Trip.com Group Bundle

How Does Trip.com Group Thrive in the Travel Industry?

Witness the incredible comeback of Trip.com Group, a global powerhouse that's redefined travel. With a staggering 122% year-over-year net revenue increase in 2023, surpassing pre-pandemic levels, this Trip.com Group SWOT Analysis reveals the secrets behind its success. Explore how Trip.com Group, alongside brands like Ctrip, dominates the online travel agency landscape.

This isn't just about numbers; it's about understanding the engine driving this travel booking platform. From its diverse travel services to its impressive financial health, we'll dissect the Trip.com Group business model. Discover how this industry leader leverages its strategic advantages to offer customers exceptional travel experiences and navigate the ever-changing demands of the global market.

What Are the Key Operations Driving Trip.com Group’s Success?

The core operations of Trip.com Group revolve around its integrated online travel platforms. These platforms offer a wide array of travel services, catering to both leisure and business travelers. The company's primary focus is on providing convenience, choice, and competitive pricing.

The value proposition centers on delivering a seamless travel booking experience. Customers can access a vast selection of travel options, supported by reliable customer service. The company's digital platforms, including Trip.com and Ctrip, are key to this operation.

The operational framework relies heavily on advanced technology and robust digital infrastructure. This includes sophisticated search and booking engines, real-time inventory management, and secure payment gateways. Strategic partnerships with airlines, hotels, and local tour operators are essential for a comprehensive supply chain.

Trip.com Group offers a comprehensive suite of travel services. These include accommodation reservations, transportation ticketing (flights, trains, buses), packaged tours, and in-destination services. Corporate travel management solutions are also available.

The company uses sophisticated technology for its operations. This includes advanced search and booking engines, real-time inventory management, and secure payment gateways. Personalized recommendation algorithms are also a key component.

Trip.com Group caters to a global clientele with localized content and customer service. This approach helps differentiate the company from its competitors. Support is offered in multiple languages to enhance the customer experience.

Customer service is a priority for Trip.com Group, offering 24/7 support across multiple channels. This commitment helps build trust and ensures customer satisfaction. The company aims to provide reliable assistance to travelers.

Trip.com Group's operational effectiveness is enhanced by strategic partnerships. These partnerships with airlines, hotels, and local tour operators ensure a competitive supply chain. The company's business model focuses on providing a seamless experience.

- Competitive Pricing: Offering competitive prices is a key strategy.

- Convenience: Providing a convenient booking experience is a priority.

- Choice: Customers have access to a wide array of travel options.

- Customer Service: Reliable customer support is available around the clock.

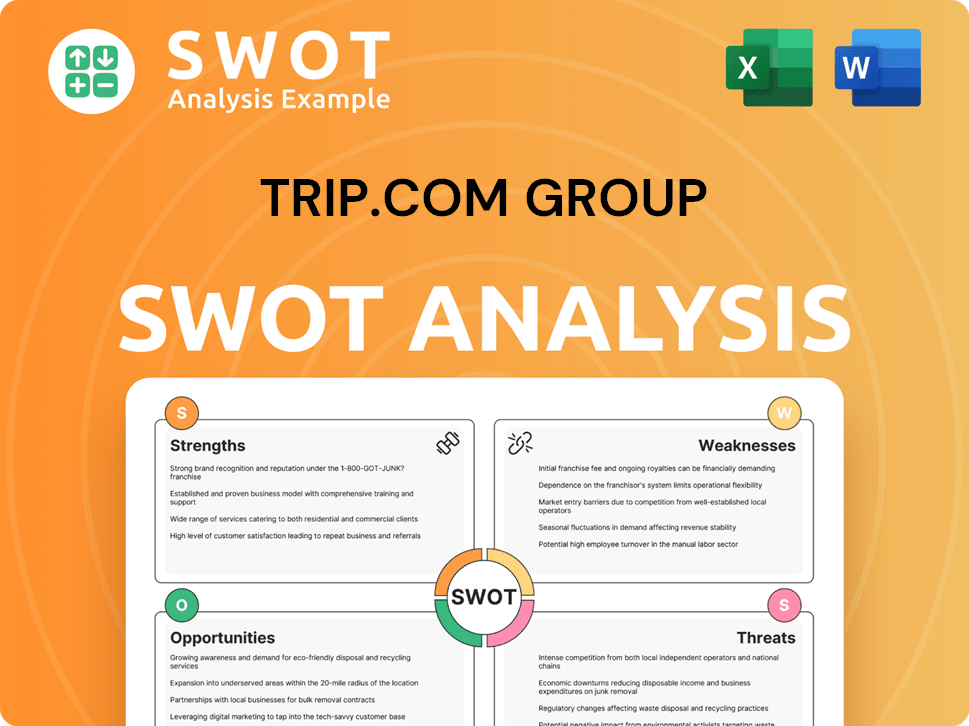

Trip.com Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Trip.com Group Make Money?

