United Parks & Resorts Bundle

Can United Parks & Resorts Continue to Thrive in the Theme Park Industry?

United Parks & Resorts, formerly SeaWorld Entertainment, is charting a new course, evolving beyond its legacy brand to embrace a broader entertainment portfolio. This strategic shift, marked by a 2024 rebranding, signals ambitious United Parks & Resorts SWOT Analysis and a commitment to growth. With a diverse collection of parks, including SeaWorld and Busch Gardens, the company is poised to capitalize on its market position and future opportunities. The question is: how will they achieve it?

This analysis delves into the Growth Strategy and Future Prospects of United Parks & Resorts, examining its Company Performance and expansion plans. We'll explore how the company leverages its assets within the Theme Park Industry to drive Business Development and increase United Parks & Resorts revenue. Understanding the company's vision and long-term strategy is crucial for anyone interested in the Future of United Parks & Resorts stock and the broader entertainment sector.

How Is United Parks & Resorts Expanding Its Reach?

The United Parks & Resorts is actively pursuing a robust Growth Strategy through various expansion initiatives. These initiatives focus on introducing new attractions, enhancing guest experiences, and exploring opportunities in international markets. The company's strategy aims to strengthen its position within the Theme Park Industry and improve its overall Company Performance.

For 2025, the company has unveiled a series of new rides and attractions across its parks. These investments are designed to draw in new customers and increase in-park spending. This strategic approach is critical for driving revenue growth and maintaining a competitive edge in the entertainment sector.

The company's expansion plans include a variety of new offerings. These include an immersive family-friendly attraction at SeaWorld Orlando, 'Jewels of the Sea' at SeaWorld San Diego, and 'Rescue Jr.' at SeaWorld San Antonio. Busch Gardens Tampa Bay will debut 'Wild Oasis,' and Busch Gardens Williamsburg will open 'The Big Bad Wolf: The Wolf's Revenge.' Water Country USA is also set to open 'High Tide Harbor.'

These new attractions aim to attract new customers and enhance the overall guest experience. The company is investing significantly in these projects to ensure long-term growth and market share. These additions are part of a broader strategy to keep the parks fresh and appealing.

The company is focused on improving in-park per capita spending. This is a key metric for evaluating the success of these initiatives. In Q1 2025, per capita spending increased by 1.1% to a record $38.58. This indicates that guests are spending more per visit, boosting revenue.

The company is also focusing on Business Development in international markets. The company's international sales growth is up mid-single digits, and group bookings are up double digits. This indicates successful market penetration and diversified revenue streams. This expansion is crucial for long-term sustainability.

The company is exploring hotel and real estate development opportunities. This further enhances its offerings and provides additional revenue streams. These developments are part of a broader strategy to create a more comprehensive entertainment experience for guests.

The company's expansion strategy is multi-faceted, including new attractions, enhanced guest experiences, and international growth. These initiatives are designed to drive revenue and increase market share. For more insights, see the Competitors Landscape of United Parks & Resorts.

- New Rides and Attractions: Launching new rides and attractions across various parks.

- Enhanced Guest Experiences: Improving in-park spending and overall guest satisfaction.

- International Expansion: Growing sales and bookings in international markets.

- Hotel and Real Estate Development: Exploring opportunities to enhance offerings.

