Vulcan Materials Bundle

How Did Vulcan Materials Company Build a Construction Empire?

Ever wondered about the bedrock beneath our modern world? Vulcan Materials Company, a name synonymous with construction, has a fascinating history. From its origins in 1909 as the Birmingham Slag Company, this Vulcan Materials SWOT Analysis reveals a story of innovation and strategic growth in the construction industry.

This mining company, a key player in the aggregate materials sector, transformed a byproduct into a building block for progress. Understanding the Vulcan history provides insights into the evolution of the construction industry and the crucial role of companies like Vulcan Materials Company in shaping our infrastructure and the economy. Explore the brief history of Vulcan Materials Company to learn more about its journey.

What is the Vulcan Materials Founding Story?

The story of Vulcan Materials Company begins on January 25, 1909. It started with the establishment of the Birmingham Slag Company in Birmingham, Alabama. This marked the genesis of what would become a major player in the construction industry.

Henry Badham founded the company, recognizing an opportunity in the steel industry. He aimed to transform blast furnace slag, a waste product, into useful construction aggregate. This innovative approach set the stage for the company’s early success.

The Birmingham Slag Company's business model focused on processing and selling slag for construction. This was a smart move, capitalizing on the growing demand for affordable building materials.

- The company sourced slag from local steel mills.

- It processed the slag into various sizes for different applications.

- The primary market was road construction and other building projects.

- Early funding likely came from local investors and Badham's capital.

The company's name, 'Birmingham Slag Company,' clearly indicated its focus. The early 20th century's industrial expansion and infrastructure needs provided a favorable environment for growth. This strategic positioning allowed the company to thrive in a time of rapid industrialization.

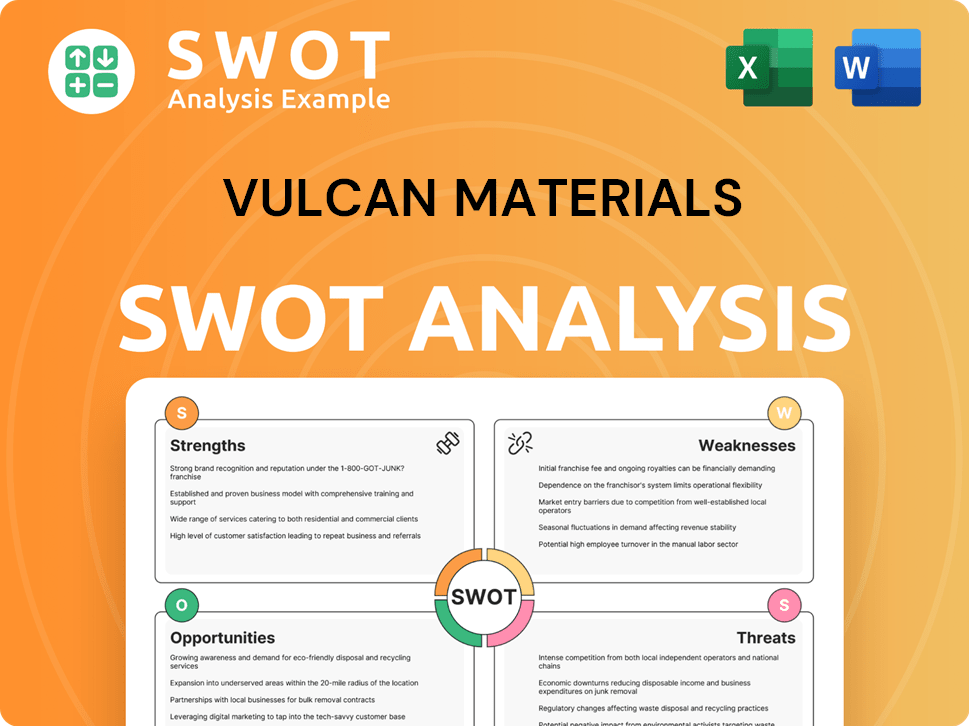

Vulcan Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vulcan Materials?

The early growth of the Birmingham Slag Company, later known as Vulcan Materials Company, was fueled by the rising demand for construction materials. Initially specializing in slag processing, the company quickly broadened its offerings to meet the needs of the construction industry. This expansion included various grades of crushed slag, crucial for roadbeds, railway ballast, and concrete aggregate.

The company initially provided crushed slag, a byproduct of steel production, for use in construction. This included materials for road construction, railway projects, and concrete. The focus was on providing essential aggregate materials to support infrastructure development.

Early clients primarily included municipal and state governments involved in road-building projects and railway companies expanding their networks. These projects created a steady demand for the company's aggregate materials, supporting its early growth. The construction industry was a key driver.

