Anheuser-Busch InBev Bundle

Who Really Controls Anheuser-Busch InBev?

Ever wondered who pulls the strings at the world's largest brewer, Anheuser-Busch InBev (AB InBev)? The answer is more complex than you might think, involving a fascinating blend of historical roots, strategic acquisitions, and a global network of stakeholders. Understanding the Anheuser-Busch InBev SWOT Analysis is crucial to grasping the company's position. From its humble beginnings to its current dominance, AB InBev's ownership story is a compelling saga of business evolution.

This deep dive into AB InBev ownership will unravel the intricate web of its AB InBev shareholders and the forces shaping its future. We'll explore the AB InBev parent company structure, key players, and the impact of their decisions on iconic AB InBev brands like Budweiser and Corona. Whether you're curious about who owns AB InBev or how to invest in its stock, this analysis provides essential insights into this beverage industry giant.

Who Founded Anheuser-Busch InBev?

The story of Anheuser-Busch InBev (AB InBev) is a tale of mergers and acquisitions, not a single founding event. Tracing its roots, the company's origins involve several breweries and families, with the earliest predecessor dating back to 1366 in Leuven, Belgium. The evolution to the current structure involved key players and significant shifts in ownership over centuries.

Early ownership was primarily concentrated within the founding families. The Busch family played a pivotal role in the American component, Anheuser-Busch. The Belgian brewing families, such as the Artois and Piedboeuf families, were also instrumental in the development of the European predecessors. These early arrangements were private, involving family partnerships.

The evolution of AB InBev involved a series of strategic moves. The company's structure is a result of mergers and acquisitions. The initial ownership was held within the founding families, with no public stock offerings in the early stages. The focus was on brewing quality and expanding regional influence.

The Den Hoorn brewery, established in Leuven, Belgium, in 1366, is the earliest predecessor of AB InBev. This historical context is essential to understanding the company's complex origins.

Eberhard Anheuser purchased the Bavarian Brewery in St. Louis in 1860. Adolphus Busch joined the company in 1864, becoming a key figure in its development.

The Busch family held significant control over Anheuser-Busch for generations. This family-centric approach shaped the company's long-term strategies.

Early breweries were largely privately held by their founding families. There were no public stock offerings, which meant no widespread public shareholding in the beginning.

The founding teams were committed to brewing quality and expanding their regional influence. This vision was reflected in the concentrated family ownership.

The merger of Artois and Piedboeuf in 1987, forming Interbrew, was a crucial step. This illustrates the growth through strategic acquisitions.

The evolution of AB InBev's competitors landscape shows how the company has grown through strategic acquisitions and mergers. Key players in the early stages included the founding families, such as the Busches in America and the Artois and Piedboeuf families in Europe. The company's structure is a result of mergers and acquisitions. Early agreements involved private family arrangements and partnerships. These breweries remained largely privately held by their respective founding families. The initial ownership disputes or buyouts were resolved within the private family structures. The vision of these founding teams was deeply embedded in their commitment to brewing quality and expanding their regional influence. This was reflected in the concentrated family ownership that allowed for long-term strategic planning without immediate external pressures.