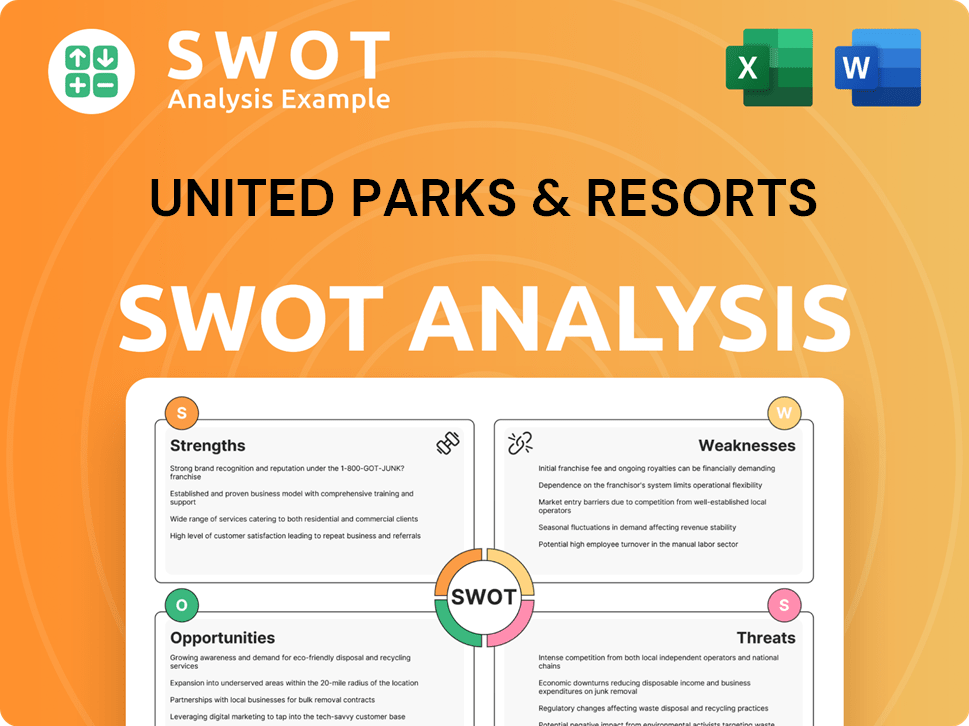

United Parks & Resorts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does United Parks & Resorts Invest in Innovation?

The company, United Parks & Resorts, is actively leveraging technology and innovation to enhance guest experiences and drive sustained growth within the Theme Park Industry. This strategic approach focuses on creating cutting-edge attractions and implementing digital transformation initiatives. These efforts are crucial for maintaining a competitive edge and attracting visitors in a dynamic market.

A key aspect of their strategy involves the development of new attractions that incorporate advanced technology. This is evident in recent projects like 'Expedition Odyssey' at SeaWorld Orlando, which opened in May 2025. This attraction uses state-of-the-art ride technology and immersive real-world footage to create a unique Arctic experience. The company's commitment to innovation extends beyond individual attractions, encompassing broader operational efficiencies.

Furthermore, the company is focused on strategic cost savings and operational efficiency initiatives, including technology upgrades and labor structure optimization. While specific details on R&D investments, AI, or IoT applications are not extensively disclosed, the emphasis on new attractions with advanced technology and digital experiences suggests an ongoing commitment to innovation. These efforts contribute to the overall Company Performance and future success.

The company invests in the development of new attractions that incorporate the latest technological advancements. This includes immersive experiences and innovative ride systems. Recent examples include 'Expedition Odyssey' at SeaWorld Orlando and 'SeaSub' at SeaWorld Yas Island.

The company is focused on digital transformation to enhance the guest experience. This involves integrating digital technologies into various aspects of park operations. The goal is to improve efficiency and provide more engaging experiences for visitors.

Strategic initiatives are in place to improve operational efficiency through technology upgrades and labor structure optimization. These efforts aim to reduce costs and streamline operations across the parks. This contributes to the overall United Parks & Resorts revenue.

Advancements in technology are utilized to improve animal care and rescue efforts. The company has a long history of animal care and rescue, having helped over 42,000 animals. Technology aids in monitoring and rehabilitation processes.

While specific details on R&D investments are not extensively disclosed, the emphasis on new attractions with advanced technology suggests a commitment to ongoing innovation. This is crucial for maintaining a competitive edge in the Theme Park Industry.

The company focuses on creating immersive experiences through the use of technology. This includes integrating real-world footage and innovative ride systems to transport guests to different environments. These efforts are key to United Parks & Resorts expansion plans.

The company's technology and innovation strategy focuses on enhancing guest experiences, driving operational efficiencies, and supporting animal care. These initiatives are critical for sustained Growth Strategy and long-term success. The company's dedication to innovation will shape the Future of United Parks & Resorts stock.

- Development of new, technologically advanced attractions like 'Expedition Odyssey' and 'SeaSub'.

- Implementation of digital transformation strategies to improve guest experiences and operational efficiency.

- Use of technology to enhance animal care and rescue efforts, supporting the company's mission.

- Focus on strategic cost savings and operational optimization through technology upgrades.

