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Trip.com Group history?

The Trip.com Group has achieved several significant milestones, shaping its journey in the travel industry. These achievements reflect its growth and strategic evolution, solidifying its position as a leading online travel agency.

| Year | Milestone |

|---|---|

| 2003 | Listing on NASDAQ. |

| 2010 | Adoption of a 'mobile-first' strategy. |

| 2019 | Ctrip.com International, Ltd. rebranded as Trip.com Group Limited. |

| 2021 | Listing on the Hong Kong Stock Exchange (HKEX). |

| 2023 | Unveiling of AI-powered assistant, TripGenie. |

| 2025 | Memorandum of understanding with Visit Oman. |

Trip.com Group has consistently embraced innovation to enhance user experience and expand its services. A key innovation was the shift to a 'mobile-first' strategy in 2010, allowing for convenient mobile bookings. The company's investment in AI has led to developments like TripGenie, which saw a substantial surge in usage in 2024.

The adoption of a 'mobile-first' strategy in 2010 allowed travelers to book services through mobile devices. This move was a significant adaptation to changing consumer behavior, making travel planning more accessible.

The introduction of TripGenie, an AI-powered assistant, revolutionized trip planning and customer experiences. In 2024, TripGenie saw a 200% surge in usage, demonstrating the impact of AI on its services.

Partnerships with airlines such as Saudia and Flynas have been crucial for expanding its reach. These collaborations enhance its service offerings and strengthen its presence in key markets.

The company has expanded its point-of-sale operations to several countries, including Bahrain, Oman, Kuwait, and Qatar. This expansion is part of its broader strategy to increase its international footprint.

In October 2019, Ctrip.com International, Ltd. rebranded as Trip.com Group Limited. This change reflected its expanded range of travel services and global ambitions.

Trip.com Group has faced challenges inherent in the travel industry, including economic downturns and competitive pressures. The cyclical nature of the travel market means it is vulnerable to global economic uncertainties, requiring resilience and adaptability.

The travel sector is susceptible to economic fluctuations, which can impact booking volumes and revenue. The company must navigate these cycles to maintain financial stability.

The online travel agency market is highly competitive, with numerous players vying for market share. This necessitates continuous innovation and strategic partnerships to stay ahead.

Global events and geopolitical issues can significantly affect travel patterns and demand. The company needs to be agile in responding to these external factors.

Rapid technological changes require constant investment in new technologies to remain competitive. The company must adapt to stay relevant in a dynamic market.

Economic downturns and fluctuations in currency exchange rates can affect profitability. The company must manage its finances carefully to mitigate these risks.

Changes in travel regulations and policies can create operational challenges. The company must comply with evolving legal requirements in various markets.

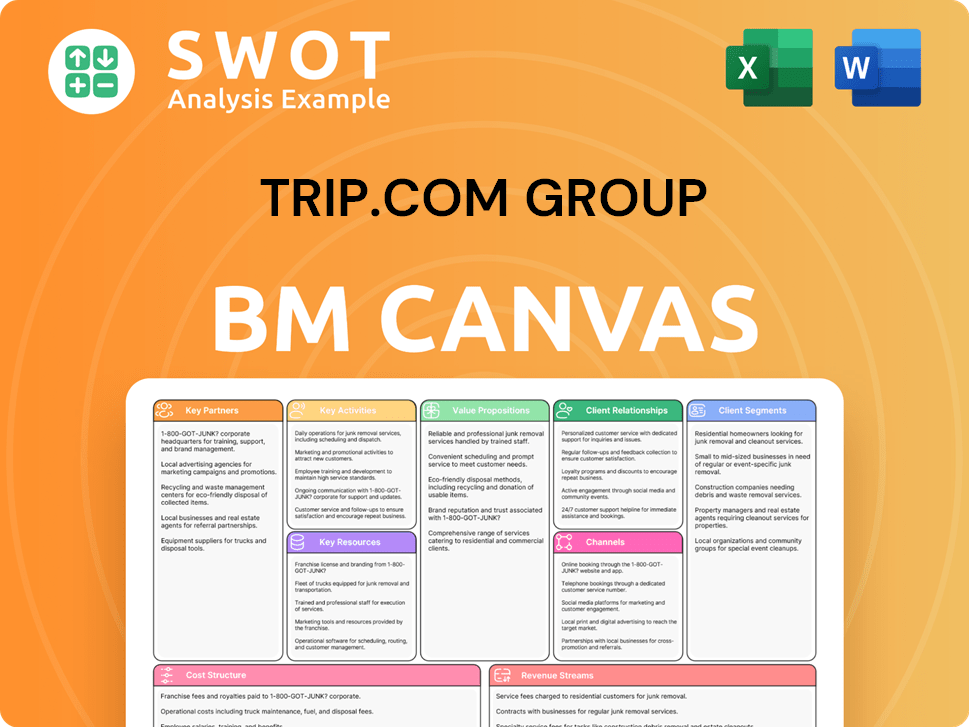

Trip.com Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Trip.com Group?

