Acciona Bundle

Who Really Owns Acciona?

Unraveling the Acciona SWOT Analysis is just the beginning; understanding the company's ownership structure is paramount for any investor or strategist. Acciona, a global leader in infrastructure and renewable energy, has a fascinating history, evolving from a merger of construction giants. Knowing who controls Acciona is key to understanding its strategic direction and future potential.

From its humble beginnings to its current status as a multinational conglomerate, the Acciona company has seen significant shifts in its Acciona ownership. This article will explore the key players behind Who owns Acciona, including major Acciona shareholders and the influence of its board of directors. We'll also examine the Acciona group's trajectory, providing insights into its financial performance and strategic decisions.

Who Founded Acciona?

The story of Acciona's ownership begins with the merger of several long-standing Spanish construction firms. The oldest of these, MZOV, dates back to 1862. This foundational structure highlights the deep roots of the Acciona company within the Spanish business landscape.

Another key element in Acciona ownership is Cubiertas y Tejados, established in 1916. This firm merged with MZOV in 1978, forming Cubiertas y MZOV. This early consolidation set the stage for future developments.

Entrecanales y Tavora, founded on March 11, 1931, by civil engineer José Entrecanales Ibarra and entrepreneur Manuel Távora, is another crucial piece of the puzzle. The merger in 1997 of Entrecanales y Tavora with Cubiertas y MZOV to form NECSO Entrecanales Cubiertas S.A. (later Acciona) brought these historical ownership lines together.

MZOV was established in 1862, marking the earliest origins. Cubiertas y Tejados was founded in 1916, later merging with MZOV. Entrecanales y Tavora was founded in 1931 by José Entrecanales Ibarra and Manuel Távora.

After Manuel Távora's death in 1940, the Entrecanales family became the sole owner of Entrecanales y Tavora. This transition highlights the importance of family control in the early years.

The 1997 merger of Entrecanales y Tavora with Cubiertas y MZOV created NECSO Entrecanales Cubiertas S.A., which later became Acciona. This merger was a pivotal moment, uniting the historical ownership lines.

The founding team's vision was centered on infrastructure and engineering. This focus reflects their core business activities and strategic direction.

Early agreements and initial ownership details of these precursor companies are not fully available in public records. However, the consolidation into Acciona centralized control, setting the stage for its future growth. For more insights into the company's strategic approach, consider exploring the Marketing Strategy of Acciona.

Acciona's ownership structure evolved from mergers of long-standing Spanish construction firms. The Entrecanales family played a crucial role in shaping the company. The mergers and consolidations highlight the strategic vision of the founding teams.

- MZOV, founded in 1862, is the oldest of the precursor companies.

- Cubiertas y Tejados merged with MZOV in 1978.

- Entrecanales y Tavora merged with Cubiertas y MZOV in 1997, forming NECSO, later Acciona.

- The Entrecanales family became the sole owner of Entrecanales y Tavora after 1940.

