Trip.com Group Bundle

Can Trip.com Group Continue Its Dominance in the Global Travel Market?

Explore the dynamic world of online travel with Trip.com Group, a company that has redefined how we experience travel. From its humble beginnings in Shanghai to its current status as a global leader, Trip.com Group's journey is a testament to strategic innovation and market adaptability. This analysis delves into the core of Trip.com's growth strategy and what the future holds for this travel industry giant.

With a record-breaking $160 billion Gross Merchandise Value (GMV) in Q4 2023 and a 16% revenue increase in Q1 2025, Trip.com Group showcases impressive financial performance. To understand the intricacies of its success, we'll examine its Trip.com Group SWOT Analysis, expansion plans, and the technological advancements driving its growth. This comprehensive overview will provide valuable insights into Trip.com's market share, competitive landscape, and long-term goals within the ever-evolving online travel agency (OTA) sector, helping you understand the company's future prospects.

How Is Trip.com Group Expanding Its Reach?

The expansion initiatives of Trip.com Group are focused on both geographical reach and diversification of its offerings, aiming to capitalize on the evolving travel industry trends. This strategic approach is designed to solidify its position in the OTA market analysis and drive sustainable growth. The company's strategy includes significant investments in international markets and the expansion of its service portfolio.

A key element of the Trip.com growth strategy involves aggressive international expansion. The company is leveraging its existing platforms and resources to tap into new markets and cater to a global customer base. This includes increasing its presence in key regions and tailoring its services to meet the specific needs of travelers worldwide. The company's expansion plans in Asia are a major focus.

Trip.com Group is also broadening its product and service offerings to enhance its value proposition and capture a larger share of the market. This includes expanding car rental services, developing its vacation business, and growing its corporate travel segment. These initiatives are supported by strategic partnerships and technological advancements to improve customer experience and operational efficiency.

Outbound travel bookings in 2024 exceeded 120% of 2019 levels, indicating a strong recovery and expansion in international travel. Air and hotel bookings on its international OTA platform increased over 70% year-over-year. Inbound travel to China also saw a surge, growing over 100% year-over-year in 2024 due to relaxed visa policies and marketing efforts.

The company aims for its overseas business revenue, including Skyscanner, to achieve a 30% compound annual growth rate (CAGR) over the next three years. The goal is for overseas revenue to contribute over 30% of total revenue by fiscal year 2027, demonstrating the importance of international expansion to the overall Trip.com future prospects.

Car rental services were expanded to Thailand, Japan, and other markets in 2024. The company plans to expand ticketing services globally, with 16 new sites and 8 new service languages planned. Trip.Biz, the corporate travel arm, has shown triple-digit growth and is expanding in multiple regions.

The group has enhanced global insurance offerings for flights, hotels, and rentals through partnerships. TripLink, an international UnionPay issuer, provides US cards and exchange services. The company is also increasing training programs and recruiting multilingual guides to support inbound tourism and corporate events.

Trip.com Group is committed to empowering women in tourism through initiatives like The Mulan Project, which has created over 20,000 female job opportunities since 2023, with further expansion planned in 2025. This reflects the company's focus on sustainability initiatives and social responsibility.

- The Mulan Project supports women's employment in the tourism sector.

- The company's commitment reflects broader sustainability goals.

- These initiatives contribute to long-term goals and positive brand perception.

- The company is focused on long term goals.

For more insights into the company's structure and ownership, you can explore the details on Owners & Shareholders of Trip.com Group. This expansion strategy, coupled with a focus on technological advancements and strategic partnerships, positions Trip.com Group to capitalize on the evolving travel industry trends and achieve its long term goals.

