United Parks & Resorts Bundle

How Does United Parks & Resorts Company Thrive in the Entertainment Industry?

United Parks & Resorts Inc., formerly known as SeaWorld Entertainment, is a leading theme park company, captivating millions with its blend of thrilling attractions and a dedication to animal conservation. Operating a diverse portfolio of theme parks and entertainment venues across the United States, UPR offers a wide array of experiences, from exhilarating rides to educational programs. Understanding the inner workings of this amusement park giant is key for investors, customers, and industry watchers alike.

This exploration into United Parks & Resorts will dissect its core operations, revealing how it generates revenue and maintains its competitive edge. From exploring its United Parks & Resorts SWOT Analysis to understanding its financial performance, we'll uncover the strategies that drive this theme park company's success. Whether you're interested in the United Parks & Resorts stock price, its mission statement, or its history, this analysis provides a comprehensive view of a leader in the amusement park sector.

What Are the Key Operations Driving United Parks & Resorts’s Success?

The core of United Parks & Resorts Company (UPR) lies in creating and delivering value through its network of theme parks, water parks, and entertainment venues. These locations offer a diverse array of experiences, blending entertainment with education and animal encounters. UPR's business model focuses on providing memorable experiences for families, tourists, and locals, with a special emphasis on wildlife and environmental stewardship.

The primary products and services offered by UPR include access to rides, live shows, animal exhibits, and educational programs. These programs highlight marine life and conservation efforts. This approach differentiates UPR from a typical amusement park, as it integrates conservation and rescue efforts into the guest experience. This is a key aspect of what makes United Parks & Resorts unique.

The company's operational processes are multifaceted, encompassing the design and development of new attractions, meticulous animal care, and rigorous safety protocols. Technology also plays a crucial role, enhancing guest experiences through digital ticketing, mobile applications, and interactive exhibits. Furthermore, the supply chain involves sourcing food, merchandise, and operational equipment, while logistics ensure smooth park operations. Sales channels include direct-to-consumer online sales, park gate ticket sales, and partnerships with travel agencies.

United Parks & Resorts provides a wide range of entertainment options, including rides, shows, and animal exhibits. Its locations also offer educational programs focused on marine life and conservation. These experiences are designed to appeal to a broad audience, from families to tourists.

UPR's operations involve designing new attractions, ensuring animal care, and maintaining safety protocols. The company utilizes technology to improve guest experiences. The supply chain and logistics are also critical for the smooth functioning of the parks.

Sales channels include direct online sales, ticket sales at the park gates, and partnerships with travel agencies. This multi-channel approach ensures that UPR can reach a wide audience. The company's focus is on maximizing accessibility for potential customers.

The value proposition of United Parks & Resorts is providing memorable leisure experiences while promoting wildlife appreciation and conservation. The integration of animal care and educational programs sets it apart. This unique approach attracts visitors interested in both entertainment and environmental responsibility.

United Parks & Resorts distinguishes itself through its strong emphasis on animal conservation and rescue efforts. This commitment is integrated into the guest experience through educational programs and research initiatives. This focus on conservation provides a unique selling point in the amusement park industry.

- Focus on animal conservation and rescue efforts.

- Integration of educational programs and research initiatives.

- Emphasis on providing memorable leisure experiences.

- Unique value proposition that fosters appreciation for wildlife.

