Tryg Bundle

Can Tryg A/S Continue Its Impressive Growth Trajectory?

Tryg A/S, a cornerstone of the Scandinavian insurance market since 1731, has consistently demonstrated a knack for strategic growth. The acquisition of RSA's Swedish and Norwegian businesses was a game-changer, significantly boosting its market presence and financial results. This Tryg SWOT Analysis offers a deep dive into the company's strengths, weaknesses, opportunities, and threats.

This analysis will explore Tryg's Tryg growth strategy, examining its expansion initiatives and how it navigates the ever-changing insurance market trends. We'll also delve into the Tryg company analysis, assessing its Tryg financial performance and the potential impact of factors like inflation on its business. Understanding the Tryg future prospects is crucial for investors and stakeholders alike, providing insights into its long-term investment strategy and ability to adapt to changes within the Danish insurance industry.

How Is Tryg Expanding Its Reach?

The Tryg growth strategy centers on expanding its presence in the Scandinavian market and diversifying its insurance offerings. This approach is designed to capitalize on its strong position in Denmark, Norway, and Sweden while addressing emerging market needs. The company's strategic initiatives are geared towards sustained growth and enhanced profitability.

A key aspect of Tryg's expansion involves integrating the acquired RSA Scandinavia businesses. This integration aims to create synergies and streamline operations. Furthermore, the company is focused on optimizing its internal processes through digitalization and automation to improve efficiency and reduce costs. These efforts are crucial for maintaining a competitive edge in the insurance market.

Tryg's financial performance is also influenced by its geographical revenue distribution. The company strategically allocates its insurance revenue across the Scandinavian countries, with approximately 50% from Denmark, 30% from Sweden, and 20% from Norway. This balanced distribution helps mitigate risks and ensures a stable revenue stream.

Tryg is expanding its product offerings, particularly in areas like cyber insurance, to meet evolving market demands. This diversification strategy aims to capture new growth opportunities and cater to the changing needs of its customers. The focus on innovative products reflects Tryg's commitment to staying ahead of insurance market trends.

The integration of the acquired RSA Scandinavia businesses is a significant part of Tryg's expansion strategy. By the end of 2024, Tryg had achieved accumulated synergies of DKK 930 million from this acquisition. This integration is designed to streamline operations and improve overall efficiency.

Tryg is focused on streamlining back-end tasks through automation and achieving economies of scale in claims through digitalization and optimized procurement. The company aims for a DKK 500 million improvement in the insurance service result by 2027. These initiatives are crucial for enhancing profitability and reducing operational costs.

Tryg has taken steps to de-risk its Corporate portfolio by reducing exposure to US liability and property insurance outside the Nordics. This strategic move is expected to enhance profitability and decrease earnings volatility. The focus on risk management underscores Tryg's commitment to financial stability.

Tryg's expansion initiatives are multifaceted, focusing on both organic growth and strategic acquisitions. The company's approach involves a combination of product diversification, operational efficiency improvements, and risk management strategies. These efforts are designed to drive sustainable growth and enhance shareholder value.

- Expanding product offerings, especially in cyber insurance, to address emerging market needs.

- Integrating the acquired RSA Scandinavia businesses to realize synergies and improve efficiency.

- Streamlining back-end tasks through automation and digitalization to reduce costs.

- De-risking the Corporate portfolio by reducing exposure to US liability and property insurance.

Tryg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tryg Invest in Innovation?

The focus of Tryg's growth strategy is on leveraging technology and innovation to drive sustained expansion, with a clear emphasis on digital transformation and enhancing customer experience. This approach is critical in navigating the evolving insurance market trends and maintaining a strong position within the Danish insurance industry. The company's initiatives are designed to improve operational efficiency, adapt to climate-related risks, and boost customer satisfaction, which are all vital components of their future prospects.

Tryg's strategic initiatives include enhancing its IT capabilities and restructuring its IT team. These efforts have already yielded positive results, improving efficiency by 15% and enabling lower distribution costs. The company is also actively working on digitalizing claims handling and streamlining back-end tasks through automation, aiming to achieve significant economies of scale. These technological advancements are key to maintaining a competitive edge and ensuring long-term financial performance.

In response to climate change, Tryg has developed new house and building insurance products that align with the EU taxonomy. These policies are specifically designed to cover climate-related risks such as storms, wildfires, and cloudbursts, showcasing Tryg's commitment to sustainability and its ability to adapt to market changes. The company's proactive approach to addressing climate risks is a significant factor in its long-term investment strategy and its ability to attract and retain customers.

Tryg is undergoing a digital transformation to streamline operations and improve customer experience. This involves automating claims handling and back-end tasks, which contributes to economies of scale.

