Vulcan Materials Bundle

How Will Vulcan Materials Company Dominate the Future of Construction?

Vulcan Materials Company, a titan in the Vulcan Materials SWOT Analysis, is navigating a dynamic landscape where its growth strategy is crucial for maintaining its industry leadership. Founded in 1909, the company has evolved from a regional supplier to the largest producer of construction aggregates in the United States. This transformation highlights the significance of its strategic approach in meeting the ever-growing demands of the construction sector.

This exploration delves into the Growth strategy and Future prospects of Vulcan Materials Company, examining how it plans to capitalize on market opportunities. We'll analyze the company's strategic acquisitions, expansion plans, and sustainability initiatives to understand its trajectory within the Aggregates industry. Furthermore, we'll provide a comprehensive Market analysis to assess the impact of infrastructure spending and other key factors on Vulcan Materials Company's financial performance and Market share.

How Is Vulcan Materials Expanding Its Reach?

The growth strategy of Vulcan Materials Company is significantly shaped by its expansion initiatives. These initiatives are strategically designed to enhance the company's market position and capitalize on opportunities in the construction materials sector. The company's approach involves a blend of geographical expansion, product diversification, and strategic partnerships, all aimed at driving sustainable growth and increasing shareholder value. This strategic focus is particularly crucial in the context of the evolving demands of the aggregates industry and the broader construction market.

A key component of Vulcan Materials Company's expansion strategy is targeted acquisitions. These acquisitions are primarily focused on areas with high growth potential, especially in regions experiencing significant construction activity. This strategy is crucial for securing long-term aggregate reserves and expanding the company's customer base. By acquiring existing operations, Vulcan can quickly increase its production capacity and market share, positioning itself to meet rising demand effectively. These moves are also supported by optimizing its existing asset base to improve operational efficiency.

Vulcan Materials Company also focuses on product diversification, particularly in downstream products like asphalt mix and ready-mixed concrete. This vertical integration strategy allows the company to capture more value along the construction supply chain. Strategic partnerships and joint ventures also play a role in its expansion, enabling access to new markets or specialized capabilities without full ownership. These initiatives are driven by the overarching goal of diversifying revenue streams and mitigating regional market fluctuations.

Vulcan Materials Company focuses on expanding its geographical footprint, particularly in high-growth regions. This includes strategic acquisitions and greenfield projects. In 2024, the company completed several bolt-on acquisitions, especially in the Sun Belt states, to capitalize on robust construction activity. This expansion is crucial for accessing new customer bases and securing long-term aggregate reserves.

The company is expanding its product offerings, especially in downstream products like asphalt mix and ready-mixed concrete. This vertical integration allows for capturing more value along the construction supply chain. Product diversification helps in mitigating regional market fluctuations and meeting the evolving demands of the construction industry. This strategy is crucial for sustainable growth.

Vulcan Materials Company leverages strategic partnerships and joint ventures to enter new markets and gain specialized capabilities. Collaborations on large-scale public infrastructure projects provide a consistent demand pipeline. These partnerships strengthen the company's market position and support its expansion goals. This approach enables access to new markets without full ownership.

Vulcan Materials Company continually optimizes its existing asset base to improve operational efficiency. This includes increasing production capacity to meet rising demand and enhancing its overall performance. By focusing on operational excellence, the company aims to maximize profitability and maintain a competitive edge in the market. This approach supports sustainable growth.

Vulcan Materials Company's expansion plans are driven by several key strategies. These include strategic acquisitions, product diversification, and operational efficiency improvements. The company's focus on the Sun Belt states reflects its strategy to target high-growth regions. These initiatives are designed to drive sustainable growth and increase shareholder value. For more detailed information, you can read about the Competitors Landscape of Vulcan Materials.

- Strategic Acquisitions: Targeting high-growth areas, especially in Texas and other Sun Belt states.

- Product Diversification: Expanding into downstream products like asphalt mix and ready-mixed concrete.

- Operational Efficiency: Optimizing the existing asset base to increase production capacity.

- Strategic Partnerships: Collaborating on large-scale public infrastructure projects.

Vulcan Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vulcan Materials Invest in Innovation?

