Anheuser-Busch InBev Bundle

Can AB InBev Maintain Its Reign in the Global Beer Wars?

The global beer market is a battlefield, and Anheuser-Busch InBev (AB InBev) is a titan. From its humble beginnings in 1852, the company has grown through strategic acquisitions, including the pivotal merger with InBev and the later acquisition of SABMiller, to become the world's largest brewer. But in the ever-changing landscape of consumer preferences and market dynamics, how does AB InBev stay ahead?

This exploration delves into the Anheuser-Busch InBev SWOT Analysis, examining its competitive advantages, and assessing the threats to its market position. We'll dissect the AB InBev competitive landscape, identifying its primary rivals and analyzing how AB InBev's strategies contribute to its market dominance. Furthermore, we'll explore the impact of economic conditions on AB InBev and its global presence, providing a comprehensive beer industry analysis.

Where Does Anheuser-Busch InBev’ Stand in the Current Market?

AB InBev maintains a substantial market position in the global brewing industry. Its extensive scale and diverse brand portfolio are key factors in its dominance. The company's core operations revolve around the production and distribution of beer and other beverages worldwide.

The value proposition of Anheuser-Busch InBev lies in its ability to offer a wide range of beer brands catering to diverse consumer preferences. This includes global brands like Budweiser, Corona, and Stella Artois, as well as a variety of local favorites. AB InBev also focuses on innovation, exploring non-alcoholic beverages and 'beyond beer' products.

AB InBev's market share in the global beer market is estimated to be around 27% as of 2023, making it the largest player by volume. This strong market position is supported by its extensive global presence, with operations spanning North America, Latin America, Europe, and parts of Asia and Africa. The company's ability to adapt to changing consumer preferences and expand into new product categories further strengthens its market position.

AB InBev holds the largest global market share in the beer industry, estimated at approximately 27% by volume as of 2023. This significant share is a key indicator of its market dominance and competitive advantage. The company's vast distribution network and strong brand recognition contribute to its leading position.

AB InBev's diverse brand portfolio includes global brands like Budweiser, Corona, and Stella Artois, along with numerous local and regional brands. This wide range of brands allows AB InBev to cater to a variety of consumer tastes and preferences across different markets. The company continuously evaluates and adjusts its brand portfolio to meet evolving consumer demands.

Anheuser-Busch InBev has an unparalleled global presence, operating in nearly every major market worldwide. This extensive reach allows the company to distribute its products efficiently and capitalize on growth opportunities in various regions. Strongholds include North America, Latin America, Europe, and parts of Asia and Africa.

AB InBev's financial performance reflects its scale and market position. The company's reported revenue for 2023 was $59.38 billion. This financial strength enables AB InBev to invest in brand development, innovation, and expansion, further solidifying its competitive advantage.

AB InBev's strategies include premiumization of its beer portfolio and investment in digital transformation. The company aims to capture higher-value segments and enhance consumer engagement through digital channels. These strategies are designed to maintain and grow its market share in a competitive environment.

- Premiumization: Focus on higher-value beer segments.

- Digital Transformation: Enhance distribution and consumer engagement.

- Geographic Expansion: Strong presence in emerging markets.

- Product Diversification: Expanding into non-alcoholic beverages.