Restructuring the IT team and enhancing IT capabilities have improved efficiency by 15%, leading to lower distribution costs. This is a key element of Tryg's competitive advantages.

Tryg has developed new house and building insurance products adapted to the EU taxonomy, covering climate-related risks. These policies support the EU's environmental goals and Tryg's sustainability initiatives.

Tryg aims to improve customer satisfaction, targeting a score of 83 by 2027. Enhanced onboarding processes and faster claims handling are key to this goal.

Tryg incentivizes customers to prevent climate-related damage by offering reduced premiums or waiving deductibles for installing preventive devices. This is part of their customer retention strategies.

Automation and streamlining back-end tasks are crucial for achieving economies of scale and improving operational efficiency. This is a key aspect of Tryg’s digital transformation strategy.

Tryg's innovation strategy is multifaceted, focusing on leveraging technology to improve customer experience and operational efficiency. These efforts are crucial for its long-term growth and market position. For more insights, you can explore the Competitors Landscape of Tryg.

- Digitalization of Claims Handling: Implementing digital tools to streamline the claims process, reducing handling times and improving customer satisfaction.

- Automation of Back-End Tasks: Automating administrative and operational tasks to reduce costs and increase efficiency.

- Development of Climate-Resilient Insurance Products: Creating insurance products that address climate-related risks, such as storms and wildfires, to meet the changing needs of customers and align with sustainability goals.

- Enhancement of IT Capabilities: Investing in IT infrastructure and restructuring the IT team to improve overall efficiency and support digital transformation.

- Customer-Centric Initiatives: Focusing on improving customer satisfaction through enhanced onboarding processes and faster claims handling, with a target score of 83 by 2027.

Tryg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Tryg’s Growth Forecast?

The financial outlook for Tryg A/S is robust, supported by a strong performance in Q1 2025 and ambitious plans for future growth. The company's strategic initiatives and effective risk management are key drivers of its positive financial trajectory. Investors and stakeholders are closely watching Tryg's progress, particularly given its significant market share in the Danish insurance industry.

Tryg's financial health is further underscored by its commitment to shareholder returns and a strong solvency position. The company’s ability to achieve its financial targets in 2024 and its proactive approach to capital allocation demonstrate its financial stability. For more insights, you can explore the perspective of Owners & Shareholders of Tryg.

Tryg's focus on operational efficiency and customer satisfaction positions it well to navigate the evolving insurance market trends. The company's strategic investments in technology and digital transformation are expected to enhance its competitive advantages and support its long-term growth objectives. This focus is crucial for sustaining profitability and market leadership.

Tryg reported a revenue growth of 3.7% in Q1 2025, reaching DKK 9.77 billion. This growth was primarily driven by strategic price adjustments.

The insurance service result increased significantly to DKK 1,540 million in Q1 2025, a 20% year-on-year increase from DKK 1,280 million in Q1 2024. This indicates improved profitability.

The combined ratio improved to 84.2% in Q1 2025, from 86.6% in the prior year. This improvement reflects stronger risk management and cost efficiencies.

The expense ratio also dipped to 13.3% from 13.5%, showing effective control over operating costs.

Looking ahead, Tryg's financial outlook is supported by strategic targets and shareholder-friendly initiatives. The company's focus on operational excellence and capital management is expected to drive sustainable value creation.

Tryg aims to achieve a combined ratio of around 81% by 2027. This target reflects continued efforts to improve operational efficiency and profitability.

The company targets an Insurance Service Result between DKK 8,000-8,400 million. This indicates expectations for consistent and strong earnings.

Tryg plans to distribute DKK 17-18 billion to shareholders between 2025 and 2027. This includes an ordinary dividend and a share buyback program.

A DKK 2 billion extraordinary share buyback program was launched in December 2024. As of the end of Q1 2025, DKK 1.3 billion of the program had been repurchased.

Tryg's solvency ratio remained strong at 195% at the end of Q1 2025, well above regulatory requirements, ensuring financial stability.

In 2024, Tryg achieved all its financial targets, reporting an insurance service result of DKK 7,324 million and a combined ratio of 81.0%, with profit before tax of DKK 6,423 million.

Tryg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Tryg’s Growth?

The Tryg growth strategy faces several potential risks and obstacles that could influence its future. These challenges range from macroeconomic pressures to regulatory scrutiny and competitive market dynamics. Understanding these potential pitfalls is crucial for assessing the long-term Tryg future prospects and the company's overall financial health.

Inflationary pressures represent a significant risk. Elevated inflation can lead to increased claims costs, potentially squeezing profit margins if price adjustments lag. Furthermore, regulatory changes and customer churn in the competitive insurance markets pose additional obstacles. The company's ability to navigate these challenges will be critical for sustained success.

The Tryg company analysis reveals that the company must proactively address these risks through strategic measures.