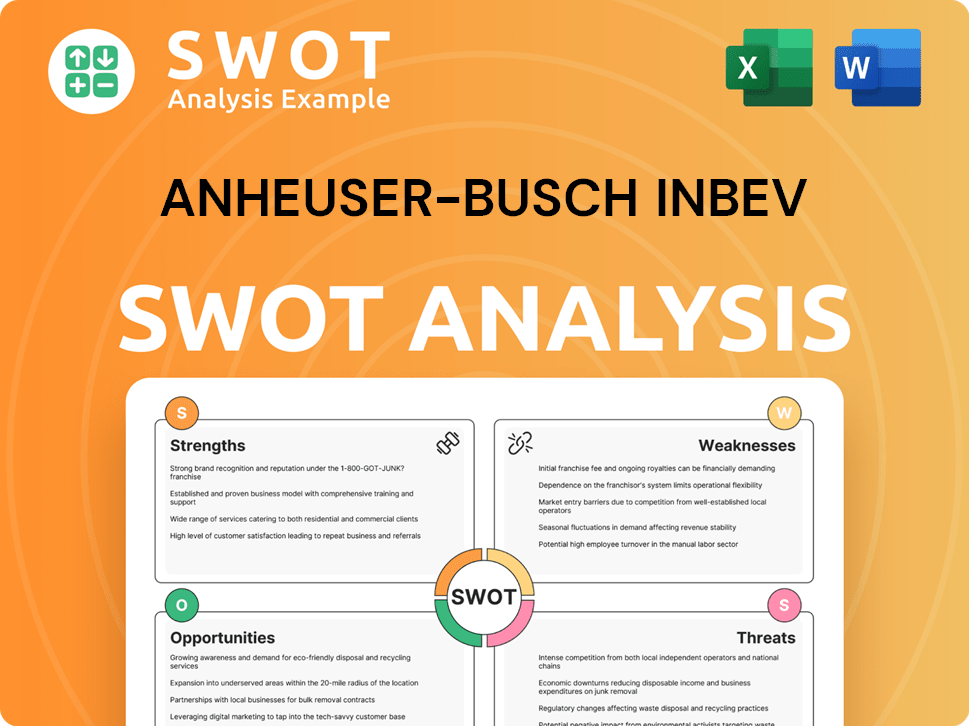

Anheuser-Busch InBev SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Anheuser-Busch InBev’s Ownership Changed Over Time?

The evolution of Anheuser-Busch InBev's ownership has been shaped by significant mergers and acquisitions. The acquisition of Anheuser-Busch in 2008 for around $52 billion marked a pivotal moment, leading to the creation of Anheuser-Busch InBev. Further expansion came with the acquisition of Grupo Modelo in 2013 and SABMiller in 2016, the latter costing approximately $107 billion, which solidified its global market presence. The SABMiller deal, in particular, altered the ownership structure as former SABMiller shareholders received a mix of cash and shares in the combined entity.

These strategic moves have transformed the company into a global beverage giant, influencing its ownership dynamics and market position. Understanding the history of these acquisitions is crucial to grasping the current ownership structure and the influences that shape AB InBev's strategic decisions. The company's journey reflects a pattern of growth through consolidation, which has led to its current status as a major player in the beer industry.

| Event | Year | Impact on Ownership |

|---|---|---|

| InBev acquires Anheuser-Busch | 2008 | Creation of Anheuser-Busch InBev, significant shift in ownership. |

| Acquisition of Grupo Modelo | 2013 | Further consolidation of market share, impact on shareholder base. |

| Acquisition of SABMiller | 2016 | Major restructuring of ownership, including new shareholders from SABMiller. |

As of early 2025, the ownership of Anheuser-Busch InBev is diverse, with major stakeholders including institutional investors, mutual funds, and families who were key shareholders in the predecessor companies. The Belgian families, such as the Van Damme, de Spoelberch, and de Mévius families, hold a significant portion through various investment vehicles. For instance, as of December 31, 2024, these families, through Stichting Anheuser-Busch InBev, held a significant percentage of the voting rights. Other major institutional investors include BlackRock Inc. and The Vanguard Group, Inc., which hold substantial passive stakes. These institutional holdings collectively represent a considerable portion of the public float. The strategic direction of AB InBev, including its focus on premiumization and expansion into emerging markets, is influenced by these major shareholders who seek long-term value creation. The market capitalization of AB InBev fluctuates, but as of early 2025, it remains one of the largest in the global beverage industry, reflecting its significant market presence and investor interest.

The major shareholders of Anheuser-Busch InBev include institutional investors and the Belgian families who were major shareholders in Interbrew and InBev.

- Belgian Families: Holding significant voting rights through investment vehicles.

- Institutional Investors: BlackRock Inc. and The Vanguard Group, Inc. hold substantial passive stakes.

- Public Float: A considerable portion of the company is held by the public through various investment channels.

- Strategic Influence: Major shareholders influence the company's direction, including premiumization and expansion strategies.

