Tryg Bundle

How Did the Tryg Company Rise from the Ashes?

Journey back in time to 1728, when a devastating fire in Copenhagen ignited the need for financial security, forever changing the landscape of Danish insurance. This event led to the birth of what would eventually become the Tryg SWOT Analysis, a Scandinavian insurance giant. From its humble beginnings as a fire insurance provider, the Tryg Company has evolved into a leading force in the Nordic insurance market.

Delving into the Tryg history reveals a fascinating narrative of resilience and adaptation. The Tryg insurance company's origins are deeply intertwined with the early efforts to protect citizens from unforeseen disasters. Today, the Tryg Group stands as a testament to its enduring commitment to providing peace of mind and adapting to the evolving needs of its customers, as demonstrated by its strong financial performance in Q1 2025. Understanding Tryg's timeline provides valuable insights into its successful strategies and its impact on the Danish insurance market.

What is the Tryg Founding Story?

The Tryg Company boasts a rich history deeply intertwined with the evolution of the Danish insurance market. Its origins can be traced back to the early 18th century, reflecting a response to societal needs and the development of financial protection mechanisms. Understanding the

The

The name 'Tryg' emerged in 1898 with the founding of 'Livsforsikringsselskabet Tryg A/S,' a life insurance company. This marked a significant step in the

The early stages of Tryg's development involved governmental responses and cooperative models, reflecting the societal and economic conditions of the time.

- 1731: 'Kjøbenhavns Brand' established, focusing on fire insurance.

- 1898: 'Livsforsikringsselskabet Tryg A/S' founded, specializing in life insurance.

- 1911: 'Andels-Anstalten Tryg' formed through mergers, expanding insurance offerings.

- These early ventures established the foundation for the future growth and diversification of Tryg.

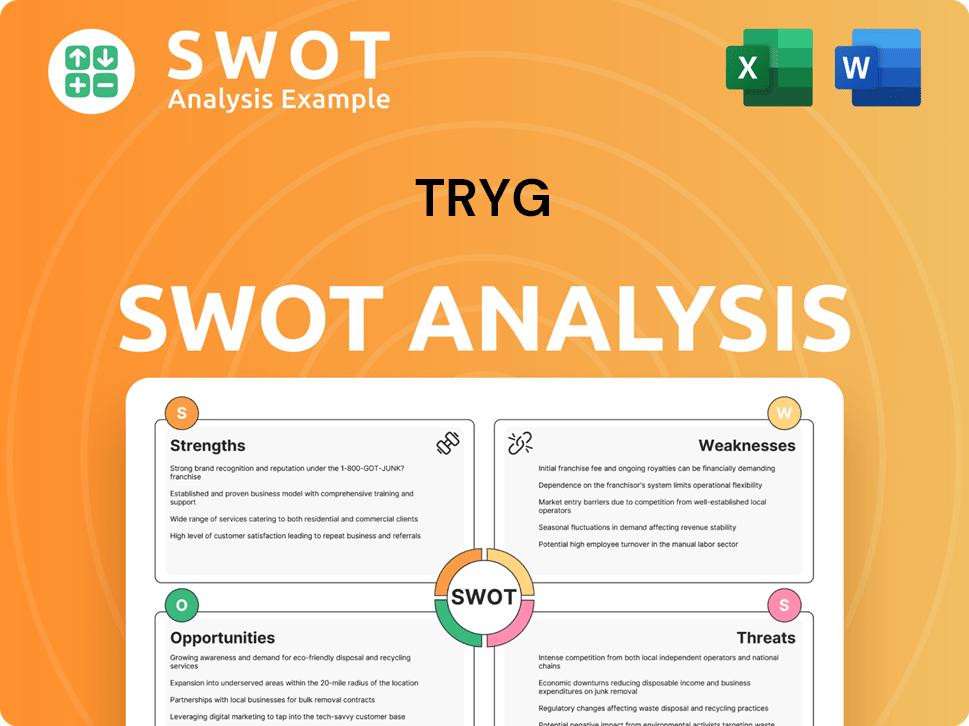

Tryg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tryg?

The early growth and expansion of the Tryg Company, a significant player in the Danish insurance market, were marked by strategic mergers and acquisitions. This period was crucial in shaping the Tryg Group's presence across the Nordic region. These moves allowed Tryg to diversify its offerings and establish itself as a major force in the insurance industry. The company's history reflects a commitment to growth and adaptation within the dynamic financial landscape.

Between 1974 and 1975, a pivotal merger occurred, uniting 'Kjøbenhavns Brandforsikring' and 'Andels-Anstalten Tryg,' among other insurance companies. This merger created Tryg Insurance as a mutual company. This consolidation marked the beginning of Tryg's journey as a unified entity, setting the stage for future developments in the Tryg Company timeline.

In 1991, Tryg Insurance transitioned from a mutual company to a public limited company. Ownership was transferred to 'Tryg i Danmark smba,' later known as 'TryghedsGruppen'. This demutualization was a significant step in the Tryg insurance company's evolution, enabling it to access capital markets and pursue further expansion opportunities.