Sustained inflation can increase claims costs, potentially impacting profit margins. While price adjustments in Q1 2025 helped offset rising costs, the mild winter's claims relief might not be repeatable. The impact of inflation on Tryg's business is a key concern, necessitating careful management of pricing and cost control.

Ongoing investigations by the Danish Consumer and Competition Authority (DCCA) into non-life insurance indexing practices could lead to pricing reforms. These reforms could potentially affect profitability. Tryg's financial performance could be directly impacted by the outcomes of these regulatory actions.

Customer churn, particularly in the competitive Danish and Norwegian markets, is a continuous challenge. Approximately 500,000 annual switches occur in Denmark alone. Addressing this requires a sustained focus on retention through service quality and digital engagement. Tryg's customer retention strategies are vital for maintaining market share.

The insurance market is subject to various market forces, including seasonal fluctuations and economic cycles. Q2 2025 may face normal seasonal volatility. The company must be prepared to manage these fluctuations effectively to ensure consistent financial results. Understanding insurance market trends is essential.

The Danish insurance industry is highly competitive. Competitors are constantly vying for market share, which can put pressure on pricing and customer acquisition costs. Tryg's competitive advantages will be tested in this dynamic environment. The company's ability to innovate and adapt is crucial.

Operational risks, such as those related to IT systems, data security, and claims processing, can also impact the company. Efficient risk management and robust operational processes are necessary to mitigate these risks. Tryg's digital transformation strategy must consider these operational aspects.

To address these risks, Tryg employs disciplined underwriting practices, focuses on cost efficiencies, and prioritizes customer satisfaction. The company's ability to manage and adapt to these challenges will determine its long-term success. For more details, you can read a Brief History of Tryg.

Disciplined underwriting helps to manage risk exposure and maintain profitability. Cost efficiencies are essential for preserving profit margins and staying competitive. Customer satisfaction is a key focus for retaining customers and building loyalty. Tryg's financial results and outlook depend on these strategies.

Tryg's long-term investment strategy includes a focus on innovation in insurance products. The company also has a commitment to sustainability initiatives, which can enhance its brand reputation. Tryg's expansion plans are supported by its strategic approach to risk management.

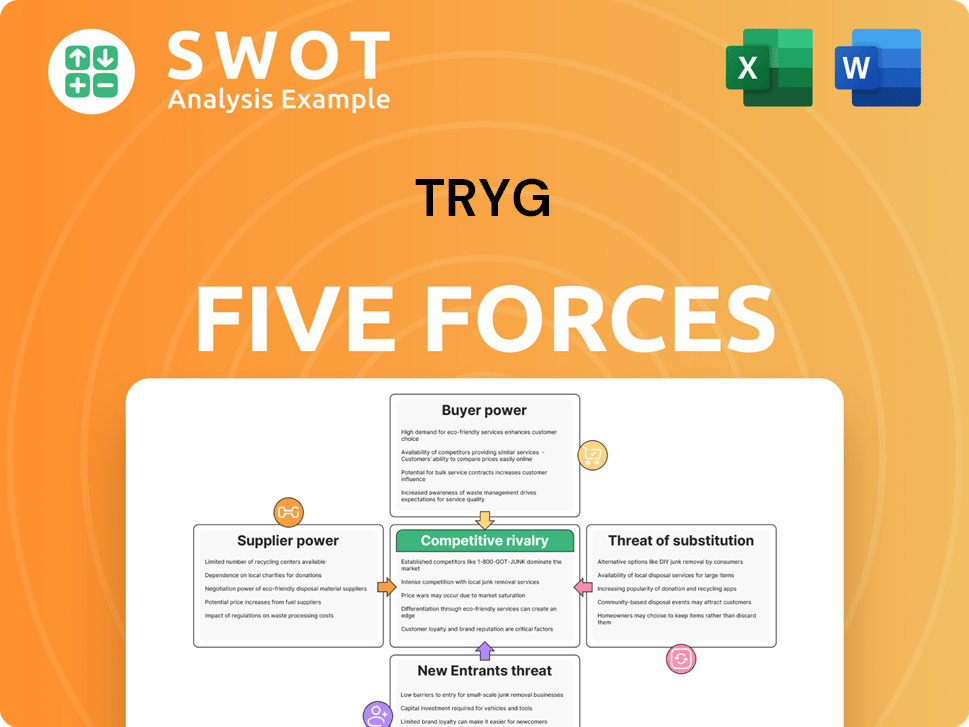

Tryg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tryg Company?

- What is Competitive Landscape of Tryg Company?

- How Does Tryg Company Work?

- What is Sales and Marketing Strategy of Tryg Company?

- What is Brief History of Tryg Company?

- Who Owns Tryg Company?

- What is Customer Demographics and Target Market of Tryg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.