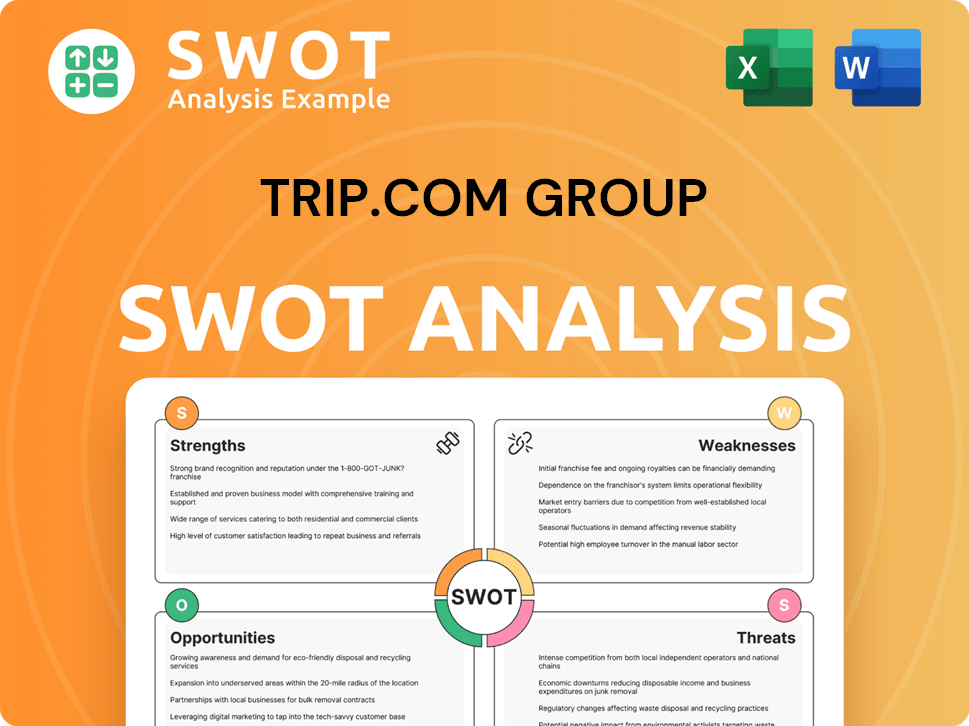

Trip.com Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Trip.com Group Invest in Innovation?

To understand the innovation and technology strategy of the company, it's essential to consider the evolving needs and preferences of its customers. Today's travelers seek seamless, personalized, and efficient travel experiences. They value convenience, preferring platforms that offer comprehensive services, from booking to on-the-ground support. Furthermore, there's a growing demand for sustainable and responsible travel options.

Customers increasingly rely on technology to make informed decisions, seeking AI-driven recommendations and curated content. They want access to real-time information, flexible booking options, and secure payment methods. The ability to easily compare prices, read reviews, and customize itineraries is also crucial. Moreover, the demand for mobile-first solutions and 24/7 customer service is higher than ever.

The company's innovation strategy is heavily influenced by these customer preferences, driving its focus on AI, personalized recommendations, and user-friendly interfaces. The company aims to meet these needs by continuously improving its technology and expanding its service offerings. This approach is key to its growth and maintaining a competitive edge in the dynamic online travel agency (OTA) market.

The company leverages artificial intelligence to enhance various aspects of its services. This includes personalized recommendations and curated lists, such as Trip.Best, which uses AI to provide travel rankings based on user reviews and bookings. The company also uses AI to create compelling visuals from hotel partners' photographs.

TripGenie, the AI travel assistant, saw a significant increase in usage in 2024. The traffic to TripGenie increased by 200% in 2024, with browsing time up almost 100%, and the total number of conversations also increased by 200%, demonstrating its effectiveness in trip planning and customer service.

The company is expanding its FinTech capabilities to support a wide range of payment options. It supports 35 payment currencies, all international card schemes, and 25 local alternative payment methods. This focus on payment flexibility enhances the user experience and facilitates global transactions.

The company has expanded its global insurance coverage to include flights, hotels, and rental cars. This provides added value and security for travelers, enhancing their overall experience and building trust.

The company is integrating ESG (Environmental, Social, and Governance) commitments into its business goals. This includes promoting low-carbon travel options, supporting family-friendly policies, and adopting features like 'badges for low carbon footprint hotels' on its international platform, which was successful on its Ctrip domestic platform.

The company is investing in technology centers to drive innovation and support its technological advancements. This investment is crucial for maintaining a competitive edge in the rapidly evolving travel industry.

The company's technology and innovation strategy is multifaceted, focusing on AI, FinTech, and ESG initiatives. These efforts aim to enhance user experience, expand global reach, and promote sustainable travel practices. These technological advancements are critical for the company's long-term growth and market leadership. To further understand the company's target market, consider reading about the Target Market of Trip.com Group.

- AI-Powered Personalization: Utilizing AI to provide highly personalized travel recommendations and curated lists.