The acquisition of Baltica in 1995 led to operations under the name Tryg-Baltica. In 1999, Tryg merged with Unidanmark, and acquired the Norwegian insurance company Vesta. These acquisitions were key milestones, expanding Tryg's reach and diversifying its portfolio within the Danish insurance market and beyond.

In 2001, Tryg-Baltica, Vesta, and Unibank contributed to the formation of Nordea, with Tryg i Danmark smba holding a 6% share. In 2002, Tryg i Danmark smba acquired Nordea's non-life insurance activities, forming TrygVesta. This marked a crucial period in Mission, Vision & Core Values of Tryg, solidifying its presence in the Nordic region.

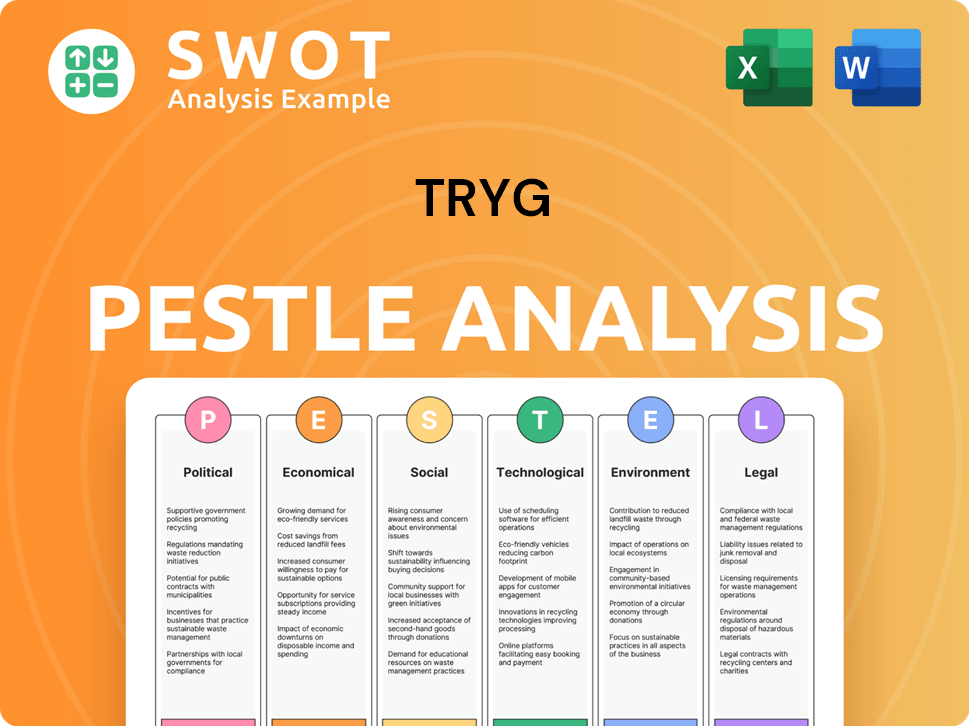

Tryg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tryg history?

The Tryg Company has a rich history marked by strategic growth and operational improvements. Its journey has been defined by key milestones, innovations, and responses to various challenges within the Danish insurance sector and beyond.

| Year | Milestone |

|---|---|

| 2021 | Acquisition of RSA Insurance Group's Swedish and Norwegian operations for approximately £4.2 billion (DKK 35.8 billion). |

| Q1 2025 | Customer satisfaction rose to 82, up from 81 in Q1 2024, reflecting enhanced customer service initiatives. |

| Q1 2025 | Processed over 500,000 claims and paid out DKK 6.6 billion in claims, demonstrating operational efficiency. |

Tryg has consistently focused on innovation to improve its services and operational efficiency. A key area of innovation includes customer-centric improvements, such as faster claims handling, which has significantly boosted customer satisfaction.

Enhanced onboarding processes and faster claims handling have been implemented to improve customer satisfaction. This focus has led to a rise in customer satisfaction scores, reflecting the effectiveness of these initiatives.

Tryg has invested in IT modernization to streamline operations and reduce costs. The restructured IT team has improved efficiency by 15%, contributing to lower distribution costs and better service delivery.

Despite its successes, the

The company has had to navigate higher claims inflation and rising claims frequencies. These factors have required strategic adjustments to maintain profitability and manage risk effectively.

An above-average number of weather-related claims, particularly in 2023, presented financial challenges. The company's ability to maintain a strong combined ratio despite these challenges demonstrates its resilience.

Tryg has maintained a strong combined ratio, with 82.8% at year-end 2023 and further tightened to 84.2% in Q1 2025 from 86.6% in the prior year. This reflects robust price increases and effective risk management strategies.

Tryg de-risked its Corporate portfolio in 2024, which improved its risk profile. This strategic move contributed to the company's overall financial stability and performance.

