Vista Outdoor Bundle

How Does Vista Outdoor Stack Up in the Competitive Arena?

Vista Outdoor Inc. is undergoing a significant transformation, splitting its Outdoor Products and Sporting Products segments. This strategic move, slated for completion in 2024, aims to sharpen its focus and boost shareholder value within the dynamic Vista Outdoor SWOT Analysis. Understanding the company's competitive landscape is crucial for investors and industry watchers alike.

This analysis delves into the Vista Outdoor competitive landscape, examining its key Vista Outdoor competitors and the broader Vista Outdoor industry dynamics. We'll explore Vista Outdoor brands, market share, and growth strategies, providing a comprehensive Vista Outdoor market analysis to inform your investment decisions. Expect insights into the strengths and weaknesses of Vista Outdoor's competitive set, including its position in the outdoor recreation market.

Where Does Vista Outdoor’ Stand in the Current Market?

Vista Outdoor currently holds a significant market position within the outdoor recreation and shooting sports industries. The company operates through two main segments: Sporting Products and Outdoor Products. This structure allows for a diversified approach to the market, catering to a wide range of consumer needs, from hunting and shooting sports enthusiasts to outdoor adventurers.

The Sporting Products segment, including brands such as Federal and Remington, is a leader in ammunition manufacturing. In Q3 FY2024, this segment generated net sales of $357 million. The Outdoor Products segment, which includes brands like CamelBak and Bushnell, focuses on a variety of outdoor activities. This segment achieved net sales of $325 million in Q3 FY2024. The combined net sales for the company in Q3 FY2024 were $682 million.

Vista Outdoor's extensive brand portfolio and broad distribution network contribute to its strong market presence. The company's geographic focus is primarily North America, but it also maintains international distribution channels. The planned separation of the two segments into independent companies, Revelyst (Outdoor Products) and The Kinetic Group (Sporting Products), is expected to refine their market positioning further.

Vista Outdoor's market share varies across its diverse product categories. While precise overall market share figures for the entire outdoor recreation market are fluid and segmented, the company is a top-tier player in many of its specific product categories. The company's strong brand recognition and extensive distribution network support its competitive standing.

The company's product offerings span a wide range, including ammunition, firearms accessories, hydration packs, camping gear, and optics. The Sporting Products segment focuses on ammunition, while the Outdoor Products segment offers products for activities like cycling, hiking, and camping. This diversification allows Vista Outdoor to serve a broad customer base and mitigate risks.

Vista Outdoor's primary market is North America, where it has a strong presence. The company also has international distribution channels, allowing it to reach customers globally. The strategic focus on both domestic and international markets helps to drive revenue and growth.

In Q3 FY2024, Vista Outdoor reported net sales of $682 million. The Sporting Products segment contributed $357 million to this total, while the Outdoor Products segment contributed $325 million. These figures reflect the company's robust performance and its ability to generate significant revenue across its diverse product lines.

Vista Outdoor's competitive advantages include a strong brand portfolio, extensive distribution network, and diversified product offerings. These factors enable the company to cater to a broad customer base and maintain a leading position in the outdoor recreation market. The company's strategy involves organic growth, strategic acquisitions, and the planned separation of its segments to enhance focus. For more insights, explore the Marketing Strategy of Vista Outdoor.

- Strong brand recognition in key product categories.

- Extensive distribution network across North America and internationally.

- Diversified product offerings to mitigate market risks.

- Strategic focus on both organic growth and acquisitions.

- Planned separation of segments to enhance focus and growth.

