Vulcan Materials Bundle

How Does Vulcan Materials Company Build America?

Vulcan Materials Company, the undisputed heavyweight in construction materials, is the engine behind the structures shaping our nation. As the leading producer of construction aggregates in the U.S., Vulcan's impact stretches from coast to coast, underpinning everything from highways to high-rises. Its vast network and strategic operations make it a linchpin of economic development and infrastructure projects.

Delving into Vulcan Materials SWOT Analysis reveals the company's core strengths and opportunities within the dynamic construction materials sector. Understanding how Vulcan Materials Company operates is crucial for anyone assessing the future of infrastructure, the construction industry, or considering investments in the company. This exploration will uncover how Vulcan's quarrying operations, production of aggregates, and strategic positioning contribute to its financial performance and market dominance. Considering questions like "How does Vulcan Materials Company make money?" and "What does Vulcan Materials Company produce?" will provide valuable insights.

What Are the Key Operations Driving Vulcan Materials’s Success?

Vulcan Materials Company (Vulcan) centers its operations on the production and distribution of essential construction materials. The company's primary offerings include aggregates, such as crushed stone, sand, and gravel, which are fundamental to construction projects. Additionally, Vulcan produces asphalt mix and ready-mixed concrete, providing a comprehensive suite of products to its customers.

The company's business model is built on vertically integrated operations, starting with the extraction of raw materials from its quarries. These materials undergo processing like crushing and screening to meet specific size and quality standards. For asphalt and concrete, aggregates are combined with other components at company-owned plants. This integrated approach allows for quality control and efficient distribution through various transportation methods, including truck, rail, and barge.

Vulcan strategically locates its facilities near major metropolitan areas and transportation corridors. This geographic advantage, coupled with integrated production and efficient distribution, allows Vulcan to offer competitive pricing and consistent product availability. This operational setup enables Vulcan to meet the demanding schedules of large-scale construction projects, setting it apart from smaller competitors. Learn more about the Growth Strategy of Vulcan Materials.

Vulcan primarily produces aggregates, including crushed stone, sand, and gravel. These materials are essential for various construction projects. The company also produces asphalt mix and ready-mixed concrete, expanding its product offerings.

Vulcan's operations are vertically integrated, starting with quarrying. Raw materials are processed through crushing, screening, and washing. Asphalt and concrete production occurs at company-owned plants, ensuring quality control. Distribution utilizes trucks, rail, and barges.

Vulcan benefits from its vast reserves of high-quality aggregates, strategically located near key markets. This geographic advantage, combined with integrated production and efficient distribution, provides a competitive edge. This allows for reliable supply and consistent product quality.

Customers benefit from Vulcan's reliable supply, consistent product quality, and ability to meet project schedules. This makes Vulcan a preferred supplier for large-scale construction projects. The company's integrated model ensures efficiency and dependability.

In 2024, Vulcan Materials Company demonstrated strong financial performance, reflecting its robust operational model. The company's strategic focus on aggregates and construction materials continues to drive its success, with significant investments in infrastructure and expansion.

- Revenue: Reported revenues of approximately $7.6 billion.

- Gross Profit: Gross profit reached around $2.7 billion, showcasing efficient operations.

- Net Earnings: Net earnings were approximately $800 million, reflecting profitability.

- Capital Expenditures: Capital expenditures were around $550 million.

Vulcan Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vulcan Materials Make Money?

The core of Vulcan Materials Company's business revolves around the sale of construction materials, with a strong emphasis on aggregates. These aggregates, which include crushed stone, sand, and gravel, form the foundation of the company's revenue streams. The company's monetization strategy is primarily volume-based, with pricing influenced by regional demand and transportation costs.

Beyond aggregates, the company diversifies its revenue through asphalt mix and ready-mixed concrete. This diversification allows Vulcan Materials to offer integrated solutions, potentially leading to higher-value contracts. The long-term nature of infrastructure projects provides a stable demand for its products, supporting consistent revenue generation.

In the first quarter of 2024, the aggregates segment experienced a 13% increase in gross profit compared to the previous year. This highlights the segment's dominant contribution to the company's overall financial performance. The company's strategic acquisitions and disciplined pricing strategy further enhance its revenue generation capabilities.