The Trip.com Group, a prominent player in the travel industry, has a rich history marked by strategic expansions and technological innovations. Founded in Shanghai in 1999 by James Liang, Neil Shen, Min Fan, and Qi Ji, the company initially employed a 'click-and-brick' business model, evolving significantly over the years. From its early days as Ctrip to its current global presence, the company's journey reflects its adaptability and commitment to growth in the dynamic online travel agency (OTA) landscape. The company has made significant strides in the travel industry, solidifying its position through key acquisitions and technological advancements.

| Year | Key Event |

|---|---|

| 1999 | Ctrip.com (now Trip.com Group) is founded in Shanghai, China. |

| 2003 | The company is listed on NASDAQ, raising approximately $75.6 million. |

| 2010 | Ctrip launches its 'mobile-first' strategy and acquires Hong Kong Wing On Travel. |

| 2014 | Ctrip becomes the largest travel group in China. |

| 2015 | Strategic investment in and acquisition of eLong. |

| 2016 | Acquisition of Skyscanner, expanding global footprint. |

| 2017 | Ctrip acquires Trip.com. |

| 2019 | Ctrip.com International, Ltd. officially rebrands to Trip.com Group Limited. |

| 2021 | Trip.com Group is listed on the Hong Kong Stock Exchange. |

| July 2023 | Trip.com Group unveils its AI travel assistant, TripGenie. |

| Q4 2023 | Trip.com Group reports a record-breaking total OTA business with a Gross Merchandise Value (GMV) of approximately $160 billion. |

| February 2025 | Trip.com Group reports unaudited Q4 and full year 2024 financial results, with net revenue for the full year 2024 reaching RMB53.3 billion (US$7.3 billion), a 20% increase from 2023. Outbound hotel and air ticket bookings recover to more than 120% of pre-COVID levels. |

| May 2025 | Trip.com Group reports unaudited Q1 2025 financial results, with net revenue of RMB13.8 billion (US$1.9 billion), a 16% increase from the same period in 2024. International businesses continue robust growth, with overall reservations on its international OTA platform increasing by over 60% year-over-year. |

| May 2025 | Trip.com Group reinforces its commitment to the Middle East, reporting rapid regional growth and strategic partnerships. |

Trip.com Group is focused on expanding its global footprint. International operations are expected to be a primary growth driver. The company anticipates its overseas business, excluding outbound tourism from China, to account for 15-20% of total revenue as of Q2 2024. The compound annual growth rate (CAGR) for overseas business is projected to exceed 50% over the next five years.

The company is committed to leveraging AI to enhance the overall travel experience. TripGenie, the AI travel assistant, is a testament to this. Data analytics and AI will be used to personalize services and improve customer satisfaction. The group continues to innovate to stay competitive in the travel industry.

Key strategic initiatives include expanding into new markets and diversifying services. The company aims to become a leading player in both Asian and global markets within the next three to five years. This involves strengthening its position in existing markets and exploring opportunities in new regions.

Trip.com Group is dedicated to promoting inbound travel. This includes improving the travel experience for international visitors. The company's focus remains consistent with its founding vision of making travel accessible and enjoyable for everyone.

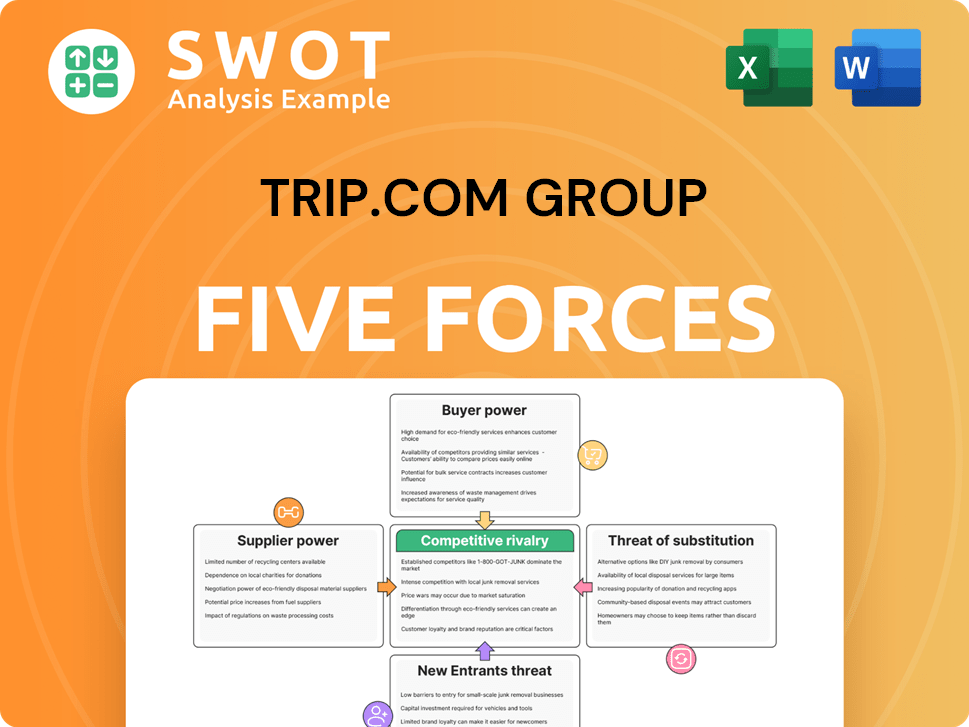

Trip.com Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Trip.com Group Company?

- What is Growth Strategy and Future Prospects of Trip.com Group Company?

- How Does Trip.com Group Company Work?

- What is Sales and Marketing Strategy of Trip.com Group Company?

- What is Brief History of Trip.com Group Company?

- Who Owns Trip.com Group Company?

- What is Customer Demographics and Target Market of Trip.com Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.