- Enhanced Customer Service: Leveraging AI to improve efficiency and quality in customer service through tools like TripGenie.

- Expanded Payment Options: Supporting 35 payment currencies and various international and local payment methods.

- Sustainable Travel: Promoting low-carbon travel options and integrating ESG commitments.

- Global Insurance: Offering expanded insurance coverage for flights, hotels, and rental cars.

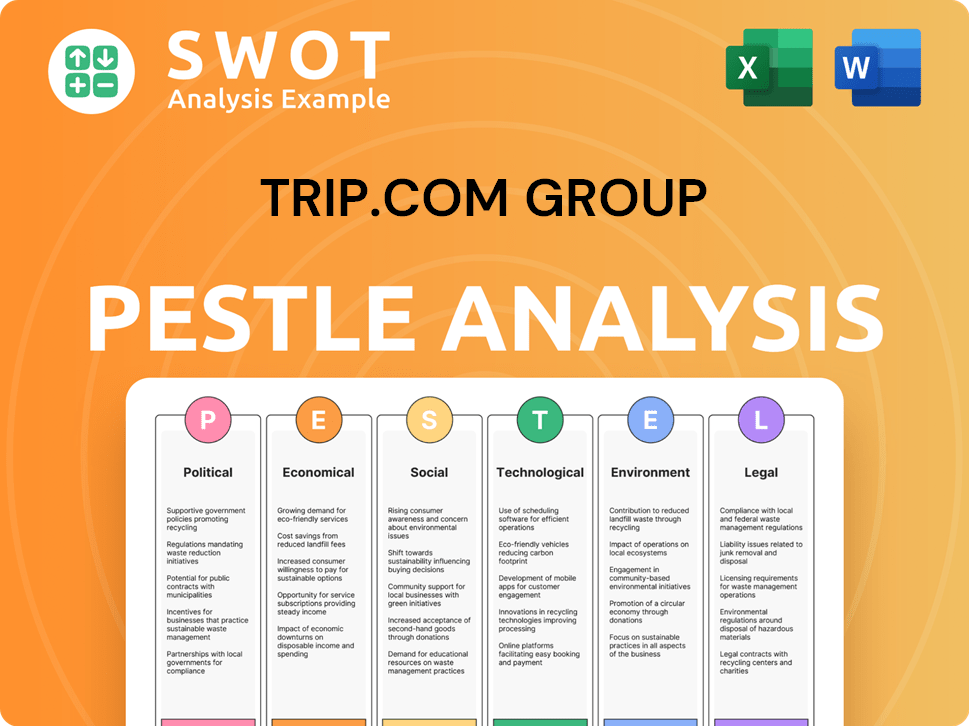

Trip.com Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Trip.com Group’s Growth Forecast?

The financial outlook for Trip.com Group is robust, reflecting strong performance and promising future prospects. The company's growth strategy has yielded significant results, positioning it favorably within the online travel agency (OTA) market. Analyzing Trip.com financial performance is crucial for understanding its trajectory and investment potential.

For the full year of 2024, Trip.com Group's net revenue reached RMB 53.3 billion (US$7.3 billion), a 20% increase year-over-year. This growth was mainly fueled by increased demand across its core segments, with accommodation reservations increasing by 25% year-over-year and transportation ticketing by 10% year-over-year. The company's net income nearly doubled to RMB 17.2 billion (US$2.4 billion) in 2024, and adjusted EBITDA margins remained steady at 32%.

Looking ahead, Trip.com Group anticipates continued revenue growth, with some projections around 14.8% for 2025 and 13.5% for 2026. Despite a slight moderation due to diminishing effects of pent-up demand and rising global macroeconomic uncertainties, the company's gross profit margins remain impressive at 81%, and it holds a 'GREAT' financial health score. For 2025, revenue estimates have increased to $65.56 billion, and earnings per share are projected at $27.02.

Trip.com's revenue growth is driven by strong demand in accommodation reservations and transportation ticketing. The company's strategic focus on these core segments has led to significant year-over-year increases. These positive trends indicate a strong recovery in the travel industry.

Trip.com maintains a 'GREAT' financial health score, reflecting its strong financial position. The company's impressive gross profit margins of 81% and substantial cash reserves demonstrate its financial stability. These factors contribute to the company's ability to invest in future growth.