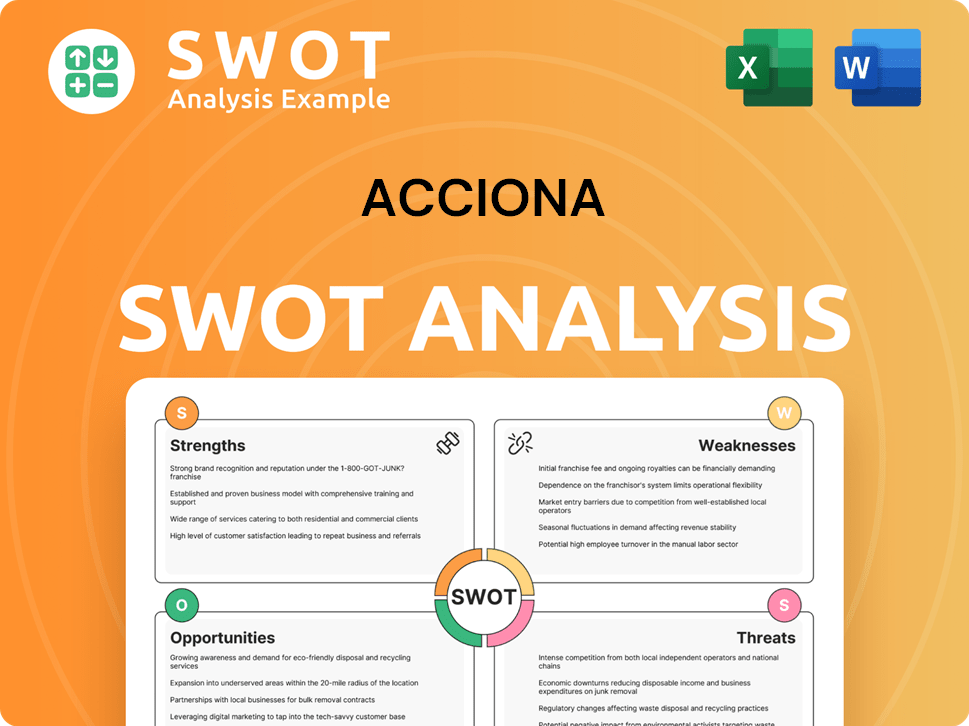

Acciona SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Acciona’s Ownership Changed Over Time?

The ownership structure of Acciona has evolved significantly since its inception in 1997 and its subsequent listing on the Madrid Stock Exchange (BMAD: ANA). The Entrecanales family has played a pivotal role, consistently maintaining a significant stake in the company. This family's influence has been crucial to Acciona's strategic direction and growth, particularly in renewable energy and infrastructure.

Key events impacting the ownership structure include the initial public offering (IPO) which allowed for broader investor participation, and the listing of Acciona Energía, a subsidiary, on the stock exchanges in 2021. These milestones have shaped Acciona's ability to undertake large-scale projects and expand its global presence. The company's ability to adapt to market changes and attract both family and institutional investors has been a key factor in its success. Understanding the dynamics of Acciona's competitors provides further context.

| Shareholder | Stake (as of February 2025) | Notes |

|---|---|---|

| Entrecanales Family | 55.12% | Held through various entities |

| Tussen de Grachten, B.V. | 29.3% | Largest shareholder within the Entrecanales family holdings |

| Wit Europese Investering B.V. | 26.3% | Significant shareholder within the Entrecanales family holdings |

| BlackRock, Inc. | 2.93% | Institutional investor |

As of May 2025, institutional investors such as Vanguard Total International Stock Index Fund Investor Shares (VGTSX), Vanguard Developed Markets Index Fund Admiral Shares (VTMGX), and iShares Core MSCI EAFE ETF (IEFA) hold notable stakes in Acciona. The market capitalization of Acciona, a key indicator of its scale, was approximately $9.2 billion USD with 54.4 million shares as of June 13, 2025. Amundi Asset Management SASU holds 0.6084% of the shares as of May 2025. These figures highlight the diverse ownership base and the company's standing in the market.

Acciona's ownership is primarily controlled by the Entrecanales family, ensuring a stable strategic direction. Institutional investors also hold significant stakes, reflecting confidence in the company's growth potential.

- The Entrecanales family's substantial stake provides long-term stability.

- Institutional investors contribute to market liquidity and investor confidence.

- Acciona's market capitalization reflects its significant presence in the renewable energy and infrastructure sectors.

- The listing of Acciona Energía enhanced the company's market visibility.