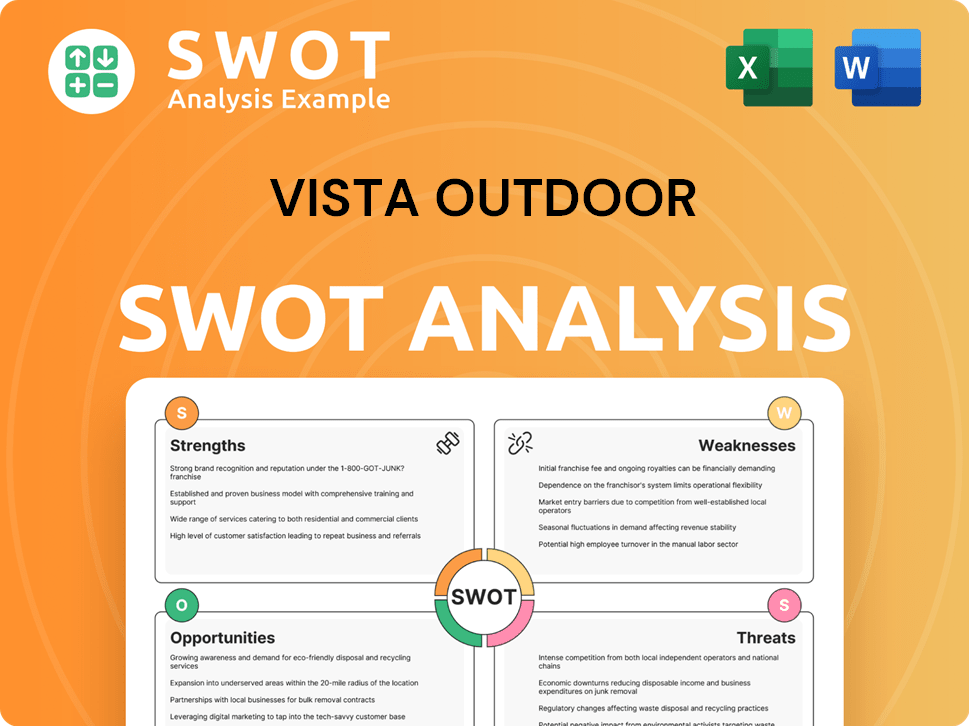

Vista Outdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vista Outdoor?

The Vista Outdoor competitive landscape is shaped by its diverse portfolio of brands and the varied markets they serve. The company operates in two primary segments: Sporting Products and Outdoor Products. Each segment faces unique competitive pressures and dynamics, influencing Vista Outdoor's overall market position.

Understanding the key competitors is crucial for assessing Vista Outdoor's strategic positioning and growth potential. The competitive environment is constantly evolving, with new entrants, technological advancements, and shifting consumer preferences impacting the industry. Market analysis reveals that Vista Outdoor's ability to adapt and innovate is essential for maintaining its competitive edge.

The planned separation of Vista Outdoor into two independent, publicly traded companies is a strategic move. This restructuring aims to enhance focus and agility, allowing each entity to better compete within its respective market segments. This strategic shift is expected to influence the competitive dynamics and market share of both companies.

In the Sporting Products segment, Vista Outdoor faces competition primarily from ammunition manufacturers. Key rivals include Olin Corporation (Winchester Ammunition) and a variety of smaller, specialized ammunition producers. These competitors vie for market share based on factors such as product performance, brand loyalty, and distribution networks.

The Outdoor Products segment features a more fragmented and dynamic competitive landscape. Vista Outdoor's brands, including CamelBak, Bushnell, and Bell, compete against a range of established and emerging brands. This segment sees competition in hydration, optics, and helmet markets.

In the hydration market, Vista Outdoor's CamelBak brand competes with companies like Hydro Flask (Helen of Troy) and Yeti. These competitors focus on product innovation, brand recognition, and diverse distribution channels to gain market share.

The optics market sees competition from established players such as Leupold & Stevens, Nikon, and Vortex Optics. These companies compete based on product quality, technological advancements, and marketing efforts.

The helmet market includes competitors like Specialized, Giro (a Bell sister brand), and other cycling and action sports helmet manufacturers. These companies compete through product innovation, design, and marketing.

Competitors employ various strategies, including product innovation, aggressive marketing, diverse distribution channels, and pricing strategies. The rise of direct-to-consumer brands and increased industry consolidation also impact the competitive landscape.

Several factors influence Vista Outdoor's competitive position within the outdoor recreation market and the broader Vista Outdoor industry. Understanding these elements is crucial for strategic planning and investment decisions.

- Market Share: Assessing Vista Outdoor's market share in each segment compared to its competitors.

- Product Innovation: Evaluating the rate of new product development and technological advancements by Vista Outdoor and its rivals.

- Brand Recognition: Analyzing the strength and loyalty of Vista Outdoor's brands versus those of its competitors.

