Tryg Bundle

How Well Does Tryg Insurance Know Its Customers?

In the competitive world of insurance, understanding Tryg SWOT Analysis is crucial for success. This involves a deep dive into the customer demographics and the Tryg target market. This exploration is vital for a company like Tryg, which operates in a dynamic Nordic market.

This analysis will uncover Tryg Company's strategic approach to market segmentation and demographic analysis, revealing how it tailors its Tryg insurance offerings. We'll examine Tryg's customer age groups, income levels, and geographic focus, alongside its customer acquisition and retention strategies. By understanding Tryg's customer needs assessment and preferred customer profile, we can gain insights into its impressive customer satisfaction metrics and market share.

Who Are Tryg’s Main Customers?

Understanding the primary customer segments is crucial when analyzing the Revenue Streams & Business Model of Tryg. The company strategically divides its operations into three main segments: Private, Commercial, and Corporate. This segmentation allows for a targeted approach to meet the diverse needs of its customer base, which includes both individual consumers and businesses.

The Private segment focuses on providing insurance solutions to individuals and families. The Commercial segment caters to businesses, ranging from small to medium-sized enterprises (SMEs) to larger corporations. Tryg also had a Corporate segment, but it was merged into the Commercial segment to streamline operations and enhance competitiveness. In 2024, the Private and Commercial businesses collectively experienced a 6% growth, mainly due to price adjustments aimed at mitigating inflation.

Tryg's customer base is spread across Denmark, Norway, and Sweden, indicating a strong geographic focus. While specific details on customer demographics such as age, gender, or income levels are not publicly available, the company's focus on price adjustments and profitability suggests a customer base that is sensitive to value. Tryg's commitment to customer satisfaction is evident, as shown by a score of 87 in 2024 and 82 in Q1 2025, highlighting its efforts to retain customers across all segments.

While specific demographic data like age, gender, and income levels are not detailed, the focus on price adjustments suggests a price-sensitive customer base. Tryg's efforts to maintain high customer satisfaction scores indicate a focus on customer retention across all segments.

The target market includes individuals and families (Private segment) and businesses of various sizes (Commercial segment). The geographic focus is on Denmark, Norway, and Sweden. Tryg's market segmentation allows it to tailor its products and services to meet the specific needs of each customer group.

Tryg's insurance offerings are divided into Private, Commercial, and Corporate segments. The Private segment provides insurance to individuals, while the Commercial segment serves businesses. The Corporate segment was merged into the Commercial segment. This segmentation allows Tryg to better serve its diverse customer base.

Tryg segments its market into Private, Commercial, and Corporate segments to tailor its products and services. The merger of Corporate into Commercial enhances operational efficiency. This approach allows for better customer relationship management and targeted marketing efforts.

Tryg's customer base is segmented into Private and Commercial segments, with a focus on serving both individuals and businesses. The company's strategic focus on price adjustments and customer satisfaction indicates a commitment to value and retention.

- Tryg's geographic focus is primarily on Denmark, Norway, and Sweden.

- The Commercial segment serves a wide range of businesses, from SMEs to larger corporations.

- Customer satisfaction scores of 87 in 2024 and 82 in Q1 2025 demonstrate a focus on customer experience.

- The merger of Corporate into Commercial streamlined operations and improved competitiveness.