Trip.com Group, a leading online travel agency, generates revenue through various travel services. Its business model encompasses accommodation reservations, transportation ticketing, packaged tours, and corporate travel management, demonstrating a diversified approach to revenue generation.

In 2023, Trip.com Group reported a net revenue of 44.5 billion RMB (US$6.3 billion), marking a substantial 122% increase year-over-year. This significant growth reflects the company's strong market position and effective monetization strategies within the travel industry.

The company’s revenue streams are primarily monetized through transaction fees and commissions. For example, Trip.com earns commissions from hotels for accommodation bookings and from airlines for transportation ticketing. Packaged tours generate revenue from the margin on bundled travel components, and corporate travel management services utilize service fees and transaction-based charges.

The growth across different segments highlights Trip.com Group's effective monetization strategies. Here's a breakdown of the revenue streams:

- Accommodation Reservation: This segment saw a 131% year-over-year increase in 2023, contributing significantly to the overall revenue.

- Transportation Ticketing: Revenue from this area grew by 130% year-over-year in 2023, driven by increased travel demand.

- Packaged Tours: A remarkable 294% year-over-year increase in revenue was observed in 2023, indicating a strong recovery in leisure travel.

- Corporate Travel Management: This segment contributes through service fees and transaction-based charges, though specific growth figures aren't detailed in the provided information.

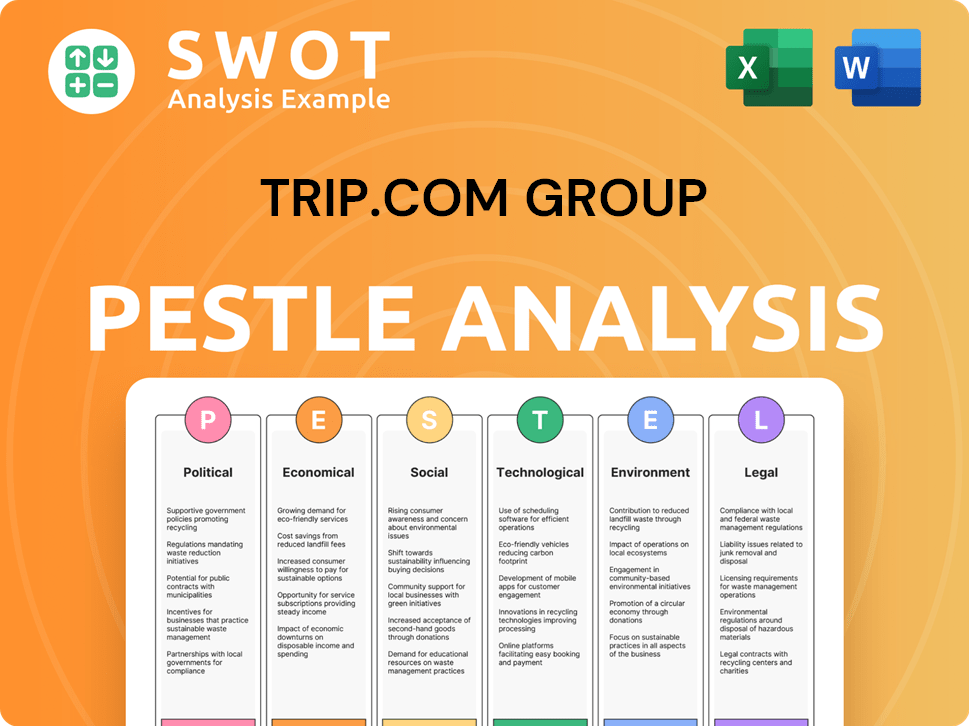

Trip.com Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Trip.com Group’s Business Model?

The evolution of Trip.com Group, a leading online travel agency, has been marked by strategic decisions and significant milestones. A key move was the acquisition of Skyscanner in 2016, which expanded its global presence and diversified its offerings. This strategic expansion allowed the company to tap into a wider user base and enhance its meta-search capabilities, solidifying its position in the competitive travel market.

Continuous investment in technology, particularly in artificial intelligence and big data analytics, has been a core strategy. This focus enables personalized travel recommendations and optimizes user experience, providing a competitive edge. The company has also demonstrated resilience by adapting to market changes, such as the COVID-19 pandemic, by focusing on domestic travel recovery and diversifying its offerings, showcasing its ability to navigate challenges effectively.