- Distribution Channels: Examining the effectiveness of Vista Outdoor's distribution networks compared to competitors, including retail, online, and direct-to-consumer models.

- Pricing Strategies: Comparing the pricing strategies of Vista Outdoor's products with those of its competitors.

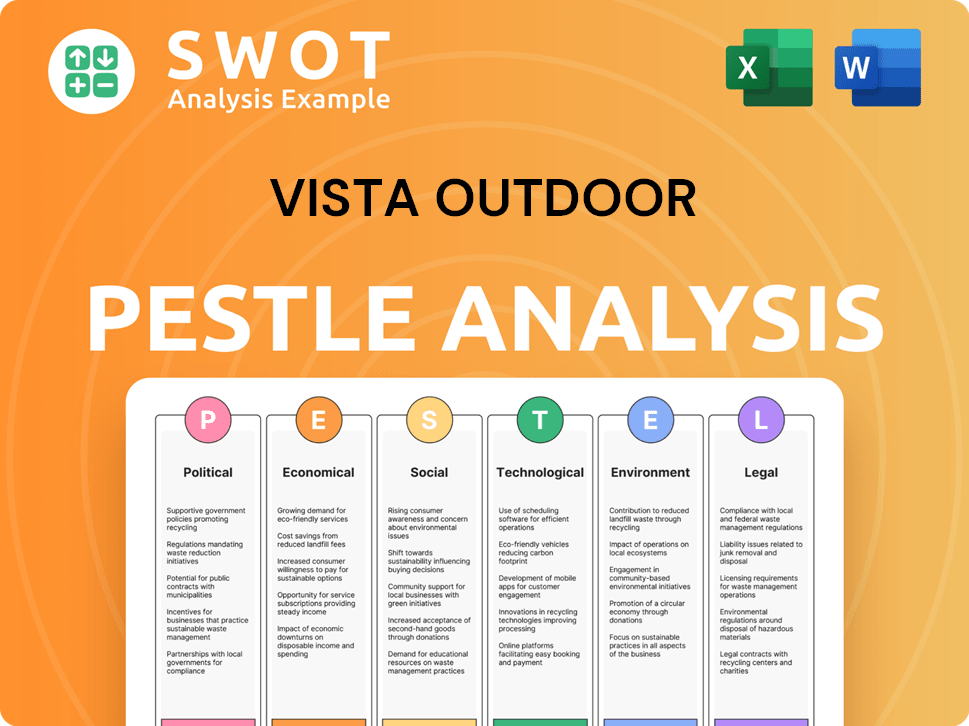

Vista Outdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vista Outdoor a Competitive Edge Over Its Rivals?

The competitive advantages of the company are largely rooted in its extensive portfolio of well-established brands and its robust distribution network. The company's brand equity, built over decades for brands like Federal, Remington, CamelBak, and Bushnell, cultivates strong customer loyalty and trust. This recognition lowers marketing expenses and creates a substantial barrier to entry for new competitors. Understanding the Growth Strategy of Vista Outdoor provides further insights into how these advantages are leveraged.

Furthermore, the company benefits from economies of scale in manufacturing and procurement, particularly within its Sporting Products segment. This allows for cost efficiencies that smaller competitors may struggle to achieve. Its broad distribution network, encompassing sporting goods retailers, mass merchandisers, and online channels, ensures wide product availability and accessibility to a diverse customer base.

The company also leverages its intellectual property, including patents and proprietary technologies, to develop innovative products. This includes advanced ammunition designs or specialized optical coatings. Over time, the company has strategically acquired complementary brands, integrating them into its operational framework to expand its market reach and product offerings.

The company's strong brand recognition, built over years, fosters customer loyalty. This is a significant advantage in the Vista Outdoor competitive landscape. Established brands reduce marketing costs and provide a barrier to entry for new competitors.

A robust distribution network ensures wide product availability. This network includes sporting goods retailers, mass merchandisers, and online channels. This broad reach allows the company to access a diverse customer base effectively.

Economies of scale in manufacturing and procurement provide cost efficiencies. This is particularly evident within its Sporting Products segment. These efficiencies give the company a competitive edge over smaller rivals.

The company leverages intellectual property to develop innovative products. This includes patents and proprietary technologies. These innovations offer superior performance or unique features, maintaining a competitive edge.