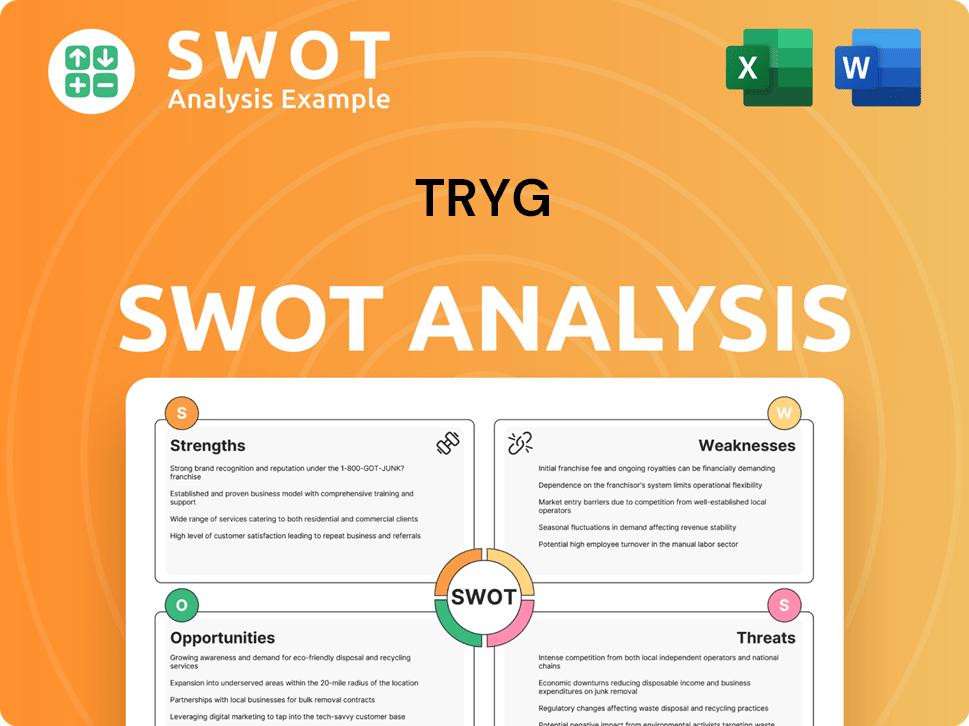

Tryg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Tryg’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the insurance sector, it's especially vital. The goal is to provide financial security and peace of mind. This involves offering protection against unforeseen events related to property, health, and life. This approach directly addresses the core needs of their customers.

For the company, customer satisfaction is a key priority. The customer experience is closely linked to customer retention. By focusing on these aspects, the company aims to meet and exceed customer expectations, which in turn fosters loyalty and drives business success.

The company's customers are primarily looking for reliability, efficient claims handling, competitive pricing, and personalized service. The company’s disciplined underwriting and cost efficiencies directly address customers' desire for value and financial stability. The company's efforts extend to addressing emerging customer needs, such as adapting to climate change.

The company achieved a customer satisfaction score of 87 in 2024, which rose to 82 in Q1 2025. This improvement is partly due to enhanced onboarding and faster claims handling.

In Q1 2025, the company processed over 500,000 claims and paid out more than DKK 6.6 billion. Streamlining operations has improved the customer experience.

The company's 2027 strategy aims to further elevate customer satisfaction to 83/100. This recognizes the strong link between customer experience and retention.

The company is responding to growing environmental consciousness. Efforts to minimize resource use and reduce CO2e emissions demonstrate this commitment.

The company's improved combined ratio of 84.2% in Q1 2025, down from 86.6% in Q1 2024, reflects its focus on cost efficiencies and disciplined underwriting, which benefits customers.

The integration of IT processes and systems from Codan Norway and Trygg-Hansa into the company's IT landscape has streamlined operations. This contributes to a more seamless customer experience.

The company's approach to understanding and meeting customer needs, as highlighted in the Owners & Shareholders of Tryg article, is multifaceted. This includes a focus on financial stability, customer satisfaction, and adapting to emerging needs like climate change. The company's ability to provide value, handle claims efficiently, and offer personalized service is crucial. The customer demographics of the company are diverse, and the company's target market includes individuals and businesses seeking comprehensive insurance solutions. The company’s commitment to these principles is evident in its financial performance and strategic goals.

The company’s focus on customer needs is evident through its actions and strategic initiatives, including:

- Reliability and Trust: Customers prioritize a dependable insurance provider.

- Efficient Claims Handling: Quick and fair claims processing is essential for customer satisfaction.

- Competitive Pricing: Offering value through cost-effective insurance products.

- Personalized Service: Tailoring insurance solutions to meet individual customer needs.

- Financial Stability: Ensuring long-term financial security for customers.

- Adaptability: Responding to emerging needs, such as climate change.