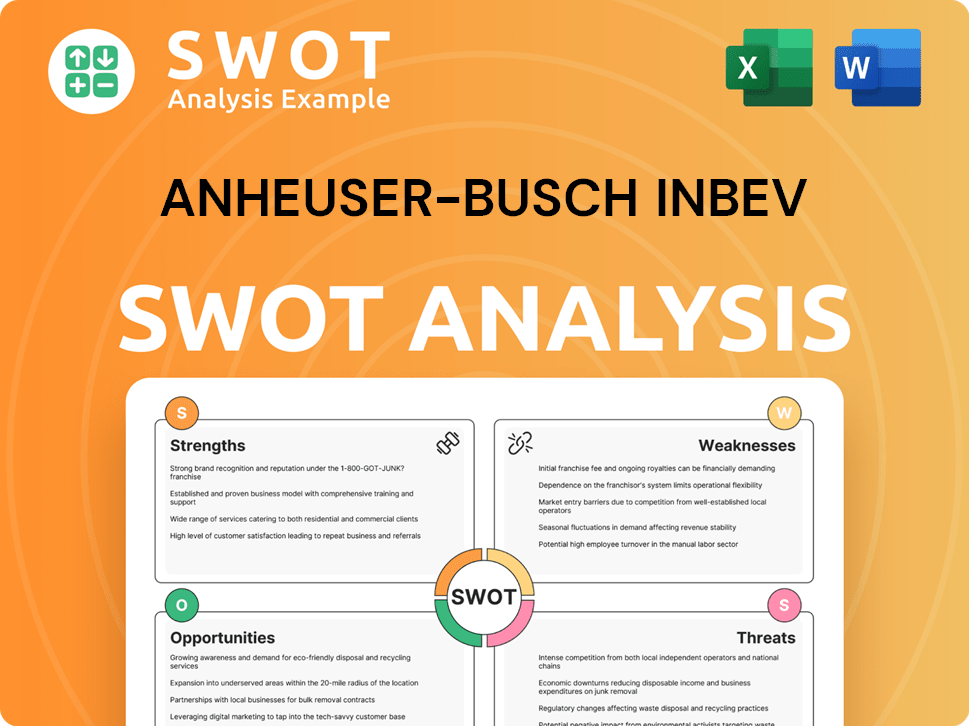

Anheuser-Busch InBev SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Anheuser-Busch InBev?

The Marketing Strategy of Anheuser-Busch InBev reveals a competitive landscape that is constantly evolving. AB InBev, a global leader in the beer industry, faces a diverse array of competitors, from established brewing giants to emerging craft breweries and alternative beverage producers. Understanding these competitors is crucial for assessing AB InBev's market position and strategic responses.

AB InBev's competitive environment is shaped by direct and indirect rivals. Direct competitors include major brewing companies that compete head-to-head in the global beer market. Indirect competitors encompass a broader range of beverage companies, including those in the 'beyond beer' category and non-alcoholic beverage producers, all vying for consumer spending.

The company's success is heavily influenced by its ability to navigate this complex environment, adapt to changing consumer preferences, and maintain its market share. The global beer market is a dynamic space, with constant shifts in consumer behavior, economic conditions, and regulatory environments.

AB InBev's primary direct competitors are major multinational brewing companies. These companies compete directly in the global beer market, often with similar distribution networks and brand portfolios.

Heineken is a significant global competitor, known for its namesake brand and a strong presence in numerous international markets. It frequently challenges AB InBev in the premium and international beer segments.

Molson Coors has a strong presence in North America and Europe, competing directly with AB InBev's mass-market brands. It has been focusing on expanding its craft and above-premium offerings.

Carlsberg Group has a solid footprint in Europe and Asia, competing for market share, particularly in its core regions. It is a key player in the global beer market.

Craft breweries pose a significant challenge, catering to niche consumer preferences. They often erode market share from mainstream brands, offering unique flavors and local authenticity.

The 'beyond beer' category, including hard seltzers and ready-to-drink cocktails, sees competition from spirits companies and new entrants. This category is growing in popularity, attracting new consumers.

The AB InBev competitive landscape is influenced by several key factors, including marketing campaigns, product innovation, and strategic distribution agreements. The global beer market is also affected by ongoing consolidation, with mergers and alliances constantly reshaping competitive dynamics.

- Market Share: AB InBev holds a significant share of the global beer market, but faces competition from Heineken, Molson Coors, and Carlsberg. In 2024, AB InBev's global market share was approximately 25%, while Heineken held around 12% and Carlsberg about 8%.

- Regional Variations: Market share varies significantly by region. In North America, Molson Coors and craft breweries have a stronger presence, while AB InBev leads in Latin America and Africa.

- Product Innovation: The industry is driven by product innovation, including new flavors, low-alcohol options, and non-alcoholic alternatives. The 'beyond beer' category is growing, with hard seltzers and ready-to-drink cocktails gaining popularity.

- Acquisitions and Alliances: AB InBev has used acquisitions to expand its portfolio and market reach. Recent acquisitions include craft breweries and regional brands.

- Sustainability: Sustainability initiatives are becoming increasingly important. AB InBev has invested in sustainable brewing practices, water conservation, and reducing carbon emissions.

- Financial Performance: AB InBev's financial performance is closely watched. The company's revenue in 2024 was approximately $59 billion, with a focus on premiumization and cost management.