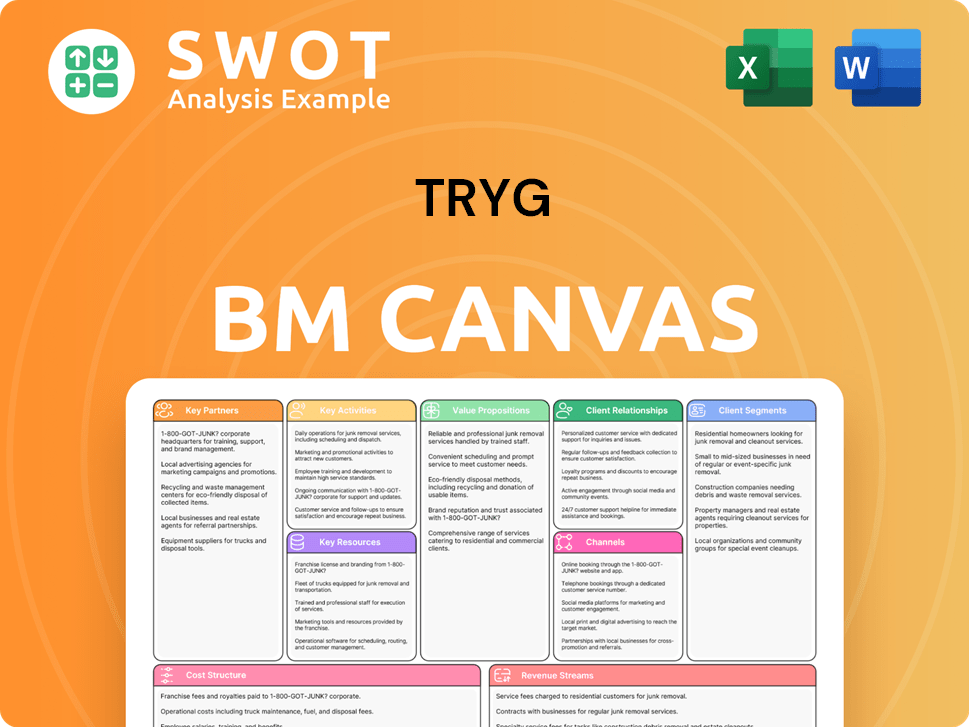

Tryg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tryg?

The Tryg Company, a prominent player in the Danish insurance market, has a rich

| Year | Key Event |

|---|---|

| 1731 | 'Kjøbenhavns Brand,' the oldest component of Tryg's history, is established following the Copenhagen fire of 1728. |

| 1898 | The name 'Tryg' first appears as part of 'Livsforsikringsselskabet Tryg A/S.' |

| 1911 | A group of smaller companies merges to form 'Andels-Anstalten Tryg.' |

| 1974-1975 | Several smaller insurance companies merge to form the mutual company Tryg Insurance. |

| 1991 | Tryg Insurance demutualizes and becomes a public limited company. |

| 1995 | Tryg acquires Baltica, operating as Tryg-Baltica. |

| 1999 | Tryg-Baltica merges with Unidanmark, and Tryg acquires Norwegian insurer Vesta. |

| 2002 | Tryg i Danmark smba acquires Nordea's non-life insurance activities, forming TrygVesta. |

| 2005 | Tryg is listed on the Copenhagen stock exchange. |

| 2010 | TrygVesta simplifies its name to Tryg. |

| 2017 | Tryg acquires Alka for DKK 8.2 billion. |

| 2021 | Tryg, in a joint offer with Intact Financial Corporation, acquires RSA Insurance Group, with Tryg retaining RSA's Sweden and Norway operations. |

| 2024 | Tryg reports an insurance service result of DKK 7,324 million and a combined ratio of 81.0%. |

| Q1 2025 | Tryg reports a strong insurance service result of DKK 1,540 million, a 20% year-on-year increase, and a combined ratio of 84.2%. |

Tryg's 2027 strategy prioritizes financial strength. The company aims for a combined ratio of around 81% by 2027. This focus ensures the company's ability to meet its obligations and deliver value to shareholders.

Customer-centricity is a core focus for Tryg. The company is committed to providing excellent service and building strong relationships with its customers. This approach is key to retaining customers and attracting new business.

Tryg is investing in innovation, particularly in areas like cyber insurance. The company is also enhancing its IT capabilities to improve efficiency and customer experience. This forward-thinking approach positions Tryg for future growth.

Tryg plans to distribute DKK 17-18 billion to shareholders during 2025-2027, including an ordinary dividend and a share buyback program. As of June 2, 2025, approximately DKK 1.84 billion of the buyback program has been completed.

Tryg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tryg Company?

- What is Growth Strategy and Future Prospects of Tryg Company?

- How Does Tryg Company Work?

- What is Sales and Marketing Strategy of Tryg Company?

- What is Brief History of Tryg Company?

- Who Owns Tryg Company?

- What is Customer Demographics and Target Market of Tryg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.