The company's competitive advantages are multifaceted, including strong brand recognition and a broad distribution network. These factors contribute to its market position within the Vista Outdoor industry. The company's ability to innovate and leverage economies of scale further strengthens its position.

- Strong Brand Portfolio: Well-established brands like Federal and Bushnell.

- Extensive Distribution: Access to sporting goods retailers and online channels.

- Economies of Scale: Cost efficiencies in manufacturing and procurement.

- Innovation: Development of advanced products through intellectual property.

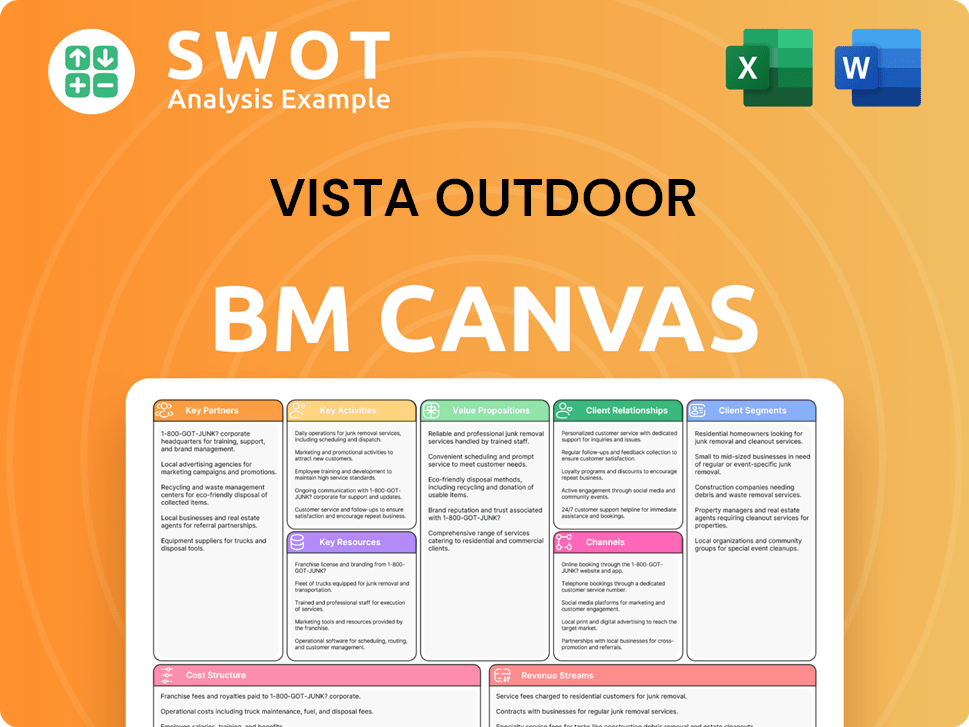

Vista Outdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vista Outdoor’s Competitive Landscape?

The Vista Outdoor competitive landscape is significantly shaped by industry trends, regulatory changes, and consumer behavior. The company faces both challenges and opportunities within the outdoor recreation and shooting sports sectors. Understanding these dynamics is crucial for assessing its future prospects and strategic positioning. For a deeper dive, explore Revenue Streams & Business Model of Vista Outdoor.

The company's performance is also influenced by its ability to adapt to changing market conditions and consumer preferences. Strategic decisions, such as the planned separation into two companies, reflect an effort to better address these evolving dynamics. This restructuring aims to enhance focus and agility within the Vista Outdoor industry, allowing each entity to capitalize on specific market opportunities more effectively.

Technological advancements are driving innovation in outdoor gear and ammunition, creating opportunities for companies that invest in R&D. Increased participation in outdoor activities, fueled by health and wellness trends, boosts demand. Digital transformation and embracing smart features in products are key to meeting evolving consumer demands.

Managing supply chain disruptions and adapting to inflationary pressures are significant hurdles. Navigating intense competition from established players and direct-to-consumer brands is crucial. Regulatory changes, particularly concerning firearms and ammunition, pose a consistent challenge. The focus on sustainability and ethical sourcing demands investment in environmentally friendly practices.