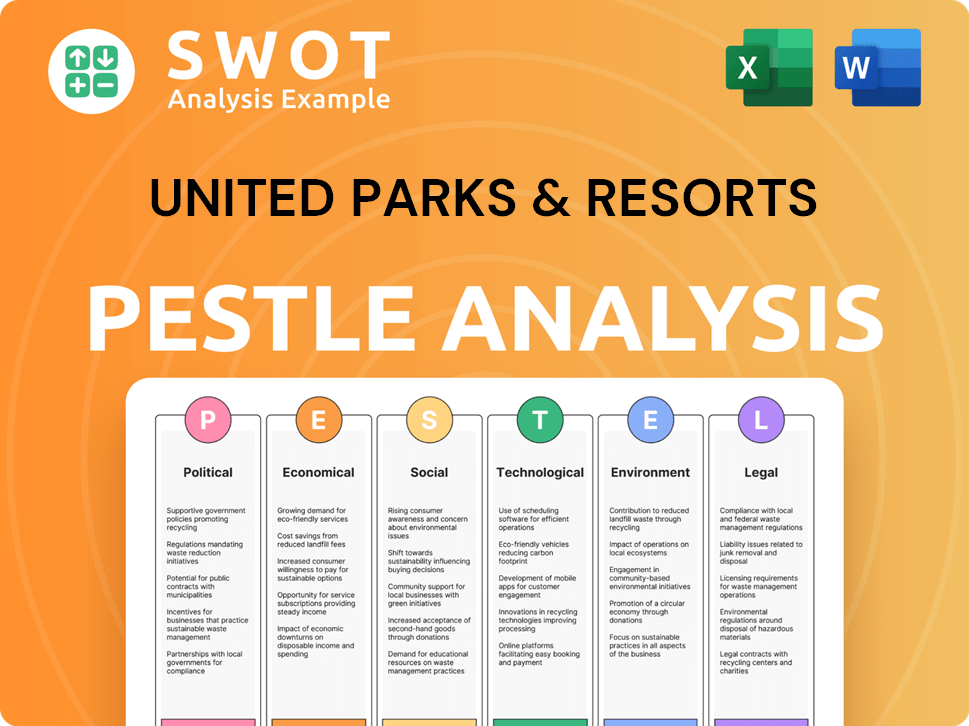

United Parks & Resorts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is United Parks & Resorts’s Growth Forecast?

The financial outlook for United Parks & Resorts is promising, with the company anticipating significant growth and new revenue and Adjusted EBITDA records for the full year 2025. This positive outlook is backed by strong booking trends, particularly in international sales, which are expected to grow in the mid-single digits, and group bookings, projected to increase by double digits. This positive trajectory highlights the effectiveness of the company's Growth Strategy within the Theme Park Industry.

Despite a challenging first quarter of 2025, where total revenue decreased by 3.5% year-over-year to $286.9 million and a net loss of $16.1 million was reported, the company remains confident in its full-year projections. This Q1 performance was mainly affected by the timing of Easter and Spring Break holidays shifting from Q1 to Q2. This shift underscores the importance of understanding seasonal impacts on the Company Performance.

In fiscal year 2024, United Parks & Resorts demonstrated robust Financial Performance, generating total revenues of $1,725.3 million, a net income of $227.5 million, and Adjusted EBITDA of $700.2 million. The company's strategic capital allocation, including repurchasing approximately 9.4 million shares of common stock in 2024 for about $482.9 million, shows its commitment to enhancing shareholder value. If you are interested in knowing more about the company's financial state, you can review the Owners & Shareholders of United Parks & Resorts.

For 2025, the company has set a capital expenditure guidance of $175 million to $200 million for core CapEx, with an additional $50 million allocated for growth and ROI projects. This investment strategy is crucial for supporting Business Development and United Parks & Resorts Expansion Plans.

Recent analyst forecasts for United Parks & Resorts indicate a consensus rating of 'Hold' with an average price target of $58.15. This suggests a potential upside of 19.98% from a recent price of $48.47, reflecting positive Future Prospects for United Parks & Resorts Stock.

The company's ability to maintain and grow revenue, as seen in the $1,725.3 million in total revenues for 2024, is a critical factor. The focus on Adjusted EBITDA, which reached $700.2 million in 2024, highlights the company's operational efficiency and profitability. These metrics are essential for assessing United Parks & Resorts Market Share and overall financial health.

The allocation of capital towards growth projects and core CapEx demonstrates a proactive approach to How United Parks & Resorts Is Growing. These investments are vital for introducing United Parks & Resorts New Attractions and maintaining a competitive edge within the Entertainment Sector.

