United Parks & Resorts Bundle

What's the Story Behind United Parks & Resorts?

Dive into the captivating United Parks & Resorts SWOT Analysis and uncover the fascinating journey of a theme park company that blends thrills with a commitment to conservation. From its inception, United Parks & Resorts, formerly known as SeaWorld Parks, has redefined entertainment, creating immersive experiences that captivate and educate. Explore the key milestones and strategic decisions that have shaped this entertainment industry leader.

The United Parks & Resorts story is one of innovation and adaptation, marked by significant park acquisitions and a dedication to animal care. Understanding the history of United Parks & Resorts, including its SeaWorld Parks origins and Busch Gardens' evolution, provides valuable insights into its current market position. This brief history will illuminate the company's expansion, ownership changes, and financial performance, offering a comprehensive view of its remarkable trajectory within the entertainment industry.

What is the United Parks & Resorts Founding Story?

The story of United Parks & Resorts Inc., operating as SeaWorld Entertainment, Inc., began with a shared vision among four UCLA graduates: George Millay, Milton C. Shedd, Ken Norris, and David DeMott. Their collective passion for marine life and entertainment laid the foundation for SeaWorld. The opening of the first park on March 21, 1964, in San Diego, California, marked the beginning of their journey.

The initial concept was innovative, featuring an underwater restaurant alongside a marine mammal show. This unique approach aimed to merge education with entertainment, providing the public with an immersive experience of the marine world. The founders focused on showcasing marine animals in theatrical settings to promote appreciation and understanding.

The primary product offered was the immersive experience of marine life shows and exhibits. The founders funded the venture through personal investments and loans, transforming their dream into reality. San Diego was chosen strategically, leveraging Southern California's tourism industry and climate to attract visitors. The company's evolution reflects significant milestones in the entertainment industry.

The early years of SeaWorld focused on building a brand around marine life entertainment. The company's growth included strategic park acquisitions and expansions.

- 1964: SeaWorld San Diego opens, introducing the public to marine life shows.

- 1970s: Expansion with new parks, including SeaWorld Ohio and SeaWorld Orlando.

- 1980s-1990s: Further park acquisitions and development, increasing the company's footprint.

- 2000s: Continued growth and evolution within the entertainment industry.

Over the years, United Parks & Resorts has expanded its portfolio. The company has navigated various ownership changes and financial performances. The locations of its parks are strategically chosen to maximize visitor access. The company's history also includes a focus on animal care and conservation efforts.

For more detailed insights into the company's evolution, including its financial performance and park locations, you can explore additional resources. One such resource is an article that delves into the history of United Parks & Resorts.