The Growth strategy of Vulcan Materials Company heavily relies on innovation and technology to boost operational efficiency and sustain expansion within the Aggregates industry. This approach includes significant investments in automation, digital transformation, and the application of cutting-edge technologies across its operations. These initiatives are designed to improve safety, increase productivity, and reduce operational costs, ultimately strengthening its position in the market.

Technological advancements are key to Vulcan Materials Company's future. The company is actively developing digital platforms for customer engagement, supply chain management, and data analytics. These platforms are aimed at streamlining processes and providing valuable insights into market trends and customer needs. Additionally, Vulcan Materials Company is exploring the use of AI and IoT for predictive maintenance and quality control.

Furthermore, sustainability is a core component of Vulcan Materials Company's innovation strategy. The company is focused on developing more environmentally friendly production processes, reducing energy consumption, and exploring the use of recycled content in its products. These efforts not only contribute to operational excellence but also enhance the company's ability to offer high-quality products and services, reinforcing its competitive advantage. For more details on how Vulcan Materials Company operates, you can refer to Revenue Streams & Business Model of Vulcan Materials.

Automation plays a crucial role in enhancing safety and efficiency. This includes the deployment of advanced fleet management systems and automated loading processes. Real-time monitoring of equipment performance helps optimize resource utilization and increase throughput.

Digital platforms are being developed for customer engagement and supply chain management. These platforms aim to streamline order processing and improve logistics. Data analytics provides insights into market trends and customer needs.

AI and IoT are being explored for predictive maintenance and quality control. IoT sensors on machinery provide real-time data to anticipate maintenance needs. This minimizes downtime and maximizes asset utilization.

Sustainability is integrated into the innovation strategy. The focus is on developing environmentally friendly production processes. The company aims to reduce energy consumption and explore recycled content in its products.

Technological advancements enable the company to offer higher-quality products and services. This strengthens its competitive advantage in the market. These improvements contribute to long-term Growth strategy.

The primary goals include improving operational efficiency and reducing costs. These strategies are designed to drive sustained growth and enhance profitability. They also aim to increase Vulcan Materials Company's market share.

In 2024, Vulcan Materials Company continued to invest heavily in technology to enhance its operational capabilities and market position. These investments are crucial for achieving long-term Future prospects and maintaining a competitive edge within the Construction materials sector.

- Automation: Further deployment of automated systems in quarries and production facilities. This includes advanced fleet management systems, automated loading, and real-time monitoring of equipment.

- Digital Platforms: Development and implementation of digital platforms for customer engagement, supply chain management, and data analytics. These platforms streamline order processing, improve logistics, and provide valuable insights.

- AI and IoT: Exploration and implementation of AI and IoT for predictive maintenance, quality control, and optimizing material blends. This includes the use of IoT sensors on machinery to anticipate maintenance needs.

- Sustainability: Initiatives focused on developing more environmentally friendly production processes, reducing energy consumption, and exploring recycled content in products.

Vulcan Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vulcan Materials’s Growth Forecast?

The financial outlook for Vulcan Materials Company appears promising, supported by robust market demand and strategic capital allocation. The company's growth strategy is closely tied to the construction materials sector, with a focus on aggregates, which are essential for infrastructure and residential projects. Market analysis indicates sustained public and private construction spending, providing a solid foundation for future revenue growth. The future prospects for the company are further enhanced by its strategic investments in capacity expansion and operational efficiencies.

In recent quarters, Vulcan Materials Company has demonstrated strong financial performance. For the full year 2023, the company reported a 4% increase in aggregates shipments and a 13% improvement in aggregates pricing. This momentum is expected to continue into 2024 and beyond, driven by the ongoing demand for construction materials. The company's ability to improve gross profit margins reflects effective cost management and favorable pricing dynamics, contributing to its overall financial health.

Vulcan Materials Company's capital expenditure plans are aligned with its growth objectives, focusing on high-return projects that expand aggregate capacity and improve logistical capabilities. The company is also committed to maintaining a strong balance sheet, providing the flexibility to pursue strategic acquisitions and return value to shareholders through dividends and share repurchases. For example, in 2024, management highlighted their disciplined approach to capital deployment, emphasizing investments that generate strong returns and support long-term value creation. The company's financial ambitions are supported by a healthy backlog of infrastructure projects and the ongoing demand for housing and commercial development, providing a stable foundation for achieving its revenue targets and profit margin goals in the coming years.

