Acciona Bundle

How Does Acciona Navigate the Competitive Landscape?

Acciona S.A. is a key player in the global infrastructure and renewable energy sectors, constantly adapting to the evolving demands of a low-carbon economy. Founded in 1997, the company has strategically positioned itself at the forefront of the green transition. Its comprehensive approach, covering design, construction, operation, and maintenance, makes it a compelling entity in a dynamic market.

This analysis provides a deep dive into the Acciona SWOT Analysis, exploring its competitive positioning within the Acciona industry. We'll examine Acciona's main competitors in renewable energy and the infrastructure sector, offering a detailed Acciona market analysis. Understanding Acciona's competitive landscape is essential for anyone seeking to grasp the dynamics of the Renewable energy market and the strategic moves of this global leader, including its Acciona's financial performance compared to competitors.

Where Does Acciona’ Stand in the Current Market?

Acciona holds a significant market position within the global infrastructure and renewable energy sectors. Its core operations span renewable energy generation (wind, solar, hydro), sustainable infrastructure development, and water management. This diversified approach allows the company to serve a broad range of customers, including governments and industrial clients.

The company's value proposition centers on providing sustainable solutions. Acciona's focus on sustainability has allowed it to capture a growing share of the market, particularly in regions actively pursuing decarbonization goals. This commitment is reflected in its significant investments in sustainable projects and its strong financial performance.

Acciona operates across five continents, with a strong presence in key markets such as Spain, North America, Latin America, Australia, and Africa. The company's diverse portfolio allows it to navigate market fluctuations and capitalize on emerging opportunities in the renewable energy market and infrastructure sector. For more information about the company, see Owners & Shareholders of Acciona.

Acciona Energía is a leading global operator, particularly in wind power. While specific market share figures fluctuate, the company consistently ranks among the top global players. This strong position is supported by its extensive project portfolio and ongoing investments in renewable energy projects.

Acciona's financial health demonstrates robust performance. The company reported a net profit of €543 million in 2023, a 22.6% increase from the previous year. Total revenues in 2023 reached €11.3 billion, with the Energy division contributing €4.09 billion and the Infrastructure division contributing €7.03 billion.

Acciona has a strong global presence, operating across five continents. Its key markets include Spain, North America, Latin America, Australia, and Africa. This extensive geographic reach allows the company to diversify its revenue streams and mitigate risks associated with regional economic downturns.

Acciona's primary business segments include renewable energy generation, sustainable infrastructure development, and water management. This diversification allows Acciona to serve a broad spectrum of customer segments, including governments, industrial clients, and residential consumers. The company's diverse portfolio allows it to navigate market fluctuations.

Acciona's strengths include its strong financial performance, global presence, and diversified business segments. The company's commitment to sustainability and its expertise in renewable energy and infrastructure projects position it favorably in the market. Acciona's competitive advantages include its ability to secure large-scale projects and its technological capabilities.

- Leading position in renewable energy, particularly wind power.

- Strong financial results, with a net profit of €543 million in 2023.

- Diversified operations across renewable energy, infrastructure, and water management.

- Global presence with projects in key markets worldwide.