As demand increased, the

The shift into natural aggregates was a significant turning point, broadening the company's product portfolio and reducing its reliance on the steel industry. Key acquisitions, such as the Union Rock Company in 1956, solidified its position and expanded its reach across the southeastern United States. The company's growth was also driven by the post-World War II construction boom.

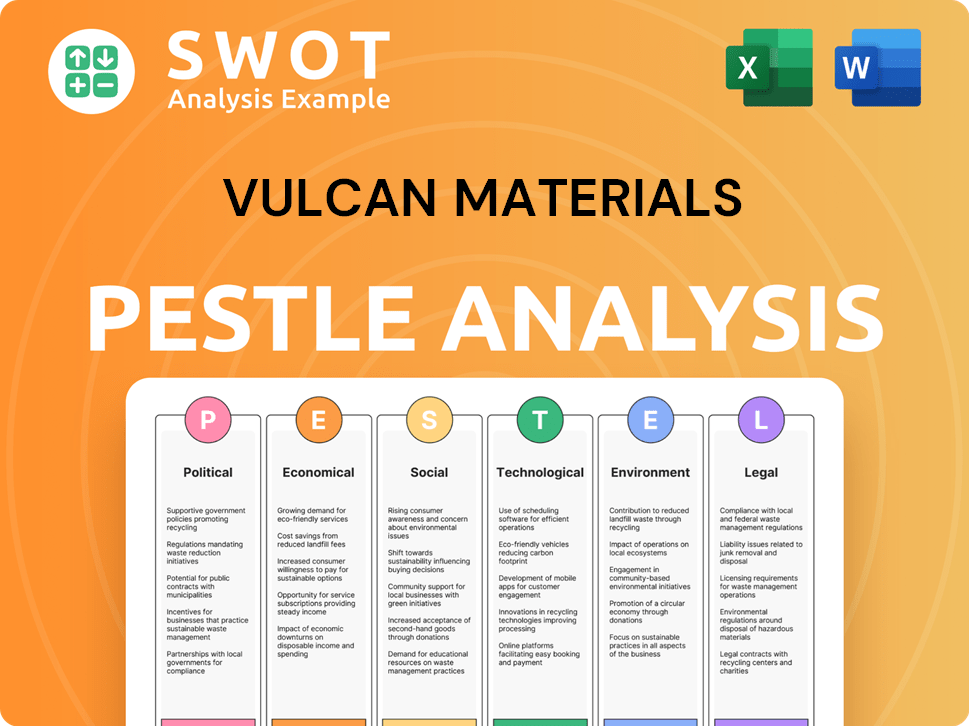

Vulcan Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vulcan Materials history?

The Vulcan Materials Company has a rich history marked by significant milestones, strategic pivots, and consistent growth within the construction industry. From its early recognition of the value in processing blast furnace slag to its present-day status as a leading mining company, Vulcan's journey reflects adaptability and a commitment to innovation in the aggregate materials sector.

| Year | Milestone |

|---|---|

| Early 1900s | The company's early years were focused on the production of slag, a byproduct of steel manufacturing, which was transformed into a usable construction material. |

| 1950s-1960s | Vulcan expanded its operations, moving beyond slag to include a broader range of aggregate materials, such as crushed stone, sand, and gravel, to meet the growing demands of the construction industry. |

| 1980s | Vulcan Materials Company made strategic acquisitions to increase its market presence and diversify its product offerings. |

| 1990s-2000s | The company continued to expand its geographic footprint and enhance its operational efficiency through technological advancements and strategic investments. |

| 2008-2010 | Vulcan navigated the Great Recession by focusing on cost management, operational optimization, and strategic divestitures to maintain financial stability. |

| 2010s-Present | Vulcan has continued to invest in sustainability initiatives and expand its product portfolio to meet the evolving needs of the construction industry, including infrastructure projects. |

Vulcan's commitment to innovation is evident in its continuous investment in advanced quarrying and processing technologies. Ongoing advancements in crushing, screening, and washing technologies allow Vulcan to produce aggregate materials tailored for specific applications, enhancing productivity and product quality.

Vulcan Materials Company was among the first to recognize the potential of blast furnace slag, transforming an industrial waste into a valuable resource for construction. This early innovation set a precedent for the company's resourcefulness and efficiency in the aggregate materials industry.

The company continuously invests in advanced crushing and screening technologies to produce aggregates that meet specific customer needs. These technologies ensure high-quality materials for various construction projects, including infrastructure development.

Vulcan employs sophisticated washing techniques to remove impurities and ensure the quality of its aggregate products. This process is crucial for producing materials that meet stringent industry standards and are suitable for diverse applications.

Vulcan's innovation allows for the customization of aggregate materials to meet specific project requirements. This includes tailoring the size, shape, and composition of aggregates for specialized applications like high-strength concrete and asphalt mixes.