Aggregates, including crushed stone, sand, and gravel, are the primary revenue drivers for Vulcan Materials. This segment consistently contributes the largest portion of the company's revenue.

Asphalt mix and ready-mixed concrete sales provide diversification. They allow Vulcan to offer integrated solutions to customers, potentially leading to higher-value contracts.

The company's monetization strategy is largely volume-based. Pricing is influenced by regional demand, transportation costs, and material availability.

The long-term nature of infrastructure projects provides a stable demand. This supports consistent revenue generation for Vulcan.

Strategic acquisitions of smaller aggregate and asphalt producers have expanded Vulcan's geographic reach. This contributes to revenue growth and market share expansion.

A disciplined pricing strategy optimizes returns. This further enhances revenue generation for the company, ensuring profitability.

Vulcan Materials generates revenue primarily from the sale of construction materials. This includes aggregates, asphalt mix, and ready-mixed concrete. The company's monetization strategy focuses on volume-based sales with pricing adjusted based on market conditions.

- Aggregates: Crushed stone, sand, and gravel are the primary revenue source, driven by volume and pricing per ton.

- Asphalt Mix: Sales are significant for road construction and maintenance projects, providing diversification.

- Ready-Mixed Concrete: Crucial for various building and infrastructure applications, offering integrated solutions.

- Monetization: Volume-based with pricing influenced by regional demand, transportation costs, and material availability.

- Strategic Acquisitions: Expanding geographic reach and market share, contributing to revenue growth.

- Disciplined Pricing: Optimizing returns and enhancing revenue generation through strategic pricing.

Vulcan Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vulcan Materials’s Business Model?

Vulcan Materials Company's journey has been marked by significant milestones and strategic initiatives. The company's growth strategy has consistently involved acquiring aggregates reserves and operations. This approach has strengthened its market position and expanded its geographical footprint, solidifying its status as a key player in the construction materials sector.

One of the most notable strategic moves was the acquisition of U.S. Concrete in 2021. This acquisition, valued at approximately $1.29 billion, significantly enhanced Vulcan's ready-mixed concrete capabilities. It also expanded its presence in crucial urban markets. This move underscored Vulcan's commitment to vertical integration, enabling it to offer a more comprehensive product portfolio and better serve its customers.

The company continually faces operational and market challenges, including economic downturns that impact construction spending and regulatory hurdles. Vulcan's responses have typically involved optimizing operational efficiency, controlling costs, and focusing on high-growth regions. These strategies have helped the company navigate various economic cycles and maintain its competitive edge.

Vulcan Materials Company has a rich history, with key moments shaping its trajectory. The acquisition of U.S. Concrete in 2021 was a pivotal move. This acquisition expanded its ready-mixed concrete capabilities and market presence.

Vulcan's strategic moves are centered on growth and market dominance. The company focuses on acquiring aggregates reserves and operations. It also emphasizes vertical integration to offer a broader product range.

Vulcan has a strong competitive position due to its strategic advantages. A vast network of quarries with long-term reserves is a significant barrier to entry. Economies of scale in production and distribution also offer a cost advantage.

The company is adapting to new trends in the construction industry. This includes the growing demand for sustainable construction materials. It also includes the adoption of digital technologies for operational efficiency and customer engagement.

Vulcan Materials Company's competitive advantages are numerous and multifaceted, contributing significantly to its success in the construction materials industry. The company's extensive network of strategically located quarries with long-term reserves of high-quality aggregates provides a substantial barrier to entry for potential competitors. This network ensures a reliable supply of materials, which is crucial for maintaining strong customer relationships and a solid reputation.

- Extensive network of quarries with long-term reserves.

- Economies of scale in production and distribution.

- Strong customer relationships and brand reputation.

- Focus on high-growth regions and operational efficiency.

Vulcan Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vulcan Materials Positioning Itself for Continued Success?

Analyzing the industry position, risks, and future outlook for Vulcan Materials Company (Vulcan) reveals a complex landscape. As a leading supplier of construction materials, Vulcan's performance is closely tied to infrastructure spending and construction activity. Understanding these factors is critical for assessing the company's potential.

Vulcan Materials Company's strategic approach to its business, including its operational strategies, financial performance, and sustainability initiatives, is key to understanding its future trajectory. The company’s ability to navigate economic cycles, regulatory changes, and technological advancements will be crucial for maintaining its market position and generating value for shareholders. This analysis provides insights into the elements influencing Vulcan Materials Company's long-term success.