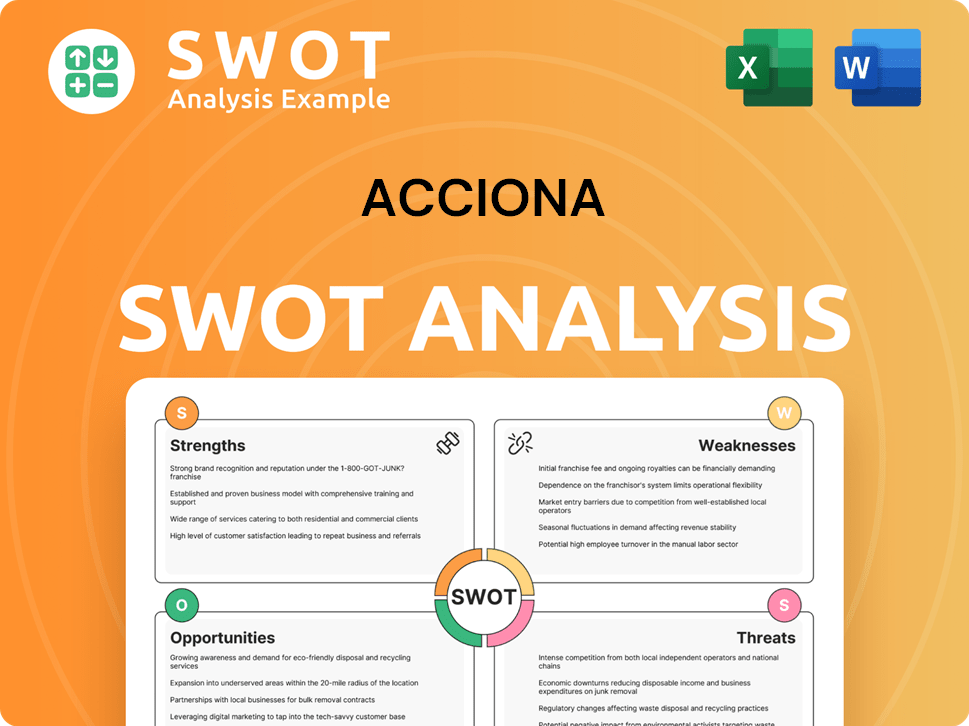

Acciona SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Acciona?

The Acciona competitive landscape is shaped by its dual focus on renewable energy and infrastructure, placing it in direct competition with some of the largest global players in these sectors. A thorough Acciona market analysis reveals a complex interplay of rivals, each vying for market share and project opportunities. Understanding these competitors is crucial for assessing Acciona's strategic position and future prospects.

The company's ability to navigate this competitive environment is vital for its continued growth and profitability. The Acciona industry faces constant technological advancements, changing regulatory landscapes, and fluctuating economic conditions, all of which influence the competitive dynamics. Furthermore, Acciona's financial performance is directly impacted by its success in winning bids, executing projects efficiently, and maintaining strong relationships with clients and partners.

Acciona's main competitors vary depending on the specific business segment. The renewable energy market and the infrastructure sector each present unique challenges and opportunities. Acciona's strategic decisions, including its investments in new technologies and geographical expansion, are constantly influenced by the actions of its competitors.

In the renewable energy sector, Acciona competes with major players like Iberdrola, Enel Green Power, and Ørsted. These companies are formidable rivals due to their extensive portfolios and global reach. They often compete aggressively for new projects, driving innovation and efficiency.

Iberdrola is a significant competitor, boasting a substantial installed renewable energy capacity and a strong international presence. In 2023, Iberdrola's renewable energy capacity reached approximately 60 GW globally. This scale allows Iberdrola to compete effectively in large-scale projects.

Enel Green Power, part of the Enel Group, is another key rival, known for its technological innovation and diverse portfolio including solar, wind, hydro, and geothermal projects. Enel Green Power's installed renewable capacity was over 63 GW as of the end of 2023.

Ørsted is a leader in offshore wind power, a segment where Acciona is expanding. Ørsted's focus on offshore wind has made it a key player in the renewable energy market. In 2023, Ørsted had approximately 15 GW of installed capacity.

In the infrastructure sector, Acciona faces competition from global construction and engineering firms such as Vinci, ACS, and Ferrovial. These companies have extensive experience and financial resources, making them formidable rivals in infrastructure projects worldwide.

Vinci is a major player in concessions and construction, with a vast portfolio of projects globally. Vinci's revenue in 2023 was approximately €68.8 billion, demonstrating its significant market presence.

Several factors influence the competitive dynamics in both the renewable energy and infrastructure sectors. These include project bidding, technological advancements, and strategic partnerships. Understanding these factors is essential for assessing how Acciona compares to its rivals.

- Competitive Pricing: Companies often compete aggressively on price to win contracts.

- Technological Innovation: Adoption of new technologies, such as advanced wind turbines or smart city solutions, is crucial.

- Geographical Presence: A strong presence in key markets, such as Spain, is a significant advantage.

- Client Relationships: Building and maintaining strong relationships with clients is essential for securing repeat business.

- Financial Strength: Companies with robust financial resources can undertake larger and more complex projects.