Analyst forecasts project continued revenue growth for Trip.com in 2025, albeit at a slightly moderated pace. Revenue is estimated to reach $65.56 billion, with earnings per share projected at $27.02. These estimates reflect the company's strong market position and growth potential.

Trip.com held RMB 77 billion in cash and cash equivalents as of December 31, 2023. The company has approved a substantial capital return program for 2024, demonstrating its commitment to shareholder value. This strategic allocation of capital supports long-term growth.

Trip.com Group's financial performance reflects its strong position in the travel industry. The company's growth strategy is supported by robust revenue, profitability, and strategic capital allocation.

- Net revenue increased by 20% year-over-year in 2024.

- Net income nearly doubled in 2024.

- Gross profit margins remain at an impressive 81%.

- Strong cash position and capital return program.

For a deeper understanding of the company's core values and vision, consider reading about the Mission, Vision & Core Values of Trip.com Group.

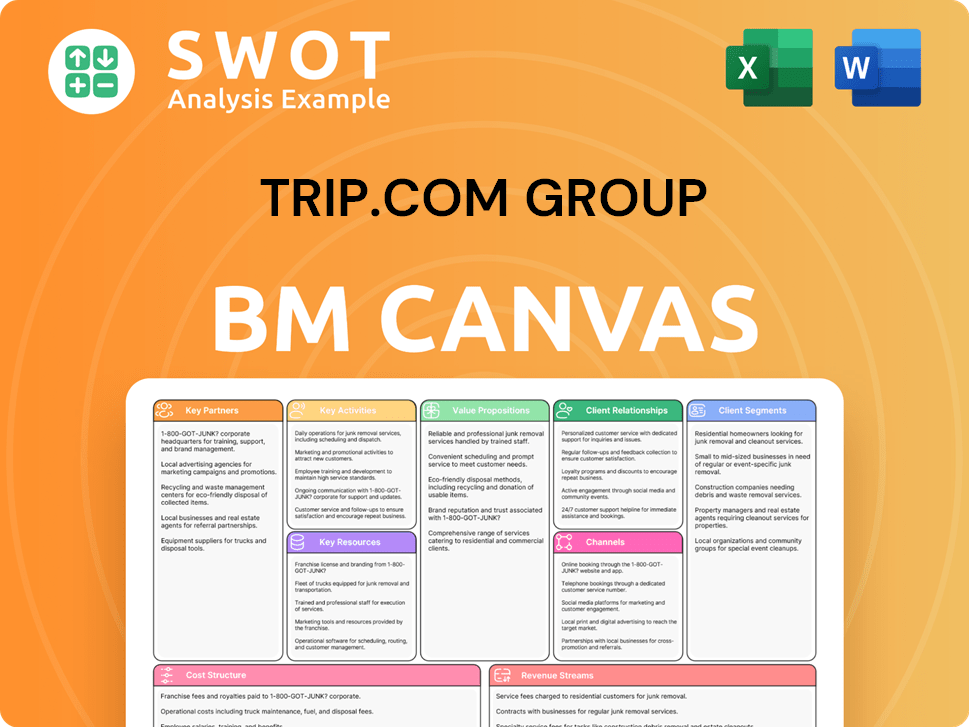

Trip.com Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Trip.com Group’s Growth?

The Trip.com Group, while demonstrating robust growth, faces several potential risks and obstacles that could affect its future. These challenges range from intense competition within the online travel agency (OTA) sector to the impact of regulatory changes and economic volatility. Understanding these risks is crucial for assessing the long-term viability of the company and its Trip.com growth strategy.

Market dynamics, including competitive pressures from rivals such as Booking Holdings and regional players, could squeeze profit margins. The company's reliance on relationships with travel suppliers and strategic alliances also presents a risk. These factors necessitate careful management and strategic adaptation to navigate the Trip.com future prospects.

Furthermore, internal and external factors, such as economic downturns, currency fluctuations, and operational challenges, can influence the company's performance. The travel industry is inherently susceptible to economic shifts, and any downturn could significantly impact travel demand. Successful mitigation of these risks is vital for sustaining and expanding Trip.com Group's market position.

The OTA market is highly competitive, with major players like Booking Holdings and regional competitors vying for market share. Intense competition can put pressure on pricing and margins, affecting profitability. Maintaining a competitive edge requires continuous innovation and effective customer acquisition strategies.