Vulcan Materials Company holds a dominant position in the North American

Vulcan faces risks from economic downturns impacting construction spending. Regulatory changes regarding environmental protection and land use can affect operations. Fluctuations in energy costs, especially diesel fuel, also pose a risk. The emergence of new construction technologies could present long-term challenges.

The future outlook for Vulcan appears positive, driven by anticipated growth in infrastructure spending. The company is focused on operational excellence, disciplined capital allocation, and sustainable practices. Vulcan aims to capitalize on market demand and maintain its focus on efficiency and cost management.

In 2024, Vulcan Materials reported strong financial results. The company's net sales for the year were approximately $7.7 billion, with a gross profit of around $2.8 billion. These figures reflect the company's ability to generate substantial revenue and maintain profitability despite economic challenges. (Source: Vulcan Materials Company Annual Report, 2024)

Vulcan is actively pursuing strategic initiatives to enhance its market position and financial performance. These initiatives are designed to optimize operations, improve customer service, and ensure long-term sustainability.

- Operational Excellence: Focus on improving efficiency and reducing costs across all operations.

- Disciplined Capital Allocation: Strategic investments in projects that provide high returns.

- Sustainable Practices: Implementation of environmentally friendly practices to reduce the company's environmental footprint.

- Strategic Acquisitions: Expanding its market presence through acquisitions. In 2024, Vulcan acquired several smaller companies to increase its capacity and reach.

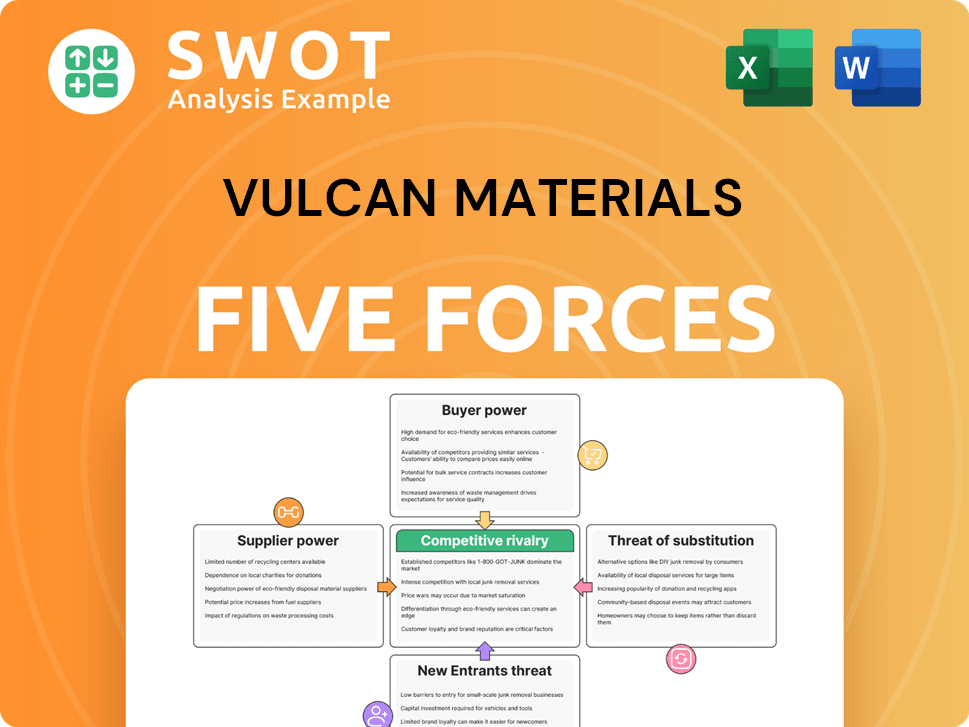

Vulcan Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vulcan Materials Company?

- What is Competitive Landscape of Vulcan Materials Company?

- What is Growth Strategy and Future Prospects of Vulcan Materials Company?

- What is Sales and Marketing Strategy of Vulcan Materials Company?

- What is Brief History of Vulcan Materials Company?

- Who Owns Vulcan Materials Company?

- What is Customer Demographics and Target Market of Vulcan Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.