The company has developed a robust supply chain to ensure the timely delivery of aggregate materials to construction sites. This efficiency is critical for supporting large-scale infrastructure projects and maintaining customer satisfaction.

Vulcan has implemented various sustainability initiatives to reduce its environmental impact. These include optimizing energy consumption, reducing water usage, and promoting the use of recycled materials in its operations.

The Vulcan Materials Company has faced numerous challenges, including economic downturns and competitive pressures. The company has consistently adapted to market fluctuations through strategic cost management, operational improvements, and strategic acquisitions to maintain its position as a leader in the construction industry.

Vulcan has successfully navigated economic downturns, such as the 2008 financial crisis, by implementing cost-cutting measures and optimizing operations. These strategies have helped the company maintain financial stability and market share during challenging times.

Competition from other large aggregate producers and regional players has required Vulcan to continuously improve efficiency and customer service. Strategic acquisitions and operational excellence are key to maintaining a competitive edge.

The construction industry is subject to cyclical market fluctuations, which require Vulcan to adapt its strategies. This includes adjusting production levels, managing inventory, and diversifying its customer base to mitigate risks.

The company must comply with various environmental and safety regulations, which can add to operational costs. Vulcan invests in technologies and processes to meet these standards and minimize its environmental impact.

Disruptions in the supply chain, such as those caused by natural disasters or economic events, can impact Vulcan's operations. The company has developed strategies to manage these risks, including diversifying its suppliers and maintaining sufficient inventory levels.

The company faces challenges in reducing its carbon footprint and promoting sustainable practices. Vulcan is actively working on initiatives to improve energy efficiency, reduce emissions, and incorporate recycled materials into its products.

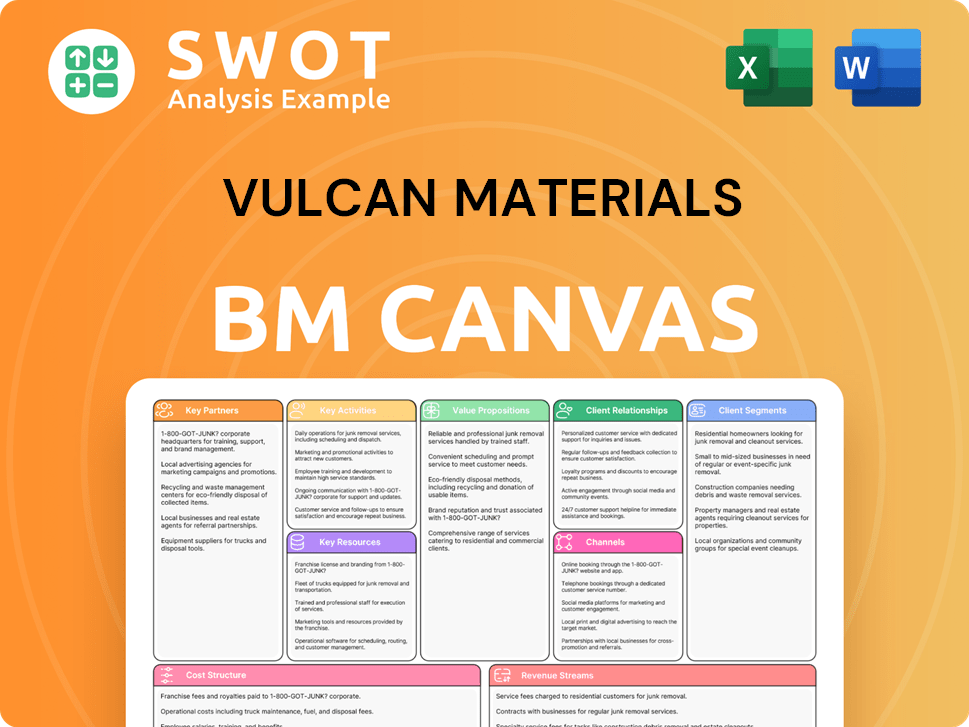

Vulcan Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vulcan Materials?

The brief history of Vulcan Materials Company showcases its growth and evolution. Founded in 1909 as Birmingham Slag Company, the company has transformed into a leading producer of aggregate materials. Through strategic acquisitions and a focus on operational excellence, Vulcan has expanded its reach and solidified its position in the construction industry. The company's commitment to sustainability and efficient operations underscores its forward-looking approach.