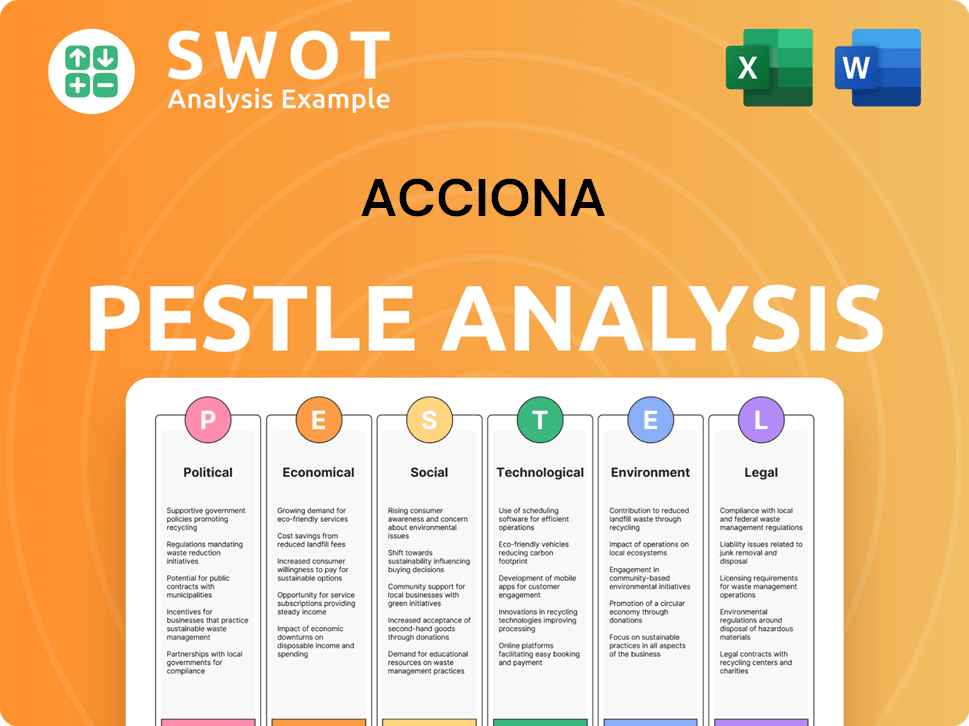

Acciona PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Acciona’s Board?

The current Board of Directors of Acciona, a key player in the renewable energy and infrastructure sectors, is pivotal in the company's governance. The board balances the interests of major shareholders, including the founding family, with independent oversight. José Manuel Entrecanales Domecq serves as Chairman and Chief Executive Officer and is a key representative of the Entrecanales family, which maintains a significant ownership stake. Juan Ignacio Entrecanales Franco holds the position of Vice Chairman and also serves as a Director of Acciona Energía.

As of June 2023, José Manuel Entrecanales Domecq indirectly holds 0.797% of the shares, while Juan Ignacio Entrecanales Franco indirectly holds 0.391%. The Board also includes independent directors, such as María Dolores Dancausa Treviño, who chairs the Audit Committee. The company's governance framework complies with Spanish Capital Companies Act regulations regarding the selection and appointment of independent directors. A Shareholders' Agreement relating to Acciona, S.A. shares, entered into by significant shareholders, was communicated to the CNMV (Spanish National Securities Market Commission) and is in force until July 14, 2026.

| Director | Position | Ownership (Indirect) - June 2023 |

|---|---|---|

| José Manuel Entrecanales Domecq | Chairman and CEO | 0.797% |

| Juan Ignacio Entrecanales Franco | Vice Chairman and Director | 0.391% |

| María Dolores Dancausa Treviño | Independent Director, Chair of Audit Committee | N/A |

The voting structure of Acciona generally follows a one-share-one-vote principle. However, the substantial stake held by the Entrecanales family grants them significant control and outsized voting power. Understanding the growth strategy of Acciona provides further insights into the company's strategic direction, which is heavily influenced by the board's decisions and the interests of major shareholders. This structure is crucial for anyone researching Acciona ownership and the broader Acciona group.

The Board of Directors at Acciona is a blend of family representation and independent oversight, crucial for governance.

- The Entrecanales family, through key figures like José Manuel Entrecanales Domecq, holds significant influence.