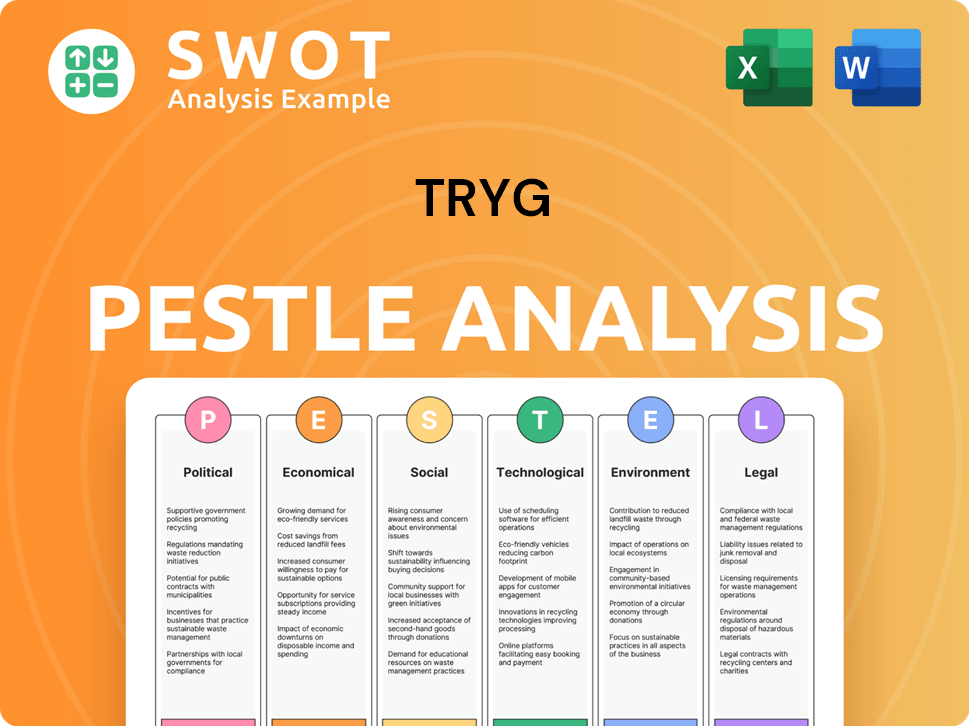

Tryg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Tryg operate?

The geographical market presence of Tryg A/S is primarily concentrated in Scandinavia, with a strong focus on Denmark, Norway, and Sweden. This strategic positioning allows the company to leverage its understanding of the Nordic market and tailor its insurance products and services accordingly. The company's operations are significantly influenced by its presence in these key markets.

Tryg has a balanced distribution of insurance revenue across its core markets. In Q1 2024, approximately 50% of its revenue came from Denmark, 30% from Sweden, and 20% from Norway. This distribution highlights the importance of each market to Tryg's overall financial performance and strategic goals. The company is a leading insurer in Denmark and holds strong positions in both Norway and Sweden.

The acquisition of Codan's Swedish and Norwegian businesses in 2022 significantly strengthened Tryg's market position in the Nordic region. The integration of Trygg-Hansa in Sweden has been particularly impactful, positioning Tryg as the third-largest P&C insurer in the Swedish market. This expansion has allowed Tryg to increase its market share and enhance its competitive advantage.

Tryg's primary focus is on the Scandinavian countries: Denmark, Norway, and Sweden. This geographical focus allows for a deep understanding of local market dynamics and customer needs.

In Q1 2024, the revenue distribution was approximately 50% from Denmark, 30% from Sweden, and 20% from Norway. This distribution shows the importance of each market.

The acquisition of Codan's Swedish and Norwegian businesses in 2022 strengthened Tryg's market presence. The integration of Trygg-Hansa in Sweden improved its market share.

Tryg is a leading insurer in Denmark and holds strong positions in Norway and Sweden. This strong market position allows for competitive advantages and growth opportunities.