For a deeper dive into Acciona's strategic approach, consider reading about the Growth Strategy of Acciona. Analyzing these competitors and the factors influencing their success provides a comprehensive understanding of Acciona's position in the market.

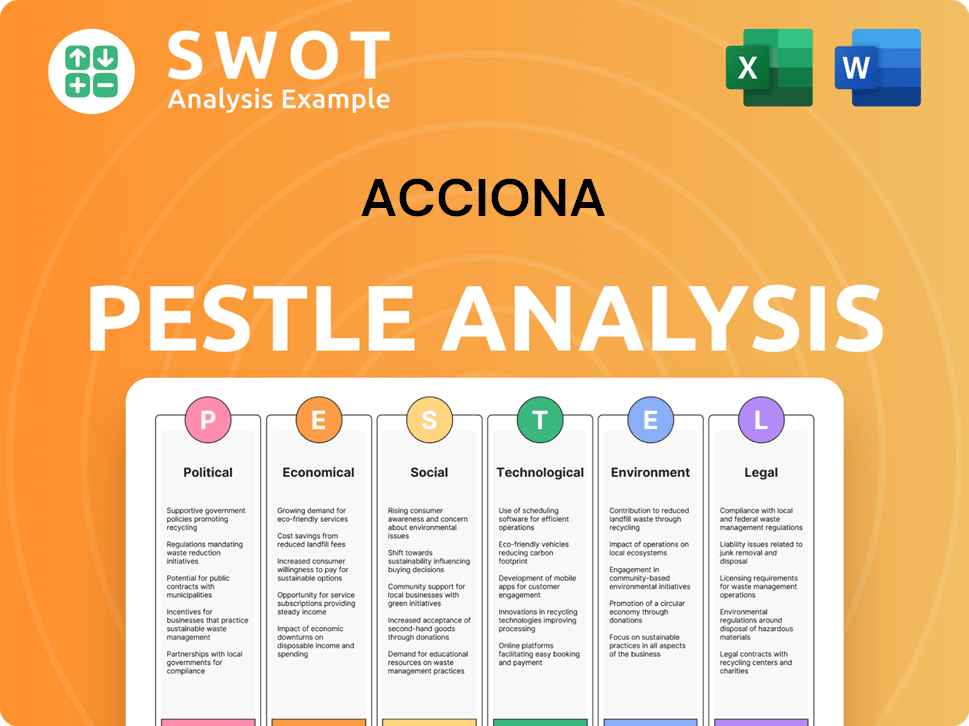

Acciona PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Acciona a Competitive Edge Over Its Rivals?

Understanding the Acciona competitive landscape is crucial for assessing its position in the renewable energy market and infrastructure sector. The company's strategic moves and competitive edge are significantly shaped by its focus on sustainable infrastructure and renewable energy. Acciona's commitment to innovation and its integrated business model further define its competitive advantages.

Acciona's ability to adapt to market demands and technological advancements is a key factor in its success. The company's strong brand equity, built on its reputation for quality, reliability, and sustainability, provides a significant advantage in securing new projects and partnerships. This analysis of Acciona's strengths and weaknesses is essential for investors and stakeholders.

Acciona's financial performance compared to competitors is a critical aspect of its market analysis. The company's strategic partnerships and alliances play a vital role in its global presence. Acciona's involvement in water treatment projects and its response to market challenges are also important considerations.

Acciona distinguishes itself through its unwavering commitment to sustainability, aligning with global environmental goals. This 'Pure Play' approach attracts environmentally conscious investors and clients, setting it apart in the renewable energy market. The company's portfolio is heavily weighted towards projects contributing to a low-carbon economy, demonstrating its dedication to sustainable development.

Acciona's integrated business model covers the entire value chain from design and construction to operation and maintenance. This end-to-end capability provides significant operational efficiencies and cost control across its energy, infrastructure, and water divisions. This model allows for greater project synergy and risk mitigation, offering comprehensive solutions to clients.

Proprietary technologies and a strong focus on innovation contribute to Acciona's competitive edge. The company invests significantly in R&D, particularly in advanced renewable energy technologies, water treatment solutions, and smart infrastructure. This investment has led to the development of highly efficient wind turbines and advanced desalination processes.