Vulcan Materials Company benefits from several key growth drivers. These include increased infrastructure spending, particularly from government initiatives, and sustained demand from residential and commercial construction. These factors are crucial in the aggregates industry. The company’s strategic acquisitions also play a role in expanding its market presence and revenue streams.

The company's capital allocation strategy focuses on high-return projects, capacity expansion, and operational improvements. Vulcan Materials Company invests in projects that increase aggregate production capacity and enhance logistical capabilities. This disciplined approach supports long-term value creation and shareholder returns.

Vulcan Materials Company consistently improves its gross profit margins through effective cost management and favorable pricing. The company's strategic investments in operational efficiencies further enhance profitability. These improvements are crucial for maintaining a competitive edge in the aggregates industry.

The company benefits from a healthy backlog of infrastructure projects and ongoing demand for housing and commercial development. These factors provide a stable foundation for achieving revenue targets and profit margin goals. The future of the construction industry looks promising for Vulcan Materials Company.

Key financial metrics indicate strong performance and positive outlook for Vulcan Materials Company. The company's focus on strategic acquisitions and expansion plans will drive future growth. For more details, you can explore the analysis provided in this article on Vulcan Materials Company.

- Revenue growth driven by infrastructure spending and construction projects.

- Improved gross profit margins due to effective cost management.

- Strategic capital allocation focused on high-return projects.

- Strong backlog of infrastructure projects supporting future revenue.

Vulcan Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vulcan Materials’s Growth?

Despite the promising growth strategy of Vulcan Materials Company, several potential risks and obstacles could affect its future prospects. The company faces challenges from intense competition within the aggregates industry and potential regulatory hurdles, which could impact its operational costs and expansion plans. Furthermore, economic downturns and supply chain disruptions could directly affect the demand for construction materials and Vulcan Materials Company's ability to deliver products efficiently.

Market dynamics and external factors such as shifts in construction spending and technological advancements also pose considerable risks. Internal challenges, including labor shortages, could impede operational efficiency and growth initiatives. Addressing these risks is critical for Vulcan Materials Company to maintain its competitive edge and achieve its long-term objectives.

Vulcan Materials Company needs to navigate a complex landscape to sustain its growth strategy. The company's success hinges on its ability to manage these risks effectively, adapt to market changes, and capitalize on opportunities for expansion and innovation. Understanding these challenges is crucial for investors and stakeholders interested in the future prospects of the company.

The aggregates industry is highly competitive, with numerous regional and local players, along with other large public companies. This intense competition can lead to pricing pressures and challenges in maintaining or growing Vulcan Materials Company's market share. Competitors constantly vie for projects, which can affect profitability.

Changes in environmental regulations, permitting processes, and transportation rules pose a significant risk. Stricter regulations or delays in approvals can increase operational costs and hinder Vulcan Materials Company's expansion plans. The company must stay compliant to avoid penalties.

Disruptions in fuel supply or equipment availability can impact production and delivery schedules. These vulnerabilities can lead to increased costs and delays in project completion. Vulcan Materials Company must maintain a resilient supply chain to mitigate these risks.

Economic downturns or fluctuations in construction spending can directly affect demand for Vulcan Materials Company's products. A slowdown in residential construction or a decrease in government infrastructure funding can reduce sales volumes, impacting the company's financial performance. The company needs strategies to maintain performance during economic instability.

Technological advancements in production methods or the emergence of new construction materials can pose a risk if Vulcan Materials Company fails to adapt. The company must invest in research and development to stay ahead of these changes. Innovation is key to maintaining a competitive edge.

Internal challenges, such as a shortage of skilled labor or difficulties in attracting and retaining talent, can impede operational efficiency. These resource constraints can limit Vulcan Materials Company's ability to execute its expansion plans effectively. Addressing these issues is vital for sustained growth.