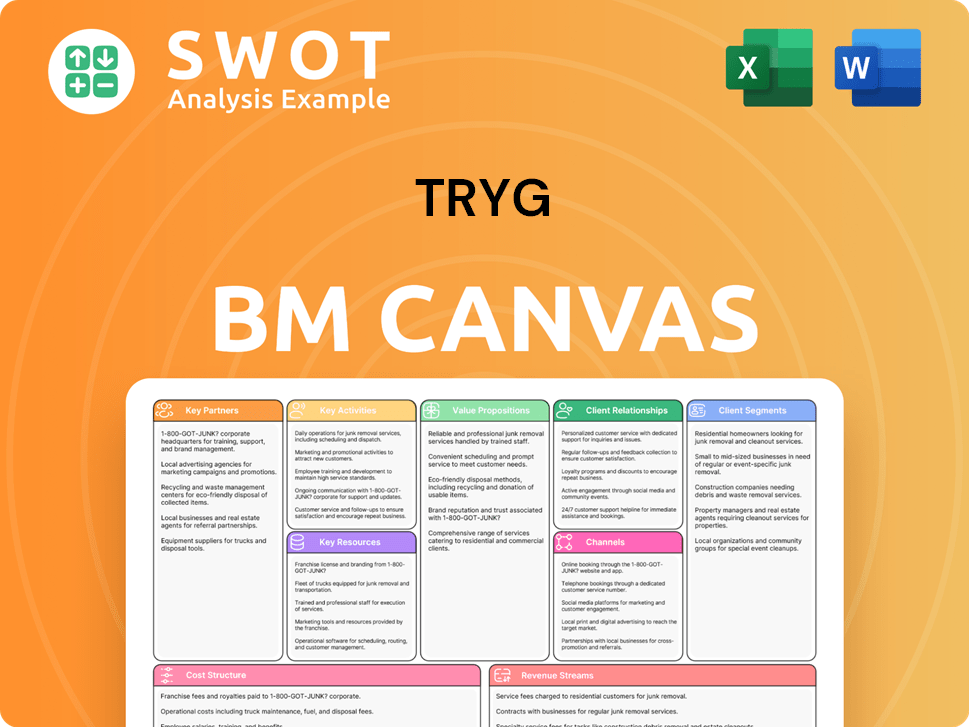

Tryg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Tryg Win & Keep Customers?

The success of customer acquisition and retention is pivotal for the growth of any insurance company, and for the [Company Name], this is no exception. The company employs a multi-faceted approach, combining traditional and digital strategies. A strong emphasis on customer experience and loyalty is central to their approach, recognizing the direct impact of customer satisfaction on retention rates.

The company's commitment to customer satisfaction is evident in its initiatives. In Q1 2025, the customer satisfaction score rose to 82, up from 81 in Q1 2024, reflecting the positive effects of these strategies. This focus is critical for maintaining and expanding its customer base in a competitive market.

The company's strategies are designed to attract and retain customers effectively. These include enhancing the customer journey, leveraging digital transformation, and fostering loyalty through various programs and acquisitions. The integration of IT systems from the Codan acquisition has also contributed to operational efficiency and improved customer experience.

The company focuses on improving the customer journey, including a redesigned onboarding process and faster claims handling. In Q1 2025, they handled over half a million claims, disbursing over DKK 6.6 billion, directly impacting customer satisfaction. This approach is crucial for building trust and ensuring customer loyalty, which is a key part of their growth strategy.

Technology is leveraged to streamline operations and enhance customer interactions. The company aims for straight-through processing for digitally reported claims to exceed 55% by 2027. This digital focus improves efficiency and enhances the overall customer experience, making interactions easier and faster.

While not explicitly detailed, data is used to tailor offerings and communication, a common practice in customer acquisition and retention. This suggests a strategic use of customer data to understand and meet individual customer needs, which is essential for building strong customer relationships.

TryghedsGruppen, the majority shareholder, continued paying a member bonus in 2023, totaling approximately DKK 950 million, equivalent to 6% of premiums paid in 2022. This bonus acts as a significant loyalty and retention mechanism, rewarding customers for their continued patronage.

The acquisition of Codan's Swedish and Norwegian businesses in 2022 significantly expanded the customer base, demonstrating an inorganic growth strategy. This expansion through acquisitions is a key element of their growth strategy, increasing market share and customer reach.

Price adjustments in 2024 helped mitigate inflation and restore profitability, highlighting the strategic use of pricing to maintain customer relationships. This approach ensures the company remains competitive while sustaining customer loyalty.