Acciona's strong brand equity, built on its reputation for quality, reliability, and sustainability, enhances customer loyalty. This reputation provides a competitive advantage in securing new projects and partnerships. The company's commitment to sustainability and its track record of successful projects have solidified its position in the market.

Acciona's competitive advantages are largely sustainable due to their alignment with global mega-trends towards decarbonization and sustainable development. Acciona's future growth strategies are centered around expanding its renewable energy portfolio and infrastructure projects worldwide. For more detailed insights, you can read more about the company in this detailed article about Acciona's business model.

Acciona's competitive advantages include a focused approach to sustainability, an integrated business model, and technological innovation. The company's strong brand equity and strategic partnerships further enhance its market position. These factors contribute to Acciona's ability to secure and execute projects effectively, as demonstrated by its recent financial performance.

- 'Pure Play' Focus: Commitment to sustainable infrastructure and renewable energy.

- Integrated Model: End-to-end capabilities across energy, infrastructure, and water divisions.

- Technological Innovation: Investments in R&D for advanced solutions.

- Strong Brand: Reputation for quality, reliability, and sustainability.

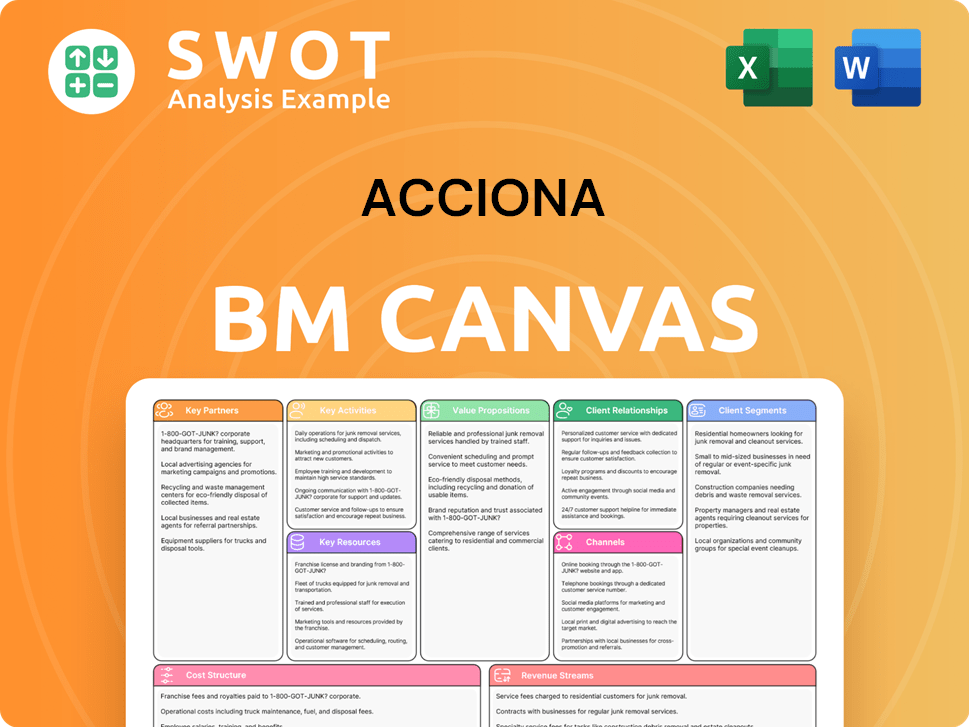

Acciona Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Acciona’s Competitive Landscape?

The competitive landscape for Acciona is influenced by the global energy transition, digitalization, and regulatory changes. The shift to renewable energy sources presents both opportunities and challenges, intensifying competition in the renewable energy sector. Technological advancements and regulatory changes, particularly those aimed at decarbonization, significantly impact Acciona's strategic positioning.

Economic shifts, including inflationary pressures and interest rate fluctuations, affect project financing and profitability. Acciona's ability to navigate these trends and adapt to market dynamics is key to its future success. Understanding the Acciona competitive landscape is crucial for investors and stakeholders assessing its long-term viability.

