Vietin Bank Bundle

How Well Do You Know the History of VietinBank?

Established in 1988, VietinBank, officially the Vietnam Joint Stock Commercial Bank for Industry and Trade, has played a pivotal role in Vietnam's economic evolution. Its establishment coincided with the nation's shift towards a market-oriented system, designed to support industrial and trade development. This Vietin Bank SWOT Analysis provides a comprehensive overview of the bank's current standing.

From its VietinBank establishment, the bank has grown to become one of Vietnam's largest and most reputable commercial banks. This brief history of VietinBank will explore its journey, from its VietinBank founding date and early challenges to its significant achievements and strategic outlook. Understanding the history of VietinBank is crucial for grasping its enduring impact on Vietnam's financial sector and its ongoing development of VietinBank.

What is the Vietin Bank Founding Story?

The VietinBank history begins on March 26, 1988. Originally named Incombank (Industrial and Commercial Bank of Vietnam), its establishment marked a pivotal moment during Vietnam's 'Doi Moi' (Renovation) period. This economic transformation aimed to decentralize activities and cultivate a market economy, necessitating new commercial banks to support emerging businesses.

The VietinBank company was created to meet the financial needs of industrial and commercial enterprises, which were primarily state-owned. Its initial focus was on providing credit for production and trade, facilitating payments, and mobilizing deposits. The State Bank of Vietnam initiated Incombank's establishment, reflecting the government's strategic vision for financial infrastructure.

The initial funding for the bank came from the state budget. This aligned with the government's role in guiding economic development during this transitional phase. This context highlights the cultural and economic influences that shaped VietinBank's establishment, positioning it as a key instrument in the nation's economic reform agenda.

VietinBank's early years were focused on supporting state-owned enterprises.

- The bank provided credit for production and trade.

- It facilitated payments for businesses.

- It mobilized deposits from industrial and commercial entities.

- The State Bank of Vietnam played a crucial role in its founding.

Vietin Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vietin Bank?

The early growth of VietinBank, formerly known as Incombank, centered on expanding its reach and services to meet the needs of a changing economy. During its VietinBank's marketing strategy, the bank started with basic banking services, such as loans and deposits, mainly for state-owned enterprises. As the Vietnamese economy opened up, VietinBank began serving a wider range of clients, including private businesses and individuals, which was a critical step in its early years.

The bank's initial focus was on building its branch network across key economic areas. This expansion was crucial for providing broader access to financial services. Early product offerings included corporate loans, deposits, and payment processing, which were essential for supporting the country's economic development. The early team expansion was a key factor in establishing a strong presence in vital economic hubs.

A major turning point was VietinBank's shift from a specialized bank to a commercial bank, enabling it to diversify its activities. The rebranding to VietinBank in 2008, along with its initial public offering (IPO), marked its transformation into a modern, publicly traded commercial bank. This period also saw the bank expanding into new areas like retail banking, international trade finance, and investment banking services.

Strategic decisions, such as investments in technology and human resources, were vital in shaping its competitive position. These investments helped VietinBank adapt to the changing financial landscape. As of Q1 2024, VietinBank demonstrated robust growth in its loan portfolio and deposit base. This reflects its continued expansion and increased market penetration within the Vietnamese financial sector.

Key milestones in VietinBank's history include its establishment, its evolution from Incombank, and its IPO. These events highlight the bank's growth and its ability to adapt to market changes. The bank's ability to diversify its services and expand its reach has been crucial to its success. The early years laid the groundwork for VietinBank's long-term growth and its role in Vietnam's economy.

Vietin Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vietin Bank history?

The VietinBank history is marked by significant milestones, reflecting its growth and evolution within Vietnam's financial landscape. From its establishment to its current status, the bank has consistently adapted to market changes and technological advancements, solidifying its position as a leading financial institution. The VietinBank company has played a crucial role in Vietnam's economic development.

| Year | Milestone |

|---|---|

| 1988 | Established as the Industrial and Commercial Bank of Vietnam, marking the VietinBank establishment. |

| Early 2000s | Focused on expanding its branch network and service offerings to cater to a broader customer base. |

| 2008 | Underwent significant restructuring and modernization efforts to enhance operational efficiency. |

| 2009 | Initiated its initial public offering (IPO), a pivotal moment in its corporate history. |

| 2010s | Continued to invest in digital transformation, launching mobile banking and online platforms. |

| 2024 | Focused on enhancing digital offerings and improving customer experience. |

Throughout its history, VietinBank has been at the forefront of innovation, particularly in adopting new technologies. Early adoption of core banking systems and electronic payment platforms enhanced efficiency and customer service.

VietinBank has invested heavily in digital transformation, launching mobile banking applications and online platforms. This has improved customer experience and operational efficiency.

Early adoption of modern core banking systems has significantly enhanced operational efficiency. These systems streamlined internal processes and improved service delivery.

The bank implemented electronic payment platforms to facilitate faster and more secure transactions. This innovation improved customer convenience and reduced operational costs.

VietinBank's mobile banking applications have become essential tools for customers, providing convenient access to banking services. The apps offer a range of features, from balance inquiries to fund transfers.

Online platforms have expanded the bank's reach and accessibility, allowing customers to manage their accounts and conduct transactions remotely. These platforms support various services, including bill payments and loan applications.

Strategic partnerships with international financial institutions have strengthened VietinBank's capabilities. These collaborations have enhanced trade finance and risk management practices.

Despite its successes, VietinBank has faced several challenges, including intense competition and economic fluctuations. The bank has consistently demonstrated resilience by adapting to market changes and regulatory requirements.