| Year | Key Event |

|---|---|

| 1909 | Founded as Birmingham Slag Company in Birmingham, Alabama, marking the beginning of the Vulcan history. |

| 1940s-1950s | Began diversifying beyond slag into crushed stone, sand, and gravel, expanding its range of aggregate materials. |

| 1956 | Acquired Union Rock Company, significantly increasing its aggregates business and geographical footprint. |

| 1957 | Changed its name to Vulcan Materials Company, reflecting its broader scope of operations. |

| 1960s-1970s | Continued expansion through acquisitions, establishing itself as a major national aggregates producer. |

| 1980s | Focused on optimizing operations and integrating acquired businesses, improving efficiency. |

| 2000s | Experienced significant growth in demand for aggregates, driven by infrastructure spending and residential construction. |

| 2008 | Navigated the challenges of the Great Recession, demonstrating resilience and strategic cost management. |

| 2014 | Completed the acquisition of certain aggregate assets from Aggregates USA LLC, strengthening its market position. |

| 2020s | Focused on sustainable practices, operational efficiency, and leveraging technology for enhanced productivity. |

| 2023 | Reported strong financial performance, with net sales reaching $7.8 billion and Adjusted EBITDA of $2.0 billion. |

| 2024-2025 | Continues to focus on strategic capital allocation, investing in high-return projects, and optimizing its network to serve growing demand. |

Vulcan Materials Company is well-positioned to benefit from anticipated increases in infrastructure spending in the United States. The Infrastructure Investment and Jobs Act (IIJA) is expected to provide a sustained tailwind for aggregate demand. The company's strategic focus is on optimizing its existing quarry network and investing in advanced processing technologies.

The company is pursuing bolt-on acquisitions in attractive growth markets. Vulcan is also investing in advanced processing technologies to improve efficiency and product quality. These initiatives are part of a broader strategy to enhance its market position and capitalize on growth opportunities within the construction industry.

Vulcan is increasingly focused on sustainability, aiming to reduce its environmental footprint. This includes responsible resource management and energy efficiency. Leadership emphasizes a commitment to disciplined capital allocation and returning value to shareholders. These efforts support long-term growth.

In 2023, Vulcan reported net sales of $7.8 billion and Adjusted EBITDA of $2.0 billion, demonstrating strong market demand. Analyst predictions for the construction materials sector remain largely positive. The company's future outlook is firmly rooted in its vision of providing essential materials for infrastructure.

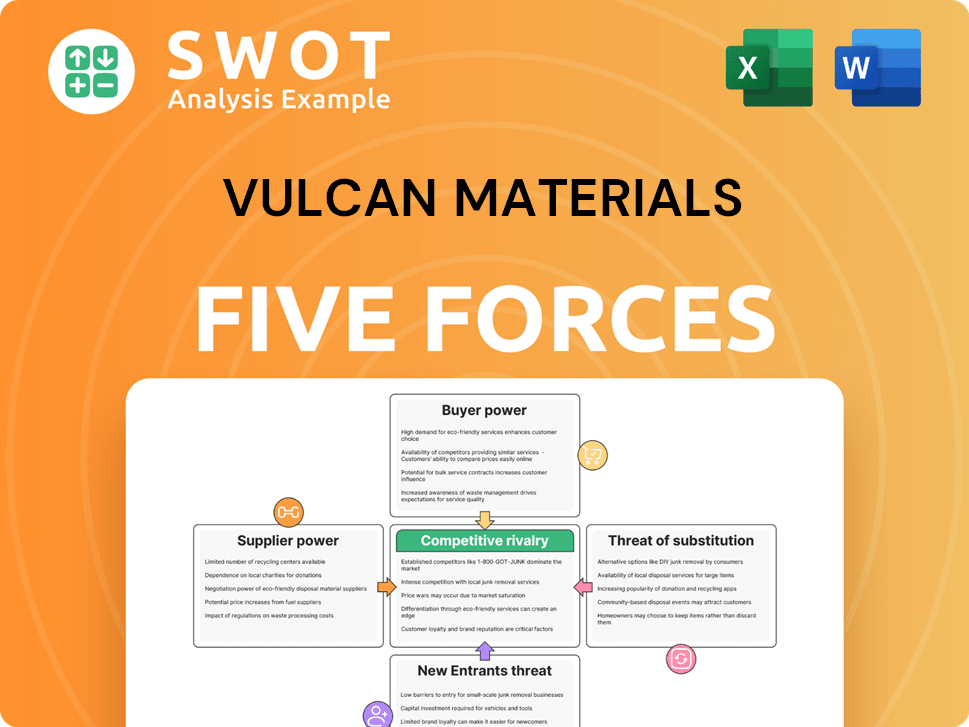

Vulcan Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vulcan Materials Company?

- What is Growth Strategy and Future Prospects of Vulcan Materials Company?

- How Does Vulcan Materials Company Work?

- What is Sales and Marketing Strategy of Vulcan Materials Company?

- What is Brief History of Vulcan Materials Company?

- Who Owns Vulcan Materials Company?

- What is Customer Demographics and Target Market of Vulcan Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.