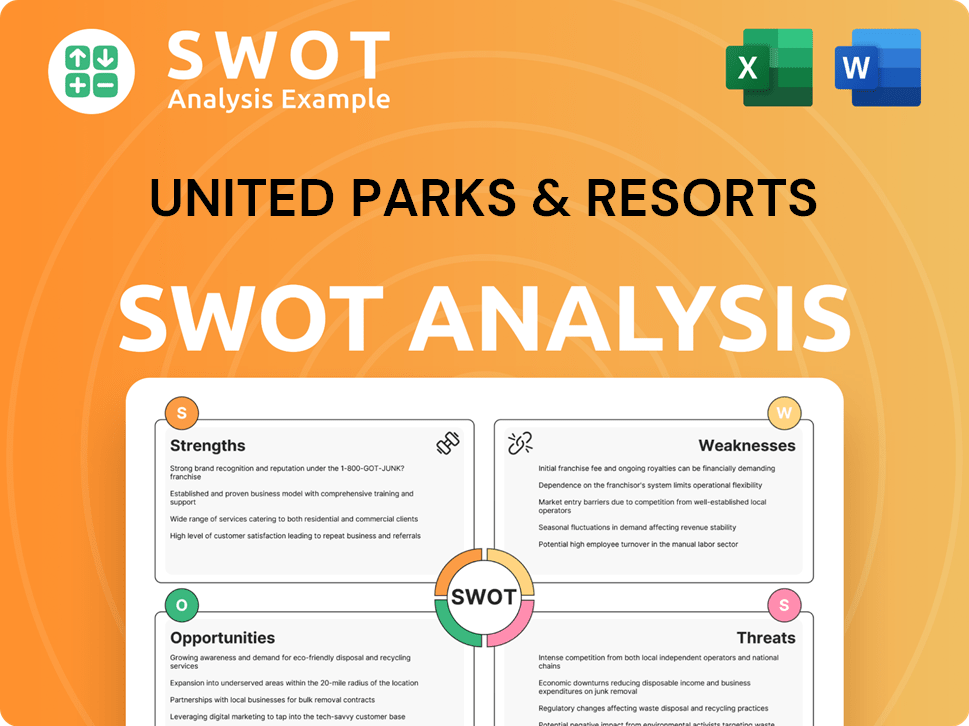

United Parks & Resorts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does United Parks & Resorts Make Money?

The United Parks & Resorts Company (UPR) generates revenue through a multifaceted approach, primarily focusing on park admissions and in-park spending. This strategy allows the theme park company to capitalize on various revenue streams. The company's financial performance is a key indicator of its success in the competitive amusement park industry.

The company's revenue model is designed to maximize profitability by leveraging multiple avenues for income generation. This includes strategic partnerships and initiatives aimed at enhancing the overall guest experience. Understanding the United Parks & Resorts business model is crucial for investors and stakeholders.

UPR's revenue streams are diverse, with park admissions and in-park spending playing significant roles. Park admissions include single-day tickets, annual passes, and group sales, forming a substantial portion of the company's revenue. In-park spending encompasses food and beverage sales, merchandise, games, and special experiences, contributing to overall profitability. For those interested in the company's trajectory, a look at the Growth Strategy of United Parks & Resorts provides further insights.

UPR employs several strategies to maximize revenue and enhance the guest experience. Tiered pricing for admission tickets and annual passes are common practices. Bundled services and cross-selling are also utilized to increase per-guest spending. The company's financial performance is closely tied to these strategies.

- Park Admissions: Single-day tickets, annual passes, and group sales contribute significantly to UPR's revenue. In fiscal year 2023, admission revenue was reported at $959 million.

- In-Park Spending: Food and beverage sales, merchandise, games, and special experiences drive per capita spending. In-park per capita spending reached $68.42 in 2023.

- Monetization Strategies: Tiered pricing, annual passes, bundled services, and cross-selling are key strategies. The company focuses on enhancing the in-park guest experience and expanding the annual pass base.

- Financial Performance: Total revenue for 2023 was $1.73 billion.