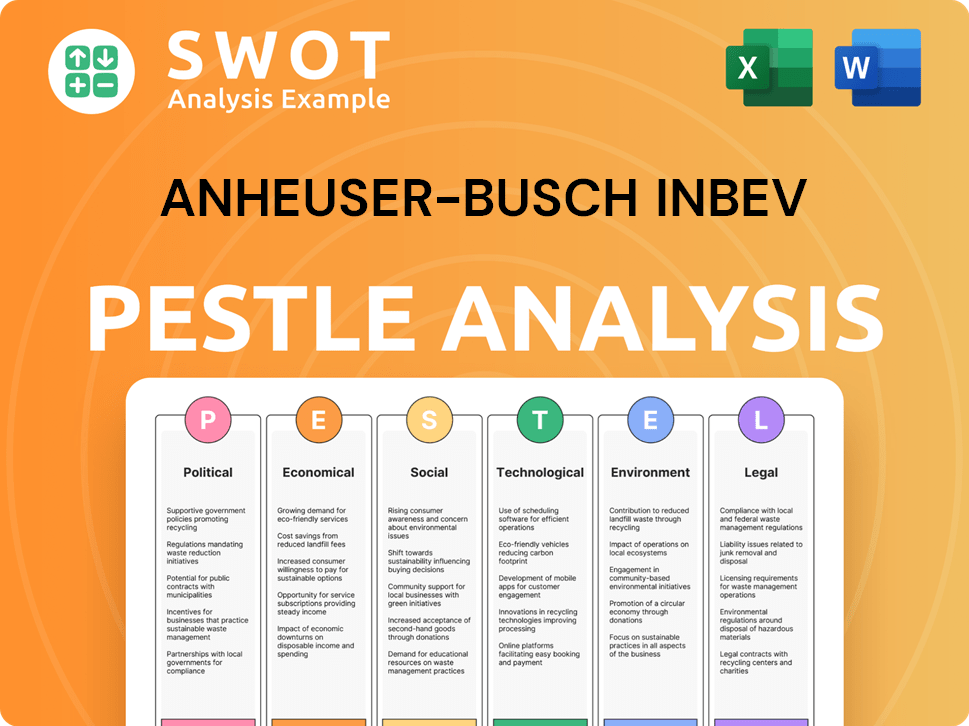

Anheuser-Busch InBev PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Anheuser-Busch InBev’s Board?

As of early 2025, the Board of Directors of Anheuser-Busch InBev is composed of a mix of representatives from major shareholders, independent directors, and executive management. The board includes individuals representing the interests of the Belgian founding families. For instance, Mr. Alexandre Van Damme is often cited as representing the interests of the core Belgian founding families, indicating a direct link between major shareholders and board representation. The board's composition is crucial in shaping the company's capital allocation strategies and global expansion plans.

The board's structure reflects a balance between shareholder representation and independent oversight. Key figures from the founding families often hold significant positions, ensuring their influence on strategic decisions. This structure has generally maintained stability, avoiding major proxy battles, due to the strong influence of core shareholders. The board's decisions are critical for AB InBev's long-term vision, which is often championed by its foundational ownership groups.

| Board Member | Role | Affiliation |

|---|---|---|

| Carlos Brito | Director | Represents major shareholders |

| Felipe Dutra | Director | Represents major shareholders |

| Alexandre Van Damme | Director | Represents founding families |

AB InBev operates with a one-share-one-vote structure for its ordinary shares. The concentrated ownership among the Belgian families grants them significant sway over strategic decisions. While there are no officially designated 'golden shares' or special founder shares with super-voting rights, the collective holdings effectively grant outsized control. Understanding the AB InBev ownership structure is crucial for investors. For more insights, consider reading about the Target Market of Anheuser-Busch InBev.

The founding families of Anheuser-Busch InBev hold significant voting power due to their substantial shareholdings. This concentrated ownership allows them to influence key decisions, including the appointment of executives.

- One-share-one-vote structure.

- Influence of founding families.

- Outsized control over strategic decisions.

- Stable governance structure.

Anheuser-Busch InBev Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Anheuser-Busch InBev’s Ownership Landscape?

Over the past few years, the ownership landscape of Anheuser-Busch InBev (AB InBev) has remained relatively stable. The major shareholders, including the founding Belgian families, have maintained their significant stakes. However, there's been a continuous adjustment in the holdings of institutional investors. For example, changes in the stakes of major asset managers reflect portfolio rebalancing and market dynamics. The company's focus on reducing debt, especially after acquiring SABMiller, has influenced investor sentiment and ownership patterns.