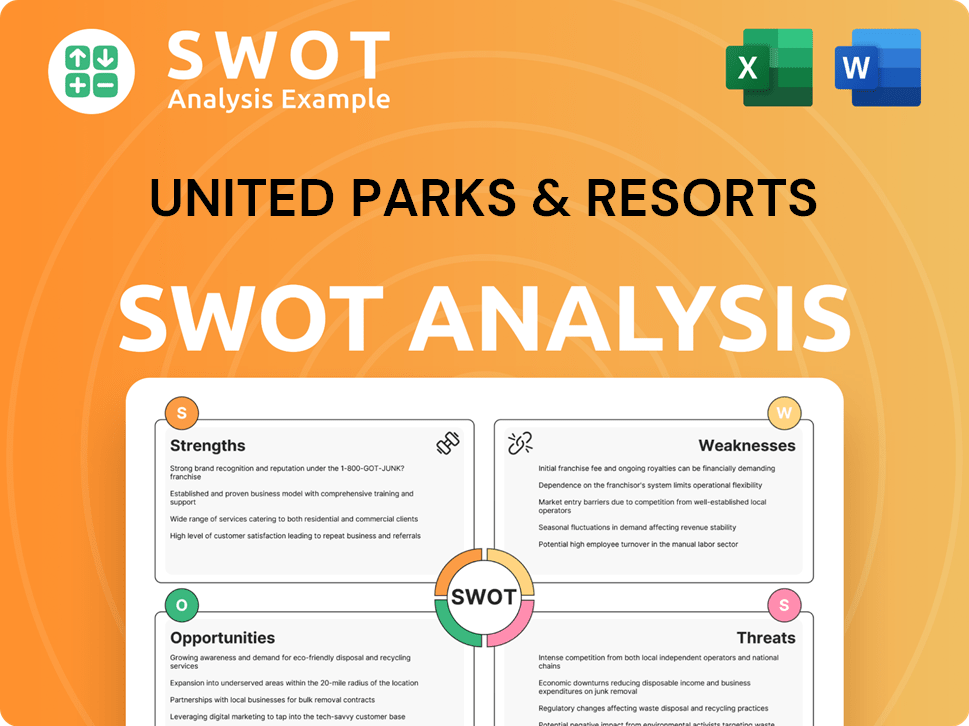

United Parks & Resorts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of United Parks & Resorts?

Following the success of its initial park in San Diego, United Parks & Resorts, formerly known as SeaWorld, experienced substantial early growth and expansion. This growth was fueled by the positive reception of its unique entertainment and educational approach. The company quickly established itself as a multi-park operator, strategically entering new geographical markets. This phase involved significant investment in infrastructure and the development of captivating shows, solidifying the brand's identity within the entertainment industry.

The company's expansion strategy included opening new parks in key locations. SeaWorld of Ohio opened in 1970, followed by SeaWorld Orlando in 1973. This marked the company's entry into new markets. SeaWorld San Antonio opened in 1988.

Park acquisitions were crucial to the company's growth. The purchase of Busch Gardens parks in 1989 diversified its portfolio. This move added traditional theme park rides to its offerings, enhancing its appeal. These acquisitions were a strategic move.

Significant capital investments were made to improve park infrastructure. New aquariums, habitats, and show venues were constructed. The company focused on innovation to stay competitive. This included continually updating entertainment offerings.

The company emphasized animal care and conservation efforts. This commitment resonated with a growing audience. The focus on animal welfare helped build a positive brand image. The company's approach attracted visitors.

This early period set the stage for United Parks & Resorts' future. The company's ability to adapt and innovate, coupled with strategic acquisitions, helped it establish a strong presence in the theme park industry. For more details on the financial aspects and business model, consider exploring Revenue Streams & Business Model of United Parks & Resorts.