The Vietnamese banking sector is highly competitive, requiring VietinBank to continuously innovate and improve its services. This competition drives the bank to enhance its customer offerings and operational efficiency.

Managing non-performing loans has been a persistent challenge, necessitating robust risk management strategies. The bank has implemented stringent measures to mitigate credit risk and improve asset quality.

Adapting to fluctuating economic conditions, including global financial crises, has been crucial for VietinBank's stability. The bank has implemented prudent financial management practices to navigate economic downturns.

Increasing compliance requirements and regulatory changes have necessitated continuous adaptation. VietinBank has consistently updated its policies and procedures to meet evolving regulatory standards.

Robust risk management strategies have been essential for mitigating potential losses and ensuring financial stability. VietinBank has implemented comprehensive risk assessment and control measures.

A continued focus on customer-centric services has helped VietinBank maintain its leading position in the market. The bank prioritizes customer satisfaction by offering tailored financial products and services.

Vietin Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vietin Bank?

The History of VietinBank, a leading financial institution in Vietnam, is marked by significant milestones, from its establishment to its current position. The bank's journey reflects its adaptation to market changes and its commitment to supporting Vietnam's economic growth. This brief history of VietinBank showcases its transformation and achievements over the decades.

| Year | Key Event |

|---|---|

| March 26, 1988 | Established as Incombank (Industrial and Commercial Bank of Vietnam). |

| 1990s | Expanded its branch network and diversified services to include individual customers. |

| 2008 | Rebranded as VietinBank and successfully completed its Initial Public Offering (IPO). |

| 2009 | Listed on the Ho Chi Minh Stock Exchange (HOSE). |

| 2010s | Invested in digital banking infrastructure and expanded international operations, including opening a branch in Germany in 2012. |

| 2014 | Launched its mobile banking application, VietinBank iPay. |

| 2018 | Celebrated 30 years of operation, solidifying its position as a leading bank. |

| 2020-2023 | Demonstrated strong performance amidst global economic uncertainties, with a focus on digital transformation and sustainable development. |

| 2024 | Reported significant growth in credit and deposit balances, reinforcing its strong market position. |

| 2025 | Expected to continue leveraging technology for enhanced customer experience and operational efficiency. |

VietinBank is focused on leveraging advanced technologies like AI and big data analytics. This will enhance personalized financial products and services. The bank aims to improve risk management and streamline operations through digital initiatives, which is a key part of its strategic priorities.

The bank is committed to sustainable finance. It integrates environmental, social, and governance (ESG) factors into lending and investment decisions. This approach aligns with the increasing focus on responsible banking practices.

VietinBank aims to expand its regional presence and international trade finance capabilities. This includes strengthening its retail banking segment and increasing its market share in the SME sector. These initiatives support its growth.

The bank recognizes industry trends, such as the increasing adoption of digital payments. It also acknowledges the rise of fintech, which will shape its strategic priorities. Leadership is committed to innovation and customer satisfaction.

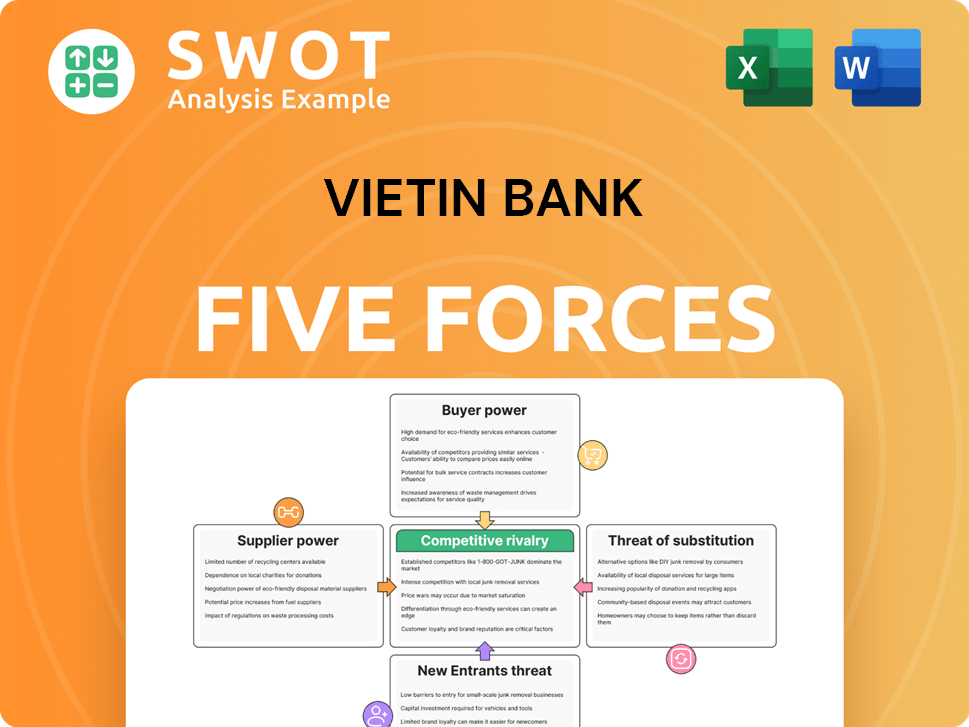

Vietin Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vietin Bank Company?

- What is Growth Strategy and Future Prospects of Vietin Bank Company?

- How Does Vietin Bank Company Work?

- What is Sales and Marketing Strategy of Vietin Bank Company?

- What is Brief History of Vietin Bank Company?

- Who Owns Vietin Bank Company?

- What is Customer Demographics and Target Market of Vietin Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.