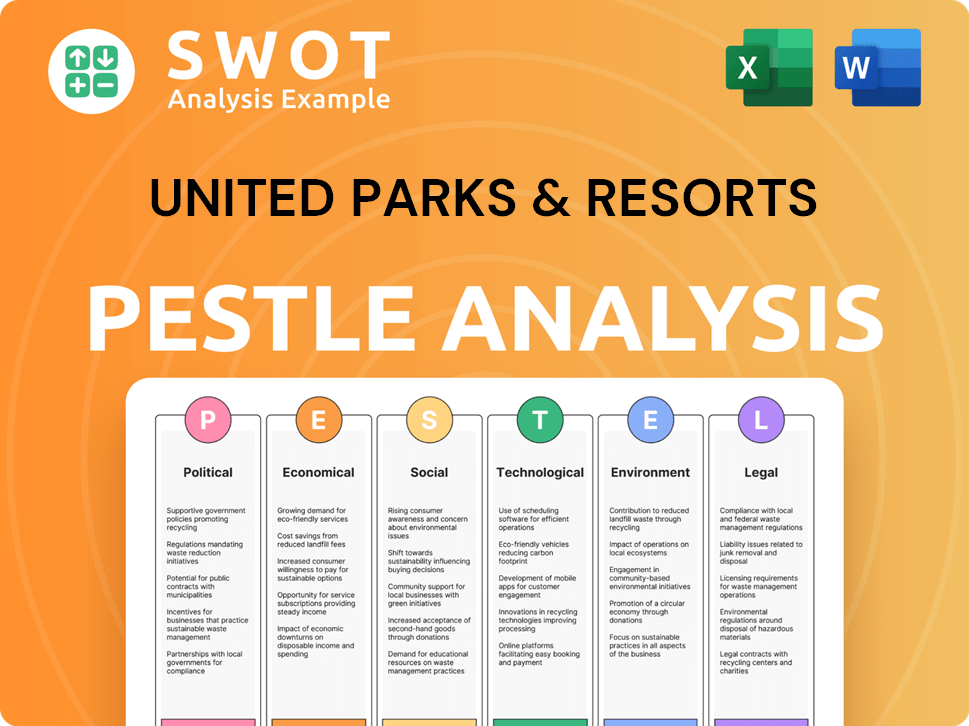

United Parks & Resorts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped United Parks & Resorts’s Business Model?

The United Parks & Resorts Company (UPR) has undergone significant transformations, marked by strategic moves aimed at enhancing its brand and operational efficiency. A pivotal milestone was the company's rebranding from SeaWorld Entertainment, Inc. to United Parks & Resorts Inc. in early 2024, signaling a broader focus beyond marine animals and a commitment to a diverse portfolio of park experiences. This strategic shift aims to better reflect the company's comprehensive offerings, including roller coasters, rides, and other attractions, alongside its animal encounters. The company's evolution underscores its adaptability and its commitment to evolving guest expectations within the amusement park industry.

The company has faced operational challenges, including past public perception issues related to animal welfare, which led to strategic responses focused on enhanced transparency, increased conservation efforts, and the development of new, non-animal-centric attractions. For instance, the company has continued to invest in new rides and attractions across its parks, such as the opening of 'Pipeline: The Surf Coaster' at SeaWorld Orlando in 2023, showcasing a commitment to diversifying its entertainment offerings. This commitment to innovation and diversification is key to maintaining its market position.

The company's competitive advantages include a strong brand portfolio with iconic parks like SeaWorld, Busch Gardens, and Sesame Place, fostering significant brand recognition and customer loyalty. Its unique blend of animal encounters and thrill rides differentiates it from many competitors. Furthermore, the company benefits from economies of scale in park operations and marketing. The company continues to adapt to new trends by investing in technology to improve the guest experience, expanding its conservation initiatives, and strategically developing new attractions to appeal to a broader audience, thereby sustaining its business model in a dynamic leisure market.

The rebranding to United Parks & Resorts in 2024 marked a significant shift, broadening the company's focus. This move aimed to encompass a wider array of attractions beyond marine life. The company's strategy now incorporates a blend of animal encounters and thrill rides.

- Rebranding from SeaWorld Entertainment, Inc. to United Parks & Resorts Inc. in early 2024.