The company plans to return DKK 17-18 billion to shareholders between 2025 and 2027, including a DKK 2 billion share buyback launched in December 2024. This financial strength builds customer trust and confidence in the company's stability.

The improvement in customer satisfaction scores from 81 in Q1 2024 to 82 in Q1 2025 is a key indicator of the effectiveness of these strategies. This demonstrates a commitment to understanding and meeting customer needs, which is crucial for long-term success. This also helps in determining the ideal characteristics of the Tryg target market.

While the exact market segmentation methods are not detailed, the focus on personalized experiences suggests that the company utilizes data to segment its customer base. This allows for targeted marketing and tailored offerings, which is a common practice in modern insurance businesses. This approach is essential for understanding the customer demographics.

Understanding the Tryg customer age groups, income levels, and geographic focus is essential for effective customer acquisition and retention. Analyzing these demographics helps the company tailor its products and services to meet the specific needs of its target audience. Further demographic analysis ensures the company’s strategies remain relevant and effective.

Regularly assessing customer needs is a critical part of retaining customers. This involves gathering feedback, analyzing customer behavior, and adapting products and services accordingly. Understanding the Tryg customer lifestyle analysis and Tryg's preferred customer profile allows the company to refine its offerings.

The company’s customer acquisition strategy includes strategic acquisitions, digital transformation, and personalized experiences. These approaches allow the company to reach and attract new customers effectively. The focus on digital channels and data-driven insights is particularly important in today’s market.

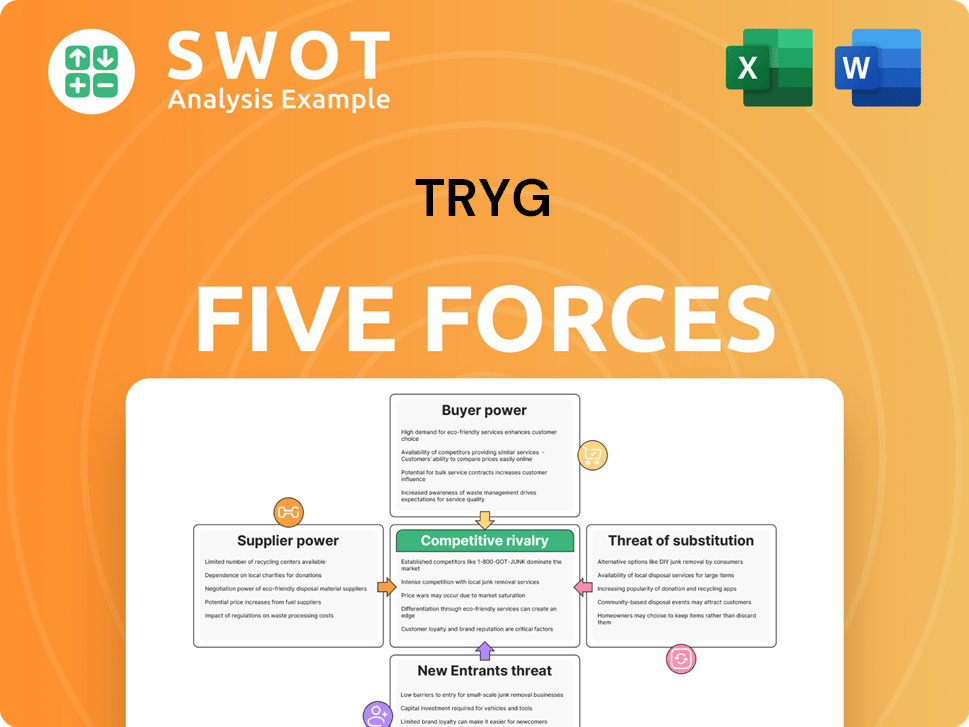

Tryg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tryg Company?

- What is Competitive Landscape of Tryg Company?

- What is Growth Strategy and Future Prospects of Tryg Company?

- How Does Tryg Company Work?

- What is Sales and Marketing Strategy of Tryg Company?

- What is Brief History of Tryg Company?

- Who Owns Tryg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.