The renewable energy market is experiencing substantial growth, driven by environmental concerns and government policies. Digitalization, including the use of smart grids and data analytics, is transforming the energy sector. Regulatory frameworks worldwide are increasingly focused on decarbonization, creating both opportunities and challenges for companies like Acciona.

Increasing raw material costs and supply chain disruptions pose significant risks to project profitability. The Acciona competitors are expanding aggressively, intensifying market competition. The emergence of new business models, such as energy-as-a-service, could disrupt traditional revenue streams.

Emerging markets, particularly in Asia and Africa, offer significant growth potential due to increasing energy demands and infrastructure needs. Product innovations in offshore wind, floating solar, and advanced water treatment technologies provide avenues for expansion. Strategic partnerships with technology firms and local entities can unlock new market access.

Acciona's focus on sustainability and technological advancements positions it well to capitalize on the green economy. The company's ability to integrate its operations and leverage digital solutions will be critical. For a deeper understanding of Acciona's business model, consider reviewing the Revenue Streams & Business Model of Acciona.

Acciona's success depends on its ability to adapt to market changes and maintain a competitive edge. The company must manage risks associated with fluctuating raw material costs and supply chain disruptions. Strategic partnerships and innovations in renewable energy technologies are crucial for future growth.

- Market Analysis: The Acciona market analysis reveals significant opportunities in emerging markets.

- Competitive Advantages: Acciona's strengths include its sustainability focus and technological prowess.

- Strategic Alliances: Partnerships can enhance market access and capabilities.

- Financial Performance: The company's financial health is influenced by project financing and global economic conditions.

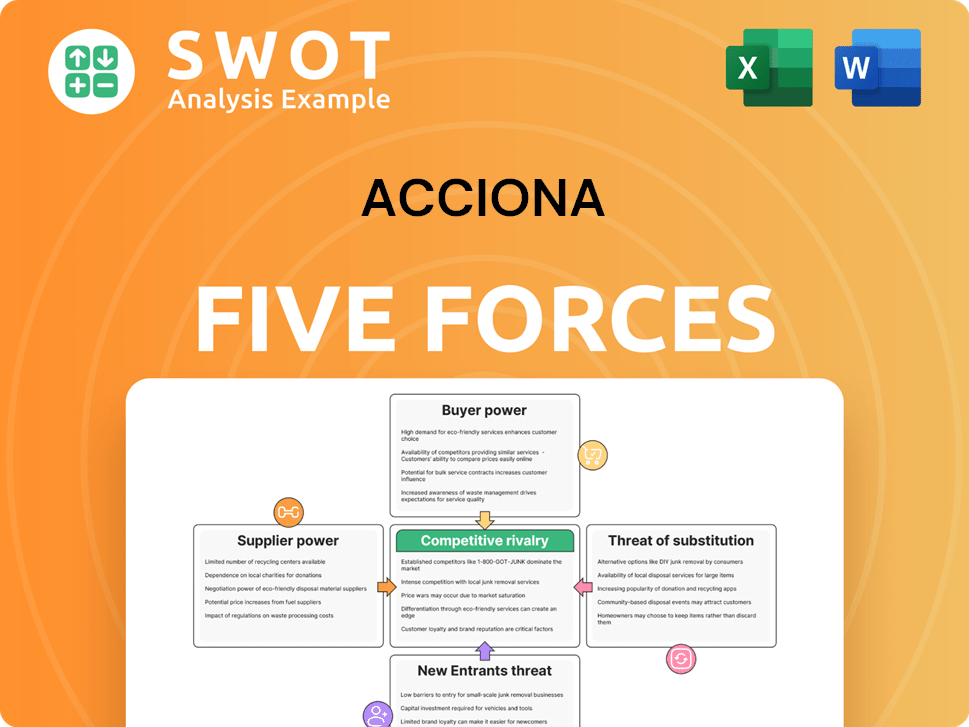

Acciona Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Acciona Company?

- What is Growth Strategy and Future Prospects of Acciona Company?

- How Does Acciona Company Work?

- What is Sales and Marketing Strategy of Acciona Company?

- What is Brief History of Acciona Company?

- Who Owns Acciona Company?

- What is Customer Demographics and Target Market of Acciona Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.