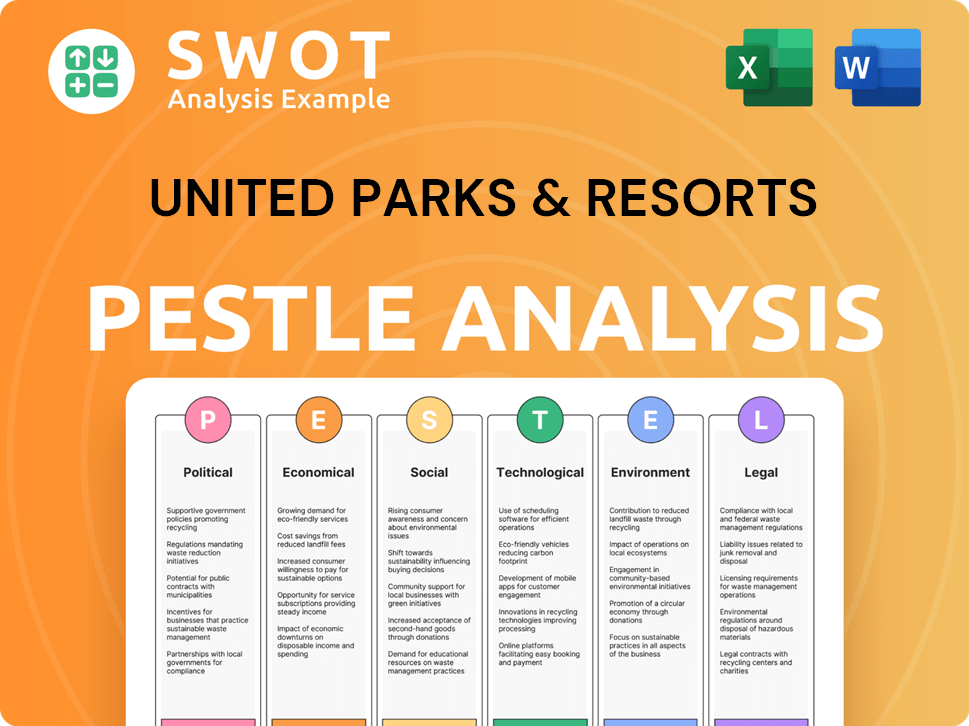

United Parks & Resorts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in United Parks & Resorts history?

The History of United Parks & Resorts, formerly known as SeaWorld Entertainment, is marked by several pivotal milestones that have shaped its trajectory in the entertainment industry. The company, through its SeaWorld Parks, has consistently expanded its portfolio and adapted to changing market dynamics.

| Year | Milestone |

|---|---|

| 1964 | The first SeaWorld park opened in San Diego, California, marking the beginning of the SeaWorld Parks brand. |

| 1976 | Anheuser-Busch acquired SeaWorld, initiating a period of expansion and investment in new parks and attractions. |

| 1989 | Busch Entertainment Corporation was formed, consolidating the management of the theme park operations. |

| 2008 | Blackstone Group acquired Busch Entertainment Corporation from Anheuser-Busch, setting the stage for further changes. |

| 2013 | The documentary 'Blackfish' was released, leading to increased public scrutiny and impacting the company's reputation. |

| 2016 | SeaWorld announced the end of its orca breeding program, signaling a shift in its animal welfare practices. |

| 2019 | The company changed its name to United Parks & Resorts, reflecting a broader portfolio of park experiences. |

| 2024 | SeaWorld's Rescue team has saved over 40,000 animals, highlighting its commitment to wildlife protection. |

United Parks & Resorts has been at the forefront of innovations, particularly in marine animal care and entertainment. These innovations have not only enhanced the guest experience but also contributed significantly to wildlife conservation efforts.

Development of advanced animal habitats that provide enriching environments for marine life, improving their well-being and allowing for better observation by guests.

Establishment of robust rescue, rehabilitation, and release programs for marine animals, contributing to the conservation of endangered species and demonstrating a commitment to animal welfare.

Implementation of educational programs and interactive exhibits designed to educate guests about marine life, conservation, and the importance of protecting the oceans.

Investment in innovative ride technologies, including roller coasters and water rides, to enhance the guest experience and attract a wider audience.

Active involvement in conservation projects, including research, habitat restoration, and partnerships with conservation organizations to protect marine ecosystems.

Continuous improvement of animal care standards, including veterinary care, nutrition, and enrichment programs, to ensure the health and well-being of the animals in their care.

Despite its successes, United Parks & Resorts has faced numerous challenges that have shaped its strategic direction. These challenges have tested the company's resilience and forced it to adapt to changing public sentiment and market conditions.

Negative publicity and public scrutiny related to animal welfare practices, particularly following the release of the documentary 'Blackfish', significantly impacted attendance and revenue.

Economic downturns and fluctuations in the entertainment industry have affected attendance and financial performance, requiring the company to implement cost-saving measures and adjust its strategies.

Competition from other theme park companies and entertainment venues has required United Parks & Resorts to continuously innovate and differentiate its offerings to attract and retain guests.

Evolving consumer preferences and a growing interest in ethical and sustainable practices have led to a need for the company to adapt its business model and messaging.

The complexities of managing large-scale operations, including maintaining animal habitats, ensuring guest safety, and managing a diverse workforce, present ongoing operational challenges.