The company's competitive advantages include strong brand recognition across its platforms, an extensive global partner network, and economies of scale. The "ecosystem effect," where users can seamlessly book flights, hotels, and activities, further strengthens its position. By embracing live streaming and social media, Trip.com Group continues to adapt to evolving trends, ensuring its business model remains robust.

The acquisition of Skyscanner in 2016 was a pivotal moment, significantly expanding its global reach. This strategic move broadened its international footprint and enhanced its meta-search capabilities. The company also focused on technological advancements to improve user experience and operational efficiency.

Continuous investment in technology, especially AI and big data analytics, has been a core strategy to personalize recommendations. Adapting to market changes, such as the COVID-19 pandemic, by focusing on domestic travel recovery and diversifying offerings, demonstrated resilience. The company's ability to adapt quickly to changing consumer preferences has been crucial.

Strong brand recognition across its platforms, including Ctrip and Trip.com, provides a significant advantage. An extensive global partner network and economies of scale allow for competitive pricing and a broad inventory. The "ecosystem effect" where users can book various services on one platform strengthens its competitive position.

Embracing live streaming for travel content and engaging with social media platforms to reach younger demographics ensures its business model remains relevant. This proactive approach allows Trip.com Group to stay ahead of evolving technological shifts and competitive threats. The company's focus on innovation and customer experience is key.

In recent years, Trip.com Group has demonstrated strong financial performance, adapting to changing market dynamics. The company's revenue for Q1 2024 was approximately $1.3 billion, a significant increase year-over-year, reflecting the recovery in the travel sector. The company's ability to manage costs and leverage its global presence has contributed to its profitability.

- Revenue Growth: Q1 2024 revenue increased significantly compared to the previous year, demonstrating strong recovery.

- Strategic Partnerships: The company continues to form strategic partnerships to expand its offerings and market reach.

- Technological Advancements: Ongoing investments in AI and data analytics improve user experience and operational efficiency.

- Market Expansion: Trip.com Group continues to expand its presence in key international markets.

Trip.com Group's success is also reflected in its ability to offer competitive pricing and a wide range of travel services, making it a preferred choice for travelers globally. To understand more about their strategic approach, consider reading about the Growth Strategy of Trip.com Group.

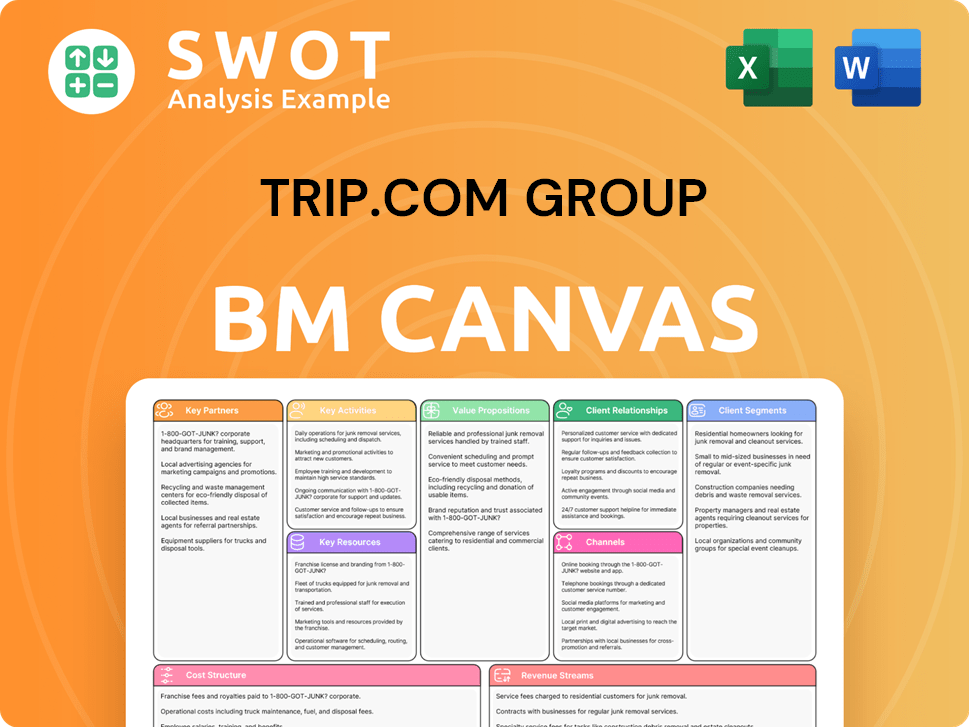

Trip.com Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Trip.com Group Positioning Itself for Continued Success?