Vulcan Materials Company addresses these risks through diversification across geographies and product lines, robust risk management frameworks, and proactive engagement with regulatory bodies. The company focuses on operational excellence and continuous improvement to mitigate cost pressures and enhance resilience against market fluctuations. Furthermore, strategic acquisitions can help to expand the company's footprint and product offerings, as seen in their recent moves to bolster their market position.

In 2024, Vulcan Materials Company reported strong financial results, with net sales of approximately $7.6 billion, reflecting a robust demand for construction materials. The company's ability to manage costs and maintain profitability is crucial for navigating potential economic downturns. The Vulcan Materials Company's financial performance is directly tied to its ability to manage these risks effectively, as highlighted in their investor relations materials.

Vulcan Materials Company is actively involved in various strategic initiatives to enhance its long-term growth strategy. These include investments in infrastructure projects, acquisitions to expand market reach, and sustainability initiatives. The company's commitment to these areas reflects its proactive approach to managing risks and capitalizing on opportunities. The company's mission, vision, and core values, as detailed in Mission, Vision & Core Values of Vulcan Materials, guide these strategic efforts.

The future prospects of Vulcan Materials Company are influenced by its ability to navigate these challenges and adapt to changing market conditions. Factors such as infrastructure spending, housing starts, and overall economic growth will significantly impact the company's performance. Analysts forecast continued growth, but this depends on the successful mitigation of risks. In 2025, the company is expected to continue its strategic focus on operational efficiency and market expansion.

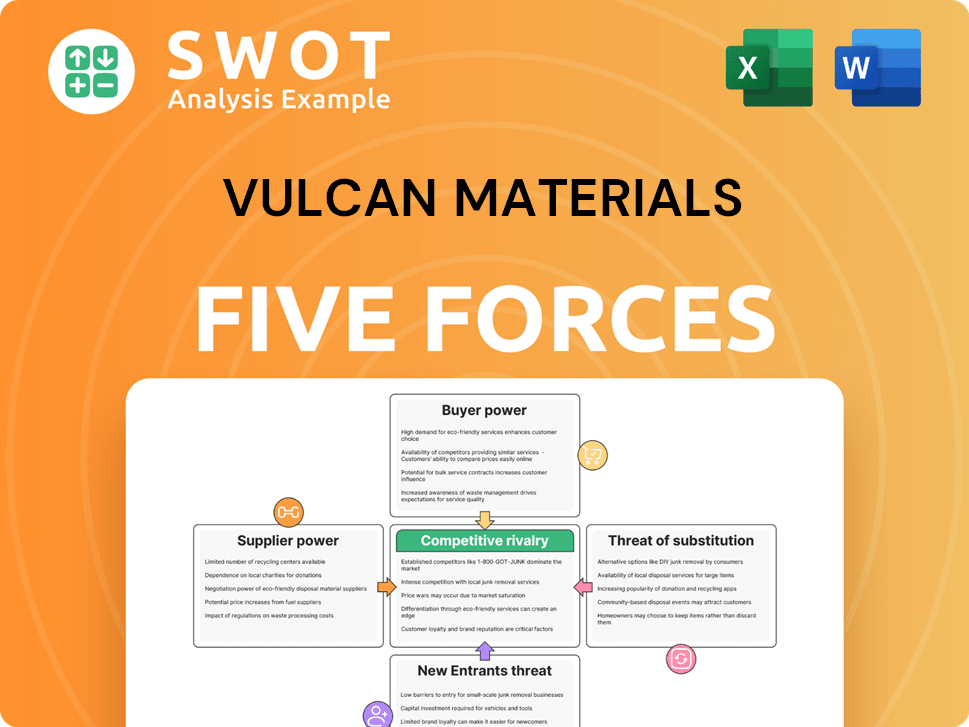

Vulcan Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vulcan Materials Company?

- What is Competitive Landscape of Vulcan Materials Company?

- How Does Vulcan Materials Company Work?

- What is Sales and Marketing Strategy of Vulcan Materials Company?

- What is Brief History of Vulcan Materials Company?

- Who Owns Vulcan Materials Company?

- What is Customer Demographics and Target Market of Vulcan Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.