The share repurchase program, with approximately 9.4 million shares repurchased in 2024, underscores the company's commitment to returning value to shareholders. This action is a key element of the United Parks & Resorts Long-Term Strategy and reflects confidence in its financial stability.

The company's optimistic outlook for 2025, supported by strong booking trends and strategic investments, points to a positive trajectory. This outlook is crucial for investors evaluating United Parks & Resorts Investment Opportunities and assessing the Future of United Parks & Resorts.

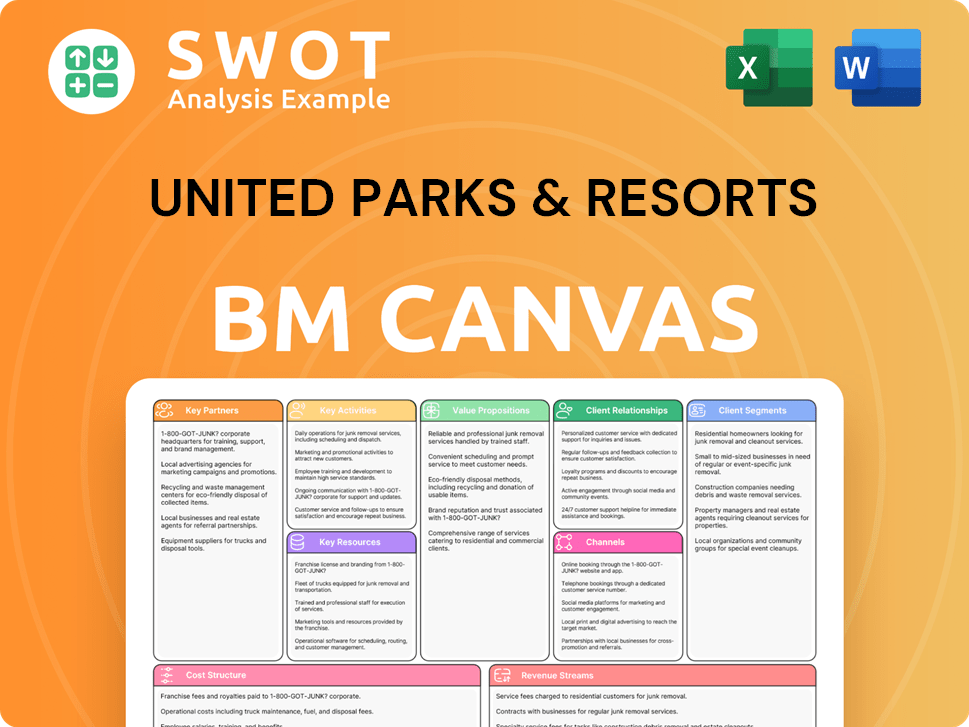

United Parks & Resorts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow United Parks & Resorts’s Growth?

The United Parks & Resorts faces several risks that could affect its Growth Strategy and Future Prospects. These challenges span market competition, public health events, and adverse weather conditions, all of which can significantly impact its operational and financial performance. Understanding these potential obstacles is crucial for assessing the company's long-term viability and investment potential within the Theme Park Industry.

Market dynamics, including the entrance of new competitors, pose a constant threat to Company Performance. External factors like pandemics and natural disasters introduce unpredictable elements that can disrupt operations and consumer behavior. Moreover, economic uncertainties and fluctuations in currency exchange rates add layers of complexity to the company's financial planning and execution.

The company's ability to navigate these challenges will be key to its Business Development and sustained growth. Strategic responses, such as cost-saving measures and operational efficiencies, are essential for mitigating risks and ensuring resilience. The influence of significant shareholders and the evolving preferences of consumers also play a crucial role in shaping the company's future trajectory.

The Theme Park Industry is highly competitive. New entrants, such as Epic in Orlando, are increasing the pressure on existing players. This requires United Parks & Resorts to constantly innovate and improve its offerings to maintain its market share and attract visitors. The competition impacts United Parks & Resorts revenue.

Public health events, like pandemics, pose significant risks. These events can lead to park closures, reduced attendance, and increased operational costs. The unpredictable nature of such events makes it difficult for United Parks & Resorts to forecast and manage its financial performance effectively. This can also affect discretionary spending on leisure activities.