- Investment in new rides and attractions, such as 'Pipeline: The Surf Coaster' at SeaWorld Orlando in 2023.

- Focus on enhanced transparency and increased conservation efforts.

- Strategic development of new attractions to appeal to a broader audience.

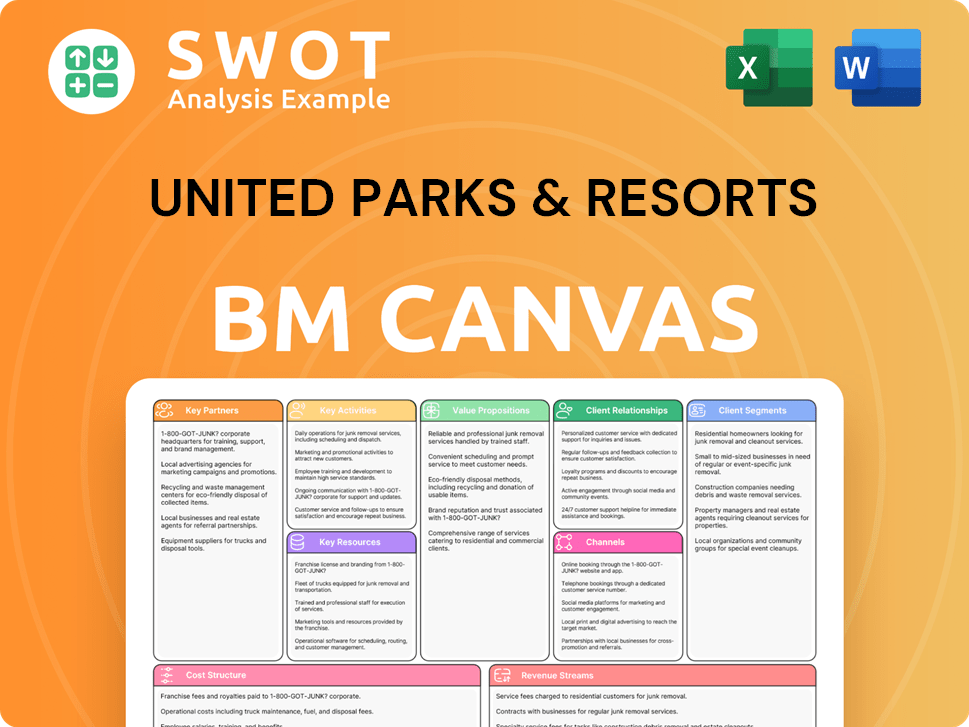

United Parks & Resorts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is United Parks & Resorts Positioning Itself for Continued Success?

United Parks & Resorts (UPR) holds a significant position within the competitive theme park industry, battling against giants like Disney Parks and Universal Parks & Resorts. The company distinguishes itself through its unique blend of animal experiences and thrill rides, maintaining a strong market share in this specific niche. UPR fosters customer loyalty through annual pass programs and educational offerings, with a primary focus on the United States, where it operates across key tourist destinations.

The company faces several risks, including economic downturns impacting discretionary spending, evolving regulations concerning animal welfare, and the need for substantial capital investments in new attractions. Competition from new entrants and changing consumer preferences, such as the demand for immersive experiences, also pose challenges. UPR’s future outlook hinges on strategic initiatives designed to sustain and expand its revenue streams.

United Parks & Resorts competes with major theme park operators, focusing on a niche that combines animal encounters with amusement park attractions. Customer loyalty is boosted through annual passes and educational programs, with a strong presence in the United States. The company's market position is influenced by its ability to innovate and adapt to changing consumer preferences and industry trends.

Key risks include economic downturns affecting leisure spending, and evolving regulations on animal welfare. Significant capital investment is needed for new attractions and maintenance. New competitors and changing consumer preferences, such as demand for immersive experiences, also pose challenges. The Competitors Landscape of United Parks & Resorts shows the intensity of the market.

