Vista Outdoor Bundle

How Did Vista Outdoor Become an Outdoor Industry Powerhouse?

Embark on a journey through the Vista Outdoor SWOT Analysis and uncover the fascinating Vista Outdoor history. From its strategic beginnings to its current market dominance, the Vista Outdoor company story is one of shrewd decisions and impressive growth. Discover how a spin-off transformed into a leader in the outdoor recreation and shooting sports sectors.

The Vista Outdoor company story begins with a clear vision: to curate a portfolio of strong Vista Outdoor brands. Understanding the Vista Outdoor acquisition strategy is key to appreciating its rapid expansion and influence. This exploration of the Vista Outdoor timeline will illuminate the key milestones that have shaped its trajectory, offering valuable insights into its evolution and impact on the industry.

What is the Vista Outdoor Founding Story?

The founding of Vista Outdoor represents a significant corporate restructuring in the sporting and outdoor goods industry. Officially established on February 9, 2015, it emerged as a spin-off from Orbital ATK, now known as Northrop Grumman Innovation Systems. This strategic move allowed Vista Outdoor to concentrate solely on the consumer market, differentiating itself from its parent company's aerospace and defense focus.

The creation of Vista Outdoor was not the work of individual founders in the traditional sense. Instead, it was a strategic maneuver designed to unlock value by creating a specialized entity. The primary goal was to better manage and grow a portfolio of established brands within the outdoor and shooting sports sectors. This approach aimed to appeal directly to investors interested in these specific markets.

The initial business model centered on being a holding company for a collection of well-known brands. These included names in ammunition, firearms accessories, and outdoor gear. The immediate 'products' were the existing portfolios of these brands, which Vista Outdoor immediately took under its umbrella. The company's name, 'Vista Outdoor,' was selected to reflect its broad scope within the outdoor and recreational markets. Initial funding came directly from the spin-off, with assets and liabilities related to the consumer brands transferred from Orbital ATK. This provided Vista Outdoor with immediate operational capital and a foundation of revenue-generating businesses, bypassing the typical seed funding rounds of a new startup.

Vista Outdoor's founding was a strategic corporate move. It was a spin-off from Orbital ATK, now Northrop Grumman Innovation Systems, on February 9, 2015.

- The primary objective was to create a focused company to manage and grow consumer brands within the outdoor and shooting sports sectors.

- The initial funding came from the spin-off, providing immediate operational capital and established revenue streams.

- The company's structure as a holding company allowed it to leverage existing market share and product lines of established brands.

- This approach was influenced by a trend towards corporate specialization, enhancing shareholder value through focused business units.

The cultural context influencing its creation was a trend towards corporate specialization. Large conglomerates were increasingly divesting non-core assets to create more agile and focused businesses, thereby enhancing shareholder value. This approach allowed Vista Outdoor to concentrate on its specific market segments. The company's formation was a direct response to the perceived sub-optimal valuation of Orbital ATK's consumer brands within a larger, more diversified defense contractor. This strategic separation aimed to unlock the full potential of these brands within the outdoor and shooting sports industry.

For those interested in understanding the company's core values, you can read more about the Mission, Vision & Core Values of Vista Outdoor.

Vista Outdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vista Outdoor?

The early years of the Vista Outdoor company, following its spin-off, were marked by significant growth and strategic expansion. This period focused on consolidating its position in the outdoor recreation and shooting sports markets. This was achieved through leveraging existing brands and strategic acquisitions. The Vista Outdoor history is a story of rapid development and market penetration.

Upon its spin-off in 2015, Vista Outdoor immediately utilized its established brands, including Federal, CCI, and Remington Ammunition, to gain a strong foothold in the market. These brands provided a solid foundation for revenue generation and market presence. This initial portfolio allowed the Vista Outdoor company to quickly establish itself as a key player.

In its first full fiscal year as an independent entity, fiscal year 2016, Vista Outdoor reported net sales of approximately $2.31 billion. This financial performance underscored the company's strong market position and the immediate impact of its existing brands. This figure demonstrated the immediate financial strength of the newly formed company.