Trip.com Group is a major player in the online travel agency (OTA) sector. The company, through brands like Ctrip and Trip.com, holds a strong market position, especially in the Asia-Pacific region. Its global reach is extensive, serving customers in over 200 countries and regions and offering services in 31 languages. This positions Trip.com Group as a significant competitor in the global travel market.

Despite its strengths, Trip.com Group faces several risks. These include regulatory changes, the emergence of new competitors, and technological disruptions. Economic downturns and geopolitical events can also significantly impact travel demand. However, the company is actively pursuing strategic initiatives to capitalize on growth opportunities.

Trip.com Group, including Ctrip and Trip.com, is a leading online travel agency. It has a strong presence in the Asia-Pacific region and a global reach extending to over 200 countries. The company's diverse service offerings and multilingual support enhance its competitive edge in the travel industry.

The company faces risks from regulatory changes, new competitors, and technological advancements. Economic and geopolitical factors also pose challenges. These factors can affect consumer travel behavior and demand, impacting the company's financial performance.

Trip.com Group's future looks positive, with plans for global expansion and tech integration. The company is focused on sustainable growth and leveraging technology to improve travel experiences. It aims to capitalize on the growth in global travel, including outbound travel from China.

Key strategies include expanding its global footprint and enhancing content. The company invests in advanced technologies to personalize travel. These initiatives aim to drive innovation and provide more convenient travel solutions.

Trip.com Group's financial performance reflects its strong market position and strategic initiatives. The company benefits from the increasing digitalization of travel services worldwide. For instance, in Q1 2024, Trip.com Group reported a $1.3 billion revenue, showing a 29% increase year-over-year. This growth is driven by a rise in both domestic and international travel bookings.

- Outbound travel from China is a significant growth driver for Trip.com Group.

- The company continues to innovate its product offerings to enhance customer experiences.

- Partnerships and collaborations are key to expanding its market reach.

- Investment in technology, like AI, is crucial for personalizing travel services.

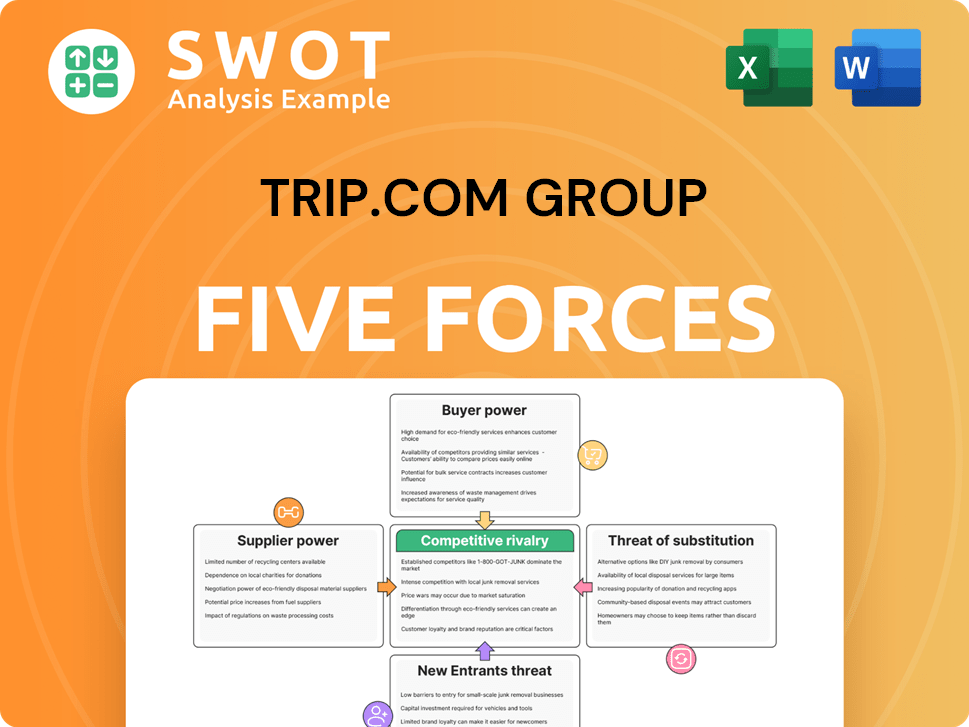

Trip.com Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Trip.com Group Company?

- What is Competitive Landscape of Trip.com Group Company?

- What is Growth Strategy and Future Prospects of Trip.com Group Company?

- What is Sales and Marketing Strategy of Trip.com Group Company?

- What is Brief History of Trip.com Group Company?

- Who Owns Trip.com Group Company?

- What is Customer Demographics and Target Market of Trip.com Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.