Navigating and complying with various regulations related to animal welfare, environmental protection, and public safety adds to the operational complexity and costs.

For more insights, consider exploring the Target Market of United Parks & Resorts.

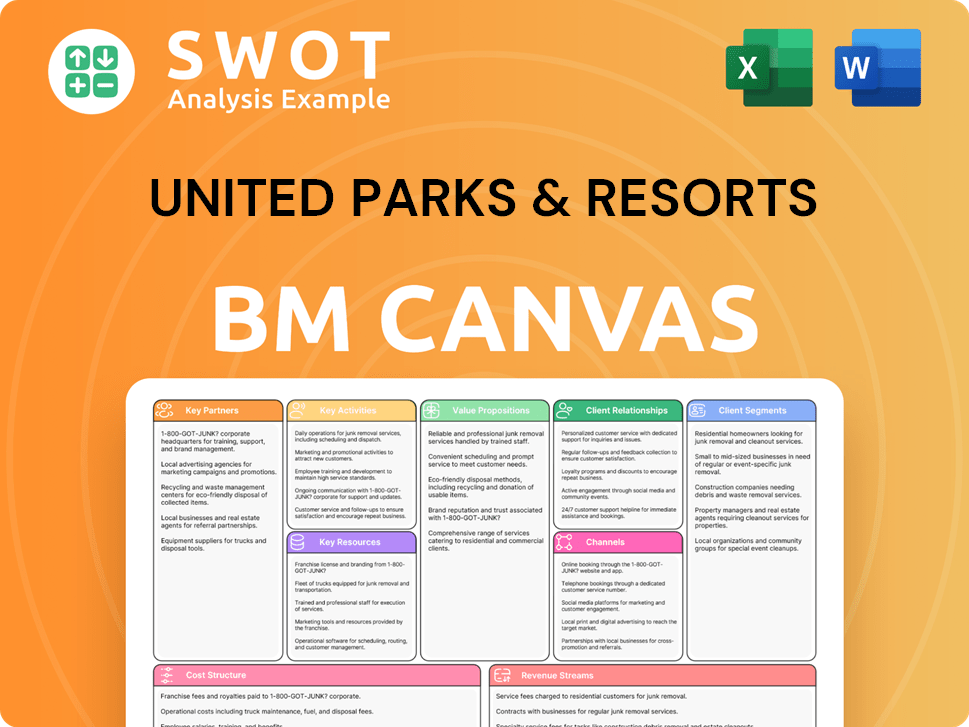

United Parks & Resorts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for United Parks & Resorts?

The journey of United Parks & Resorts, previously known as SeaWorld Entertainment, Inc., has been marked by significant milestones since its inception. From its humble beginnings in 1964 with the opening of the first SeaWorld park in San Diego, California, the company has grown into a major player in the theme park industry. Key acquisitions, such as the Busch Gardens parks in 1989, broadened its portfolio and market reach. The company navigated ownership changes, including the acquisition by Blackstone in 2009, and went public in 2013. A pivotal decision in 2016 saw the end of its orca breeding program, reflecting evolving perspectives on animal welfare. The company has also faced challenges, notably during the COVID-19 pandemic in 2020, but has shown resilience, with record revenues and attendance reported in 2022. In 2024, the SeaWorld Rescue team has saved over 40,000 animals.

| Year | Key Event |

|---|---|

| 1964 | The first SeaWorld park opened in San Diego, California, marking the beginning of the theme park company. |

| 1970 | SeaWorld of Ohio opened, expanding the company's presence. |

| 1973 | SeaWorld Orlando opened, establishing a significant presence in Florida. |

| 1988 | SeaWorld San Antonio opened, further expanding its reach. |

| 1989 | Busch Entertainment Corporation acquired the Busch Gardens parks, diversifying the company's portfolio. |

| 2009 | Blackstone acquired SeaWorld Parks & Entertainment from Anheuser-Busch InBev. |

| 2013 | SeaWorld Entertainment, Inc. went public on the New York Stock Exchange. |