A key component of Vista Outdoor's early expansion strategy was strategic acquisitions. The acquisition of CamelBak Products in 2015 for approximately $412.5 million was a significant move. This expanded the company's product categories beyond shooting sports. Another key acquisition was Jimmy Styks, a stand-up paddle board company, further diversifying its outdoor offerings.

During this period, Vista Outdoor focused on integrating acquired businesses and optimizing its supply chain. Leadership transitions were also crucial, as the company worked to build a strong executive team. These changes were vital to managing a diverse brand portfolio and achieving growth goals. The competitive landscape was robust, but Vista Outdoor brands were able to maintain and grow market share.

Vista Outdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vista Outdoor history?

The Vista Outdoor company has experienced several key milestones since its inception, shaping its trajectory in the outdoor and shooting sports industries. These achievements reflect its growth and strategic adaptations within a competitive market.

| Year | Milestone |

|---|---|

| 2015 | Spun off from Alliant Techsystems (ATK) to become an independent, publicly traded company. |

| 2019 | Announced a restructuring plan and the sale of several non-core brands to streamline operations. |

| 2022 | Announced the separation of its Outdoor Products and Sporting Products segments into two independent, publicly traded companies. |

Innovations at Vista Outdoor often involved product line extensions and enhancements within its established brands. The company's strategic acquisitions of numerous well-known brands also represented a significant innovation, allowing for market consolidation and cross-selling opportunities.

Introduction of new ammunition types from Federal and advancements in hydration systems from CamelBak exemplify product line extensions. These enhancements cater to evolving consumer needs within existing brand portfolios.

Acquiring well-known brands allowed for market consolidation and cross-selling opportunities, expanding the company's reach. This strategic move enhanced its market presence.

Continuous investment in research and development led to technological advancements in product design and manufacturing. These improvements enhanced product performance and consumer experience.

The Vista Outdoor has faced several challenges, including market downturns and competitive pressures. For instance, in fiscal year 2019, the company reported a net loss of $648 million, primarily due to goodwill impairment charges.

Fluctuations in demand, particularly in the shooting sports segment, have impacted financial performance. Regulatory pressures have also influenced market dynamics, requiring strategic adjustments.

Competition from established players and emerging brands has necessitated continuous product development and marketing efforts. This dynamic requires ongoing innovation and market adaptation.

Product failures or underperforming segments led to strategic adjustments, including the divestiture of certain brands. The 2022 decision to separate into two companies reflects a significant restructuring effort.

Vista Outdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vista Outdoor?

The Vista Outdoor company's journey, marked by strategic acquisitions and significant corporate restructuring, showcases its evolution in the outdoor and sporting goods sectors. From its spin-off in early 2015 to the planned separation into two distinct companies, Vista Outdoor has navigated a dynamic market, adapting its strategy to capitalize on emerging opportunities and enhance shareholder value. The $1.91 billion sale of The Kinetic Group in February 2024 to Czechoslovak Group (CSG) is a pivotal move, reshaping the company's future trajectory.

| Year | Key Event |

|---|---|

| February 9, 2015 | Vista Outdoor officially spun off from Orbital ATK, becoming an independent publicly traded company. |

| 2015 | Acquired CamelBak Products, expanding its outdoor products segment. |

| 2016 | Reported net sales of approximately $2.31 billion in its first full fiscal year as an independent company. |

| 2017 | Acquired the remaining interest in Camp Chef, a leading manufacturer of outdoor cooking equipment. |

| 2019 | Reported a net loss of $648 million, primarily due to goodwill impairment charges. |

| 2020 | Acquired Remington Ammunition, strengthening its position in the shooting sports market. |

| May 2022 | Announced a plan to separate its Outdoor Products and Sporting Products segments into two independent, publicly traded companies. |

| November 2023 | Vista Outdoor announced that the spin-off of its outdoor products segment, 'Revelyst,' is on track for 2024. |

| February 2024 | Vista Outdoor announced that it has entered into a definitive agreement to sell its Kinetic Group business, which includes its ammunition brands, to Czechoslovak Group (CSG) for $1.91 billion. |

| April 2024 | Vista Outdoor confirms the ongoing process of separating its outdoor and sporting products segments, with Revelyst (Outdoor Products) and The Kinetic Group (Sporting Products) becoming distinct entities. |