Industry trends indicate a rise in institutional ownership among large multinational corporations, and AB InBev is no exception. Passive index funds and actively managed funds hold substantial portions of its publicly traded shares. While founder dilution is a trend in many mature companies, it's been less pronounced for AB InBev's founding families. Consolidation within the beverage industry remains a key theme, and future mergers or acquisitions could influence its ownership structure if equity is used as consideration. There are no public announcements regarding privatization or significant ownership changes, suggesting a continued focus on operational performance and organic growth. As of early 2025, the company seems to be operating within its current ownership framework.

| Shareholder Type | Approximate Ownership (as of early 2025) | Notes |

|---|---|---|

| Founding Families | Significant, but not precisely quantified | Maintains a controlling influence |

| Institutional Investors | Varies, significant percentage | Includes passive and active funds; subject to quarterly adjustments |

| Public Float | Remaining shares | Subject to market trading |

AB InBev's market capitalization as of May 2024 was approximately $115 billion. The company's headquarters are located in Leuven, Belgium. The company operates in numerous countries worldwide, with a vast portfolio of AB InBev brands. Understanding the ownership structure is crucial for investors looking to invest in AB InBev stock. For more detailed information, you can refer to an article about Anheuser-Busch InBev. The current CEO is Michel Doukeris. AB InBev's financial performance in recent years has been influenced by its global presence and brand strength.

The major shareholders include the founding Belgian families and a variety of institutional investors.

Yes, AB InBev is a publicly traded company, with shares available on major stock exchanges.

AB InBev owns Budweiser, along with many other well-known beer brands.

As of May 2024, the market capitalization of AB InBev was approximately $115 billion.

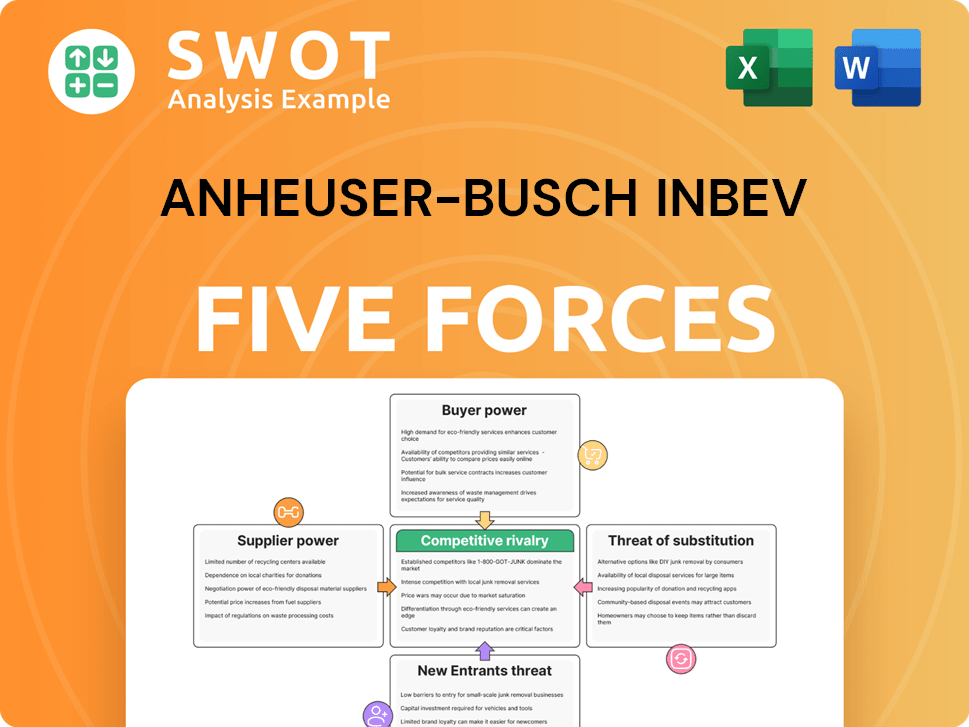

Anheuser-Busch InBev Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Anheuser-Busch InBev Company?

- What is Competitive Landscape of Anheuser-Busch InBev Company?

- What is Growth Strategy and Future Prospects of Anheuser-Busch InBev Company?

- How Does Anheuser-Busch InBev Company Work?

- What is Sales and Marketing Strategy of Anheuser-Busch InBev Company?

- What is Brief History of Anheuser-Busch InBev Company?

- What is Customer Demographics and Target Market of Anheuser-Busch InBev Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.