| 2016 | The company announced the end of its orca breeding program. |

| 2020 | The company faced operational challenges due to the COVID-19 pandemic. |

| 2022 | Reported record revenues and attendance, signaling a strong recovery post-pandemic. |

| 2023 | Continued investment in new rides and attractions across its parks. |

| 2024 | SeaWorld Rescue team has saved over 40,000 animals. |

United Parks & Resorts is focused on continuous growth through new attractions. The company plans to open new rides and attractions in 2024 and 2025, aiming to boost attendance and revenue. This expansion strategy is crucial for maintaining its competitive edge within the entertainment industry.

A key focus is on sustainability and conservation efforts. This aligns with broader industry trends and consumer preferences for responsible tourism. The company's commitment to animal welfare and environmental stewardship is a core part of its mission.

Analyst predictions suggest a positive outlook for United Parks & Resorts. The travel and leisure sector is expected to continue recovering, benefiting theme park operators. The company's financial performance is closely tied to these broader market trends.

The company is committed to innovation in entertainment to enhance guest experiences. This includes leveraging technology to improve park operations and attractions. For more detailed insights, you can explore the Growth Strategy of United Parks & Resorts.

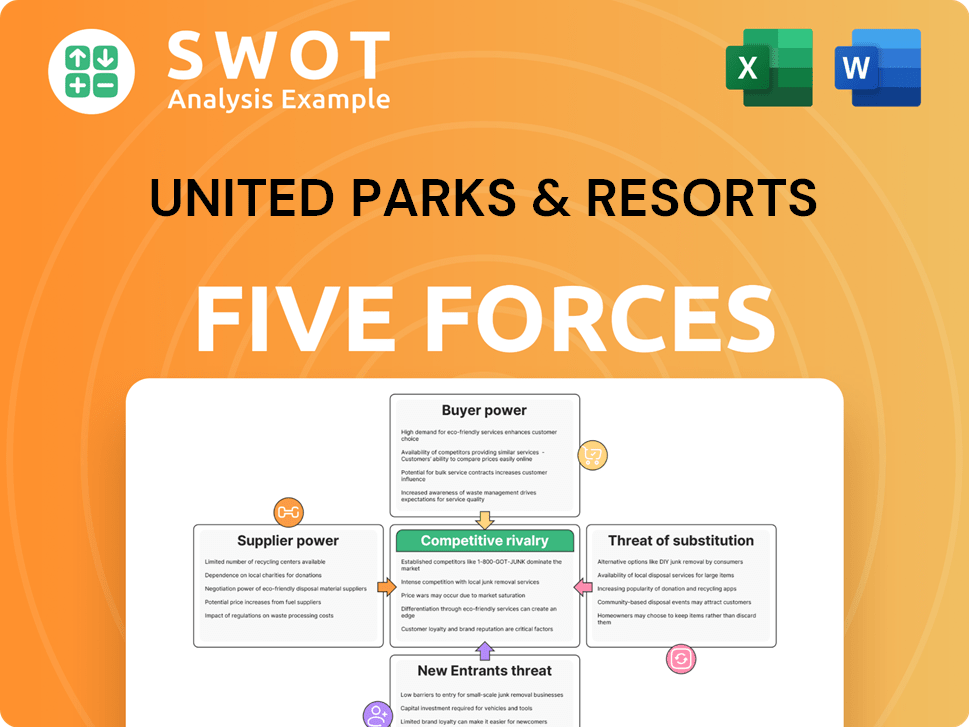

United Parks & Resorts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of United Parks & Resorts Company?

- What is Growth Strategy and Future Prospects of United Parks & Resorts Company?

- How Does United Parks & Resorts Company Work?

- What is Sales and Marketing Strategy of United Parks & Resorts Company?

- What is Brief History of United Parks & Resorts Company?

- Who Owns United Parks & Resorts Company?

- What is Customer Demographics and Target Market of United Parks & Resorts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.