- Independent directors ensure regulatory compliance and balanced decision-making.

- A Shareholders' Agreement reinforces the framework for decision-making among key stakeholders.

- Understanding the board's composition is essential for anyone interested in Acciona shareholders and the company's direction.

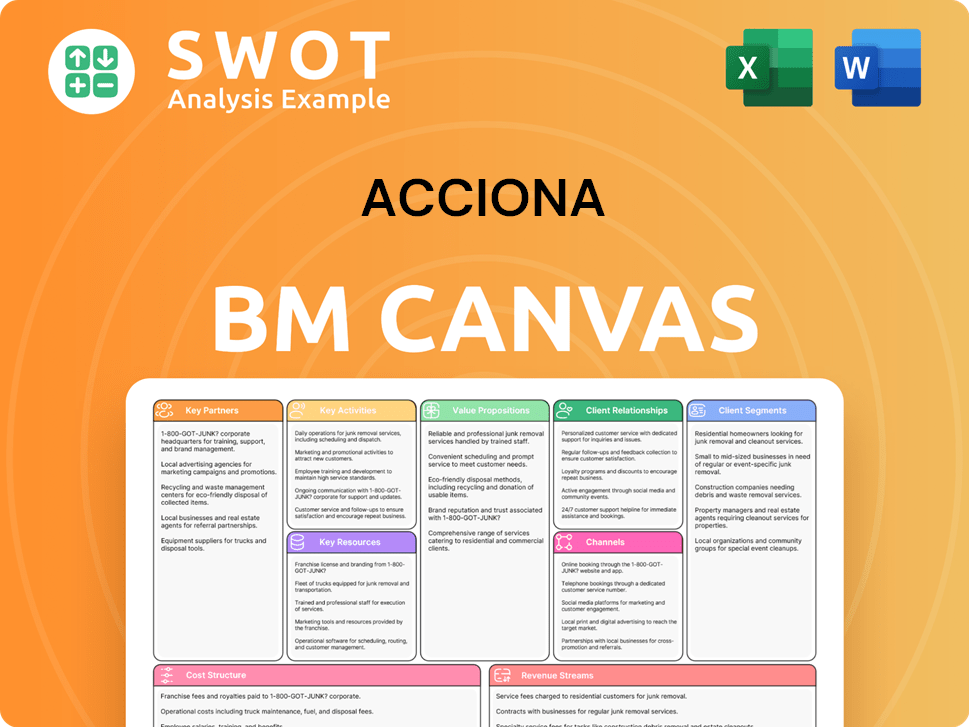

Acciona Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Acciona’s Ownership Landscape?

Over the past few years, the ownership structure of Acciona has seen strategic shifts. In May 2024, the company acquired an 80% stake in Freya, a renewable energy consultancy firm, following acquisitions like CARGACOCHES in October 2021 and Auriga Sport in September 2019. This reflects a pattern of strategic investments aimed at strengthening its portfolio and market position. These moves are part of a broader strategy that includes a focus on core businesses and asset rotation, particularly within its energy division.

A notable trend is Acciona's active asset rotation strategy, especially in its energy sector. For example, in November 2024, it sold 175 MW of hydro assets in Spain to Elawan for €287 million. This was followed by the sale of 626 MW of hydro plants to Endesa for approximately €1 billion, a transaction that closed on February 26, 2025. These divestments aim to unlock value and provide funds for future growth, while supporting its commitment to maintaining investment-grade credit ratings. The company's expansion of its renewable energy capacity and strategic acquisitions are key indicators of its growth trajectory.

| Metric | Value | Year |

|---|---|---|

| Revenue | €20.88 billion | 2024 |

| Earnings | €422 million | 2024 |

| Stock Price (as of June 13, 2025) | $168.42 | 2025 |

| Market Cap | $9.2 billion | 2025 |

The renewable energy subsidiary, Acciona Energía, has significantly expanded its capacity, adding approximately 2 GW of new capacity in 2024, mainly in Australia, India, Canada, the United States, Spain, and Croatia. The company also acquired Green Pastures, a portfolio of two wind farms in Texas with a combined capacity of 297 MW in 2024. As of December 31, 2024, Acciona Energía's total installed capacity reached 15,354 MW. This growth underscores the company's commitment to renewable energy and its strategic investments in this sector. For more detailed insights, you can read about the Growth Strategy of Acciona.