Adverse weather significantly impacts park operations and attendance. In 2024, poor weather conditions, particularly in Florida, led to an estimated loss of approximately 432,000 guests. These weather-related disruptions can lead to a decrease in United Parks & Resorts financial performance. The long-term strategy must account for these factors.

Fluctuations in foreign exchange rates and inflation expose United Parks & Resorts to market risks. These factors can affect consumer spending and operational costs. Economic uncertainties can impact discretionary spending on leisure activities. This could affect United Parks & Resorts expansion plans.

Operational challenges include hiring and retaining employees, especially in specialized roles. International ticket sales remain below pre-COVID levels, which impacts revenue. These operational issues can influence the Future of United Parks & Resorts stock. The company must focus on these challenges for United Parks & Resorts growth in the entertainment sector.

The influence of Hill Path Capital LP, holding a significant portion of the company's stock, could impact strategic decisions. This could lead to changes in the United Parks & Resorts long-term strategy. The company's investment opportunities and United Parks & Resorts competitive analysis are affected.

To address these risks, United Parks & Resorts employs strategic cost savings, operational efficiency initiatives, and active debt portfolio management. These measures aim to enhance the company's resilience and ensure its ability to capitalize on United Parks & Resorts new attractions and other opportunities. For more information on the business model, see Revenue Streams & Business Model of United Parks & Resorts.

The company is also focusing on sustainability initiatives to mitigate environmental risks and appeal to environmentally conscious consumers. The company's vision includes investing in eco-friendly practices. These United Parks & Resorts sustainability initiatives are critical for long-term success. The company is evaluating the What is United Parks & Resorts' vision.

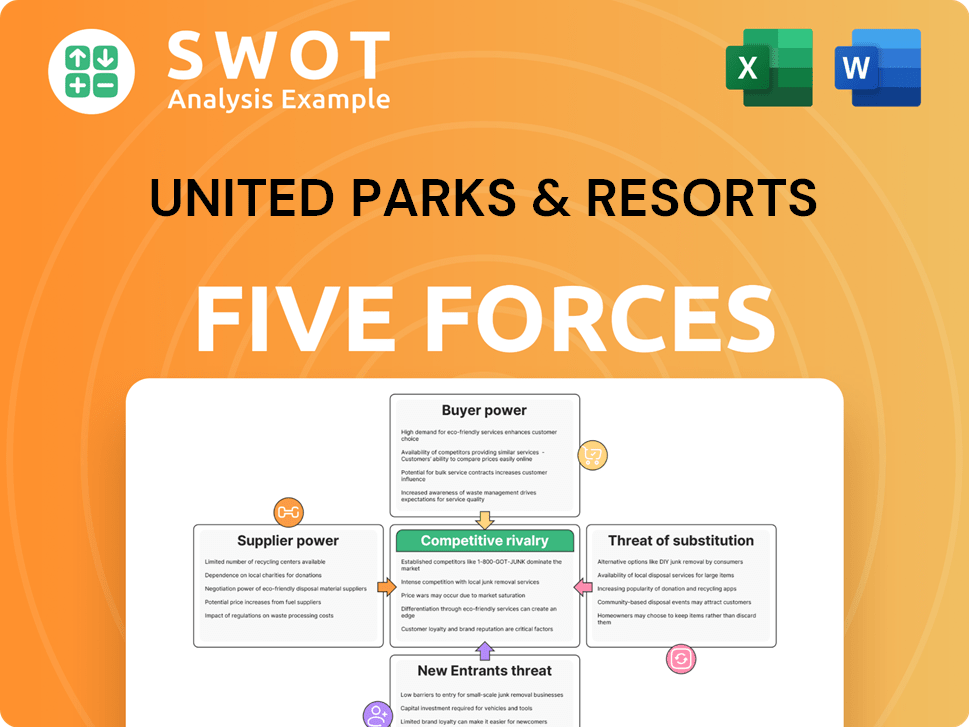

United Parks & Resorts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Parks & Resorts Company?

- What is Competitive Landscape of United Parks & Resorts Company?

- How Does United Parks & Resorts Company Work?

- What is Sales and Marketing Strategy of United Parks & Resorts Company?

- What is Brief History of United Parks & Resorts Company?

- Who Owns United Parks & Resorts Company?

- What is Customer Demographics and Target Market of United Parks & Resorts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.