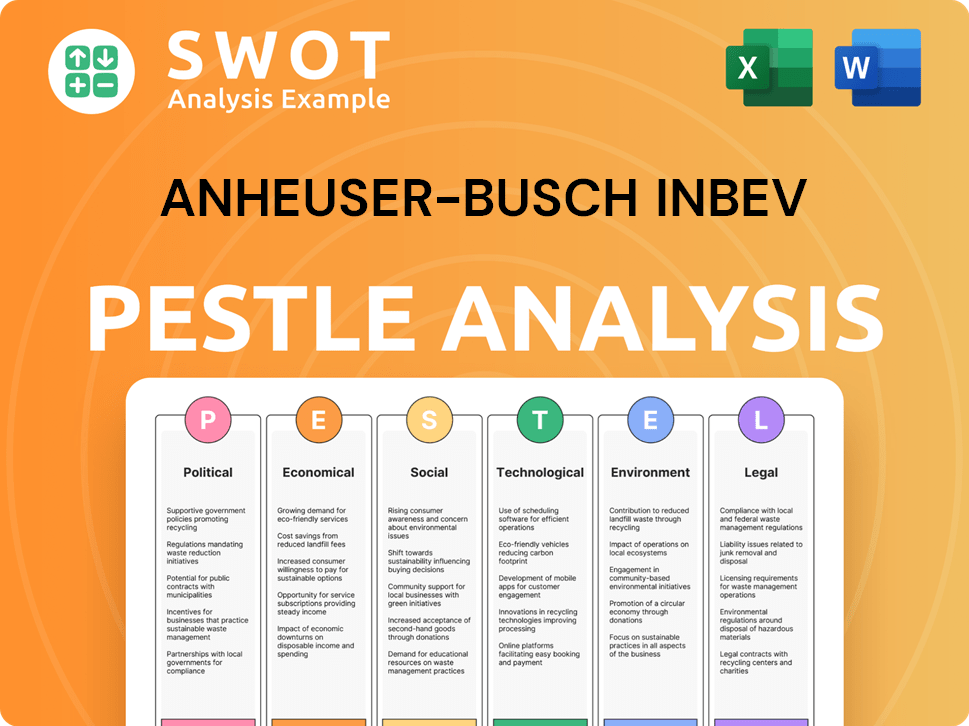

Anheuser-Busch InBev PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Anheuser-Busch InBev a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Anheuser-Busch InBev (AB InBev) requires a deep dive into its strategic advantages. AB InBev has solidified its position as a global leader in the beer industry, leveraging a combination of factors that set it apart from its competitors. These advantages are crucial in understanding its market dynamics and future prospects. The company's success is a result of strategic moves and operational excellence.

AB InBev's competitive edge is built on several key pillars. These include a robust brand portfolio, extensive distribution networks, and operational efficiencies. The company's ability to maintain and enhance these advantages is critical for its continued success in the dynamic global beer market. The company's strategies for market dominance are constantly evolving to meet new challenges.

The Growth Strategy of Anheuser-Busch InBev highlights the company's commitment to innovation and market expansion. Its focus is on maintaining its competitive edge and adapting to changing consumer preferences. This approach is essential in an industry facing evolving trends and challenges.

AB InBev's brand portfolio includes globally recognized brands like Budweiser, Corona, and Stella Artois. These brands command significant market share, allowing for premium pricing and robust marketing campaigns. In 2024, Budweiser held a significant market share in several key regions, reflecting its global appeal. The company's key brands are a cornerstone of its competitive strategy.

As the world's largest brewer, AB InBev benefits from substantial economies of scale. This includes favorable purchasing power for raw materials and optimized production processes. These efficiencies result in reduced per-unit costs, providing a significant cost advantage over smaller competitors. AB InBev's financial performance compared to competitors is often bolstered by these efficiencies.

AB InBev's vast global distribution network is a key competitive advantage. This network ensures its products reach consumers worldwide, providing a significant barrier to entry for new players. The company's global presence is a critical factor in its market dominance. AB InBev's market share by region reflects the effectiveness of its distribution strategies.

AB InBev leverages strong supply chain management and technological investments to enhance operational efficiency. This includes innovation in brewing technology and sustainable practices. These initiatives help maintain its competitive edge. The company's sustainability initiatives also contribute to its long-term viability.

AB InBev's competitive advantages are multifaceted, encompassing brand equity, economies of scale, and a global distribution network. The company's focus on operational efficiency and innovation further strengthens its position. These advantages are crucial in the global beer market.

- Brand Equity: Strong brand recognition and consumer loyalty for brands like Budweiser and Corona.

- Economies of Scale: Favorable purchasing power and optimized production processes.

- Distribution Network: Extensive global reach, ensuring products are available worldwide.

- Operational Efficiency: Strong supply chain management and technological investments.

Anheuser-Busch InBev Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Anheuser-Busch InBev’s Competitive Landscape?

The global beverage industry is undergoing significant shifts, impacting companies like Anheuser-Busch InBev (AB InBev). Technological advancements, evolving consumer preferences, and regulatory changes are reshaping the competitive landscape. Understanding these trends is crucial for evaluating AB InBev's position and future prospects. For an in-depth look at who AB InBev targets, check out the Target Market of Anheuser-Busch InBev.

AB InBev faces both challenges and opportunities in this dynamic market. The rise of craft beers and the 'beyond beer' category, along with changing consumer health consciousness, pose challenges. However, emerging markets and innovation in the no-alcohol sector offer significant growth potential. AB InBev's strategic responses, including premiumization and digital engagement, will be key to navigating these complexities and maintaining its market dominance.