The company has consistently invested in acquisitions to bolster its portfolio. These include Freya, CARGACOCHES, and Auriga Sport, reflecting a strategic approach to expanding capabilities and market presence.

Acciona actively rotates its assets, particularly in its energy division. Sales of hydro assets to Elawan and Endesa demonstrate this strategy, aiming to generate funds for growth and maintain financial stability.

Acciona Energía has significantly increased its renewable energy capacity, adding approximately 2 GW in 2024 across various regions. The acquisition of Green Pastures further enhances its renewable energy portfolio.

In 2024, Acciona reported revenues of €20.88 billion, though earnings decreased to €422 million. The company has a target of €1.5 - €1.7 billion in proceeds for FY 2025 from its asset rotation strategy.

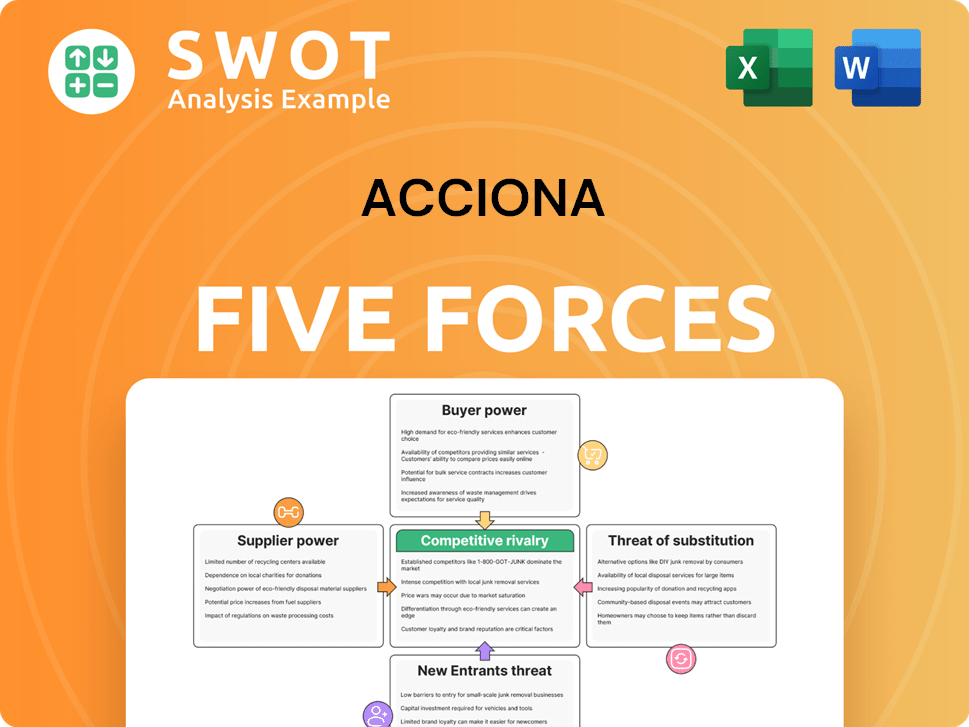

Acciona Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Acciona Company?

- What is Competitive Landscape of Acciona Company?

- What is Growth Strategy and Future Prospects of Acciona Company?

- How Does Acciona Company Work?

- What is Sales and Marketing Strategy of Acciona Company?

- What is Brief History of Acciona Company?

- What is Customer Demographics and Target Market of Acciona Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.