Expanding into emerging international markets with growing middle classes presents a significant opportunity. Product innovation, especially in sustainable and technologically advanced offerings, can unlock new revenue streams. Strategic partnerships and collaborations can enhance market reach and product development capabilities. The planned separation into two companies allows for targeted strategies.

The Vista Outdoor market analysis must consider how the company navigates regulatory changes, which can significantly impact sales. The outdoor recreation market saw a surge during the COVID-19 pandemic, benefiting companies like Vista Outdoor. The planned separation into Revelyst (Outdoor Products) and The Kinetic Group (Sporting Products) is a strategic move to address these dynamics.

The Vista Outdoor competitive landscape is characterized by a mix of established players and emerging brands. Understanding the strengths and weaknesses of Vista Outdoor competitors is crucial for strategic planning. Key factors include product innovation, market reach, and operational efficiency. The company's ability to adapt to changing consumer preferences and market dynamics will be critical for future success.

- Who are Vista Outdoor's main competitors in the ammunition market: Key competitors in the ammunition market include Olin Corporation (Winchester), and Federal Premium Ammunition.

- What is Vista Outdoor's market share in the hunting industry: Specific market share figures fluctuate, but Vista Outdoor holds a significant position in the hunting and shooting sports industries.

- How does Vista Outdoor compare to its competitors in terms of revenue: Comparing revenue requires examining recent financial reports; however, Vista Outdoor's revenue is in the billions of dollars annually.

- What are the growth strategies of Vista Outdoor's competitors: Competitors are focusing on product innovation, expanding into new markets, and leveraging digital channels.

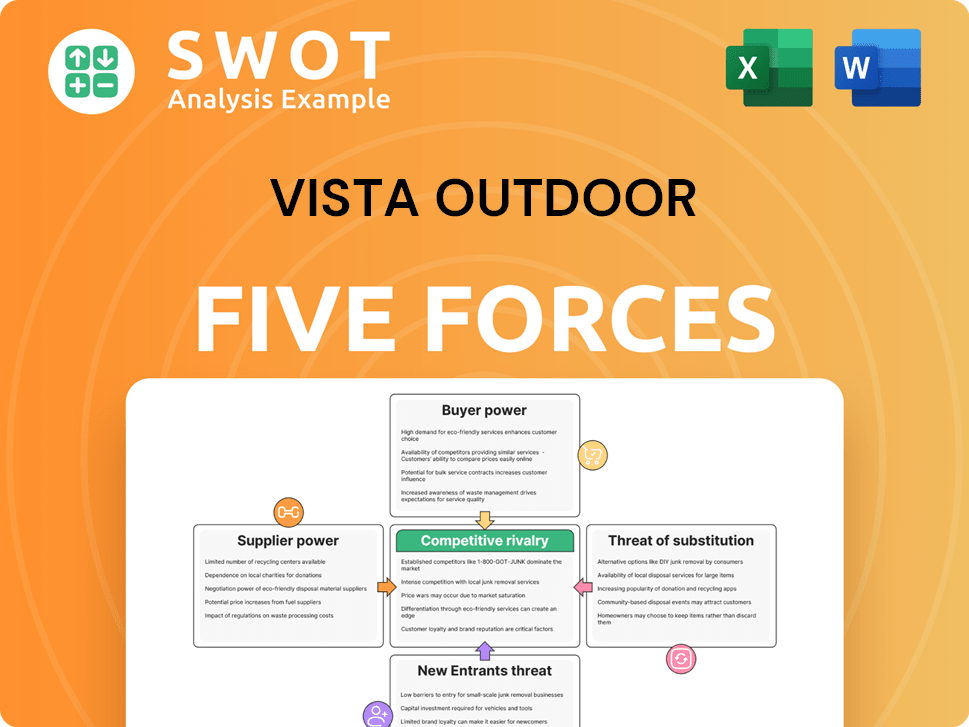

Vista Outdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vista Outdoor Company?

- What is Growth Strategy and Future Prospects of Vista Outdoor Company?

- How Does Vista Outdoor Company Work?

- What is Sales and Marketing Strategy of Vista Outdoor Company?

- What is Brief History of Vista Outdoor Company?

- Who Owns Vista Outdoor Company?

- What is Customer Demographics and Target Market of Vista Outdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.