The beer industry is influenced by digital transformation, with e-commerce and data analytics playing a bigger role. Regulatory changes, such as stricter alcohol advertising laws, are also impacting the industry. Consumer preferences are shifting towards healthier options and premium products, driving innovation in the market.

AB InBev faces challenges from the craft beer segment, which fragments the market. Increased health consciousness may lead to lower beer consumption in some markets. Economic shifts, like inflation and supply chain disruptions, can impact production costs and consumer spending.

Emerging markets offer substantial growth potential for beer consumption. Innovation in non-alcoholic beverages presents an opportunity to capture new consumer segments. Strategic partnerships and acquisitions can help AB InBev stay competitive and tap into new trends.

AB InBev focuses on premiumization, investing in digital platforms for direct-to-consumer engagement, and emphasizing sustainability. These strategies aim to maintain resilience and capitalize on evolving market dynamics, ensuring the company's long-term success. The company's focus on premium brands, such as Stella Artois and Corona, is a key strategy.

AB InBev's global market share is a key indicator of its competitive position; figures vary, but it remains a dominant player. The company's financial performance is closely watched, with revenue and profit margins reflecting its ability to navigate market challenges. AB InBev is actively expanding its presence in emerging markets, particularly in Asia and Africa, to capitalize on growth opportunities.

- Market Share: AB InBev holds a significant global market share, although this varies by region and is constantly evolving.

- Financial Performance: The company's financial results, including revenue and profitability, are closely monitored by investors and analysts. For instance, in Q1 2024, AB InBev reported a revenue growth of 2.7% organically.

- Strategic Acquisitions: AB InBev continues to make strategic acquisitions to strengthen its portfolio and expand its market reach.

- Sustainability Initiatives: AB InBev is investing in sustainability, including reducing water usage and promoting circular packaging.

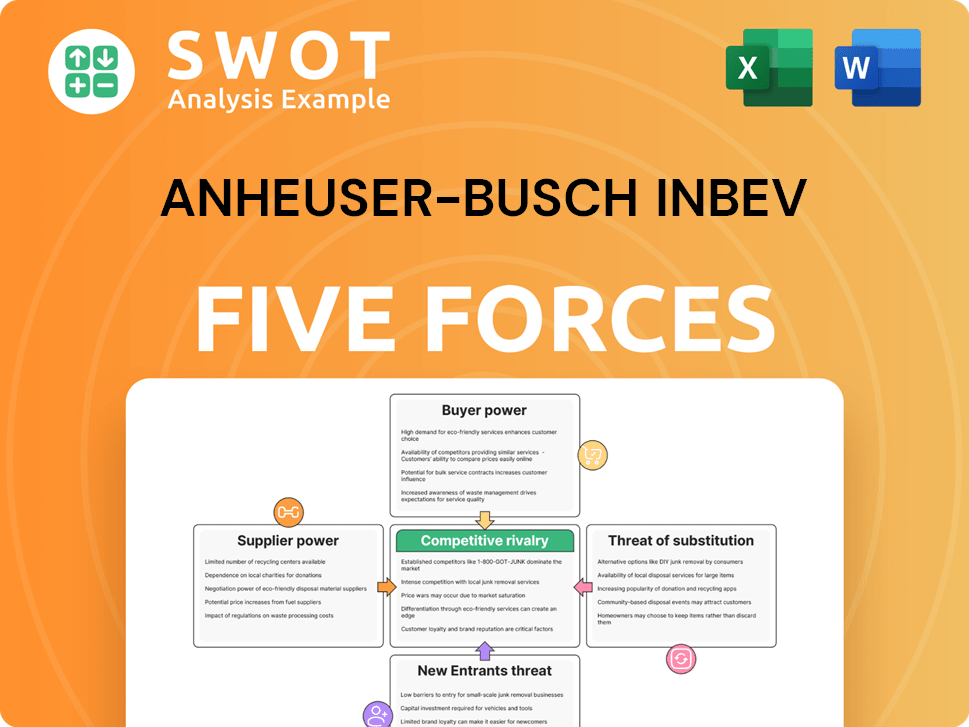

Anheuser-Busch InBev Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Anheuser-Busch InBev Company?

- What is Growth Strategy and Future Prospects of Anheuser-Busch InBev Company?

- How Does Anheuser-Busch InBev Company Work?

- What is Sales and Marketing Strategy of Anheuser-Busch InBev Company?

- What is Brief History of Anheuser-Busch InBev Company?

- Who Owns Anheuser-Busch InBev Company?

- What is Customer Demographics and Target Market of Anheuser-Busch InBev Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.