UPR focuses on strategic initiatives to drive attendance and increase in-park spending. This includes investing in new rides, expanding culinary and merchandise offerings, and leveraging its conservation mission. The company plans to sustain growth through strategic capital allocation, potential expansion, and a focus on operational efficiency and guest satisfaction. Leadership emphasizes delivering 'experiences that matter'.

In 2024, SeaWorld Entertainment, a major part of UPR, reported revenues. The company continues to invest heavily in new attractions, with capital expenditures. The company's focus remains on enhancing guest experiences and expanding its brand through strategic investments and operational improvements.

UPR is concentrating on several strategic areas to maintain its growth trajectory. These include investments in new attractions, expansion of food and merchandise offerings, and strengthening its conservation efforts. The company is also focused on operational efficiency and enhancing guest satisfaction to drive repeat visits and spending.

- Investment in new rides and attractions to boost attendance.

- Expansion of culinary and merchandise offerings to increase in-park spending.

- Leveraging the conservation mission to enhance brand appeal and guest engagement.

- Strategic capital allocation for existing parks and potential expansion opportunities.

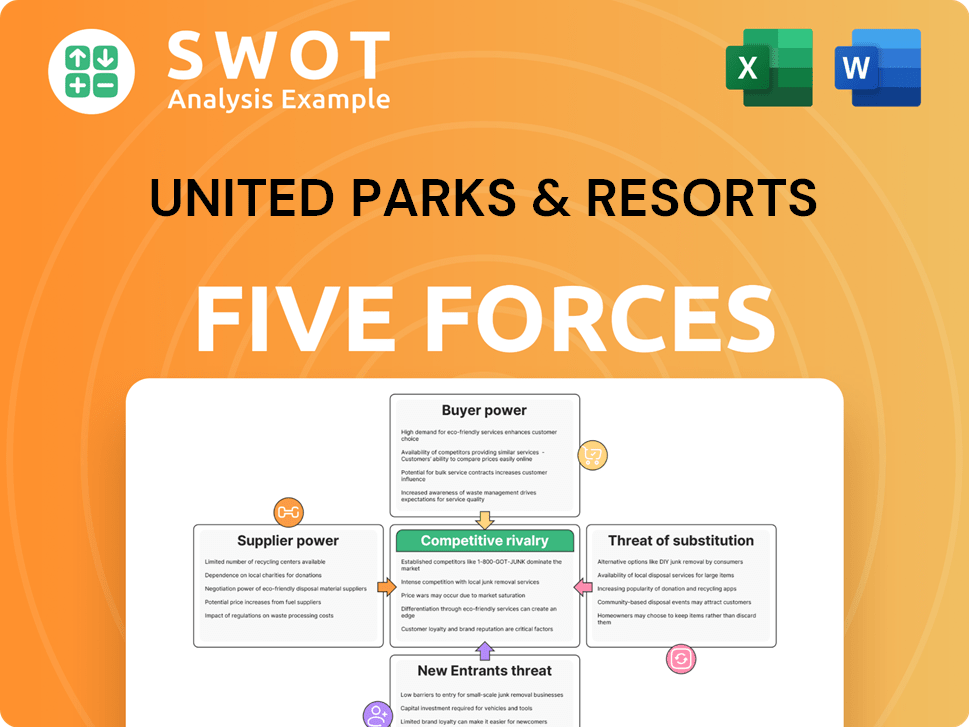

United Parks & Resorts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Parks & Resorts Company?

- What is Competitive Landscape of United Parks & Resorts Company?

- What is Growth Strategy and Future Prospects of United Parks & Resorts Company?

- What is Sales and Marketing Strategy of United Parks & Resorts Company?

- What is Brief History of United Parks & Resorts Company?

- Who Owns United Parks & Resorts Company?

- What is Customer Demographics and Target Market of United Parks & Resorts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.