Changes in travel regulations, such as visa policies, tax rules, and data security, can disrupt operations. Increased scrutiny of data security and antitrust practices in China could impose higher compliance costs. Adapting to these regulatory shifts is essential for sustained growth.

The travel industry is sensitive to economic fluctuations. A global or Chinese economic downturn could reduce travel demand, particularly in discretionary segments. Currency fluctuations, such as a weaker yuan against the USD, can also impact international revenue. These factors require careful financial planning.

Internal factors, such as managing current and future growth, strategic investments, and acquisitions, pose challenges. Seasonality in the travel industry and potential infrastructure failures can also affect performance. Effective management of these operational aspects is key to success.

Dependence on relationships and contractual arrangements with travel suppliers and strategic alliances presents a risk. Disruptions or changes in these partnerships could impact the company's ability to offer services and maintain competitive pricing. Diversifying partnerships can help mitigate this risk.

Damage to or failure of infrastructure and technology, as well as the loss of key executives, could impede growth. Cybersecurity threats and the need for continuous technological upgrades require significant investment and robust risk management strategies. Staying ahead in this area is critical.

To address these risks, Trip.com Group employs several strategies. Diversification across business segments helps reduce reliance on any single area. The company's substantial liquidity, such as the US$12.3 billion in cash in 2024, provides a buffer to invest in innovation and weather economic downturns. Strategic planning and proactive risk management are essential for long-term success.

Understanding the competitive landscape is crucial for evaluating Trip.com Group. The company's market share in 2024, along with its financial performance analysis, offers insights into its ability to navigate these challenges. For a deeper understanding of Trip.com Group's background, consider reading Brief History of Trip.com Group.

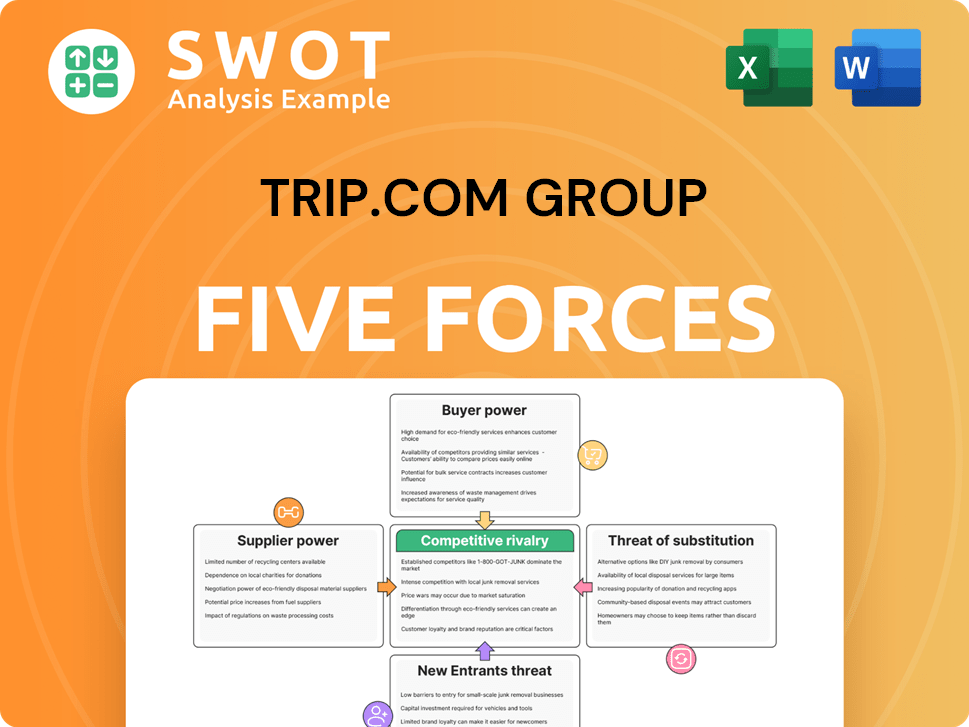

Trip.com Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Trip.com Group Company?

- What is Competitive Landscape of Trip.com Group Company?

- How Does Trip.com Group Company Work?

- What is Sales and Marketing Strategy of Trip.com Group Company?

- What is Brief History of Trip.com Group Company?

- Who Owns Trip.com Group Company?

- What is Customer Demographics and Target Market of Trip.com Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.