Revelyst, the outdoor products segment, is positioned to capitalize on the growing interest in outdoor recreation. This segment will likely focus on innovation in outdoor gear and accessories. The company aims to expand its market presence and cater to evolving consumer preferences within the outdoor space.

The Kinetic Group, now under CSG, will concentrate on the shooting sports market, including ammunition and firearms accessories. The dynamics of this market, influenced by consumer demand and regulatory changes, will be key to its performance. The sale for $1.91 billion marks a significant shift in the company's strategy.

Increased participation in outdoor activities presents growth opportunities for Revelyst. Consumer preferences for specialized gear and innovative products drive demand. The evolution of the shooting sports market continues to be a critical factor for The Kinetic Group.

The separation into two focused entities aims to maximize value by allowing agile responses to specific market demands. This strategy should enhance shareholder value by enabling each company to pursue tailored growth strategies. This strategic shift is designed to optimize capital allocation.

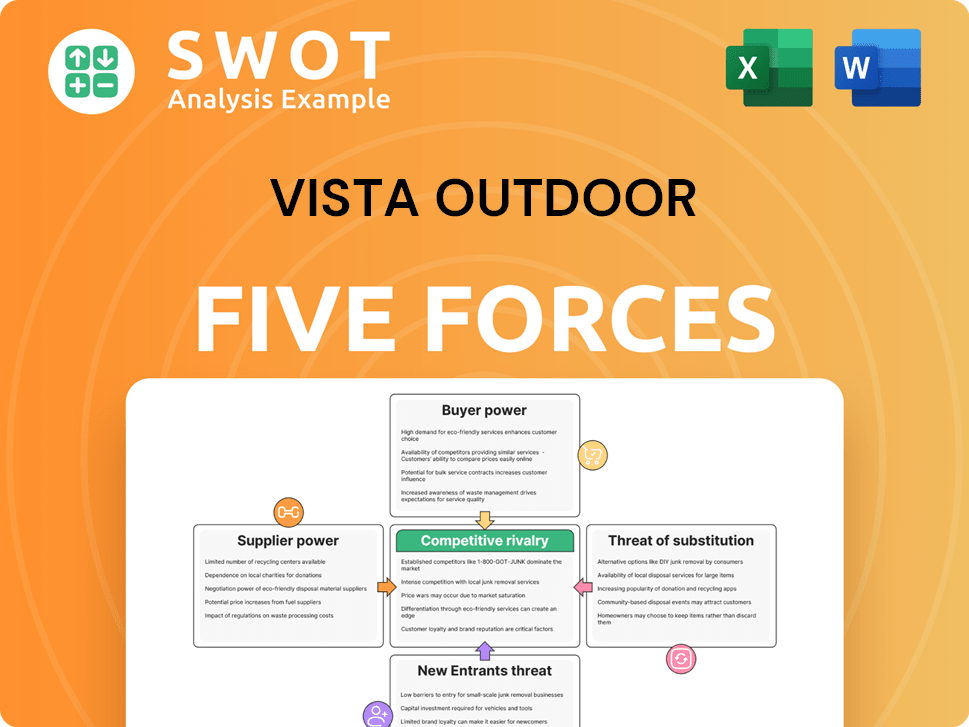

Vista Outdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vista Outdoor Company?

- What is Growth Strategy and Future Prospects of Vista Outdoor Company?

- How Does Vista Outdoor Company Work?

- What is Sales and Marketing Strategy of Vista Outdoor Company?

- What is Brief History of Vista Outdoor Company?

- Who Owns Vista Outdoor Company?

- What is Customer Demographics and Target Market of Vista Outdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.